Texas M&A activity plunged in 2020 as the overall business climate cooled due to the coronavirus pandemic and the state’s energy sector took a beating with the downturn in oil prices earlier in the year, according to exclusive data provided to The Texas Lawbook from MergerMarket.

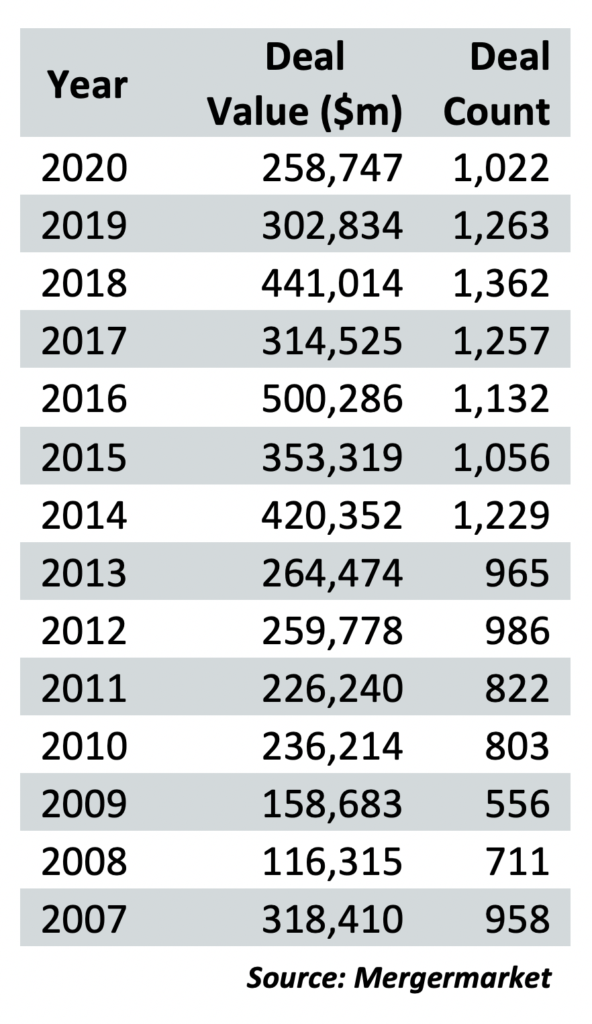

Deals amounting to $258.8 billion were announced in the Lone Star State last year, representing a 14.6% drop over 2019 and the worst annual M&A performance since 2011.

Deal count also dropped year-on-year by 241 to 1,022, the lowest number since 2013.

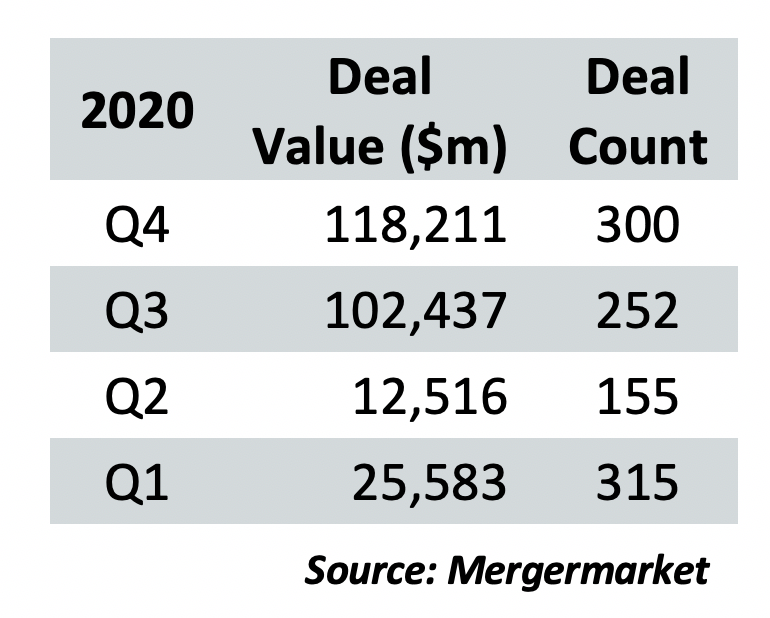

The year started out normal enough, with 315 deals announced in the first quarter of 2020, compared to 317 the previous quarter. That figure quickly dwindled by half to 155 in the second quarter as lockdowns, travel bans and work-from-home orders rattled the world.

