Begin Update: If you’re looking for the most active financial institution making pandemic relief loans to Texas law firms look no further than San Antonio-based Frost Bank.

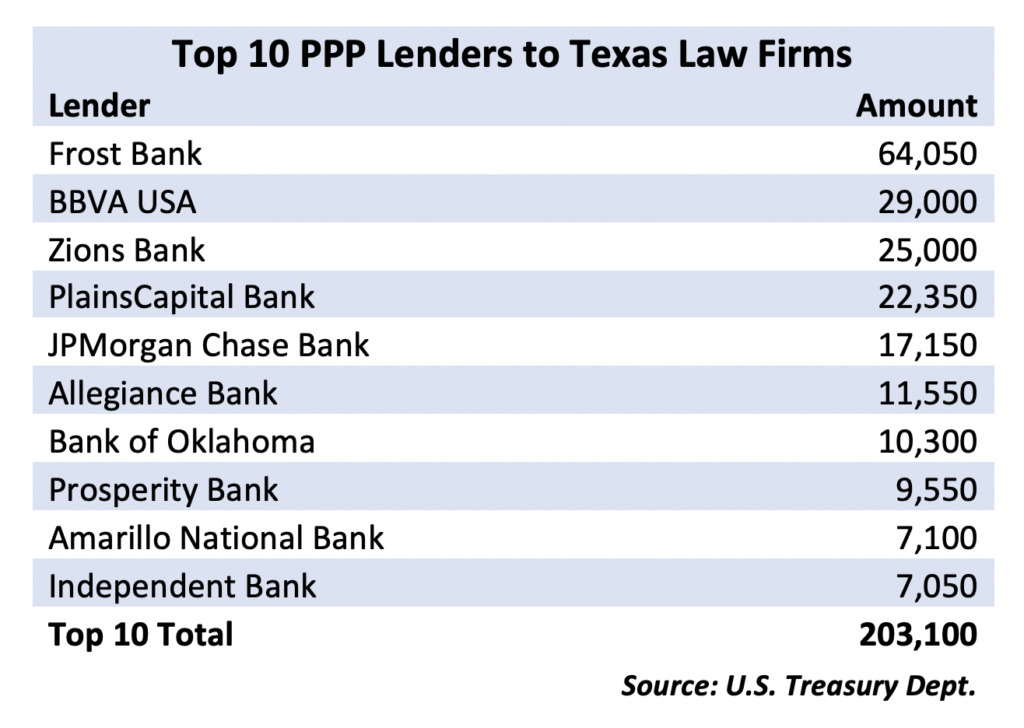

Of the top ten lenders to Texas law firms, Frost Bank was far-and-away the legal profession’s most active financial institution under the federal Paycheck Protection Program.

According to data provided this week by the U.S. Treasury Department, Frost Bank made 159 loans valued, at a minimum, at $64 million — nearly double the 83 loans made by second-ranked BBVA and more than double their minimum value of $29 million.

Frost Bank also dominated lending at the top end of the spectrum, with three of the seven law firm loans for amounts between $5 million and $10 million. Of Frost Bank’s 159 loans, 20 were for $1 million or more.

Just as Frost Bank dominated other Texas financial institutions in law firm PPP lending, so did the top 10 financial institutions involved in the program.

Of 1,160 PPP loans made to Texas law firms, the top 10 lending institutions made 513, or 44.2% of the total. Since the value of the loans were recorded in five different ranges, the value of those loans cannot be calculated exactly. But the minimum value of those loans was $203.1 million.

Ranking third behind BBVA was Salt Lake City-based Zion’s Bank with 48 loans made for $25 million or more. Fourth was PlainsCapital Bank (37 for $25 million) and rounding out the top five was JPMorgan Chase Bank (71 loans for $17.15 million).

End Update

When Congress voted to fund the Paycheck Protection Program to protect the livelihood of workers sheltered-at-home during the pandemic, thousands of Texas businesses got their law firms to guide them through the process.

And apparently in that process, more than a few of the state’s law firms decided to help themselves.

