During the past few weeks, The Texas Lawbook asked corporate practice leaders at Kirkland & Ellis, Latham & Watkins and Vinson & Elkins who they see most often sitting across the table from them when negotiating the big mergers, acquisitions, joint ventures and divestitures.

The answers were simple:

-

- V&E’s Keith Fullenweider: Kirkland and Latham;

-

- Kirkland’s Andy Calder: V&E and Latham; and

-

- Latham’s Michael Dillard: V&E and Kirkland.

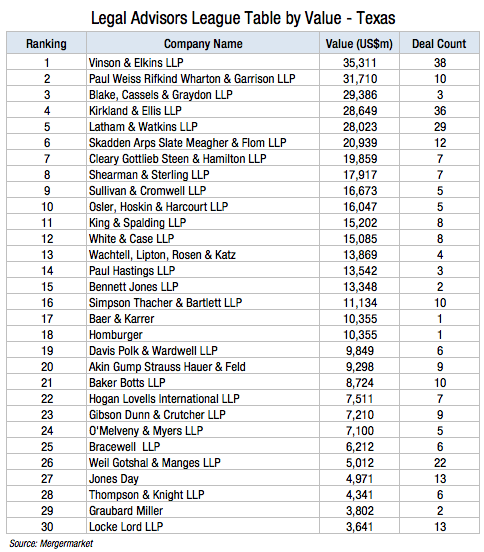

New data provided exclusively to The Texas Lawbook by independent research firm Mergermarket shows that most corporate law firms operating in Texas increased the number of deals they handled for clients during the first half of 2017 and that V&E, Kirkland and Latham continue to dominate the top of the league table rankings.

Law firms headquartered outside of Texas continue to grab more of the deal pie away from firms based inside the state and Texas’s larger corporations continue to turn to national law firms – many of which have no Texas office at all – to handle their biggest and most complex M&A, according to Mergermarket.

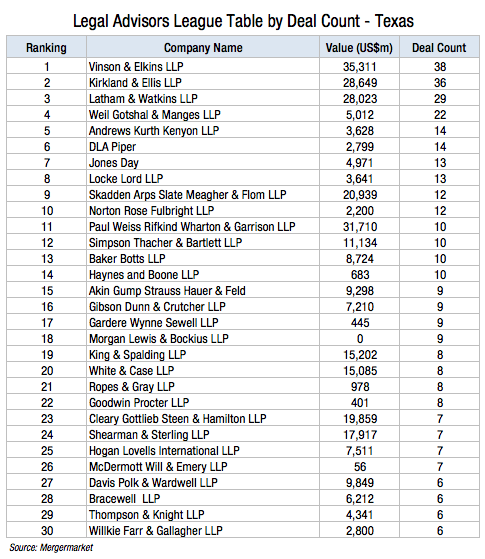

The Mergermarket data for deal count for the first six months of 2017 found that:

-

- Twenty-three of the top 30 law firms advised on more transactions than they did one year earlier;

-

- Four law firms – Haynes and Boone, Locke Lord, White & Case and Willkie Farr – did fewer deals than they did in H1 2016;

-

- Eight law firms – Andrews Kurth Kenyon, Gardere, Gibson Dunn, Morgan Lewis, Simpson Thacher, Skadden, V&E and Weil – doubled the number of transactions they handled;

-

- Twenty-one of the 30 firms doing the most deals are based outside of Texas;

-

- Eight of the 30 firms do not have offices in Texas; and

-

- Four law firms – Jackson Walker, Porter Hedges, Sidley and Sullivan & Cromwell – dropped out of the top 30 for deal count.

Mergermarket M&A analyst Chad Watt, who is based in Dallas, says H1 2017 was a solid six months for most business law firms with offices in Texas.

V&E recaptured the top ranking for both deal count and deal value during the first six months of 2017. The Houston-based firm was the legal adviser in 38 deals for a total value of $35.3 billion involving Texas companies – up from 19 transactions a year earlier and nearly triple the deal value of $12.4 billion of 2016.

V&E, which was ranked third in deal count and 11th in deal value in H1 2016, represented Blackstone Group in a $2 billion energy midstream acquisition, MoneyGram in two transactions valued at $3.3 billion and Outrigger Energy in a $1.5 billion deal.

Watt points out that national firms continue to steal legal talent from Texas-based firms and that the deals have followed the lawyers to their new firms.

The most obvious example is Chicago-based Kirkland, which has seen its Houston office double in size during the past year. K&E handled 38 transactions involving Texas businesses with a combined value of $28 billion – up from 28 deals worth $14 billion in H1 2016. The 2017 numbers do not include Kirkland’s leading role in Energy Future Holdings’ sale of Oncor to Berkshire earlier this month for $9 billion in cash and a reported total deal valuation of $18 billion.

Latham also saw its deal count jump from 20 during the first six months of 2016 to 29 transactions this year. The value of Latham’s deals also jumped from $17 billion to $29 billion. Latham is advising Whole Foods in its $13.4 billion sale to Amazon and Enbridge Energy in a $2.1 billion transaction with Midcoast Energy Partners.

Jumping to number four in the deal count rankings is Weil, Gotshal & Manges, which doubled its deal count from 11 during H1 2016 to 22 this year. Weil is advising Thomas H. Lee Partners in its $1.7 billion divestiture to MoneyGram.

The biggest move in the deal count rankings was Andrews Kurth, which leaped from 24th last year to number five so far in 2017. AK advised in 22 transactions during the first six months of this year, compared to 11 deals a year earlier. San Antonio-based NuStar Energy turned to AK lawyers to advise it in its $1.5 billion acquisition of Navigator Energy Services, while Tokyo Gas America hired AK to represent it in an investment in the Haynesville Shale.

Overall, Texas-based companies were involved in 420 transactions during H1 2017 – up from 417 during the first half of 2016.

The cumulative value of the 2017 deals was $108.6 billion, which was 27 percent higher than a year earlier.

Mergermarket data shows that 24 of the top 30 ranked firms by deal value are non-Texas firms and only two of the top 20 – V&E at No. 1 and Akin Gump at No. 20 – have Texas roots. Six of the top 10 have no Texas office at all.