There are more than 20 million family-owned businesses in the United States. Very few family businesses successfully transition from one generation to the next. Common reasons transitions fail include (i) certain family members are detached and disengaged from the family business, (ii) certain family members feel trapped and held hostage to the family business through the estate instruments of the patriarch or matriarch (i.e., the estate-planning vehicles dictate control over decision-making, liquidity rights and distribution rights), (iii) certain family members feel that a big portion of their wealth is locked up and contingent on the performance of others family members, (iv) certain family members not working in the family business develop hostility toward family members and management working in the family business, and (v) the board of directors and family members are not attentive to the tools available to the family business and to the family to successfully implement ownership transition from one generation to the next.

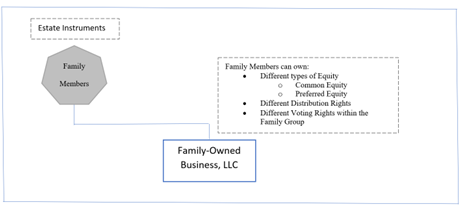

The old technique used to transition family businesses solely involved the use of estate instruments of the patriarch/matriarch that superimposed an outcome on the family and the family business without focusing on the proper ownership and corporate governance structure of the family business (which fails to put the family and the family business in a position to address the challenges related to transitioning the family business).

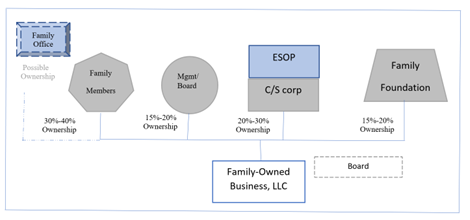

The new technique focuses on the family business and involves the implementation of a structure that stabilizes and balances the ownership structure and promotes good corporate governance through the use of a combination of family ownership, employee stock ownership plan (ESOP) ownership, family foundation ownership and management ownership, along with using proper estate instruments that are consistent with the ownership and governance structure of the family business.

New Thinking – The Ownership Balance and Corporate Governance Structure Are Key to Transitioning a Family Business

Directors, especially independent members, play a critical role in directing the family business and the family through the process. For independents and key family members to be effective and valuable to the whole family, the independents need to understand (i) the family dynamics (from multiple sides), (ii) the varying economic interests and needs of the family members, (iii) the goals and objectives of the family members (which may vary substantially and change over time), (iv) the decision-making process associated with the family business and (v) the tools available to the family business and to the family for creating a flexible ownership structure with good corporate governance that creates a balanced decision-making process (which helps resolve issues that always arise in a family business and within a family).

As the independents and key family members work together using the tools to preserve the family business, the independents and the family need to recognize that this is a process to implement because of the varying and different family agendas. The first phase is to implement an entity structure that (i) permits fluctuations in ownership by allowing certain liquidity opportunities for the family members from time to time, (ii) permits shared ownership with management and its employees, (iii) facilitates the family and the business in their efforts to support the community, and (iv) creates a stable and consistent corporate governance platform that will last for years (a structure that does not require the patriarch/matriarch to dictate decision-making from the grave through the estate instruments). The goal is to create a structure using a combination of family ownership, ESOP ownership and foundation ownership to create a stable governance structure and to create liquidity avenues for certain family members that embed rules on the valuation of the business (i.e., family members have various vehicles to access locked-up wealth). The second phase is to incorporate estate planning for the family as part of the overall family business transition plan to enhance the benefits to the family members without negatively impacting the business. All the ownership groups are structured to support sustainable private ownership, shared ownership and servant leadership that perpetuates the legacy of the family through the business.

Below is a diagram that reflects a successful family business ownership transition plan that creates significant ownership flexibility. This structure is flexible enough for the directors to address the challenges that occur as the ownership of the business transitions from one generation to the next. The structure promotes effective family leadership, management succession and employee continuity.

Phase 1: Family Business Ownership Flexibility-Principled Entity Structure

LLC – entity flexibility and ownership: The choice of entity structure appropriate for most family businesses is a limited liability company with the following characteristics: (i) ownership allocation that stabilizes the operations and the decision-making process; (ii) ownership that can fluctuate based on the liquidity needs of the family members, the management team, the ESOP and the foundation; (iii) ownership that permits different classes of equity of the business (different attributes, such as voting rights, distribution rights, valuation rights and repurchase rights); and (iv) ownership that structurally results in the family, the management team and the employees having a common goal to preserve and sustain the business. The ownership percentages will fluctuate over time, depending on the needs of the family. Based on my experience in implementing these types of structures over the last 10 years, the rule of thumb is to maintain the ownership percentages within the ranges set forth in the above diagram.

