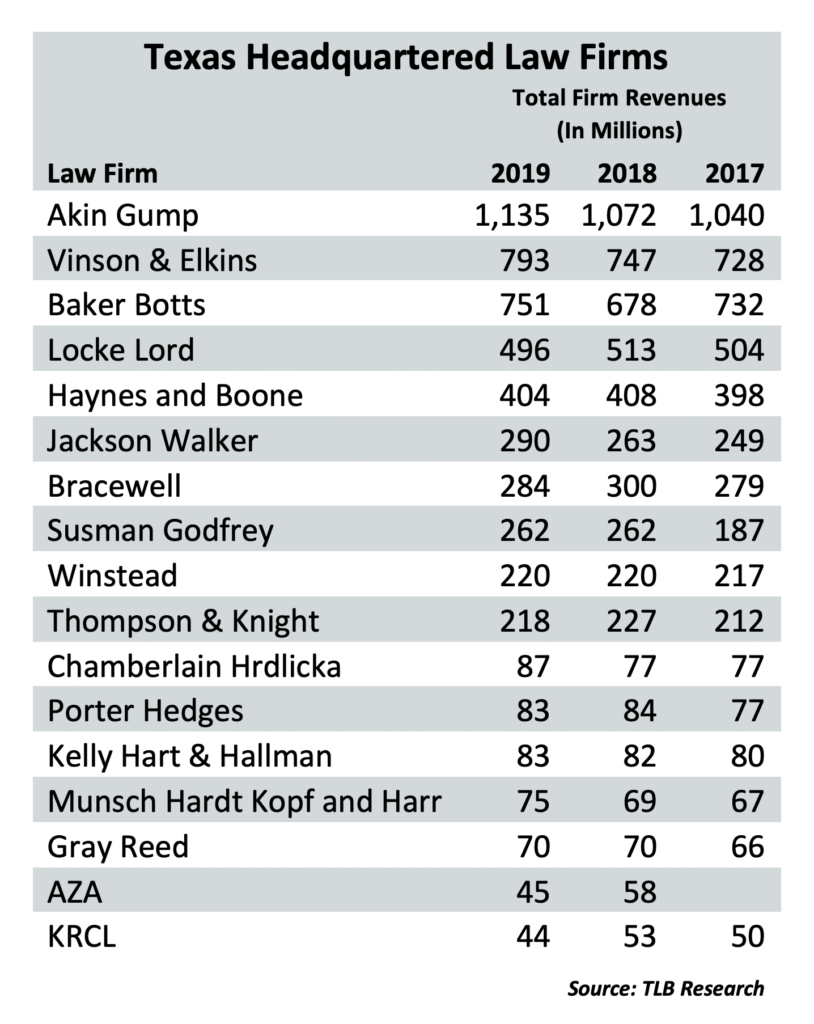

A dozen of the 17 corporate law firms on The Texas Lawbook 50 that are based in Texas generated more money in 2019 than they did the year before. Seven scored record high revenues. Three firms made more money than the other 14 combined.

