Anytime you delve into data, the result can be compared with the parable of the blind man and the elephant: how you perceive the whole depends on which part of the data elephant you happen to be in touch with.

That’s especially true of Texas-related M&A data for 2023 compiled from The Texas Lawbook‘s exclusive Corporate Deal Tracker. It was a strangely successful year — even a record year in some quarters — again, depending on where and how you look.

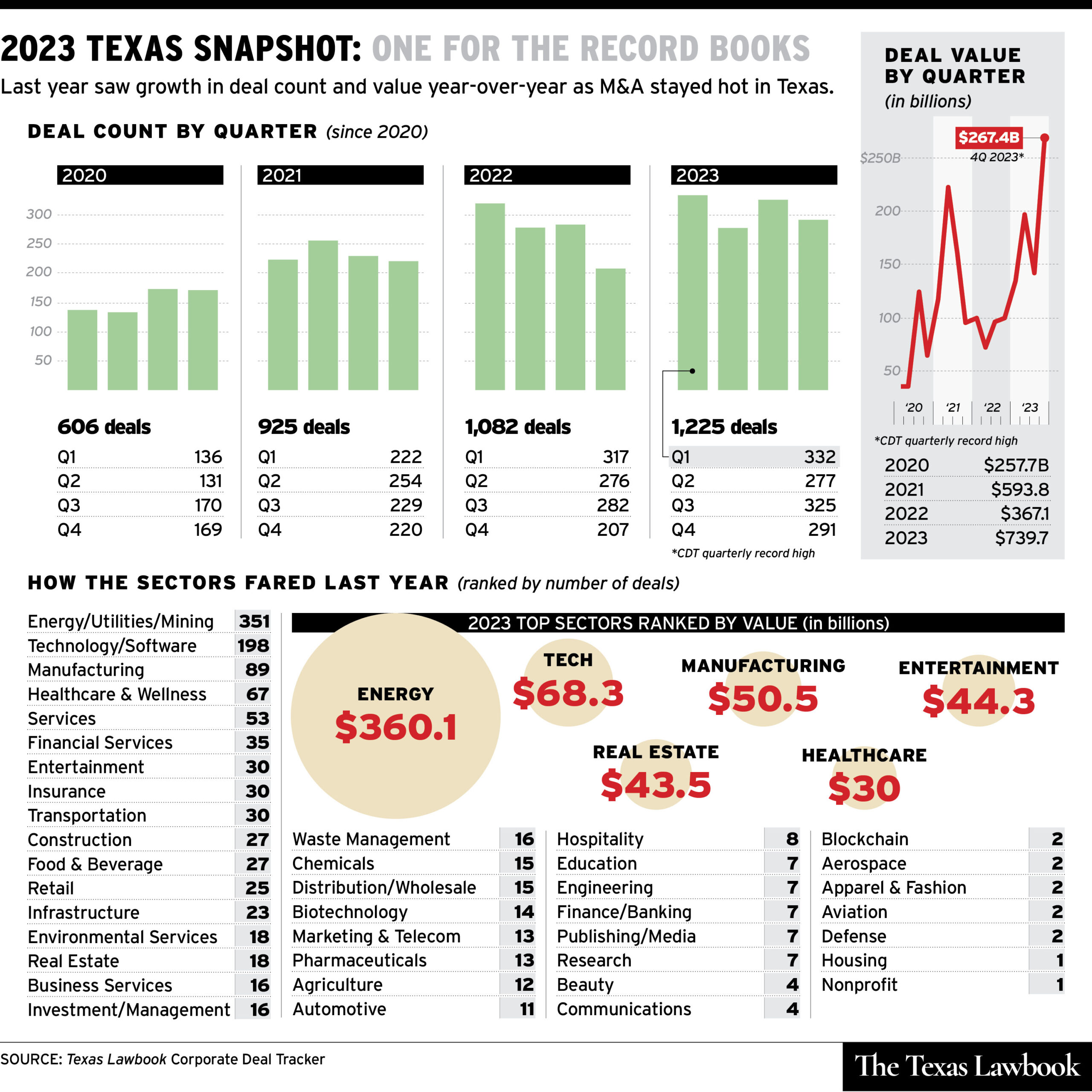

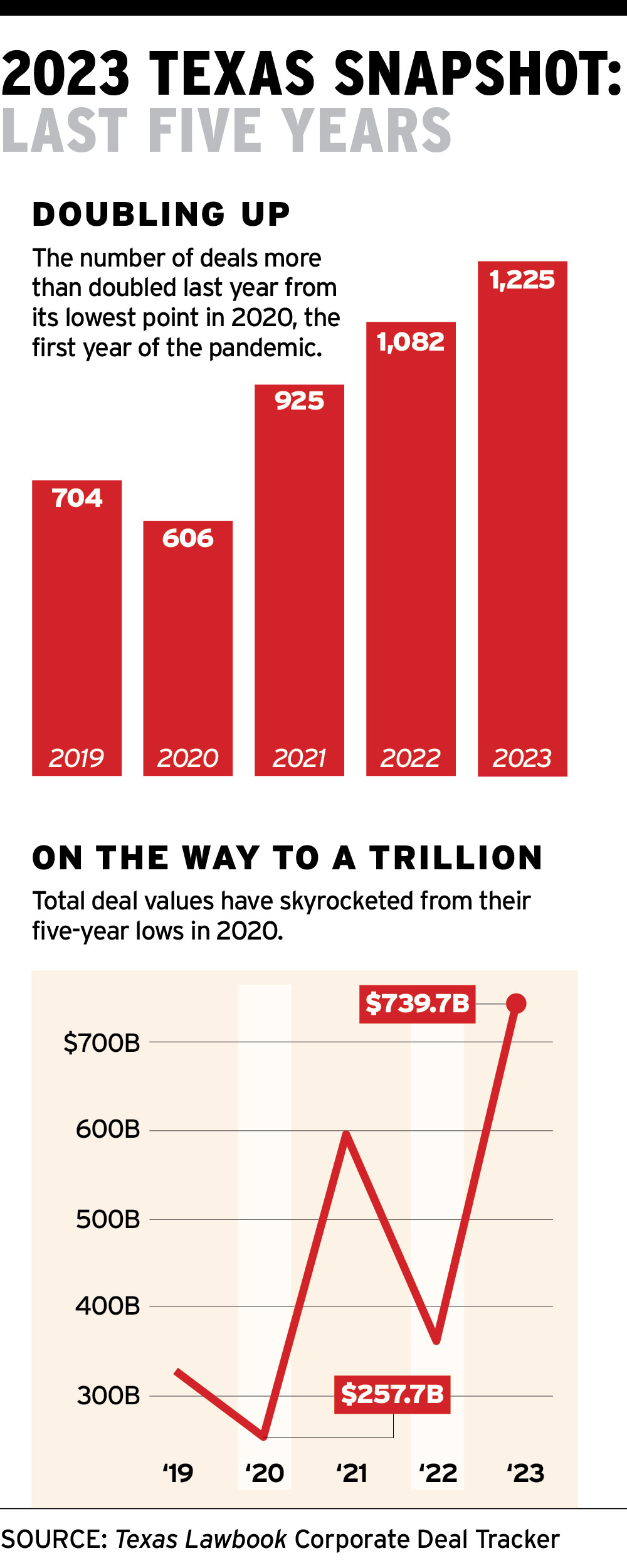

First, a record number of Texas-related deals were reported: 1,225 mergers, acquisitions and joint ventures with an aggregate value of $739.7 billion. That’s a 13.2 percent climb in deal volume over 2022 (1,082) and more than double year-over-year values ($367.1 billion).

