© 2015 The Texas Lawbook.

By Mark Curriden

(May 14) – Oakland A’s General Manager Billy Beane stood before partners of Haynes and Boone last October at the Gaylord Texan Hotel with a message: Just because you cannot afford the highest priced talent doesn’t mean you cannot play in the major leagues.

HayBoo and about a dozen other large, full service Texas-based law firms face competitive pressures that are quickly and dramatically transforming the Texas legal marketplace – changes that result in wealthy, aggressive law firms being bigger and more profitable while other firms shrink, merge or eventually dissolve.

The Dallas-based firm believed that Beane, the baseball genius who was the focus of the book Moneyball: The Art of Winning an Unfair Game, could provide crucial advice. Or at least they would get to meet the character played by Brad Pitt in the movie version.

As it turned out, Beane’s insight was a home run.

“Billy Beane talked to us about competing at the highest levels, despite not having the biggest payroll,” said HayBoo Managing Partner Tim Powers. “He said we have to look at things differently and figure out how to compete and succeed based on the resources that we have.

By all appearances, the Texas legal market is firing on all cylinders. Overall, Texas business lawyers worked more hours, generated more revenues and earned more profits in 2014 than any year in history, according to data obtained by The Texas Lawbook.

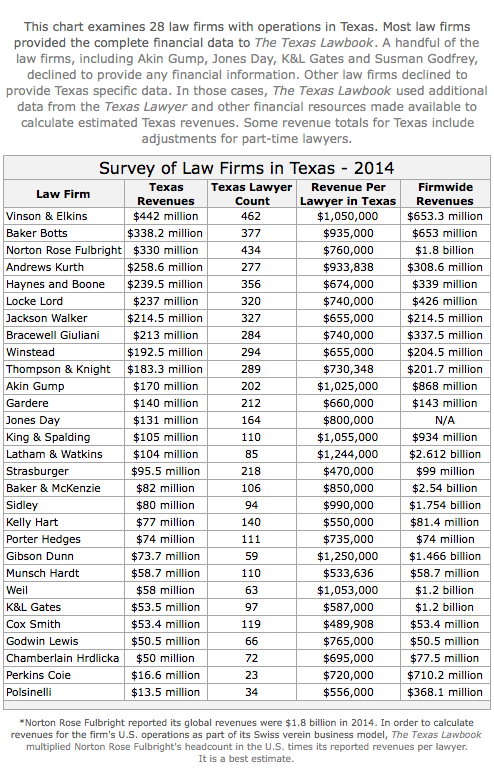

Lawyers practicing at 28 of the largest law firms operating in Texas billed more than $4 billion in revenues last year – an increase of more than seven percent from 2013, according to financial information provided to The Texas Lawbook. The demand for legal work by Texas companies actually increased nearly four percent last year, even as corporate legal work in most other markets was stagnant or declined in 2014.

Despite the record revenues and profits, legal industry insiders say that the Texas legal marketplace is in turmoil.

A handful of law firms – those described by legal consultants and analysts as the “elites” – are experiencing phenomenal growth in revenues, profits and workload. Litigation boutiques targeting business disputes seem to open weekly. National law firms with specialty practice areas such as health care, employment law and intellectual property law, are flooding into Texas. Even global mega-law firms have infiltrated the state’s once tightly knitted legal marketplace.

“Texas is an extremely competitive market for talent and clients,” said Thompson & Knight Managing Partner Emily Parker. “The elite firms are following the energy clients. We see franchising operations setting up in every major city, including now in Dallas and Houston. All these factors are coming together at once because of the Texas economy.”

“Many of the big Texas firms became too comfortable and they didn’t pay the attention necessary to meet their clients’ evolving needs,” said Houston law firm consultant Bill Cobb. “As a result, they have lost significant business and are indeed fighting for survival.”

Financial analysts who monitor the legal industry in Texas agree.

