© 2015 The Texas Lawbook.

By Mark Curriden

(Feb. 16) – Texas business bankruptcies jumped significantly in 2015, but lawyers and financial experts say last year’s increase is nothing compared to the tidal wave of corporate failures headed this way.

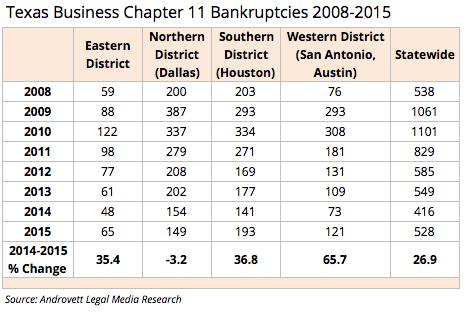

Bankruptcy courts in South and West Texas saw the number of companies filing for protection under Chapter 11 of the U.S. Bankruptcy code increase 37 percent and 65 percent respectively last year, according to new data provided by Androvett Legal Media.

Financial and legal advisers who specialize in corporate restructuring say they have been hired during the past few weeks by scores of additional Texas-based businesses – most of them in the oil and gas sector – to explore their bankruptcy options.

Eighteen prominent bankruptcy experts interviewed by The Texas Lawbook say they expect the number of oil and gas companies in Texas that file for bankruptcy in 2016 to double and that those bankruptcies will cause a domino effect that will spread to other business sectors.

“The carnage is going to be terrible and widespread unless oil prices rebound quickly,” said William Snyder, head of restructuring at Deloitte in Dallas. “Bankruptcy filings are going to double.”

Snyder, who is viewed as one of the nation’s leading bankruptcy experts, said Deloitte has an additional 75 oil and gas companies on the accounting firm’s danger list – companies, he said, that are “running out of cash.”

“Everyone is panicked,” he said. “We are going to see some gigantic companies filing that no one even suspects.”

Forty-eight oil and gas service companies and exploration and production companies filed for bankruptcy during the past 13 months – nearly all of them upstream exploration and production companies or oil and gas service companies, according to a report issued last week by the law firm Haynes and Boone.

To make matters worse, there’s growing concern that new legal tactics being argued by lawyers for bankrupted E&P corporations will cause the financial distress to spread more quickly to midstream companies, which had previously been viewed as less vulnerable to the economic downturn.

“But this is Texas,” Columbus said, “which automatically means oil and gas, even in bankruptcy.”

Emanuel Grillo, a partner in the financial restructuring section at Houston-based Baker Botts, agreed that bankruptcies will expand well beyond oil and gas companies.

“The ripple or domino effect will infect retail, manufacturing, recycling of plastics and more,” he said.

As a result, law firms are beefing up their bankruptcy practices. Bankruptcy courts in Texas, which were basically deserted for the past five years, are suddenly busy and about to get inundated with new cases.

Most of the large Texas law firms have added lawyers to their bankruptcy sections.

“Firms are definitely increasing their depth. We added three lawyers a couple weeks ago and are looking to grow our expertise,” says Bill Wallander, who leads the bankruptcy and restructuring practice at Vinson & Elkins. “It’s very competitive right now for talent and clients.”

Business bankruptcy filings in the Western District of Texas, which extends from Waco to Midland to El Paso, escalated 66 percent last year. The Southern District of Texas, which includes Houston, experienced a 37 percent leap in new filings. The Eastern District of Texas, which spans from Beaumont to Plano to Texarkana, witnessed a 35 percent increase in Chapter 11 corporate restructuring petitions.

The single anomaly was the Northern District of Texas, which actually witnessed a three percent decline in business bankruptcies.

“Dallas-Fort Worth is more economically diverse than the other regions in Texas and has not been hit as hard or as fast or as direct as the other regions,” said Sid Scheinberg, a bankruptcy partner at the Godwin law firm in Dallas. “The oil and gas impact on North Texas is just delayed, but it is almost certainly coming.”

“These companies are trying to avoid the expense and unpredictability that can come in bankruptcy court,” Sutherland said.

The sad truth is that the distress in the oil patch is welcomed news for those who specialize in bankruptcy restructuring and reorganization.

Business bankruptcies declined every year since the end of the Great Recession in 2009. There had been so few corporate bankruptcies during the past few years that many law firms shifted their restructuring and reorganization lawyers to their mergers and acquisitions practices to assist overworked dealmakers.

“The Chapter 11 practice was all but dead in Texas the past several years,” said Demetra Liggins, a partner in the bankruptcy section at Thompson & Knight in Houston. “We had nowhere to go but up.”

“Many oil and gas companies are finally approaching the point where they can no longer extend and pretend,” Liggins said. “Bankruptcy is the only option.”

Then came last June, when access to the capital markets and easy money dried up for heavily leveraged companies and federal regulators squeezed financial institutions to be tougher on the debt for those businesses. At the same time, oil and gas prices declined further, just as debt payments came due.

As mergers, acquisitions and securities offerings fell, bankruptcy filings climbed.

“This is just the beginning of the downturn,” said Winston & Strawn bankruptcy partner Lydia Protopapas in Houston. “There are some pretty dire predictions out there.”

“More and more oil and gas companies are becoming more vulnerable because the hedges are finally rolling off,” Protopapas said.

Protopapas and others say there’s definitely a pattern that’s developing in this economic cycle.

“Smaller and weaker oil and gas service companies and E&P companies filed for bankruptcy first,” Wallander said. “Sometimes, the failure of weaker companies can impact larger oil and gas companies that were considered healthy.

“If a large company fails unexpectedly, then there will be a domino effect,” he said.

Legal experts say there is a potential landmine in the oil patch that surfaced during the past three weeks that could negatively impact midstream companies, which have been presumed to be almost immune from bankruptcy because they have long-term, lucrative contracts to transport dry gas, propane and crude oil.

Lawyers representing Houston-based Sabine Oil & Gas, which filed for Chapter 11 protection last July in the Southern District of New York, asked the federal bankruptcy judge overseeing the case to reject expensive gathering and processing agreements on certain properties that Sabine signed with midstream pipeline companies during more prosperous financial times.

These contracts have previously been considered untouchable, even in bankruptcy court, because they were viewed as “covenants running with the land” under Texas law because they actually touched the property, which meant the agreements attached to them could not be rejected in bankruptcy court.

But New York Bankruptcy Judge Shelley Chapman, during a hearing in the Sabine bankruptcy two weeks ago, said she was “inclined” to grant Sabine’s motion to reject the contracts the oil and gas company has with its midstream partners, which could possibly save Sabine tens-of-millions of dollars annually.

While such a ruling would benefit E&P companies, it could financially devastate some midstream companies and force them into bankruptcy, according to lawyers involved in the Sabine litigation.

Bankruptcy lawyers described it as the “undertow effect.”

“Weaker companies suddenly cause instability among larger companies that are otherwise strong,” Grillo said. “Strong companies suddenly become vulnerable. Once the dominoes start falling, watch out.”

© 2015 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.