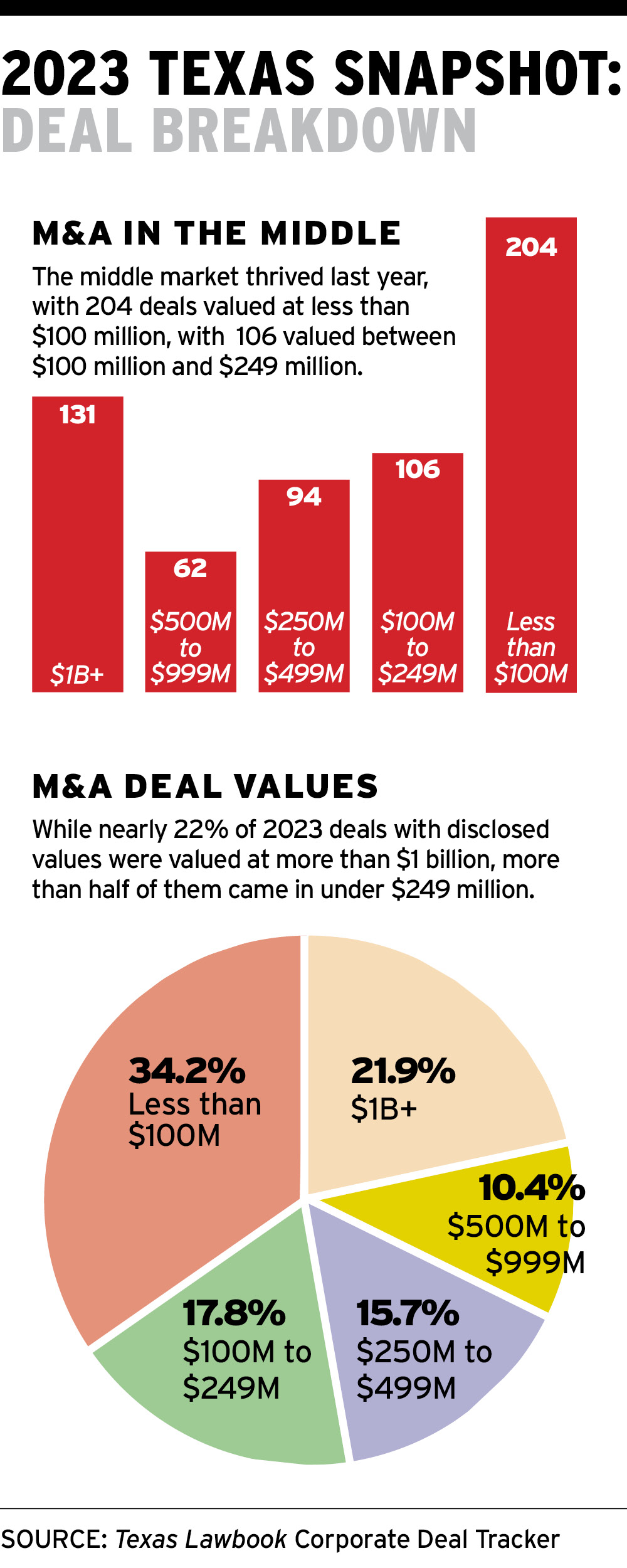

It was a record year for billion-dollar deals (131). But it was also a record year for deals under $100 million (204).

Moreover, when compared with the previous three years, 2023 began with the top quarter in deal volume (Q1, 332) and ended with the top quarter in deal value (Q4, $267.4 billion).

But the year seemed to feel more adequate than record-breaking, even to those who were grinding out M&A transactions all year.

Here’s Mollie Duckworth, Austin partner at Latham & Watkins:

“It was a challenging year for M&A, with continued market volatility and geopolitical conflicts dampening the initial optimism that we saw at the beginning of 2023. The combination of macroeconomic uncertainties and rising interest rates created somewhat of a perfect storm, impacting valuations, and diminishing market participants’ willingness to spend the time and resources needed to transact.”

Likewise, Rob Kibby, a corporate group shareholder at Munsch Hardt in Dallas, saw the year as a downturn of sorts:

“Many businesses got a huge shot in the arm (pun not intended) in the aftermath of Covid and saw much improved 2021 and 2022 results. But 2023 represented a pullback, which caused buyers to question whether the 2021 and 2022 numbers were sustainable.”

That’s not simply a gut feeling by two veteran Texas dealmakers. Globally, deals were down six percent by volume and 17 percent by value, according to LSEG Data & Analytics. In the U.S., dealmaking was down by five percent, the lowest level LSEG has reported in the past six years.

Moreover, 2023 was a year of angst. In January, inflation stood at 6.4 percent. In March, a banking scare precipitated by the failure of Silicon Valley Bank came. In October came the brutal Hamas attack on settlements in Southern Israel with its repercussions throughout the Middle East, and in between loomed periodic threats of a U.S. government shutdown.

But inflation flagged, dropping to 3.4 percent by year’s end. Likewise, interest rates cooled, governments across the globe responded quickly to the potential banking crisis, budget deals were reached and dealmakers responded to volatile markets and credit prices with what seemed like unprecedented creativity.

Hence, Chrissy Metcalf, a partner in the Dallas offices of O’Melveny & Myers, saw 2023 through a more bullish lens.

“Our team definitely saw ups and downs throughout the year, which started in H1 and continued through H2, but with less extreme ups or downs in H2. In 2023, we continued to see strong businesses being successfully sold and selling for solid multiples,” Metcalf said.