“Upper middle market law firms are getting squeezed. They are getting pressure from both ends,” said Jeff Grossman, senior director of Wells Fargo Bank’s Wealth Management Legal Specialty Group. “There’s an uber segmentation of the Texas marketplace.

“The top profitability law firms are significantly outpacing the other law firms,” he said.

Grossman said that revenues at the elite business law firms in Texas grew by 12 percent in 2014, while the remaining full service law firms experienced minimal to no gains.

It is a trend that spans several years and shows no sign of turning back.

Eight of the 28 law firms in The Texas Lawbook financial survey saw its revenue per lawyer increase by more than 25 percent during the past five years. By contrast, revenue per lawyer at a dozen Texas-based full service law firms surveyed grew less than 10 percent since 2010.

Seven law firms with sizeable operations in Texas reported revenues per lawyer at or above $1 million a year. Five of those firms are based outside of Texas.

Four of the seven highest revenue per lawyer firms – Gibson Dunn, King & Spalding, Latham & Watkins and Sidley Austin – had no office at all or only a miniscule presence in Texas in 2009. The 349 Texas-based lawyers at those four firm law firms generated more than $362 million in revenues in 2014, according to The Texas Lawbook financial survey.

“The elite law firms are doing so much better than the rest,” said John Wilmouth, a senior client advisor with Citi’s private banking law firm group.

Legal industry analysts almost unanimously agree that those four non-Texas based firms, plus Dallas-based Akin Gump and Houston-based Baker Botts and Vinson & Elkins, are the “elite” firms dominating the aristocracy of the Texas legal marketplace, at least when it comes to generating revenues and profits.

Texas-based lawyers at Gibson Dunn in Dallas and Latham in Houston generated $200,000 more in revenues in 2014 than their counterparts at Akin Gump and V&E, which are the highest performing Texas-based law firms.

The revenue gap widens to $500,000 per lawyer per year or more when Gibson Dunn and Latham are compared to lawyers at upper mid-market firms such as Haynes and Boone, Locke Lord and Thompson & Knight.

Experts point out that there are other “elite” firms operating in Texas, including Kirkland & Ellis, Simpson Thacher & Bartlett and Skadden, Arps, Slate, Meagher & Flom, and Weil Gotshal & Manges, but that there footprint in the state remains considerably smaller than their competitors.

“The gap between the ‘haves’ and the ‘have nots’ has widened quickly in Texas,” said Rob Walters, managing partner of Gibson Dunn’s Dallas office. “We’ve been in a steady ascent toward the barrister system, where expertise and the ability to specialize is given a much higher value. This is especially true in the litigation practice, where many of the large full service Texas firms no longer get the high-end work.

To prove the point even more dramatically, Texas Lawyer reported last month that the average profits per partner at the 25 largest law firms in Texas grew by just one percent from 2013 to 2014.

One percent.

At the same time, profits per partner at two of those law firms, Baker Botts and Vinson & Elkins, skyrocketed by 26 percent and 13 percent respectively, according to Texas Lawyer magazine. V&E reported that its profits per partner exceeded $1.9 million in 2014, which is more than double the profits per partner at upper middle market firms Locke Lord, Winstead, HayBoo, Gardere, Jackson Walker and Thompson & Knight.

Just six years ago, Texas-based law firms dominated the rankings of successful legal practices in the state when judged by revenues per lawyer and profits per partner. Only two national law firms – Jones Day and Weil – even made the top 10.

Today, seven of the 15 top firms in revenues per partner are based outside of Texas. Five of them would not have been on the chart just five years ago.

“The deck has been completely reshuffled in Texas,” said Kent Zimmerman, a legal consultant with Zeughauser Group. “In a short amount of time, the leaderboard has changed significantly.”

The trend can be traced to 2010, when Latham opened a Houston office by poaching about a dozen top corporate and tax lawyers from V&E, Baker Botts and Akin Gump.

