© 2015 The Texas Lawbook.

By Natalie Posgate and Mark Curriden

(Nov. 9) – Houston corporate attorney Mike O’Leary has had an incredibly productive year.

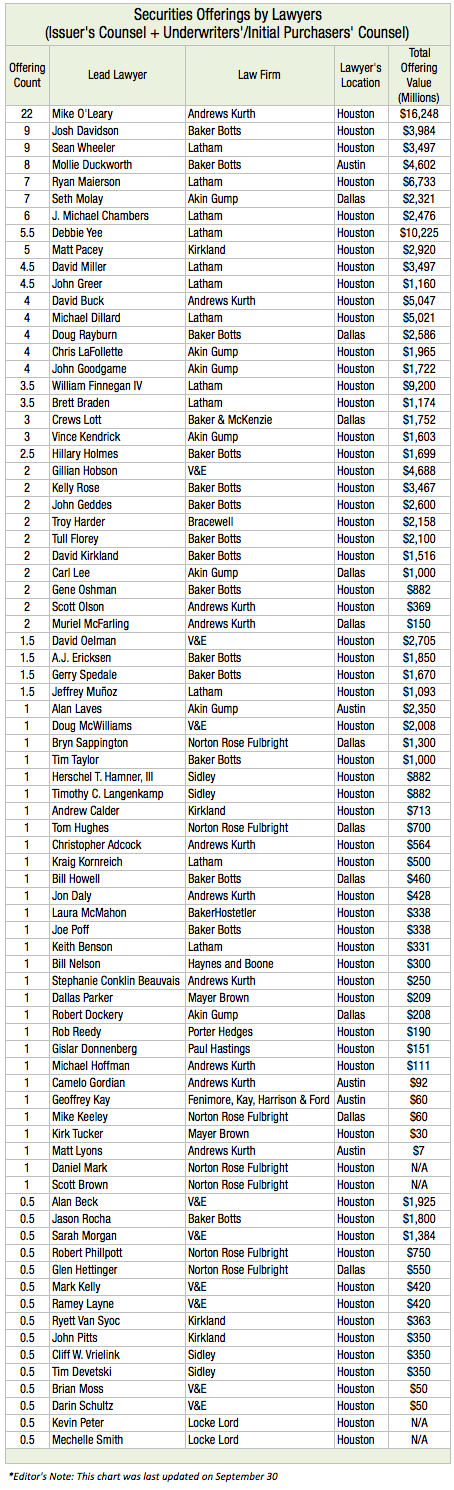

The Texas Lawbook’s Corporate Deal Tracker shows that O’Leary represented issuers and underwriters in 22 securities capital and debt offerings valued at $16.2 billion, which is three times more than the capital markets attorney in second place.

O’Leary’s securities offering work primarily involves representing energy companies and underwriters investing in the energy industry.

Offerings he has handled range from Landmark Infrastructure Partners’ $50 million follow-on offering of 3 million common units to Energy Transfer Partners’ $3 billion offering of senior notes. He represented the underwriters in both of those instances.

O’Leary’s securities offering work follows the downturned pattern of activity in capital markets. Out of the 22 offerings O’Leary has handled this year, 73 percent occurred in the first six months.

Across the board, Texas lawyers only worked on 25 securities offerings in the third quarter, compared to 171 offerings in the first two quarters.

But out of those 25 offerings in the third quarter, O’Leary handled nearly one-fourth of them.

“We witnessed an awful lot of securities offerings during the first six months of the year,” O’Leary said. “It was a rush by companies to raise as much money as possible. There were so many offerings in such a short period of time. They wanted to grab the money while it was still available to them.”

During the first half, O’Leary and his colleagues witnessed several clients who would finish an equity securities offering and immediately jump into a debt offering.

“Oil and gas upstream companies have other debt that needs to be refinanced or capital commitments and obligations that they need to fund or face losing the opportunity,” said O’Leary, a graduate of the University of Houston Law Center. “But the bloom is clearly off the rose.”

O’Leary said he anticipates the levels of activity for securities offerings in the fourth quarter to remain about the same as the third quarter.

“There’s no catalyst for change for the next quarter or several months,” O’Leary said. “It will take a while.”

O’Leary pointed out that initial public offering activity will be interesting to watch in the upcoming quarter, because new data indicates that a record number of IPOs have been put on hold or even withdrawn during the past few months.

One IPO that is pending is Freeport McMoRan’s, which was announced in June. O’Leary is representing the underwriters in that IPO – if it gets done.

“We saw a lot of MLPs and corporate IPOs, but the market is now very volatile,” O’Leary said. “It will be interesting to see how many of the IPOs actually get done.”

On the M&A side, O’Leary ranks fourth for the most deals completed by Texas lawyers this year. He has led or co-led seven deals valued at $9.3 billion.

His work ranges from representing Crestwood Equity Partners’ $7.5 billion merger with Crestwood Midstream Partners to representing the conflicts committee of EV Energy Partners’ $259 million acquisition of oil and natural gas properties from EnerVest Institutional Partnerships.

Most recently, O’Leary led a BP subsidiary’s Oct. 20 agreement to sell 15 refined products terminals to Kinder Morgan for $350 million and subsequent joint venture.

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.