Note: This article has been updated to include information from Texas respondents.

As 2019 closes out its astonishing docket of disputes, there are more – perhaps many more – to look forward to in 2020, according to Norton Rose Fulbright’s 15th annual survey of litigation trends.

According to the NRF survey, litigation regarding labor and contracts disputes, cybersecurity and regulatory intervention continued to climb in 2019, while fears of an economic downturn and upheavals in international trade relations were cited by respondents who predict a rise in dispute volume in 2020 brought about by “potentially turbulent times ahead.”

“A rise in disputes typically accompanies an economic downturn,” said Gerry Pecht, Norton Rose Fulbright’s Global Head of Dispute Resolution and Litigation. “If the economy goes sour, more deals may fail, more contracts will fall through, and employees will be laid off.”

More than a third of respondents (35%) said they expect a rise in litigation next year while fewer than one in ten (9%) said they expect litigation to decline. In 2018, by comparison, only 17% of respondents said they expected a rise in litigation, while 10% said they expected a decline.

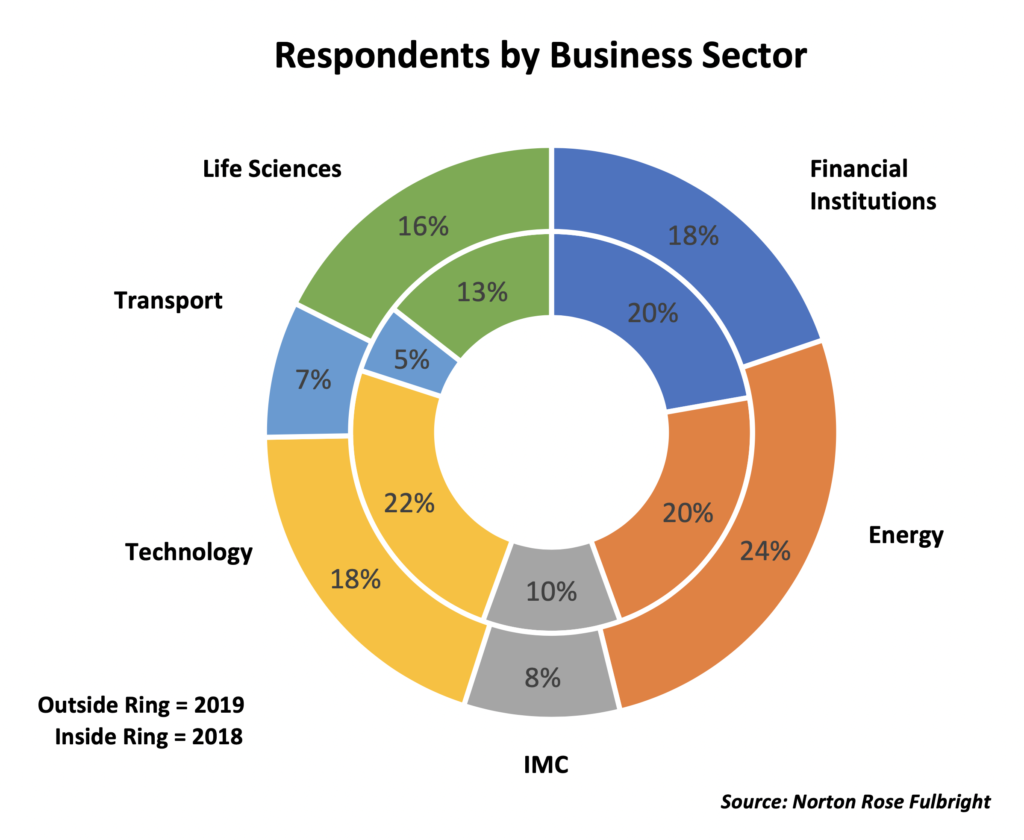

Conducted mostly by telephone, the survey included responses by 287 corporate counsel for US-based organizations. Of those 39% were general counsel, 27% were senior counsel and about 19% were heads of litigation.

