In what may have turned out to be a tough time to take the pulse of American business, Dykema Gossett has issued its periodic survey on the short-term outlook for mergers and acquisitions.

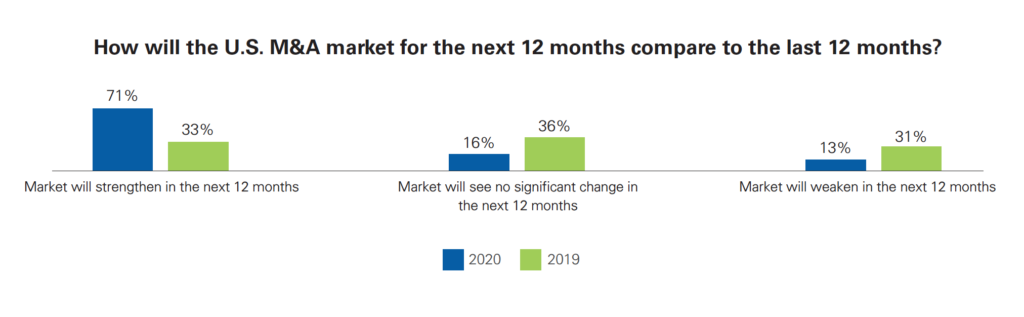

A week that began with a stock market tumble fueled by a mixed government response to COVID-19, more than 70% of the nation’s top business executives surveyed said they are essentially optimistic that the market for mergers and acquisitions will strengthen in the next 12 months. Moreover, 87% expect M&A involving privately-owned businesses to increase and 72% say their own company is likely to be involved in an M&A deal.

According to the Dykema data there is no vivid reason for the optimism about the coming year. Aging business owners seeking to sell may not be able to postpone a transaction. Uncertainties surrounding COVID-19 may yield to financial necessity. A resurgence of the economy in general (or oil prices in particular) could make dealmaking both more possible and more attractive.

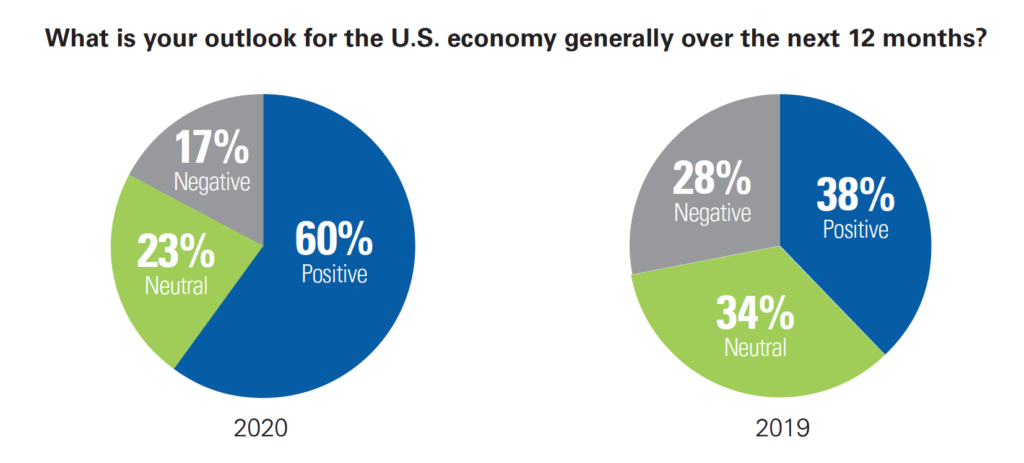

On the issue of the economy, 60% say they are optimistic about the U.S. economy over the next 12 months, up dramatically from June when a Dykema flash survey revealed only 38% thought the economy would see an uptick.

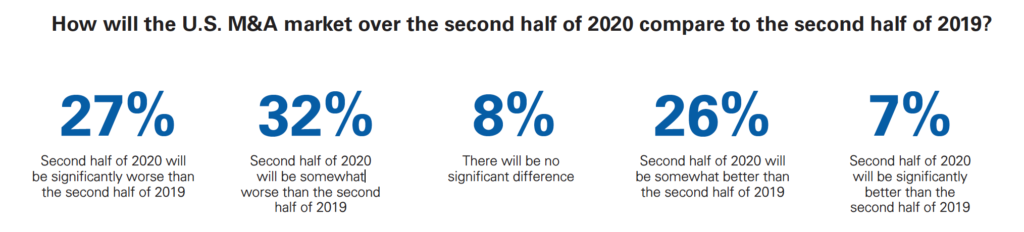

On the flip side respondents aren’t keen on the short term, with 59% predicting that the second half of 2020 will be worse than the second half of 2019, while fully a third (33%) believe that the second half will see a righting of the economy.

