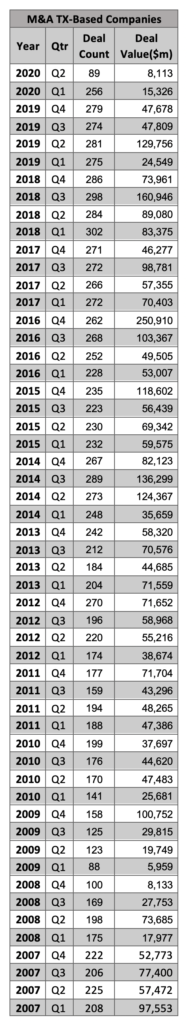

M&A activity in Texas plummeted to historic lows during the second quarter of 2020. New data shows that the decline in Texas dealmaking – especially in the oil patch – has been much more severe than anyone predicted.

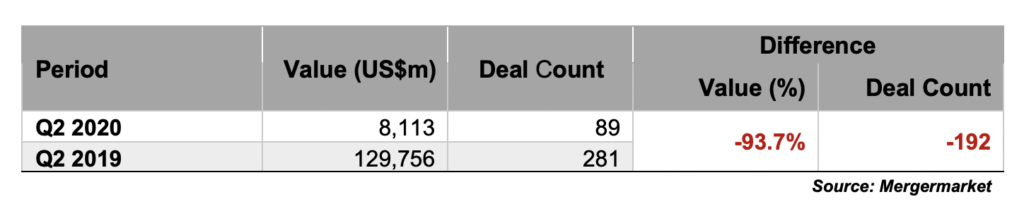

The number of mergers, acquisitions and joint ventures plummeted 68% between April 1 and June 30 compared to the same three months in 2019, according to new statistics from the research firm Mergermarket, which were provided exclusively to The Texas Lawbook.

Deal value declined an astonishing 93.7% during Q2 compared to the same time period in 2019.

Texas businesses and private equity firms were involved in only 89 transactions during the past three months – down from 256 deals during the first quarter of 2020 and down from 281 during the second quarter of 2019, according to Mergermarket.

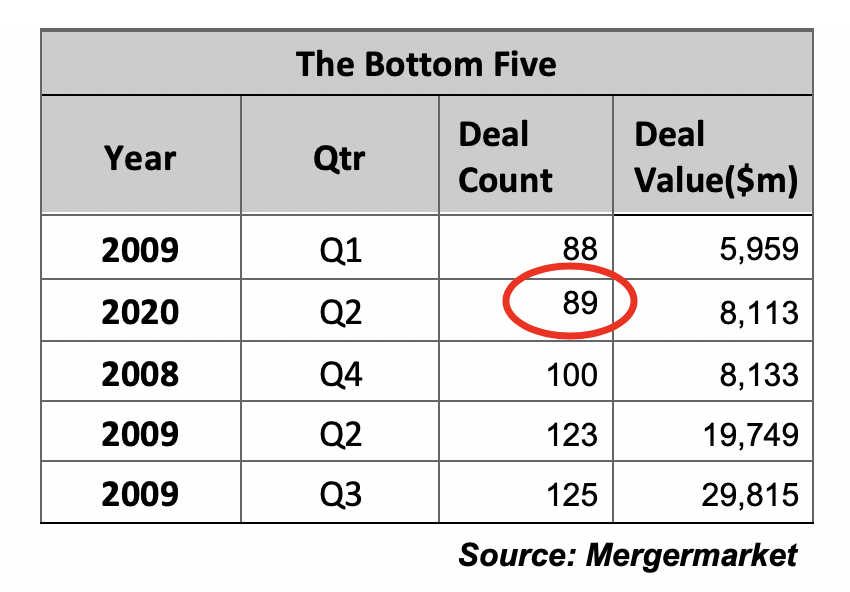

Not since the first quarter of 2009, in the bowels of the Great Recession, has M&A in Texas experienced such lows. There were a record low 88 transactions during the first three months of 2009 – one less than this past quarter.

In fact, Texas had witnessed 26 consecutive quarters with 200 or more M&A deals going into 2020.

“It’s every bit as bad as the numbers are portraying,” said Jeff Muñoz, a corporate partner in the Houston office of law firm Latham & Watkins. “No one is doing any of what you might call regular M&A work.”

The problems of Texas, however, are also playing out across the country, according to Mark Druskoff, data-driven content coordinator for Mergermarket. Not only was dealmaking down nationwide, the U.S. saw a decline in its global share of M&A.

“The full impact of COVID-19 became manifest in 2Q20, particularly in the U.S. and Texas. The U.S. was one of the hardest hit of all major global regions in the first half as one uncertainty layered upon another. Overall, M&A was down 75 percent on value and one-third on volume, and the U.S. saw its global share of M&A tumble from 52 percent to 31 percent,” Druskoff said.