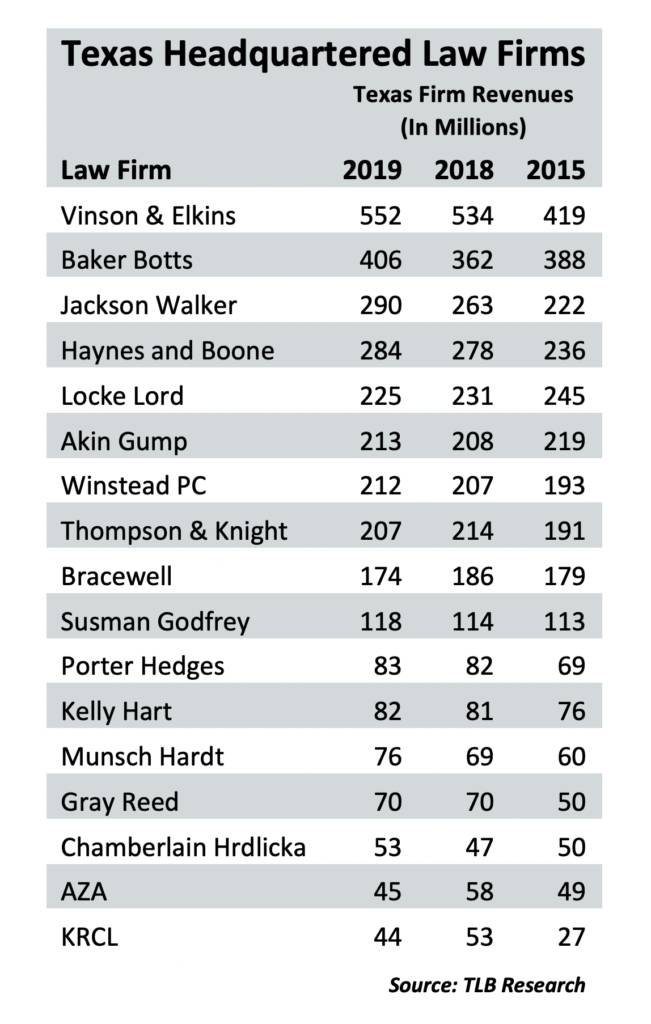

And these 17 Texas legacy firms actually increased billings and collections from their lawyers working outside of the state at three times the rate of their Dallas, Houston and Austin practices.

This year, however, the leaders at most of those legal practices are just hoping they make 70-cents on last year’s dollar.

Legal industry analysts say corporate law firms headquartered in Texas had a solid – but not great – 2019. Most of them continued to lose ground (meaning partners and business) to the national law firms that continued their expansion in the Lone Star state.

Baker Botts bounced back from two consecutive down years to report a 10.7% revenue jump in 2019 and its second-best year for revenue in firm history. Three other Texas law firms – Jackson Walker, Munsch Hardt and Chamberlain Hrdlicka – had a strong 2019, increasing revenue by 10% or more.

“We had a great 2019. We grew our lawyer headcount by more than 5% and we increased our hours billed by 7%,” said Jackson Walker managing partner Wade Cooper. “March was a great month and collections in April are good so far. It is going to be a bumpy time for a while, but we feel good about how we are positioned going into this crisis. We are going to see a wave of business difficulties broader than we have seen in a long time.”

Jackson Walker, which has all 370 of its lawyers in Texas, increased its annual revenue from $221.5 million in 2015 to $290 million last year – a 31% jump during the past five years.

Five large, full-service Texas firms – Locke Lord, Haynes and Boone, Bracewell, Thompson & Knight and Winstead – had slight drops in firmwide revenues in 2019 – though the Texas lawyers at Haynes and Boone and Winstead actually increased the money they collected in 2019 over the prior year.

The Texas Lawbook interviewed more than 30 law firm leaders and legal industry analysts about 2019 firm financials and 2020 revenue projections. The overwhelming prediction for the current year is that annual income could drop to levels not seen since 2012 because of the COVID-19 and crude oil price crises.

Law firm revenues in Texas, they speculate, will be down 15% to 30% in 2020 if the economy restarts in June and experiences no hiccups or relapses the rest of the year.

Income, they predicted, could decline 40% to 60% if the crises continue into the fall or if the coronavirus returns in a significant way in the fall and winter. The impact is already being witnessed.

This week, Baker Botts, which boasts 700 lawyers and revenues exceeding $750 million, announced that it is temporarily reducing the compensation of partners, counsel, associates and some staff. Norton Rose Fulbright made the same announcement last week. Other major law firms are expected to do the same in the next couple of weeks.

“The revenues and profits for 2019 matter for one reason at this point: If you did well in 2019, you entered into the COVID-19 crisis with a strong balance sheet and you have more room to maneuver,” said Kent Zimmermann, a law firm consultant with Zeughauser Group in Chicago.

“The Texas firms still seem to be in a period of turmoil from continuing to fend off new national and regional law firms moving into Dallas and Houston and trying to steal talent,” Zimmermann said.

