© 2015 The Texas Lawbook.

By Mark Curriden

(July 9) – Corporate mergers and acquisitions in Texas declined dramatically during the first half of 2015, thanks to turbulence in the oil and gas industry.

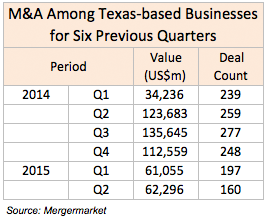

While deal-making nationally increased to a near record-setting pace, M&A activity involving Texas-based companies plummeted 28 percent during the first six months of the year compared to the same period in 2014, according to Mergermarket, an independent global M&A research firm.

Businesses headquartered in Texas participated in 357 mergers, acquisitions, divestitures and joint ventures with a total deal value of $123.3 billion in 2015, compared to 498 such deals valued at $158 billion last year, reports Mergermarket, which produced the data exclusively for The Texas Lawbook.

“Deal-making across nearly all business sectors – health care, technology, industrial, manufacturing and even restaurants – is strong and active,” said Rick Lacher, managing director of the Dallas office of investment bank Houlihan Lokey.

“Everybody in our office is busy – not hair-on-fire busy like last year but very active,” Lacher said.

Chad Watt, an M&A analyst and writer with Mergermarket, agrees.

“Nearly every business sector except energy upstream has witnessed a solid year of deal-making,” Watt said. “If oil and gas upstream joins the M&A uptick, we are going to have quite a party at some point in the second half of the year.”

Mergermarket data shows that M&A activity across the U.S. is up 21 percent so far this year and is on pace to meet the record levels set in 2007.

Between 2009 and 2014, Texas led the U.S. in corporate deal-making as oil and gas companies and private equity funds poured tens of billions of dollars into exploration and production as the result of new discoveries in the various shale plays.

But corporate lawyers and investment bankers say M&A among energy upstream companies has been essentially non-existent so far this year due to the decline and instability of crude prices.

The oil and gas deals being announced are getting done mostly because of necessity, lawyers and bankers say.

Fredrickson and others say the oil and gas deals that are closing are significantly more complex and are taking much more negotiations to get both sides to agree.

“Sellers are finally willing to consider transactions at these lower prices, as long as they eventually get to share some of the upside,” said Vinson & Elkins partner Steve Gill.

The oil and gas midstream market, however, has not been impacted by the downturn in prices.

“There is still a lot of infrastructure that needs to be built and these companies have access to a lot of cash to make acquisitions,” said David Taylor, a partner at Locke Lord in Houston.

In fact, the largest transaction of the year so far came in January, when Dallas-based pipeline giant Energy Transfer Partners acquired Regency Partners, another Dallas master limited partnership, for $18 billion.

Last year, more than half of the 20 largest corporate deals involved Texas oil and gas E&P companies – compared to only four of the top 20 transactions this year.

“There’s a strong belief that when the hedges that oil companies currently have in place roll off and the banks complete their fall redetermination of the value of oil companies’ borrowing bases, we are going to see a lot of activity,” Taylor said. “The oil companies will need capital and to lower their debt and private equity firms will move in, making strategic acquisitions.”

Some oil and gas companies are facing a situation in which they need to either raise money soon through a joint venture with a private equity firm or face bankruptcy, according to William Snyder, who heads the national bankruptcy and restructuring practice group at Deloitte in Dallas.

“There are several companies that can either kick the can down the road or kick the bucket,” Snyder said. “The banks are going to bend over backwards to extend debt because the same banks are holding the hedges and, in many cases, the hedges are more valuable than the looming liabilities.

“The private equity firms have billions and billons and billions of dollars, but the deals just aren’t there yet,” he said.

Tom Harris, a corporate partner at Haynes and Boone in Dallas, said private equity firms are flush with cash and are eager to put the money to work.

“We are seeing a lot of private equity firms that are based here in Texas but are looking for good deals in Texas but also outside the state,” Harris said. “Most of the private equity funds seek good management teams and solid growth potential.”

The best example came in June, when Dallas-based Lone Star Funds purchased New York real estate firm Home Properties for $7.6 billion. It is the fifth largest deal of 2015 involving Texas-based businesses.

Scott Parel, a corporate partner at Sidley Austin in Dallas, said non-energy M&A is keeping lawyers and bankers busy in Texas and across the country.

“Everyone agrees that the Supreme Court’s decision upholding the Affordable Care Act will lead to a significant number of mergers and acquisitions in the health care space,” Parel said. “We are also seeing a ton of consolidation in the semi-conductor and chip space.”

Parel points to NXP Semiconductors purchase in March of Austin-based Freescale Semiconductor for $15.9 billion.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.