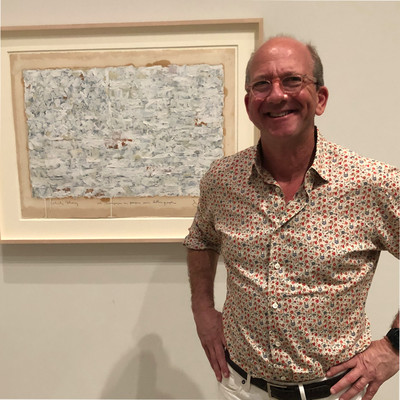

Bruce Herzog, who launched Willkie Farr & Gallagher’s Houston office in 2014, has left the firm for Latham & Watkins.

A native Houstonian, the attorney has more than 32 years’ experience representing Houston and New York-based buyout and energy funds. He’s dedicated his practice to private equity ranging from fund formations, LBOs, equity-line investments, portfolio company transactions and a host of exits.

Herzog previously was a partner at Vinson & Elkins in Houston before joining Willkie’s New York office in 2008. He received his undergraduate degree from Yale University and his law degree from the University of Texas.

Most recently, Herzog represented Pennsylvania-based healthcare recruiting and staffing company GHR Healthcare, backed by Platform Partners, on its sale to MidOcean Partners in December for undisclosed terms. Platform is a frequent client.

This past October, Herzog also advised Proppant Express, a Denver fracking company known as PropX, on its sale to Liberty Oil Field Services for $76.5 million; and CapStreet Group-backed HungerRush on its purchase of Menufy for undisclosed terms.

Houston-based CapStreet is also a frequent client, as is the Sterling Group.

Herzog also has advised Lime Rock Partners, Riverstone, Carlyle, EnCap and Yorktown on deals involving their portfolio energy companies.

In building the Houston office for Willkie with co-head Mike Piazza, in 2020 Herzog hired away Jay Hughes, who was managing partner of McGuire Woods’ office in Houston; energy M&A expert Archie Fallon in 2018 from King & Spalding; and energy private equity pro Steven Torello from DLA Piper, also in 2018.