Data from The Texas Lawbook 50 shows that the 17 indigenous Texas firms collectively grew income 4.1% – up from 3.6% a year earlier but just shy of the 5% revenue increase reported by the American Lawyer 100 corporate law firms.

Unlike previous years, The Texas Lawbook 50 in 2019 experienced no mergers and no closings. Only two Texas-based law firm dropped out of the top 50 – Bell Nunnally and Coats Rose. Bell Nunnally actually scored record revenues in 2019, but two other firms increased their income even more. Coats Rose did not respond to multiple requests for information and interviews. In 2017, 23 Texas-based firms were in the top 50.

The combined 17 Texas firms generated $5.34 billion from all their offices last year – up from $5.13 billion from a year earlier.

Those same firms collected a total of $3.13 billion from their Texas operations in 2019, which is $70 million – or 2% – more than the previous year. By contrast, lawyers for the Texas legacy firms in offices outside the state in 2019 generated $2.21 billion – a 6% jump from 2018. The numbers show that a handful of law firms – Baker Botts, Haynes and Boone and V&E, for example – have tried to aggressively grow their non-Texas offices during the past two years through lateral hiring.

“There is no question that the Texas indigenous law firms continue to lose business to the national law firms,” said Citi Private Bank Law Firm Group Managing Director Jeff Grossman. “If you look at just revenues, the Texas market underperformed other markets last year. Demand in Texas was flat, while revenue grew outside of Texas.”

“Most of the Texas firms saw their margin of growth come from rate increases, not from increased demand,” Grossman said.

Legal industry insiders pointed out that there were 26 Texas-based law firms in The Texas Lawbook 50 in 2014 – nine more than in 2019 – and that there were three-dozen homegrown firms in the top 50 in 2011.

What happened?

Some firms, such as Burleson, simply closed shop and went fishing. Others experienced severe revenue declines and dropped off the list, including Godwin Lewis – now Godwin Bowman – and Thompson Coe. Several of the Texas law firms – Fulbright & Jaworski, Andrews Kurth, Gardere, Cox Smith, Strasburger and Beirne Maynard, to name a half-dozen – merged with out-of-state operations. Those six firms employed nearly 2,000 lawyers and generated a combined $1.4 billion in revenues in 2014.

Data for The Texas Lawbook 50 is collected from multiple sources, including law firms that submit their annual firm financials, interviews with current and former partners at law firms, legal industry analysts and from other publications such as the American Lawyer.

The result has been a dramatic shift of talent and revenues from midsized regional law firms to the larger firms with deeper pockets.

Recent data from The Texas Lawbook’s exclusive Corporate Deal Tracker, which documents transactions in which Texas lawyers were lead counsel for the buyers, sellers or targets, showed that mergers and acquisitions and capital markets activity handled by Texas lawyers declined significantly in 2019 and dropped even more in the first quarter of 2020.

Akin Gump, V&E and Baker Botts

Three law firms headquartered in Texas – Akin Gump, Vinson & Elkins and Baker Botts – skew the non-Texas office revenue numbers. Together, the three made $2.68 billion in all their offices in 2019, which is 50.1% of all the income reported by all 17 Texas firms in The Texas Lawbook 50.

Akin Gump, which was founded in Dallas and has co-headquarters in Washington, D.C. and Dallas, is the only billion-dollar-revenue Texas-based law firm, though less than 20% of its revenues were made by its lawyers in Texas. Akin Gump took in $1.135 billion at its 20 offices worldwide – $213 million of it in Dallas and Houston.

Achieving elite status with revenues per lawyer of $1.25 million in 2019, Akin Gump also increased its profits per equity partner by 8.2% to $2.6 million.

“We had a great year in 2019 – revenues up by 6%, and we feel there will be a wave of litigation regarding the economic fallout from the COVID-19 shutdown,” said Scott Barnard, managing partner of Akin Gump’s Dallas office.

Since 2010, Akin Gump has increased its firmwide revenues by 41%, although income from the firm’s Texas offices has remained between $208 million and $225 million for the past six years. The firm also has maintained between 170 and 210 lawyers in Dallas and Houston for the past decade.

