Main Content

Breaking News

Exclusive

Outline

Top Stories

Top Stories

Frisco Attorney Speaks Out Against Dallas Judge’s ‘Standing Recusal Order’ Against Her - A Dallas County district court judge has issued a standing order barring a Frisco attorney from handling cases in her courtroom — a move the judge said was necessary to ensure “the impartial and efficient administration of justice,” but the attorney says the order constitutes oppression. June 30, 2025Michelle Casady

State Fair of Texas Can Ban Guns, Judge Rules - Firearms can now be listed as a prohibited item at the State Fair of Texas, a Dallas County District Judge ruled. Judge Emily Tobolowsky granted summary judgment to the city of Dallas and its city manager in a lawsuit brought by Texas Attorney General Ken Paxton. June 30, 2025Alexa Shrake

The Home Depot to Acquire GMS Inc. for $5.5B - Weil and Alston & Bird are advising on the acquisition of the Georgia-based building supply distributor. The acquisition is being made through Home Depot's McKinney-based subsidiary SRS Distribution, which was acquired last year for $18.25 billion. June 30, 2025Allen Pusey

Hines CLO Joins Greenberg Traurig in Houston - After 18 years as an in-house counsel and more than four years as the chief legal officer at real estate giant Hines, Richard Heaton is returning to practice law. Greenberg Traurig announced that Heaton has joined the firm’s Houston office as a shareholder in its real estate practice. June 30, 2025Mark Curriden

Judge Declares Trump EO Against Susman Godfrey Unconstitutional and Retaliatory - A federal judge has declared that President Donald Trump’s executive order targeting Susman Godfrey is an illegal act of retaliation and violates the First Amendment of the U.S. Constitution. The judge also permanently enjoined all federal officials from enforcing the order against the Texas-based law firm. U.S. District Judge Loren AliKhan of Washington, D.C., in a 53-page opinion issued Friday, states that President Trump’s order issued in April “threatens the independence of the bar — a necessity for the rule of law.” June 27, 2025Mark Curriden

SCOTX Wipes Out $116M Judgment Against Werner in Fatal Crash Case - A case that began 11 years ago with a fatal crash on an icy stretch of highway near Odessa was ended Friday by the Texas Supreme Court when the justices issued an opinion wiping out a more than $100 million verdict against trucking company Werner Enterprises and its driver. June 27, 2025Michelle Casady

Lease Operator Owns ‘Produced Water,’ SCOTX Says - The Texas Supreme Court addressed ownership of “produced water,” an oilfield byproduct made increasingly valuable by new treatment methods. Absent a specific conveyance, the court said in a closely watched case, a surface estate does not retain ownership of the water separated from hydrocarbons during hydraulic fracturing operations. June 27, 2025Janet Elliott

Centerpiece

CDT Roundup: Deals Driven by Data, Plus a Deal to Make More Deals - For the week ending June 28, there were a dozen deals valued at nearly $7.8 billion: six in M&A and funding; six in capital markets and credit. But rather than compare that with last week's 16 deals for $6 billion or the 14 deals for $6.3 billion this time last year, let's compare these deals with each other. All in all, it was a curiously complicated week. June 30, 2025Allen Pusey

SCOTX: Winter Storm Uri Lawsuits Seeking Billions of Dollars Narrowed But Still Alive - The Texas Supreme Court ruled Friday that the Winter Storm Uri lawsuits brought by thousands of individuals and small businesses against electric transmission and distribution utilities in Texas are legally flawed, but the justices allowed lawyers for the plaintiffs to amend their lawsuits to fix the legal issues and even provided a roadmap for their possible success. In a unanimous decision, the state’s highest court dismissed allegations of intentional nuisance and gross negligence against Oncor, CenterPoint and American Electric Power, but the decision to allow the plaintiffs to replead their gross negligence claims is viewed by attorneys for the plaintiffs as a significant victory because it keeps their lawsuits alive and moving forward. (File photo by Ron Jenkins/Getty Images) June 27, 2025Mark Curriden

SCOTX: Winter Storm Uri Lawsuits Seeking Billions of Dollars Narrowed But Still Alive - The Texas Supreme Court ruled Friday that the Winter Storm Uri lawsuits brought by thousands of individuals and small businesses against electric transmission and distribution utilities in Texas are legally flawed, but the justices allowed lawyers for the plaintiffs to amend their lawsuits to fix the legal issues and even provided a roadmap for their possible success. In a unanimous decision, the state’s highest court dismissed allegations of intentional nuisance and gross negligence against Oncor, CenterPoint and American Electric Power, but the decision to allow the plaintiffs to replead their gross negligence claims is viewed by attorneys for the plaintiffs as a significant victory because it keeps their lawsuits alive and moving forward. (File photo by Ron Jenkins/Getty Images) June 27, 2025Mark CurridenExpert Voices

Is Your Commercial Property Insurance Ready for Hurricane Season? - As hurricane season kicks off, ensuring your company’s insurance coverage can withstand the storm is more important than ever. Commercial property insurance policies contain numerous potential coverage pitfalls that can significantly impact a corporate policyholder’s ability to recover for losses. These challenges often remain hidden until a loss occurs, at which point they can severely restrict or even eliminate coverage for otherwise valid claims. Understanding these common issues during the policy review process can help risk managers and legal counsel identify and address potential coverage gaps before they impact an organization. June 26, 2025Carlton D. Wilde III

Legislature’s Expansion of the Business Court Proves Lone Star State’s Commitment to Commercial Justice - Nine months ago, skeptics questioned whether Texas’ ambitious new business court would survive infancy. The specialized tribunal, which began operations Sept. 1, 2024, faced early criticism over its narrow jurisdiction, steep amount in controversy requirements and procedural uncertainties — all of which threatened to limit the court’s effectiveness as a forum for many business disputes. The Texas Legislature has now resolved many of these doubts and doubled down on its judicial innovation. On June 1 — in the final hour of the final day of the legislative session — the Legislature passed House Bill 40 with significant support, considerably expanding the Texas Business Court’s jurisdiction. The law demonstrates Texas’ commitment to position itself as the premier destination for business litigation. June 24, 2025Ben Barnes & Nick Brown

Stories You Might’ve Missed

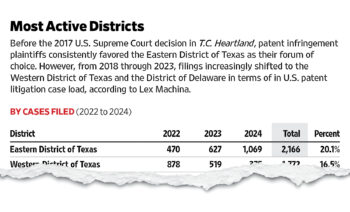

Report: Judge Gilstrap Again the King of Patent Litigation - Patent infringement litigation has mostly been on the decline across the U.S. for the past three years, but not in the Eastern District of Texas, which has re-established its courts as the preferred destination for disputes regarding patent infringement. A new report by legal analytics firm Lex Machina shows that U.S. District Judge Rodney Gilstrap of Marshall was assigned 795 new patent lawsuits in 2024 — six times more than any other federal judge in the U.S. June 3, 2025Mark Curriden

Report: Judge Gilstrap Again the King of Patent Litigation - Patent infringement litigation has mostly been on the decline across the U.S. for the past three years, but not in the Eastern District of Texas, which has re-established its courts as the preferred destination for disputes regarding patent infringement. A new report by legal analytics firm Lex Machina shows that U.S. District Judge Rodney Gilstrap of Marshall was assigned 795 new patent lawsuits in 2024 — six times more than any other federal judge in the U.S. June 3, 2025Mark Curriden