National legal powerhouses Simpson Thacher, Sidley, Winston & Strawn and Kirkland soon opened their own shops in Houston. Gibson Dunn dramatically expanded its Dallas office.

“Law firms moved into Texas, buying lawyers with $4 million-a-year profits per partner was bound to have a big impact,” said Parker with Thompson & Knight. “It is hard to compete with firms with those kinds of resources. Of course, with those salaries come New York rates.”

The elite national law firms targeted some of the best partners at each of the Big Tex firms – lawyers with significant books of business who specialize in high-dollar practice areas, such as corporate M&A, oil and gas transactions, capital markets, tax law and complex commercial litigation.

“It was rare for V&E and Baker Botts to ever lose partners,” said Brad Hildebrandt, a national law firm consultant who works with several firms in Dallas and Houston. “Texas was an isolated market. Law firms follow clients and money. Texas law firms have never seen this kind of competition before.”

As a lure, the elite national firms offered significant pay increases, including guaranteed compensation packages valued between $2 million and $5 million annually.

“The fight for the best talent has gotten fierce,” Zimmerman said. “The law firms that pay the most get the best talent. The best talent gets the best clients. The best clients pay the highest rates, which leads to greater revenues and profits.”

Nowhere is the success of the national elite firms more evident than in the world of mergers and acquisitions.

Two of the top four law firms that handled the most mergers, acquisitions, joint ventures and securities offerings in 2014 for Texas-based businesses were Latham and Kirkland & Ellis, neither of which even had an office in Texas prior to 2010. More than half of the top 20 law firms representing Texas-based companies involved in M&A were firms based outside of Texas.

“Texas has a lot of mid-market law firms that once got a lot of big deals that just do not see that work anymore,” said Michael Dillard, managing partner of Latham’s Houston office. “Companies look for expertise. It is hard for mid-market law firms to compete for the talent that has the expertise.”

“We still see growth opportunities in Texas, but it certainly will not be as fast as the past five years,” Dillard said.

Two other law firms – Sidley and Morgan Lewis – are following Latham’s lead. Both firms spent a considerable amount of money to expand in Dallas and Houston.

“We think there’s still significant growth opportunities here,” said Yvette Ostolaza, managing partner of Sidley’s Dallas operation. “Our revenues here are as good, maybe even better, than the national average. So, we will continue to seek additional strategic hires.”

“It is a market disruption,” said Powers of Haynes and Boone. “Lawyers get all these phone calls about better pay. What are they supposed to do? Just the invasion creates some anxiety.

“I’m not going to lie to you,” he said. “We worry constantly if we are positioned well enough to keep our partners from going to more lucrative law firms or well enough for our lawyers to keep or grow their clients.”

Powers and leaders at more than a dozen Texas law firms say they continue to receive calls from national law firms seeking to open an office in the state or interested in discussing a merger.

National law firms that have expressed an interest in starting a branch in Texas include San Francisco-based Orrick, Herrington & Sutcliffe, London-based Allen & Overy and White & Case in New York.

Gibson Dunn, which has experienced tremendous success in Dallas, is interested in opening in Houston, if the right situation presents itself, said Walters.

“We’ve had lots of conversations about Houston, but it could be six months or six years before it happens,” he said. “Of the 30 or so firms that have moved into Houston, only a few have done it well. Latham and Sidley are two.”

Walters said Houston lawyers who receive inquiries about their interest in joining Gibson Dunn in Houston are being misled.

“Nobody is calling on behalf of Gibson Dunn,” he said. “These are headhunters trying to be entrepreneurial.”

Walters said his old law firm, Vinson & Elkins, should be given a lot of credit for making tough business decisions and developing a strategy to be a go-to elite energy law firm.

“V&E used its reputation as a great energy law firm and focused its money and resources on what it does best,” Walters said. “Latham, Sidley and Gibson Dunn raided V&E for top partners and yet the firm continues to demonstrate its depth and influence in the state and in oil and gas legal work.”