“In Houston, the energy economy experienced a challenging year in 2019, as M&A was down and capital markets were much less available,” said John Goodgame, managing partner of Akin Gump’s Houston office. “Though, 2019 looks like a flood compared to now.”

Akin Gump is one of 11 Texas law firms that increased revenues per lawyer and profits per partner last year.

Akin Gump and V&E reported moderate growth in their Texas operations, though Akin Gump hired CapM partner Ryan Cox and M&A partner Eric Williams from Haynes and Boone in March.

V&E lawyers in Texas increased revenues 3.4% in 2019, but the firm’s lawyers in its nine offices outside the state grew income by 12.5%. Thirty percent of V&E’s $792.6 million in revenue was earned by its non-Texas lawyers.

During the past five years, V&E has increased its revenue in Texas from $419 million in 2015 to $552.1 million last year – a 31.8% jump. The firm has raised its revenues per lawyer statistic from $1.03 million five years ago to $1.21 million in 2019 – a 17% increase.

“It is hard to predict when things will get back to normal,” V&E chairman Mark Kelly said. “I think our bankruptcy/restructuring folks and our tax group will be busy, as clients have a lot of questions about the stimulus package. The one thing we know is that the energy space has always been resilient.”

The Texas Lawbook’s Corporate Deal Tracker, which documents every M&A transaction of lawyers in Texas, shows that last year V&E lawyers in Texas were the lead counsel on 55 transactions valued at $95.6 billion, which was 21% fewer deals than they handled in 2018 but still enough to keep them ranked No. 1. The first quarter of 2020 didn’t start much better for V&E. Mergermarket reports that the firm advised only nine Texas companies on transactions during the first three months of the year – down 36% from the same period in 2019.

Baker Botts ended two years of declining revenues by increasing its firmwide income from $678 million in 2018 to $751 million last year. The firm’s Texas lawyers did even better in 2019, raising revenues 12.1% from $362 million to $405.7 million. About 46% of Baker Botts’ income was made by lawyers outside of Texas.

“We saw increased client demand across the firm and in nearly all practices,” said Baker Botts managing partner John Martin, who last year became the firm’s first managing partner based outside of Texas. “We took a comprehensive strategic review in an effort to galvanize our lawyers. Baker Botts is not all things to all people. We are sharpening further our areas of strength.”

Baker Botts grew its firm-wide headcount 6% in 2019. In Texas, a key hire was former Stream General Counsel Daniel Terrell in October.

One-third of the firm’s revenues came from the energy sector, one-third came from technology and one-third from other businesses, Martin said.

With more than 150 lawyers in its intellectual property and technology practices, Baker Botts benefited greatly from the explosion of patent infringement litigation in the federal courts in the Eastern District of Texas between 2010 and 2018. Baker Botts has represented AT&T in dozens of patent disputes.

When the U.S. Supreme Court issued its decision in T.C. Heartland, whichsignificantly limited the venue options of plaintiffs in patent cases, Texas IP practices, including Baker Botts, saw cases decline.

But Baker Botts and other patent practices in Texas received a boost when newly appointed federal judge Alan Albright of the Western District of Texas announced that he planned to turn his courtroom in Waco into another rocket docket for patent infringement cases. The number of new patent disputes being filed in Judge Albright’s court now equals those being filed in the Eastern District.

Not all the data is peachy for Baker Botts. The Texas Lawbook 50 shows that firmwide revenues have increased only 15% since 2014 and income from its Texas lawyers has climbed only 7% during that time span.

In addition, the number of M&A transactions that the firm’s lawyers in Texas led in 2019 dropped 41%, from 56 deals in 2018 to 33 valued at $48.1 billion last year, which was still the third most in the state, according to The Texas Lawbook’s Corporate Deal Tracker.

Regarding the COVID-19 and oil price crises, Martin said the firm is “planning for the worst and hoping for the best.”

“First, you do the best you can do,” he said. “Next, you pick the data points that are available. We are evaluating everything – how bad will it be, how long will it last. Like every other law firm, we are operating in the dark.”