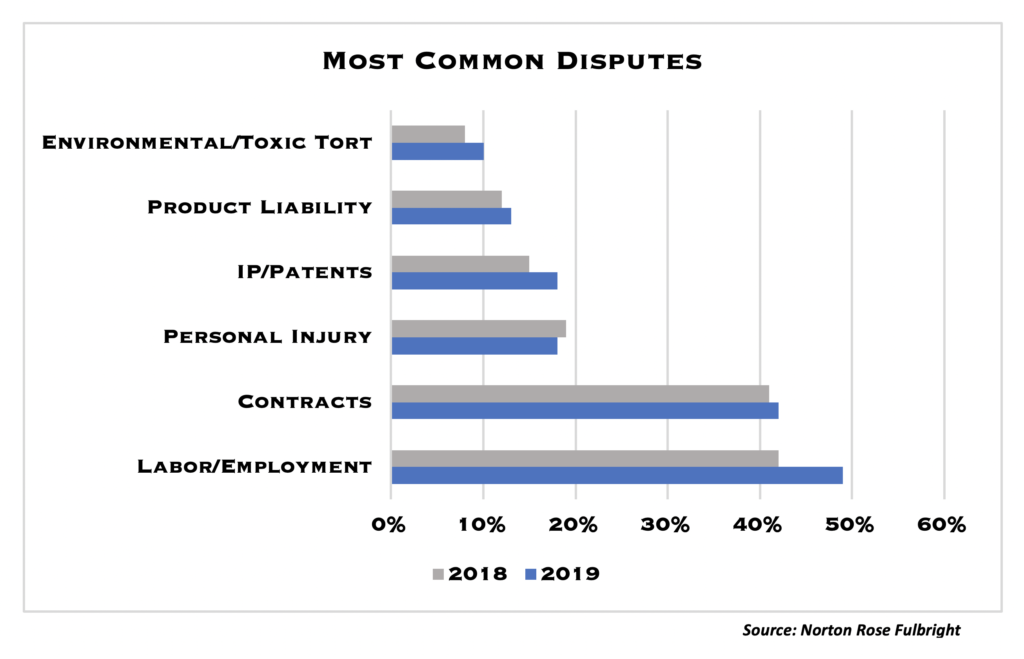

Of those responding, nearly half cited a significant rise over last year in labor and employment disputes. Slight rises were also reported in litigation regarding contracts, patents, product liability and environmental/toxic tort disputes. The only litigation category that reported a lower volume than last year was personal injury.

Texas respondents tracked their national counterparts pretty closely, citing contracts (51%), labor/employment (39%) and personal injury (31%) as the most common types of disputes.

But while organizations in different sectors reported high volumes of labor, contract and product liability litigation, those categories were not seen as major concerns to most business sectors. Of greater concern, in most cases, were the potential risks associated with intellectual property, regulatory and class action disputes.

Texas had a significantly lower “spend” per dispute than that reported respondents as a whole. The survey’s median average of $1.5 million per $1 billion in revenue declined to $1 million among Texas respondents. Two-thirds of Texas respondents (67%) reported using Alternative Fee Arrangements (AFA), as opposed to 56% in last year’s survey.

Cybersecurity and data privacy were, by far, the most anticipated new source of disputes for those surveyed. About 44% cited cyber issues as the fastest expanding new litigation problem. Only 10% or less said regulatory, environmental, IP or other issues would gain new importance in their litigation portfolio.

Protecting and defending data was clearly on the minds of many. More than half the respondents (52%) said they feel more exposed to cyber issue disputes than they did last year. Respondents cited new and stricter laws, the growing sophistication of cyber criminals and the rapid growth of their own data collection as their reasons for concern.

Among Texas respondents, cybersecurity was also the highest concern for future disputes, but at a bit lower rate (38%) than the overall survey. Texas legal departments also expressed the same concern as last year (47%) about the balance between laws protecting data and discovery requirements from jurisdiction to jurisdiction.

But Texas organizations were more concerned (at 18%) than other respondents about the future litigation impact of environmental and toxic tort claims.

Moreover, the level of concern over cybersecurity and data privacy tracked the size of the organization responding. Less than half (41%) of the organizations under $100 million in revenues viewed cybersecurity risks as “highly important,” while a whopping 94% of companies reporting more than $10 billion in revenues viewed them with the highest level of concern.

Now, regarding the money: Responding organizations reported that 73% of their overall legal budget is spent on law firms. About one-fifth (19%) of the organizations say they contest legal disputes with great regularity (“usually” or “as much as possible”), while only 10% say they are prone to settle (“usually settle” or “quickly settle as much as possible”).

Of note: Median revenue for 2019 respondents was $1 billion, down from $1.5 billion in 2018. Median legal team size in 2019 was 2.5 lawyers per $1 billion in revenue, also down from 2.7 per $1 billion in 2018. The largest business sector represented was Energy (24%); the smallest at 8% was IMC (Infrastructure, Mining and Commodities).

Other Texas responses:

- One third of Texas respondents foresee new sources of dispute for their businesses in the next 2-3 years.

- The median number of lawsuits commenced against respondent’s organizations in the past 12 months was five.

- The average number of lawsuits defended per $100 million in revenue is 7.95 and the median is 1.17, both in line with last year.

- Texas legal departments work with a median average of five law firms.