When it comes to being involved in the biggest mergers, acquisitions and joint ventures in Texas so far this year, a dozen or so law firms claim that distinction.

Nearly all the firms are based outside of Texas. Nearly a half of them have no office in Texas. They are at the top of the charts because they represented buyers, sellers, third parties or investment banks in a dozen separate M&A transactions valued between $1.5 billion and $21 billion.

The deal value rankings can be highly misleading, and all legal analysts agree it is an inferior measure to deal count rankings. Even so, it is a fun number to discuss.

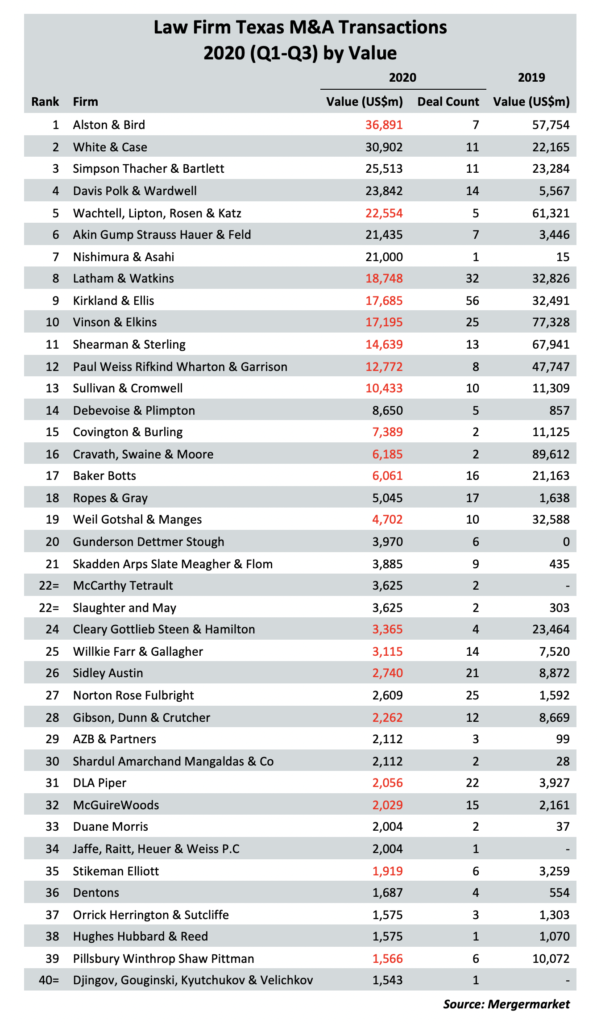

New data provided exclusively to The Texas Lawbook by the business research firm Mergermarket shows that 13 law firms were each involved in more than $10 billion worth of corporate transactions involving Texas-based companies or private equity firms.

Those 13 law firms include many of the M&A regulars – White & Case, Simpson Thacher, Davis Polk, Wachtell Lipton, Paul Weiss, Akin Gump, Latham & Watkins, Kirkland & Ellis, Vinson & Elkins and Shearman & Sterling.

But there are some surprise additions at the top of the Mergermarket M&A law firms by deal value, including Alston & Bird and Japan-based Nishimura & Asahi. In fact, Alston & Bird ranks No. 1 and Nishimura is No. 7, but both firms are examples of why deal value can be a less relevant data point than deal count when analyzing the actual legal work lawyers are billing on a matter.

The Atlanta-founded Alston & Bird tops the deal value ranking at $36.9 billion because of its representation of investment banks in three of the 10 largest transactions during the third quarter. Nearly all the lawyers for Alston & Bird who worked on these transactions were based outside of Texas. That being said, there are scores of corporate law firms who envy Alston & Bird and would love to be representing financial advisors in those megadeals.

Whose tops the M&A deal value data and why?

There were two mega M&A transactions (11-digits) and three deals of $3.6 billion or more during the third quarter of 2020, and those five have an outsized impact on the Mergermarket data. In several of these matters, the lawyers for the firms are not based in Texas.

The largest is 7-Eleven’s $21 billion acquisition of Speedway. Akin Gump and Nishimura & Asahi advised 7-Eleven. Wachtell Lipton represented Speedway. Alston & Bird advised investment bank Credit Suisse. Davis Polk also represented a third party.

The second megadeal is Chevron’s purchase of Noble Energy for $12.6 billion. Paul Weiss advised Chevron, while V&E represented Noble. Shearman & Sterling handled the antitrust issues, Simpson Thacher advised a third party, and Alston Bird once again advised Credit Suisse.

The third largest transaction by deal value was Blackstone Group’s sale of its 40% interest in Houston-based Cheniere Energy Partners to Brookfield Infrastructure and Blackstone Infrastructure for $7 billion. Kirkland advised Brookfield. Latham represented Blackstone. Simpson Thacher provided legal counsel for Blackstone Infrastructure. Covington & Burling advised a third party.

The fourth and fifth largest M&A transactions during the third quarter, according to Mergermarket, were Austin-based technology company Epicor Software’s sale for $4.7 billion to a New York private equity firm and NRG Energy’s $3.6 billion purchase of Direct Energy. The law firms involved in those deals include Simpson Thacher, Latham, White & Case, Baker Botts and Cravath.

Overall, 37 of the top 40 legal advisors by deal value are based outside of Texas. Akin Gump, V&E and Baker Botts are the only three Texas-based law firms in the Mergermarket top 40 by deal value.

Again, this can be somewhat misleading. Of the top 40, 12 of the law firms worked on three deals or less.

Four law firms are in the top 40 but worked on only one transaction. Nishimura is one of those, ranking No. 7 overall.

White & Case, which has an office in Houston, ranks No. 2 because it was involved in 11 transactions with a combined $30.9 billion price tag. Simpson Thacher ranks third with 11 deals valued at $25.5 billion, according to Mergermarket.

Wall Street law firms Davis Polk & Wardwell and Wachtell, Lipton, Rosen & Katz rank fourth and fifth, even though neither firm has an office in Texas. Davis Polk lawyers worked on 14 transactions valued at $23.8 billion. Wachtell Lipton handled only five deals, but they were big-dollar transactions, including the 7-Eleven-Speedway merger.

Kirkland & Ellis, which worked on the most Texas deals (56), ranked ninth in deal value ($17.7 billion).

Latham & Watkins ranked second in deal count (32) and eighth in value ($18.7 billion).

The three Texas law firms ranked in the top 17.

Akin Gump is No. 6 with seven transactions with a combined value of $21.4 billion. The firm’s Dallas lawyers were the lead advisors for 7-Eleven in the Speedway transaction.

V&E ranks 10th with 25 deals with a combined price tag of $17.2 billion. Baker Botts is 17th and worked 16 transactions with a value of $6 billion.

Next week, my Texas Lawbook colleague Allen Pusey will unveil updated Corporate Deal Tracker data for Q3 2020. While Mergermarket measures M&A by the location of the buyer and seller, the CDT calculates transactions solely of the lawyers based in Texas. The first CDT data will document M&A deal count and deal value of the lead legal advisors for the buyers and sellers only.