Jay Cuclis

In February 2018, the global law firm White & Case opened its Houston office with four lawyers, no associates, no support staff and sublet space in Two Allen Center.

The goal, firm leaders announced at the time, was to grow the office to 50 attorneys.

Nearly six years later, White & Case now has more than 100 attorneys in its Houston office, including 11 first-year associates who just joined. The New York-based corporate law firm occupies the 29th and 30th floors in 609 Main Street, also known as Trophy Tower, and just took over the 31st floor, which will allow it to expand to 150 lawyers. And it has an option for half of the 28th floor.

“We have vastly exceeded my expectations and vastly exceeded the expectations of White & Case,” said Jay Cuclis, executive partner of the firm’s Houston office and co-chair of its global energy practice. “White & Case has had a well-known energy practice that focused on projects and finance, and we came to Houston to fill a hole in the donut.”

White & Case generated $97 million in revenues from its Houston operation in 2022 — up from $44 million in 2020, according to the Texas Lawbook 50. About 50 percent of the work being done by the firm’s Houston lawyers came from business generated by lawyers in Houston and 40 percent came from the firm’s institutional clients.

Cuclis, who spent 36 years at Vinson & Elkins before joining White & Case in 2018, said the firm is expecting another year of strong revenue growth in 2023.

Thirty different clients paid $1 million or more in legal fees to lawyers in White & Case’s Houston office in 2022, and no single client accounted for more the six percent of the office’s revenue.

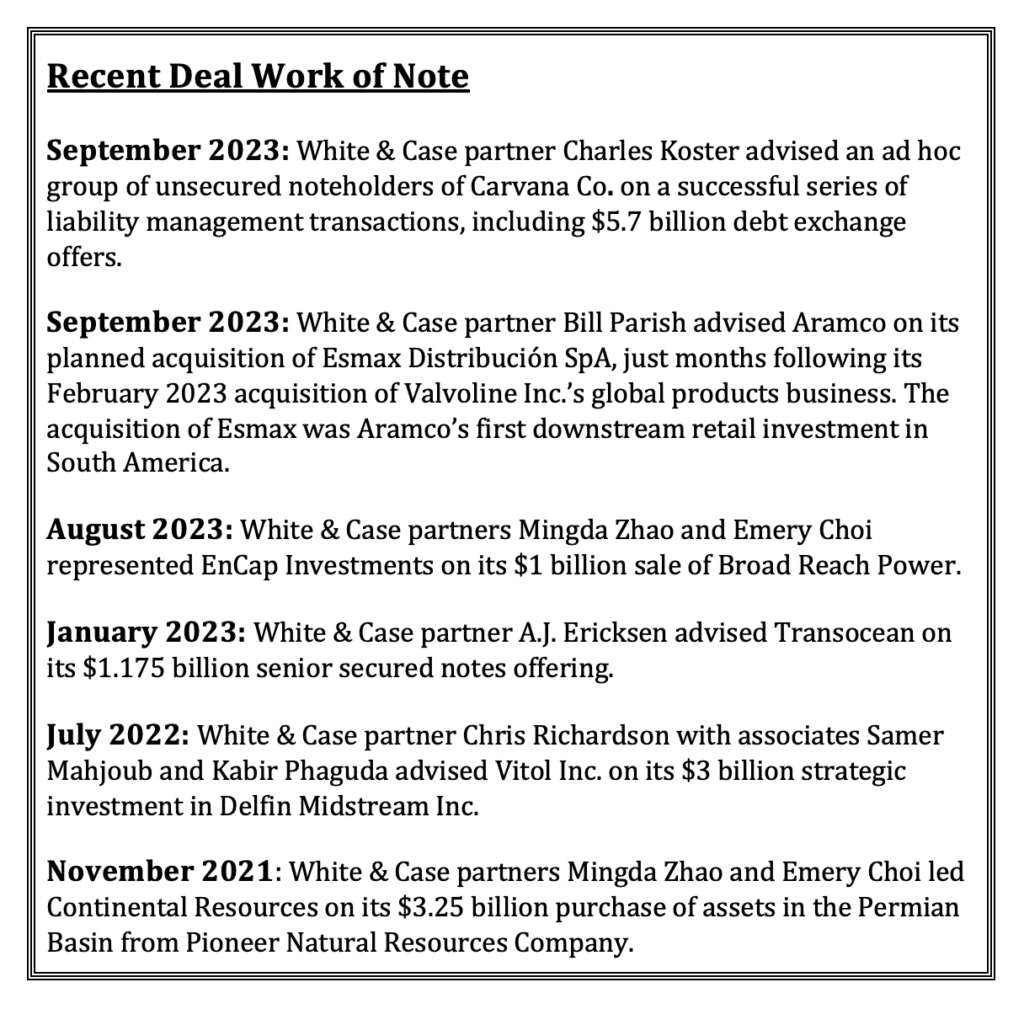

White & Case’s Houston lawyers have represented energy powerhouses such as Vitol, Continental Resources, Sempra Energy, Transocean and EnCap Investment. During the past three years, the firm’s Houston lawyers have led or co-led more than 100 publicly announced M&A and capital markets transactions with a combined value of $100 billion, according to The Texas Lawbook’s exclusive Corporate Deal Tracker database, which identifies transactions handled by lawyers based in Texas. The firm reports that its Texas lawyers have been involved in more than 6,000 corporate transactions with a value of $5 trillion.

Earlier this month, Cuclis and the firm advised Occidental Petroleum in BlackRock’s $550 million investment in Oxy’s direct air capture decarbonization project in West Texas called Stratos.

“The past two to three years of carbon capture projects have been unique and an incredible learning experience,” Cuclis said. “We’re working with several clients accessing funds for projects under the Inflation Reduction Act. Over the next six months, we are going to see a lot of activity and announcements.”

“I feel like I’ve learned to speak carbon capture, which is its own language,” he said.

White & Case has grown aggressively through lateral hiring, including CapM attorneys from Baker Botts, M&A lawyers from Vinson & Elkins, an energy project finance attorney from Bracewell and a corporate in-house counsel from Noble Energy.

“We were busy from day one,” he said. “The biggest challenge that we’ve faced is having enough lawyers to do the work our clients have for us.”

In January, White & Case officially expanded its Texas operation beyond corporate transactional practices when the firm hired three litigation partners from Bracewell: Sean Gorman, Chris Dodson and Andrew Zeve.

“We kept having clients who were getting sued, and we realized we were sending a lot of work to other law firms,” Cuclis said.

The firm, which has 46 offices around the globe, reported annual revenue of $2.8 billion in 2022 and profits per partner of nearly $3 million.

Cuclis said the firm has “no immediate plans” to open offices in either Dallas or Austin, but it does plan to continue growing in Houston.

“We are focusing on deepening the benches of the legal practices that we have, especially oil and gas and energy transition,” he said.