© 2015 The Texas Lawbook.

By Natalie Posgate and Mark Curriden

(Nov. 9) – M&A activity in the oil patch continues to shrink, but the deals that are getting done are twice as big and significantly more complex.

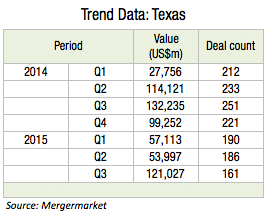

New data shows that mergers, acquisitions and joint ventures involving Texas businesses have declined four consecutive quarters. The state is on track to have the fewest number of corporate transactions since the end of the Great Recession in 2009, even as M&A across the rest of the U.S. surges to record highs, according to Mergermarket, an independent global research firm.

Corporate lawyers and investment bankers now predict energy M&A could remain stagnant or plunge even more over the next year.

“This market is just brutal,” says William Snyder, who heads the restructuring practice at Deloitte in Dallas. “There’s going to be prolonged pain.”

Mergermarket reports there were 161 M&A deals between July 1 and September 30 involving Texas-based businesses, which is a 36 percent decline from the 251 transactions during Q3 2014.

“There’s no doubt that there’s been a slashing of mergers and acquisitions this year,” says Ken Menges, a partner at Akin Gump in Dallas who specializes in corporate transactions. “The deals that are getting done are either mega-huge deals or smaller, mid-market transactions.”

But the dramatic decline in oil and gas transactions has a disproportionate impact in Texas, he says.

“From 2008 to 2014, M&A was down or stagnant just about everywhere else but Texas,” Watt says. “During those years, Texas experienced tons of M&A activity because energy, especially oil and gas, was so hot. Now, we are seeing the opposite impact of oil being so dominant in Texas.”

Eric Burgess, who is a director of transaction advisory services in Grant Thornton’s Dallas office, says, “If you strip energy out of the equation… you would see an increase in deals in just about all other sectors, But [oil and gas is] such a large sector in Texas that the decline in deals is really driving that data more than anything else.”

About 42 percent of the M&A deals involving Texas companies announced during the past nine months were in the energy sector, which is down from more than 60 percent during the first nine months of 2014, according to data provided by Mergermarket and The Texas Lawbook’s Corporate Deal Tracker.

“The only oil and gas deals getting done are because the seller has to get them done,” Snyder says. “The bid and the ask remain very far apart. All the talk about the oil and gas market returning in 2016 is now gone. Now, the talk is 2017.”

While the number of Texas M&A transactions declined, the dollar value of the deals announced jumped significantly.

Mergermarket reports that the total price tag for the 161 transactions announced during the third quarter was $121 billion. By comparison, there were 376 deals announced during the first and second quarters combined with a total value of $111.1 billion.

“When there are significant market shifts and changes like this, there are also opportunities for really big companies to get even bigger,” says Michael Dillard, a partner at Latham & Watkins in Houston. “The business conditions – low commodity prices and volatile markets combined with low cost financing – are certainly right for really big transactions.

The average value of M&A transactions jumped from $290 million during the second quarter of 2015 to $751.7 million during the third quarter.

“Historically, it is more likely that mega-deals are pursued when times are turbulent,” Menges says. “With the global debt market as it is, there is an extraordinary amount of money available to fund mega-deals.”

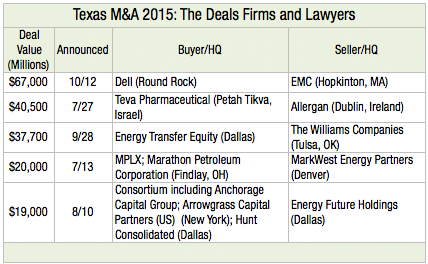

Five of the seven highest valued transactions involving Texas companies in 2015 have occurred since June 30, according to The Texas Lawbook’s Corporate Deal Tracker.

The three largest transactions are Dell Inc.’s $65 billion acquisition of EMC Corp. in October, Energy Transfer Equity’s $37.7 billion purchase of The Williams Companies on Sept. 28 and Energy Future Holding’s $19 billion sale of Oncor on Aug. 10.

Legal and investment banking experts expect additional jumbo deals over the next few months.

“The Exxons and Chevrons have all the resources in the world to do a mega-acquisition,” says Houlihan Lokey Managing Director Rick Lacher.

Lacher and others say the big questions are whether possible targets – Anadarko Petroleum, Apache Corp., Continental Resources and Pioneer Natural Resources, to name a few – are suitable strategically and are price appropriate.

Mega-mergers, according to Baker Botts corporate partner Samantha Hale Crispin, “will be more based off their desire to grow globally, and do they see a synergistic fit that makes sense. And whether they get past antitrust approvals.”

Cliff Vrielink, an M&A partner at Sidley Austin in Houston, says much of the deal activity for the next few months will involve highly distressed oil and gas upstream companies forced to sell their “crown jewel” assets to pay creditors or fund other capital commitments.

“There are situations where folks have been waiting too long to address the problem (of low cash flow),” says Jeff Jones, a managing director at Dallas investment bank Blackhill Partners, who made the comments at the recent University of Texas School of Law’s 11th Annual Mergers and Acquisitions Institute. “There are opportunities to buy if you have a good balance sheet.”

But that optimistic view is declining among most corporate deal makers, according to a new survey by Dykema Cox Smith, a law firm with large offices in San Antonio and Dallas.

The study found that only 37 percent of corporate deal makers believed M&A activity will improve in the next 12 months – down from 59 percent just one year ago.

“The M&A market was so heated for such a lengthy period of time that it was bound to cool down,” says Jeff Gifford, co-leader of Dykema’s M&A practice in San Antonio. “But there are still a lot of deals getting done at the smaller and mid-market levels.”

The most opportunistic buyers during turbulent times are the private equity firms and hedge funds, says Andrews Kurth corporate M&A partner Mike O’Leary in Houston.

“It’s opportunities like this that create huge wealth for private equity owners and investors willing to take significant risks,” O’Leary says.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.