© 2013 The Texas Lawbook.

By Mark Curriden

Senior Writer for The Texas Lawbook

(May 6) – Merger and acquisition activity involving Texas-based businesses declined dramatically during the first three months of 2013 compared to the final quarter of last year.

The number of corporate deals in Texas dropped from 143 during 2012’s fourth quarter to 81 during Q1 of this year – a 43 percent decline, according to mergermarket media.

Legal experts say that the disparity between the two quarters shows just how many transactions were announced during the final three months of 2012. They point to the fact that there were 80 deals announced during Q1 of 2012.

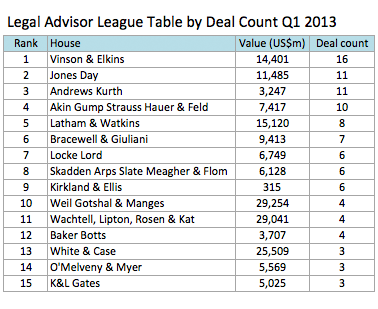

Buoyed by a seemingly endless number of oil and gas acquisitions, mergers and joint ventures, Vinson & Elkins led all law firms in deal count with 16. Jones Day, Andrews Kurth, Akin Gump and Latham & Watkins rounded out the top five.

Weil, Gotshal & Manges and Wachtell, Lipton were involved in only four deals each during Q1, but they were biggies. Both played lead roles in Silver Lake Partners’ proposed $20.2 billion acquisition of Dell Inc. and Kinder Morgan’s $4.2 billion purchase of Capano Energy.

The value on the 81 deals announced during the first three months of 2013 was $36.2 billion, meaning that the Dell and Kinder Morgan transactions accounted for more than two-thirds of the total deal value.

Seventy-three of the transactions had price tags of $500 million or less.

Evercore Partners was the financial adviser in nine of the deals valued at a combined $31.2 billion. Citi advised eight of the deals worth a total $30.5 billion.

© 2013 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.