Mike Considine, a Dallas partner at Kirkland & Ellis, counts himself unsurprised by 2023.

“We had all anticipated a turbulent start to 2023 with an uptick in either the late second half or start of 2024. Things played out relatively close to plan. The market was looking for stability and once inflation and interest rates seemed to level off and both were known quantities, the markets reacted in kind.”

“While there were fewer traditional M&A deals in 2023 to start, we continued to see a number of complex fund level transactions, including secondaries, GP minority stakes (and mergers) and continuation vehicles,” Considine said.

That complexity has given rise to what Wilson Chu, a partner at McDermott Will & Emery, sees as an under-reported development in M&A finance.

“Dallas is becoming the country’s top-dog financial hub not-named-New York City. DFW is now firmly No. 2 (beating Chicago) in finance workers,” Chu said. “More (financial types) means more deals, and more traffic on the (North Dallas) toll road.”

DEALING WITH DEALS

Given the increased complexity of the M&A market, a note about the Corporate Deal Tracker process seems in order.

The CDT recognizes “Texas-related” M&A as deals involving a Texas-headquartered party or the work of Texas-based lawyers. It’s an expansive definition but one that has historically kept pace with broader market trends tracked by others.

In 2023, more firms submitted more qualifying deals involving their Texas lawyers (1,429 of them) than ever before. (By the way, thank you for that). More aggressive reporting by firms may account, in part, for the record numbers when compared to the past.

But greater volume tends to track alongside deals that involve smaller or undisclosed values, as firms report transactions that might have gone unreported in the past. Over the years, roughly half of the deals reported each cycle have included undisclosed values. In 2023, more than 51 percent of the deals reported included undisclosed values, and more than a third of the deals (34.2%) that included a value were valued at less than $100 million.

In 2022, the 140 deals under $100 million comprised 30.2 percent of the total number of deals with reported value. In fact, the 2023 share of deals under $100 million is the largest in the last five years. Beyond simple reporting bias, Kibby posits an intriguing explanation: demographics.

“There are a massive number of mid-market businesses owned by baby-boomers that can’t or won’t be passed on to the kids,” he said. “Those baby boomers aren’t getting any younger. M&A will happen naturally, regardless of whether the time to sell is optimal. Recently, I’ve seen an increased number of sales being driven by the passing of business owners, as the estate looks to wind up and sell its most significant asset.”

Kibby said he found the tech sector to be disappointing. He had a reason. Although there were 198 deals we’ve attributed to the technology sector, they accounted for only 16.2 percent of the Texas M&A volume and with $68.3 billion, just above 9 percent of deal value.

Even so, says Chu, technology has been gaining ground in Texas that may not yet be reflected in Lone Star State statistics.

“One under-reported trend is Texas becoming the undisputed U.S. hub for America’s semiconductor renaissance,” Chu said. He points out that a $2.2 billion semiconductor wafer fabrication facility in Sherman is already under construction by Dallas-based Texas Instruments.

“Together with activity driven by semiconductor adjacent businesses, it’ll be a seismic driver for Texas tech innovation and deal activity.”

Next behind technology M&A was manufacturing, with 89 transactions valued at $50.5 billion, with a 7.3 percent share of deal volume and a 6.8 percent share of value, a significant uptick from the record-breaking post-pandemic year of 2021, which saw 66 deals in the manufacturing sector valued at $17.1 billion.

Perhaps the most surprising was a surge in M&A involving entertainment and sports. The 30 deals reported in that sector accounted for $44.3 billion in value, ranking the sector fourth in 2023.

Kirkland’s Considine says the seeds for a rise in SM&E (Sports, Media & Entertainment) could be seen early on.

“Even at the start of 2023 when deal activity in some sectors was at a lull, the sports and media sector was very active. I guess we should not be surprised; the resiliency of sports drives a very compelling investment thesis. The sports industry, in particular, both at the professional and the collegiate level, will continue to evolve and we should expect to see some material developments this coming year.”

AND THEN THERE’S ENERGY

But this is also Texas. And the state is the undisputed epicenter of energy M&A, so we are obliged to discuss it. The energy sector — especially upstream and midstream energy — was a steady transactional performer — against many regulatory and economic headwinds — both in Texas and across the globe.

“The energy and infrastructure sector was definitely a bright spot with substantial deal activity last year,” says Duckworth. “Despite a notably down year across M&A as a whole, several significant energy deals shaped a remarkable year for M&A in the sector.”