Locke Lord, Haynes and Boone, Bracewell and Thompson & Knight

If leaders at V&E and Baker Botts think they have it rough, they need only to look down the street to Locke Lord, Haynes and Boone, Bracewell and Thompson & Knight, which face even mightier battles.

Those four Texas legacy firms – three headquartered in Dallas and one in Houston – are not only fending off national firms to keep their talent, but also Akin Gump, Baker Botts, V&E, smaller boutique law practices and even each other, according to legal industry experts.

Zimmermann and Citi’s Grossman said that upper middle market full-service firms are under siege from all sides because they have some really talented lawyers with good books of business.

“Firms like this are getting squeezed. The cycle is simple,” Zimmermann told The Texas Lawbook in an interview in early April. “The wealthier, more profitable law firms have the money to hire away the best lawyers. The best lawyers have the best clients. The best clients pay the highest legal fees and generate the most revenues. Those firms can then use those revenues to continue to hire and pay the best lawyers with the best clients. And so it goes.”

Locke Lord, Haynes and Boone, Bracewell and TK all compete heavily for clients in the upper middle market, although each has premium clients — from AT&T to Exxon Mobil to Kinder Morgan – that even Wall Street firms envy.

All four recorded drops in firmwide revenues in 2019, though none of the declines were severe. All of them also saw the number of M&A transactions their Texas lawyers led plummet 50% or more.

Locke Lord’s firmwide income and revenues generated in Texas slid 3.1% and 2.6% respectively in 2019. The firm’s headcount dropped 4% at its non-Texas offices, but up 1% in Texas.

On the positive side, Locke Lord has increased its revenues per lawyer 14.5% during the past five years. On the downside, the firm has seen its overall income drop 17% since 2015, from $597 million to $496.4 million in 2019. In Texas, Locke Lord’s revenue has declined 8% during the same five-year period.

About 45% of Locke Lord’s overall revenue came from lawyers outside of Texas.

By contrast, Haynes and Boone experienced several consecutive years of financial growth until 2019. And even then, the decline was relatively minuscule.

Haynes and Boone’s firmwide income climbed 26% between 2014 and 2018, but then dropped 1% in 2019 to $404.3 million. Texas lawyers for Haynes and Boone generated $284.2 million last year, which was 2.4% more than the previous year and 20.4% more than in 2015.

Nearly 30% of Haynes and Boone’s revenues were generated by lawyers outside of Texas.

More impressively, the firm has increased its revenue per lawyer to $825,700 – a 21.6% jump from five years ago.

“2019 was a tale of two halves,” Haynes and Boone managing partner Tim Powers told The Texas Lawbook. “The year started slow, partially because of the federal government shutdown. But then the year started to rebound and we finished the year very strong. The first two months of 2020 were the best in firm history.”

“Obviously, the crisis will have a significant impact, though no one knows how much for sure,” he said. “We also are getting into a brutal election year, which tends to impact CEO and investor confidence, and things just slow down.”

In order to retain talented lawyers, Powers said, firms need to be able to “paint a picture” of the future of a law firm so that the attorneys “want to be part of it.”

“Some lawyers leave for the money, but many leave simply because they are not sold on the future of the law firm,” he said. “We cannot do what Kirkland or Winston are able to do on compensation or guarantees.”

Powers added that it is risky for law firms to dramatically modify their compensation systems just to retain partners being tempted with much larger sums by other law firms.

“If you have such disparities between the haves and the have nots, you could tear the firm apart,” he said. “It is a very fragile situation. You can’t create two worlds inside the one law firm.”

To be fair, Haynes and Boone lawyers are not always the prey in the world of lateral hiring. In February, for example, the firm hired two corporate finance lawyers – Jim Markus and Tim Johnston – away from V&E. Last year, the firm also hired former Potter House general counsel Darwin Bruce, who specializes in lower middle market M&A.

Haynes and Boone is the fifth largest corporate law firm in Texas by lawyer count with 358 attorneys in Austin, Dallas, Fort Worth, Houston and San Antonio.

In sixth place is Thompson & Knight, which boasts 297 lawyers in Austin, Dallas, Fort Worth and Houston.