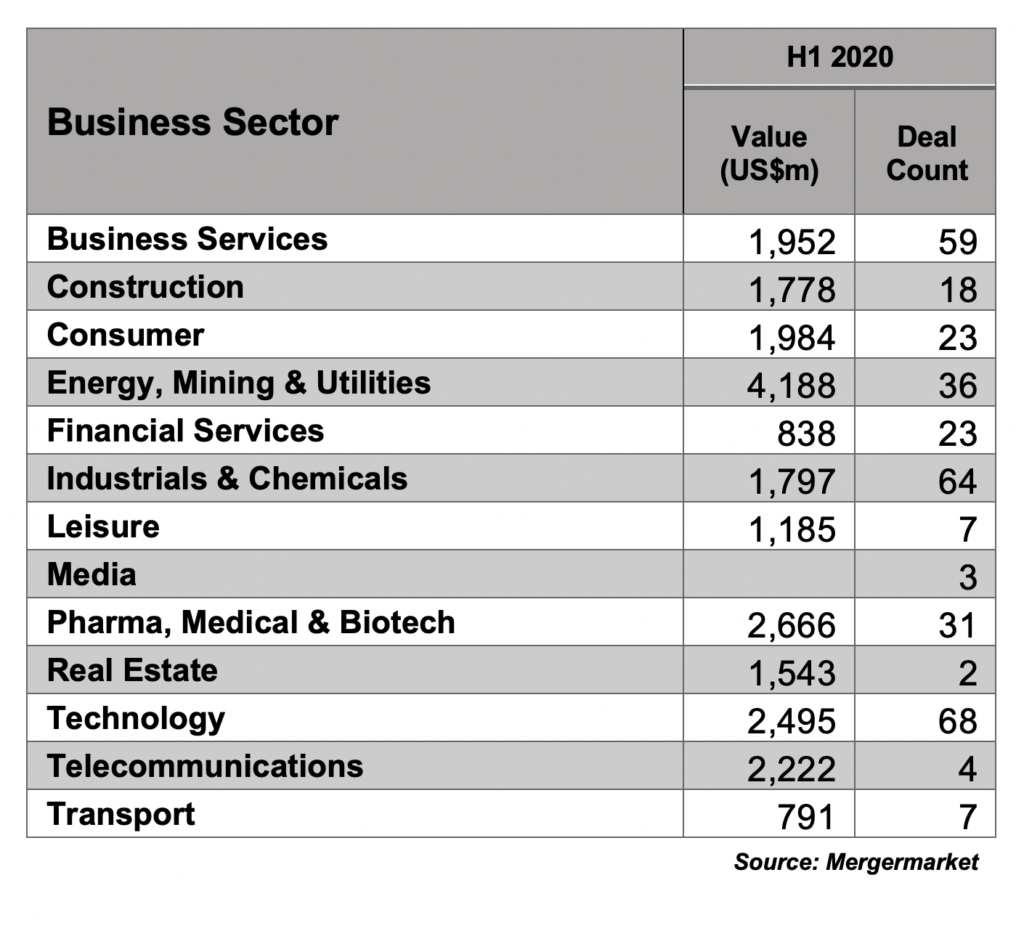

The Mergermarket data shows that M&A declined in nearly every business sector, but energy suffered the most – down 60% year over year.

In fact, three other business sectors – technology, business services and industrials – saw more dealmaking than energy – an unfathomable statistic entering 2020.

“Texas M&A activity declined nearly 85% by value compared to 1H19,” said Philip Segal, head analyst at Americas Mergermarket. “A lot of activity involves deals in the Energy, Mining, and Utilities sector, which saw a big decline throughout the U.S. There were only 36 deals worth $4.2 billion announced in the sector so far this year, while in all of 2019 there were 191 deals in the space announced worth a combined $142.6 billion.”

Only two transactions during the second quarter reached 10 digits – Optima Investments $1.54 billion acquisition of a 61% ownership stake in Global Trade Centre from Lone Star Funds and Vistra Energy Partners’ $1.51 billion purchase of a 2.3% share of telecommunications giant Jio Platforms Limited.

Neither transaction would have ranked in the top 10 deals by value in the second quarter of 2019, according to Mergermarket.

Moreover, the deal pipeline for the immediate future appears bleak, both in the number and nature of deals. Muñoz says firms have work, but the work is primarily that of liability management.

“Are we keeping busy? Yes. But it’s mostly restructuring or pre-restructuring work: looking at contracts in case of bankruptcy, or for customers in bankruptcy –much more planning than anything,” Muñoz said.