Dykema’s 16th annual M&A survey is based on responses from 225 top senior executives to a survey distributed by Dykema via email. The survey population included a cross section of CEOs, CFOs, senior executives and professional advisors in M&A transactions. The respondents were from a broad range of industries including automotive, energy, food and beverage, health care, retail, technology, industrial/manufacturing and financial services.

Respondents also represented companies with annual revenues from less than $1 million to more than $1 billion in 39 states.

The availability of quality targets remained the main visible obstacle to increased M&A activity over the past year, according to the survey. Respondents once again cited the availability of quality targets as the main obstacle to making deals. But economic uncertainty, which wasn’t in the top five last year, ranks as the number two obstacle this year. Moreover, “valuation” was also seen as problematic in a market marked by that uncertainty.

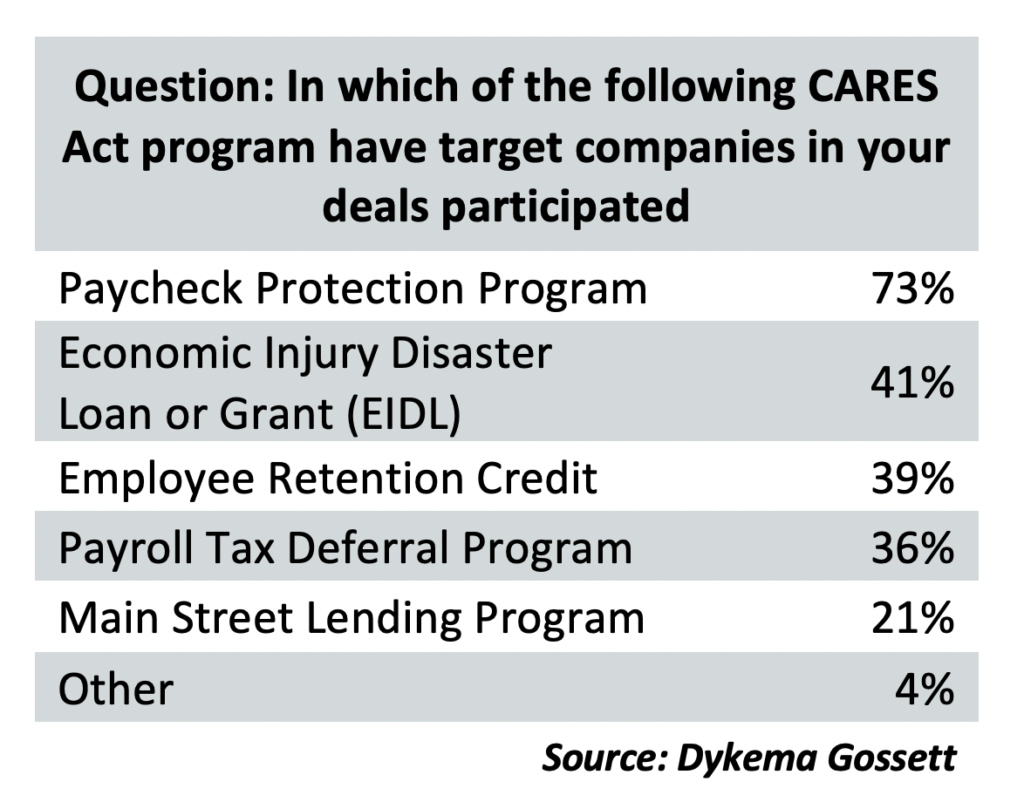

As might be expected, the role of the Paycheck Protection Program (PPP) and related economic recovery programs were new to this year’s menu of questions. And a whopping 73% of respondents said they had participated in the massive COVID-19 recovery program, as well as other business relief efforts.

Moreover, with loans on the books that may or may not be forgiven, respondents who had participated in M&A transactions were asked how they had handled the existing of that particularly novel form of debt?

How have outstanding Paycheck Protection Program (PPP) loans been dealt with in M&A deals in which you have been involved?

- 38% Buyer required escrow for PPP loan, until forgiven

- 32% Reduced purchase price by amount of PPP loan

- 30% Lender required escrow for PPP loan, until forgiven

- 28% Treated forgivable amount as debt

- 19% Required seller to pay off PPP loan at closing

- 17% Did not treat forgivable amount as debt

- 16% Buyer assumed PPP Loan

- 8% Deal did not close because of PPP loan

- 7% Other

COVID-19 and fears of its continuing spread was, by far, seen as the greatest threat to M&A activity in the coming year, with 63% of respondents.

Politics, however, was close behind. The prospect of a Biden presidency (48%) and a Democrat control of the House and Senate (46%) weighed on the respondents as a major threat.

But the re-election of Donald Trump (31%) and control of Congress by Republicans (23%) were also listed as potential threats to M&A.

In 2019 “political uncertainty” was cited as a major threat to business by 35% of respondents.

The full 16th Annual Dykema Gossett M&A Survey can be found and downloaded here.