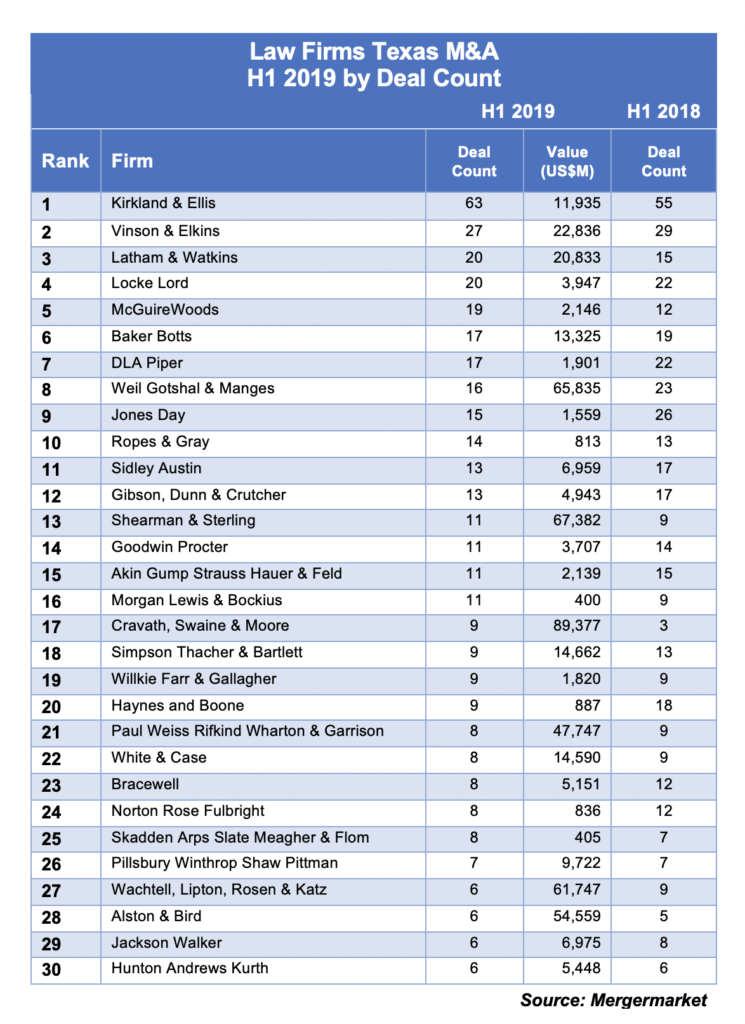

M&A activity involving Texas companies may have declined during the first six months of 2019, but the slump does not seem to have impacted the corporate transactional machine that is Kirkland & Ellis.

The Chicago-founded law firm represented 63 companies and private equity firms involved as buyers or sellers of businesses headquartered in Texas – up from 55 such deals during the first half of 2018, according to new data from Mergermarket provided exclusively to The Texas Lawbook.

Kirkland lawyers were legal advisors in more than twice as many M&A deals as second ranked Vinson & Elkins and three times more than any other law firm.

Eighteen of the top 30 law firms in the Mergermarket data were involved in fewer transactions during H1 2019 than the year before.

Only nine law firms did more M&A deals between this Jan. 1 and June 30 than a year earlier – and all nine are firms based outside of Texas.

Houston-based V&E ranks second on the Mergermarket charts, representing 27 clients in the deals involving Texas companies with a combined value of $22.8 billion.

Latham & Watkins, a firm founded in Los Angeles, worked on 20 matters – up from 15 during H1 2018 – with a total price tag of $20.8 billion.

Texas-headquartered Locke Lord also represented 20 clients in transactions with Texas connections for a combined value of $3.95 billion.

McGuireWoods handled 19 deals during H1 2019, while Baker Botts and DLA Piper were involved in 17 transactions. Weil Gotshal and Jones Day represented clients in 16 and 15 deals respectively.

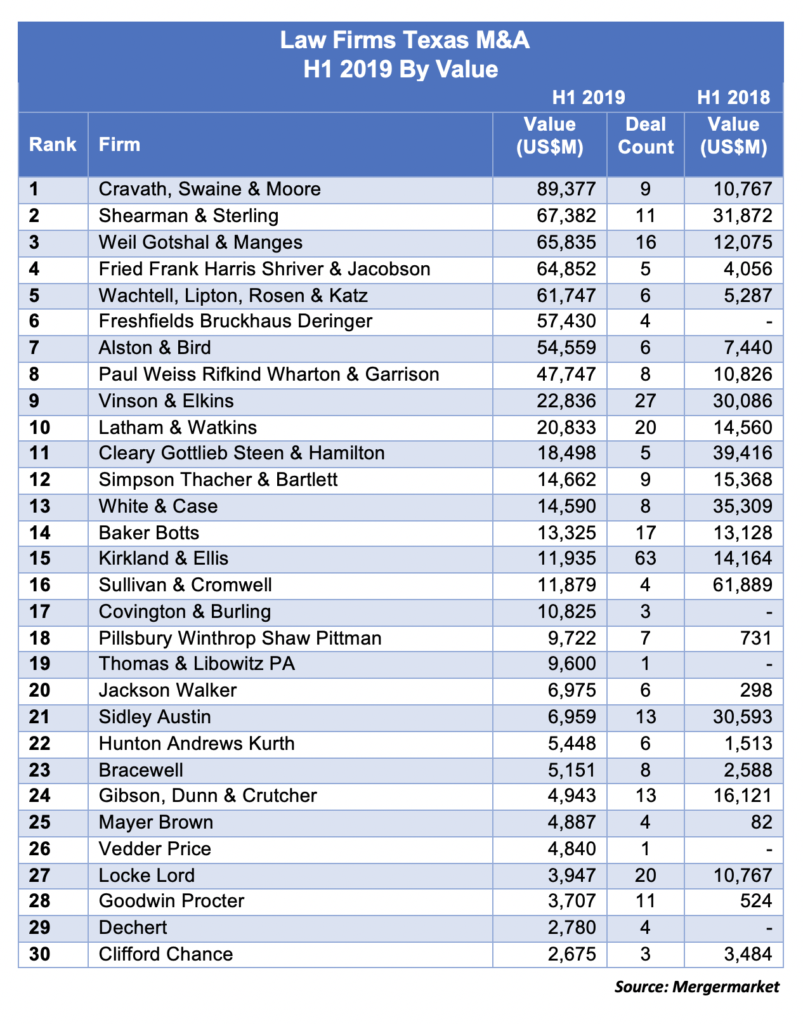

Mergermarket ranks New York-based Cravath, which does not have a Texas office, as No. 1 in deal value. Cravath lawyers were the legal advisors in nine transactions with a combined value of $89.4 billion.

Shearman & Sterling, which opened Texas operations last year, ranked second in deal value with 11 transactions with a combined price tag of $67.4 billion.

Weil Gotshal is third with 16 deals valued at $63.8 billion.

Other Texas-based law firms in the top 30, according to Mergermarket are Baker Botts ranked sixth with 17 deals valued at $13.3 billion. Haynes and Boone came in at No. 20 with nine transactions, while Bracewell was one behind with eight deals.