When it came to first quarter deal figures in Texas, it was same song, second verse. Deal value and count volumes were a restatement of the second half of 2020 as dealmakers continue to push past last year’s coronavirus-induced hesitancy and M&A demand forges ahead.

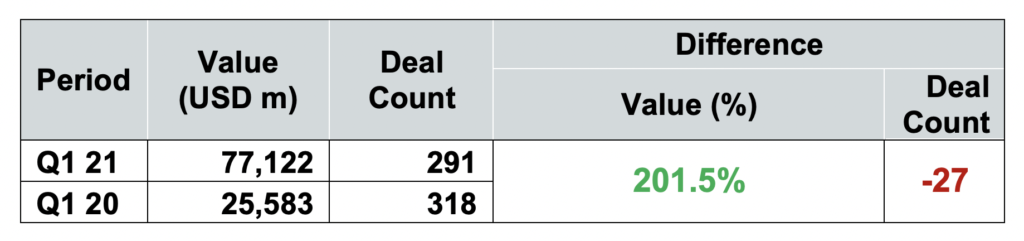

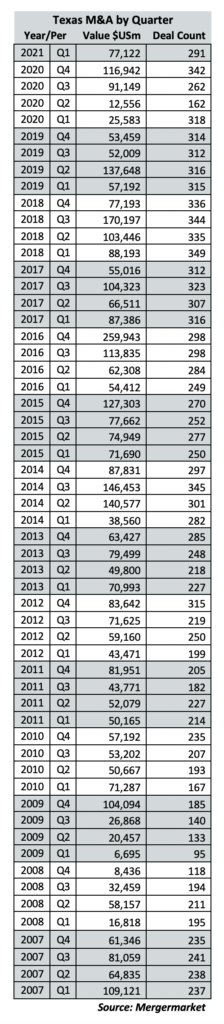

Year-over-year, deal value tied to Texas-based companies and private equity jumped by 201.5% in the first quarter, though the deal count dropped by 27 to 291, according to Mergermarket data provided exclusively to The Texas Lawbook.

Mergermarket reported that 25.5% of the Q1’s deals (81 deals; $19.6 billion) were tied to technology by value, followed by Energy, Mining & Utilities with 17.4% (32 deals; $13.4 billion), and Industrials & Chemicals at 13.5% (50; $10.4 billion).

The continued momentum into the first quarter reflects what dealmakers have been feeling and hearing anecdotally in terms of volume across a variety of industries. Though eclipsed by the more than $91 billion of Q3 2020 and the over $116 billion of Q4 2020, Q1 2021 saw more than $77 billion in deal value.

Keith Fullenweider, co-head of Vinson & Elkin’s corporate department, pointed to the influence of special purpose acquisition companies on Q4 2020 and Q1 2021’s numbers.

“When you look at the transaction values, it’s helpful to realize that some of that might be debt-financed and some of that might be equity-financed. SPAC transactions are all equity deals, so you’ll tend to see larger dollar signs with those transactions,” said Fullenweider, who is based in Houston. “SPAC mergers have been trending towards larger transactions, if you compare them towards the middle of last year for the deal size.”

Brandon McCoy, a partner in Haynes & Boone’s mergers and acquisitions practice group in Dallas, pointed to the additional uncertainty around the election that kept some deal flow pent up into Q4 2020 and causing it to trickle into Q1 2021.

“You had a tick-up in deals in the fourth quarter, but all of those deals didn’t get done in the fourth quarter. A lot of the volume in Q1 was from some of those deals that couldn’t happen in the fourth quarter for a variety of reasons,” said McCoy. “On the deal value side, it was more likely that the larger, more complex deals were the ones that weren’t able to make it across the finish line.”

It should be noted that, of the 291 deals reported to Mergermarket, values were not disclosed for 175. Year-over-year, there were 13 more billion-dollar or higher deals reported. The majority of the deal values reported for Q1 2021 were between $101 million and $250 million (31) or between $251 million and $500 million (21).

Randy Ray, a Dallas-based partner in the corporate practice of Munck Wilson Mandala, noted that one thing he’s seen at the firm is that when it is representing both buy-side or sell-side clients, more strategic buyers have been involved vs. pure financial players.

“Sometimes that shifts with the wind, but I would expect that there’s private equity sitting on cash that are looking hard at deals and trying to deploy that,” added Ray.

Looking ahead, Texas dealmakers expect activity to continue at a steady, if not accelerated clip based on what they’re seeing.

“Right now, it’s every bit as busy as it was toward the end of 2020 and into the first quarter,” said Fullenweider. “Our feeling is that you never know quite how long this level of activity is going to continue, but we’re certainly very much in the same sort of situation: very busy across the M&A practice across many industries.”

Ray said that Munck continues to see M&A running at a level consistent with the past few quarters.

“I’ve got several deals that are in-process or sitting in a proposed LOI stage, so there seems to be still plenty of activity out there, and I don’t see any hesitancy to move forward with it,” said Ray.

McCoy concurred, saying he didn’t expect to see any kind of pullback in the near future, especially as fundraising in not only private equity, but venture capital rises in Texas.

“We’ve seen a trend over the last few years of not just your volume, but also your value going up, especially in Texas, as more funds have grown their presence here as more companies come in and existing companies expand their presence,” said McCoy.

“I think that has combined to not only increase volume, but also has Texas more involved in those larger deals that may not have touched Texas several years ago.”