Governance – board members: As opposed to having an estate instrument mandating a decision-making regime that works contra to the best interests of the family business, the directors need to be empowered to make important decisions that are in the best interests of the business (as compared to the directors reacting to a family situation). In addition, the directors need the flexibility to make decisions on behalf of the business based on the economic environment (as compared to following an estate instrument that encapsulates a decision-making regime based on the beliefs and the prophecy of the deceased patriarch/matriarch). Normally, the directors consist of two family members, one management member (with the CFO participating in the meeting) and two independent members. This type of governance minimizes family member and management team biases and agendas that come into play in a family business. The diversity and quality of the directors will play a big role in perpetuating the business and the legacy of the family.

Shared ownership: Directors need to motivate the management team, the employees and the engaged family members to strive toward the same economic objectives by focusing on shared ownership and shared economics. This type of ownership structure (i) minimizes the impact that dysfunctional family members have on the financial well-being of the family business (two friendly owners – the ESOP and the foundation), (ii) creates an ownership structure that is not disruptive to the business and creates certain rules (i.e., the ESOP creates rules around the valuation of the equity), and (iii) creates a culture that perpetuates the business. By using an ESOP and a foundation as part of the ownership structure, the family business will have (i) long-term owners, (ii) good and principled partners, and (iii) stable contributors that create balance among the owners (which will benefit the overall economic well-being of the business and wealth of the family).

ESOP: The ESOP accomplishes many objectives. The ESOP is used: (i) to create liquidity from time to time for family members who want to diversify some of their personal wealth (i.e., normally detached family members); (ii) to provide significant income tax advantages for the family business and the family members participating in the liquidity event; (iii) to provide rules on the valuation of the equity of the family business; (iv) to provide a stable, friendly and long-term owner of the family business focused on being a good partner and on equity growth (which creates a balance of ownership); and (v) to create an incentive for the employees, tying their interest to the value of the equity of the family business, creating a mutual goal to perpetuate the business (which preserves the family’s legacy). The ESOP ownership will fluctuate between 15 to 35 percent (and should not exceed 40 percent). Like most family businesses, there are family members who will want to continue to participate in the ownership of the business, and others who will want to diversify all or part of their ownership in the Business. The ESOP is a neutral buyer that can be used to create liquidity for those family members. Because the ESOP is required to obtain an annual valuation by law each year from an independent valuation firm, the family business bases all its liquidity events on the ESOP valuation (which minimizes family disputes).

Foundation: Most family businesses are an integral part of the community. Normally, such businesses support community activities and projects (which also benefits the family business and is part of the identity of the family). The foundation is used to unite the family members, the management team and the employees. Through the foundation’s ownership, the foundation is guaranteed a certain level of annual funding used to support the community. Typically, family members and management serve as directors of the foundation. The foundation plays the role in bringing together the family members (i.e., connecting the family to this core value). The foundation also provides stability from a corporate governance standpoint.

Family office. Often, the family business will partner with a family office group to obtain funding for organic and acquisition growth. Family offices tend to make good business partners for family businesses since they are long-term investors.

Phase 2: Estate Planning Incorporated in the Ownership and Governance Structure

Estate planning: Family members with large equity holdings in the family business will coordinate their estate planning consistent with the business’ ownership and governance structure. The family has an opportunity to take advantage of many estate-planning techniques. For example, the type of equity of the family business (common, preferred, voting, non-voting and other attributes) held by a family member may result in some estate tax benefits. As part of the estate planning, the family addresses the election of the directors that represent the family. So the family business is in an healthy position to transition the families ownership from generation to the next, the objective is to coordinate the family’s estate instruments with the governance structure of the family business.

Conclusion

Directors and engaged family members have successfully navigated through multiple generational transitions by using the various tools (such an ESOP and a foundation) discussed in this article. Different than attempting to transition a family business through estate instruments, this approach is a long-lasting structure that can be used by the family business to successfully transition it from generation to generation. The objective is to propel the family business through each chapter of its existence and to preserve the legacy of the family (and to take care of the family).

John Kober is a corporate and tax partner in the law firm of Morgan, Lewis & Bockius LLP and has spent his whole career advising families, family businesses, directors of family businesses and estate planners throughout the country on transitioning their family businesses from one generation to the next growing generation.