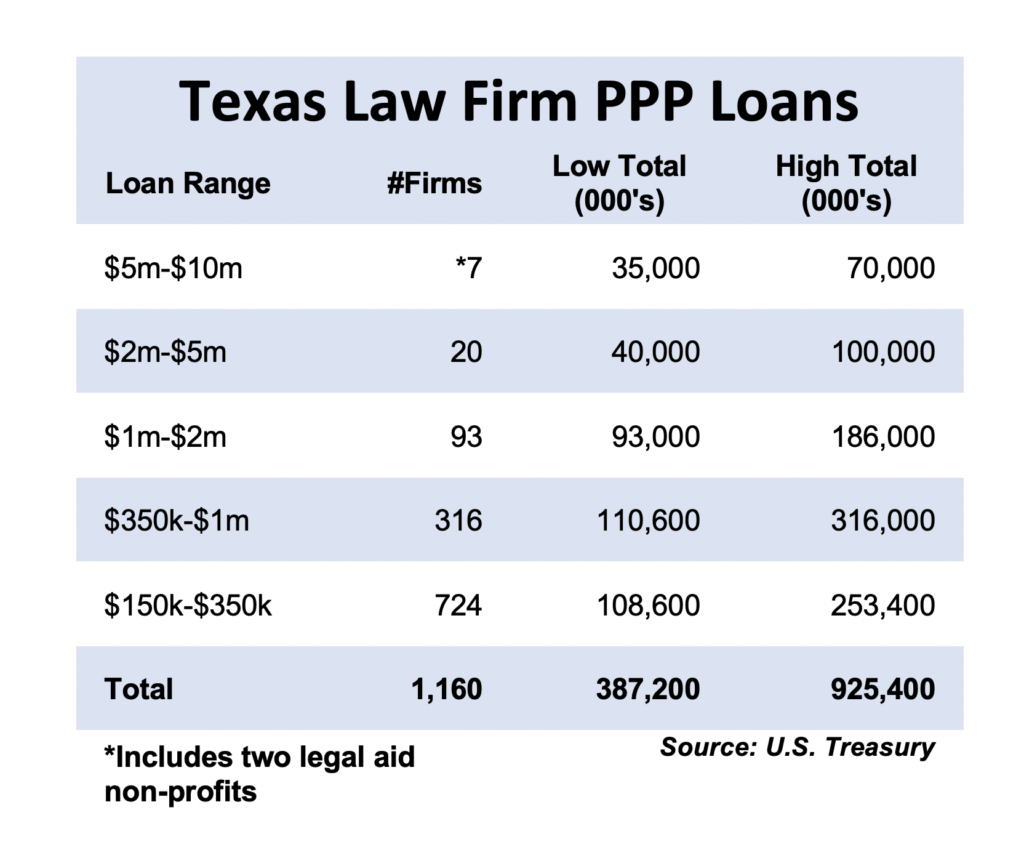

According to data just released by the U.S. Treasury Department, 1,160 Texas law firms applied for and received as much as $924 million total in ultimately forgivable loans ranging from $150,000 to $10 million — loans designed to protect the paychecks of as many as 35,796 law firm employees.