“Improved commodity prices with respect to traditional oil and gas deals particularly impacted upstream activity, but there also continues to be a tremendous focus on investment in energy transition and decarbonization, highlighting the sector’s resilience even against a backdrop of broader economic difficulties,” Duckworth said.

In Texas, energy accounted for 351 (28.7%) of the 1,225 M&A transactions, followed by technology, a distant second with 198 deals (16.2%). Two of those energy deals were the top deals across the planet, and a third was among the top 12:

- ExxonMobil’s $64.5 billion acquisition of Pioneer Natural Resources

- Chevron’s $59.6 billion purchase of Hess Corp.

- ONEOK’s $18.6 billion acquisition of Magellan Midstream

Part of that has to do with pricing. Crude oil prices began the year at $78 per barrel and, according to Federal Reserve statistics, never dropped below $70 during the year. But deals in the energy space — and 2023 deals in general — were notable not just for their size but also, as noted by Considine, for their complexity, a natural market response to a sector buffeted over the past five years by price volatility, fears of inflation, global ESG concerns and geopolitical unrest.

Duckworth notes that the energy space has actually benefitted from some of those concerns.

“Improved commodity prices with respect to traditional oil and gas deals particularly impacted upstream activity,” she said. “But there also continues to be a tremendous focus on investment in energy transition and decarbonization, highlighting the sector’s resilience even against a backdrop of broader economic difficulties.”

Kibby says the rising complexity of deals was notable in the second half of 2023. Biden administration efforts to curb inflation, in effect, became the mother of dealmaking invention.

“The economic headwinds driven by the Fed’s efforts to put the brakes on the economy via rising interest rates, which effectively reduced the availability of credit,” Kibby said. “This has driven much greater uses of alternative financing, such as earnouts, mezzanine financing, non-bank lending, etc.”

WHAT ABOUT 2024?

With 2023 tucked in, what do their deal pipelines suggest about 2024? As always, there’s optimism tempered by experience.

Chu, for his part, sees a “breather” for PE firms and aggressive capital deployment by strategics.

“Strategic buyers are increasingly jumping on growth opportunities, especially in the under-$1 billion market where big strategics can pay out from petty cash,” said Chu.

For Metcalf, the pipeline suggests a steady first six months for 2024, a continuation of H2 2023.

“That being said, in terms of deal terms and who has the negotiating leverage, we definitely aren’t back to being in a “seller’s market” by any means,” Metcalf said.

Kibby is equally optimistic, particularly for the Lone Star State. “Both private equity and private equity-backed portfolio company M&A have been very strong and are a key driver of mid-market M&A transactions. There is so much capital on the sidelines, waiting for an opportunity to be invested.”

“I believe the Texas M&A market will remain healthy. 2023 was a great year, and there’s no reason to believe that 2024 will be any different. I don’t know that other areas of the country are saying the same thing,” Kibby says.

“The thing I’m most worried about is sentiment,” says Kibby, who worries that aging Baby Boom owners will resist entering transactions, even if they make economic sense.

“Business owners typically sell for reasons that are more emotional than analytical. Successful mid-market business owners tend to operate on their gut instinct, which has served them well over the decades they’ve run the business. The decision to sell is much more complex than attempting to maximize the sale price for the business. It includes questions like: What am I going to do with the rest of my life? How do I take care of family members? Am I going to have to take orders from someone else?” Kibby says.

Count Duckworth among the optimists. “Our current pipeline suggests that 2024 will be a dynamic year for deal activity, fueled by considerable pent-up demand. Many players who stayed on the sidelines in 2023 are now eager to engage. And the potential for more stable conditions in both interest rates and the geopolitical environment is generating a renewed sense of optimism. Particularly if we start to see the public capital markets re-open in a meaningful way, we expect a strong deal landscape this year.”

Considine is also hopeful, based on what he sees in his client pipeline of ongoing deals.

“We had a number of clients spend the latter half of 2023 and early start of this year preparing for a sale process. We also have a number of clients that have significant capital to deploy. For those processes that have started, we are already seeing strong engagement and interest. These are great assets and there is a flight to quality right now, so it is not unexpected.”

“In addition to traditional portfolio sales, we expect a number of carve-out acquisitions and divestitures as larger organizations refocus their balance sheets and business lines this year. Overall, 2024 has the opportunity to be a very solid year,” says Considine.