However, dealmaking recovered to 252 in the third quarter and up to 300 in the fourth quarter as the business world adapted to remote working systems and as lockdowns were lifted.

While Covid-19 lockdowns early in the year ground dealmaking to a halt, the pandemic cannot be completely blamed for the decline in activity, as energy M&A activity was already on the downward slide from 2018 to 2019, according to Vinson & Elkins partner Matt Strock.

“It was around a 35% drop on the numbers we see just from 2018 to 2019, so there’s no doubt that kind of coming out of 2019, 2020 energy M&A limped at best into 2020,” Strock, based in Houston, told The Texas Lawbook.

MergerMarket’s data shows deal value in Texas dropping from $441 billion in 2018 to $302 billion in 2019, with the annual count falling from 1362 to 1263.

But King & Spalding partner Jonathan Newton pointed out that lower deal activity in 2019 versus 2018 did not make a trend.

“I think that 2020 was poised to be a really good M&A year, putting aside Covid, because I think that economically things were going really well, there was a lot of momentum,” Newton, who is based in Houston, told the Texas Lawbook. “And then, unfortunately, what would have been a really good M&A year was completely reversed by virtue of Covid.”

The pandemic had another interesting effect on deal activity in 2020. The fourth quarter, historically one of the quietest periods of the year in terms of M&A, saw the most activity, with 300 deals amounting to $118 billion announced. The weakest quarter was the period from April to June, with just 155 deals adding up to $12.5 billion.

“I think the fourth quarter was the busiest partly because the second quarter could not have been any worse,” Kirkland & Ellis partner Sean Wheeler told The Texas Lawbook.

Energy, mining and utilities deals, totalling $57.2 billion in value, made up the largest share of the market with 25.2%. Technology, a growing sector in the state, was a close second at 22%.

“We’re definitely seeing real strong growth on the tech side,” Strock said. “I think if nothing else COVID probably further accelerated that as people became increasingly comfortable with remote working, and the notion that (they) don’t have to be in California to be able to be effective.”

Newton also said he was not surprised by the strong showing from the technology sector.

“In some respects technology was immune to COVID, if not benefited from COVID,” he said. “I’m sitting in my kitchen right now, with my iPad, my computer, my two phones for work and my personal phone, and I’ll be here all day.”

Looking ahead, Wheeler expects law firms’ emphasis on technology and renewable energy to grow, as those sectors become more significant relative to traditional hydrocarbons. He predicts that tech deals will overtake energy deals in the next five years or so.

“There is a massive shift underway away from hydrocarbons toward renewables and toward technology,” he says. “So I would continue to expect energy deals to kind of suffer. Even if oil prices go back up, I don’t think that energy deals are going to exceed their 2019 (levels).”

Looking ahead, Strock and Newton both expect dealmaking activity, especially in the tech and energy sectors, to continue into 2021 on the upward path that started in the final months of last year.

“We’ve seen that fourth quarter momentum carrying over into this year,” Strock said. ”Lots of people are looking at deploying capital, sponsors are actively looking at various opportunities on the tech side and on the energy side. The energy revolution, renewables, are all very hot areas right now, attracting a lot of capital and work. We’re very optimistic about 2021, going into it and really see a lot of a lot of momentum in a number of our key areas.”

Wheeler, however, has a much more bearish outlook, citing a lukewarm but limited interest in dealmaking on the part of buyers and sellers.

“I don’t feel a lot of momentum toward deals,” he said. “We were busy, but it’s not like there’s a lot of excitement about doing deals. I mean, people are still trying to understand what’s happening, where the market’s headed.”