TK generated $217.9 million in firmwide revenues in 2019, which was down from $226 million in 2018 but up from $201 million in 2015.

In Texas, lawyers for Thompson & Knight made $207.3 million last year – down 3% from 2018 but up 8.5% from 2015.

“2019 started fast, but then we saw a drop in private equity and energy deal work later in the year,” said Thompson & Knight managing partner Mark Sloan. “Intellectual property and bankruptcy practices started slow last year but picked up as the year went on and are very busy right now. We were above budget during the first three months of 2020.”

Sloan said that “there’s no game plan” for the COVID-19 crisis.

“Every law firm is anticipating a slowdown in collections and a drop in cash flow,” he said. “But we have done well in previous down markets. Our real estate and lending clients are already calling to prepare for restructuring.”

Sloan and others predict that there will be a rush to the courthouse when the coronavirus threat lessens and the courthouse reopens for business and trials, which should benefit TK and its litigation practice led by partner Greg Curry. To beef up its IP practice, the firm hired three patent trial attorneys – Phillip Philbin, Jamie McDole and Michael Karson – away from Haynes and Boone in early April.

Thompson & Knight also bolstered its white-collar criminal defense and investigations practice in 2019 when it hired former Beneficient Group GC Jessica Magee to join the firm as a partner. Magee spent seven years in senior positions in the enforcement division of the U.S. Securities and Exchange Commission in Fort Worth. She joined another former SEC official, Richard Roper, and a team of about a dozen attorneys at TK handling internal investigations and white-collar defense.

In a strategic move, Thompson & Knight also hired Texas state Senator Nathan Johnson, who specializes in bankruptcy litigation, last September. Johnson is married to Haynes and Boone appellate law partner Anne Johnson.

TK has been on both the taking and receiving end of lateral movement for corporate transactional lawyers.

In January, the firm added two real estate partners – Doug Stewart from Winstead in Houston and Michael Jo from Carlton Fields in New York. But in March, TK lost two star M&A partners – Anne Marie Cowdrey and Nathan Meredith – to Shearman & Sterling.

Greg Bopp, the managing partner of Bracewell, said that lateral movement among partners is now just part of doing business.

In December, Bracewell welcomed back two patent litigation partners – Michael Chibib and Conor Civins – who left the firm five years ago to practice at Pillsbury. Bopp said they are two of about 25 “boomerang lawyers” who left but later returned.

“We have an active alumni program because these folks were our partners and friends when they left to go to other firms,” said Bopp. “We always want to keep the door open for them if they want to return.”

Bopp agrees with Sloan and others that there will likely be a rush to the courthouse and a significant amount of litigation that will follow both the COVID-19 and crude oil price crises.

“Congress continues to discuss a major infrastructure legislation and it is clear that critical infrastructure projects are needed,” Bopp said.

Infrastructure spending means public financing and municipal bonds, which is a specialty practice area for Bracewell, which is led by partners Ben Brooks, Rob Collins and Jonathan Leatherberry.

In 2019, Bracewell’s firm-wide revenues dropped 5% to $286 million. The firm generates about 62% of its revenue from its Texas offices, which saw its revenue decline by 6% last year from the year before.

During the past five years, Bracewell has increased its revenues per lawyer from $730,000 in 2015 to $838,000 in 2019.

“The firm reached all-time highs in revenues per lawyer and profits per partner in 2019 and the first quarter of 2020 was fantastic,” Bopp said. “What the numbers will look like this time next year is anyone’s guess.”

Articles in this series to come:

Tuesday, May 5: National Law Firms: Is the invasion complete?

Thursday, May 7: A Parallel Universe: Porter Hedges, Kelly Hart, Munsch Hardt, KRCL, Chamberlain, Bell Nunnally

Tuesday, May 12: The Elites: Who are they and how did they get there?

Monday, May 18: $1,500-an-Hour Billing Rates? Look in the Rearview Mirror

Wednesday, May 27: Will $700-an-Hour Law Firms Survive in Texas? Some GCs Pray that they do.