The evidence supports Walters’ claim. Despite having lost more than three-dozen lawyers during the past few years to national elite firms, V&E has seen its revenue per lawyer and profits per partner steadily increase. Texas Lawyer reports that V&E’s profits per partner topped $1.9 million in 2014.

While revenues and profits increased, V&E’s lawyer headcount actually declined. The firm shed less profitable practice groups, including healthcare, government lobbying, public finance and products liability litigation.

“Texas law firms started in 2012 to push out senior partners from equity positions and shed less lucrative practices,” said Grossman of Wells Fargo, who did not mention V&E specifically.

“If the upper middle market law firms take this opportunity to address over-capacity and focus on value billing, they will survive and be successful,” Grossman said. “Sometimes, shrinking and getting smaller is better.”

V&E focused on its strength: oil and gas transactions.

The Texas Lawbook’s Corporate Deal Tracker shows that V&E continues to dominate M&A activity involving oil and gas companies. In 2014, V&E advised companies involved in 81 mergers, acquisitions and joint ventures. Latham was second with 53 deals.

“V&E is performing at a very high level,” Zimmerman said. “Baker Botts is also doing well.”

Indeed, Baker Botts joined V&E in having a record financial year in 2014.

Baker Botts was lead counsel in four of the five largest transactions of 2014, including Kinder Morgan’s $58.7 billion restructuring and Halliburton’s $38 billion acquisition of Baker Hughes. The Houston-based firm saw its revenue per lawyer increase nine percent and its profits per partner leap 25 percent, to $1.7 million.

“The Texas legal market has matured into a market that previously existed in other global cities,” Baker Botts Managing Partner Andrew Baker said. “Competition today comes more from practice groups than from geography.

Baker pointed out that Baker Botts celebrates its 175-year anniversary later this year and is committed to being a full service law firm.

“We are taking the time to consider why our firm has lasted this long when the average life of a Fortune 500 company is 40 years,” he said. “We are spending tremendous resources to re-examine every aspect of our firm to improve legal services.”

Partners at Baker Botts and V&E say they have no interest in merging with other national or international law firms.

“We discussed the possibility of merging with an equal-sized or larger global firm, but decided against it,” said V&E Chairman Mark Kelly. “We want to grow, but we decided against the strategy of having lawyers in every market.”

“There is going to be more consolidation in the Texas legal market,” said Locke Lord Chair Jerry Clements, who continues to engineer the Dallas-based firm through its most recent merger with the Edwards Wildman firm in Boston.

“Anyone in my position would be crazy not to keep an eye open to opportunities,” Clements said. “But I am not considering any merger discussions right now. I’ve got my hands full with our recent merger. We still have a few things we want to do, but we are in every major market where we wanted to have a footprint.”

HayBoo’s Powers admits that he also receives regular inquiries from non-Texas firms seeking a merger, but that no such plans are in the works.

Instead, Powers said that he and his partners are applying the practices Billy Beane discussed by developing a business strategy that is unique to Haynes and Boone and its clientele.

“Upper middle market is where we operate best,” Powers said. “The upper middle market is hugely profitable and there’s so much legal work that needs doing in that space.

“It is not about competing with the top five-tiered law firms, but about competing with the law firms in our space,” he said. “Firms must realize their strengths and identify the opportunities that are there for them.”

While HayBoo is a full service law firm, specific practice areas certainly standout as among the best in the state. For example, the firm’s litigation and appellate section, led by Anne Johnson, Nina Cortell, Barry McNeil and David Harper, represents high-profile clients, including Energy Transfer Partners, NextEra Energy and the National Football League.

“We can be the top law firm in one or two or three areas and then expand on that,” Powers said.

(Editor’s note: The Texas Lawbook does not include profits per partner numbers in its law firm financial report because it is too easy for firms to manipulate it by shifting lawyers out of equity partnership positions.)

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.