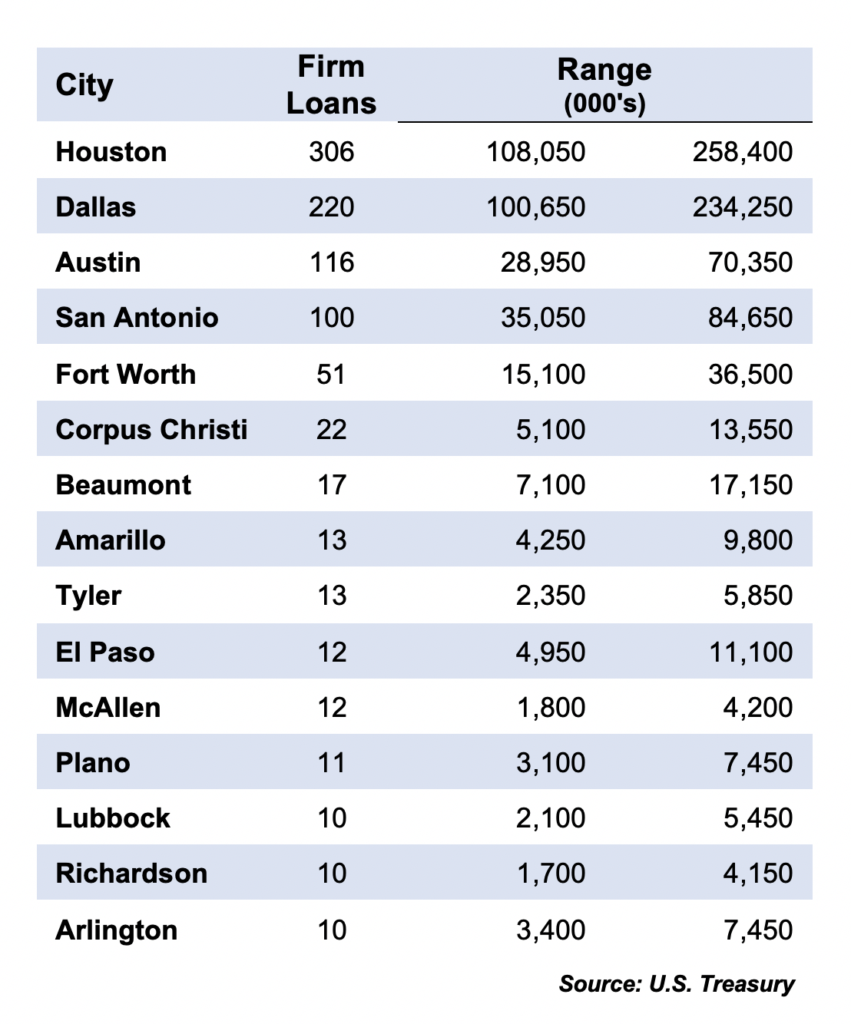

The loans were granted to firms large and small in virtually every corner of Texas — from El Paso to Tyler, from Amarillo to McAllen. The firms included some familiar firms and surprising names, including two nonprofit legal aid providers protecting the paychecks of their 787 employees.

The amounts of the loans were reported across five ranges, so exact amounts are unavailable, but The Texas Lawbook is making the complete list of firms available here.

According to the data, more than 62% of the loans were in the lowest range, $150,000 to $350,000. Only 120 firms, about 10%, received loans of more than $1 million. Only seven of those were in the highest range of $5 million to $10 million, but even that includes the two nonprofits mentioned, Lone Star Legal Aid and Texas Rio Grande Legal Aid.

Three corporate law firms received between $5 million to $10 million, including Chamberlain Hrdickla, Thompson & Knight and Thompson Coe. McKool Smith, which focuses on high end complex civil litigation and intellectual property litigation, and the Thomas J. Henry Law Firm, which bills itself as the largest personal injury practice in Texas, also received $5 million to $10 million.

Using a weighted range, measuring the loan count for each range against its lowest and highest amount, Texas firms borrowed a total of somewhere between a lowest possible amount of $387.2 million and a highest possible amount of $925.4 million from the PPP fund.

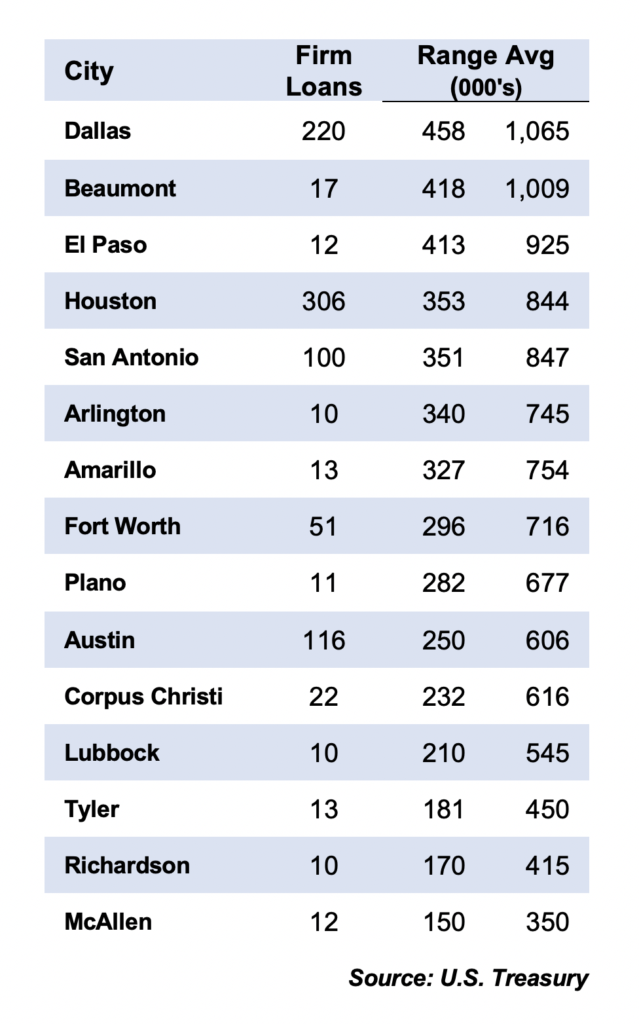

Houston firms received the most loans (306) and the most money, between $108 million and $258.4 million. But Dallas firms had a higher average range ($458,000 – $1,065,000) for their 220 loans.

Note: As previously reported, The Texas Lawbook also received funds from the PPP, a total of $107,000.