Corporate bankruptcies in Texas shattered all records during the first 11 months of 2020, as the Covid-19 pandemic and struggles in the oil patch sent an historic number of large, multibillion-dollar companies rushing to federal court to restructure.

All that changed in December, as Chapter 11 business bankruptcies plummeted more than 60% from November.

But bankruptcy experts say the decline in businesses seeking court protection under the U.S. Bankruptcy Code is a false indicator about what is ahead: a second blitz of bankruptcies – this time filed by middle market and smaller companies, which will be much more difficult to restructure. And many may end up as Chapter 7 liquidations.

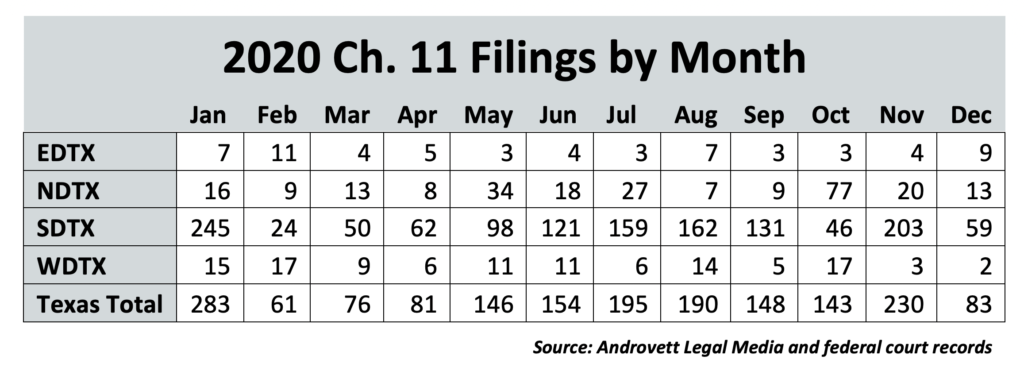

Corporate bankruptcies in Texas jumped 145% in 2020 over the year before, according to Androvett Legal Media research.

In all, 1,790 companies filed in Texas to restructure in 2020, making the state the most popular in the union for declaring bankruptcy. The previous high was 2009, in the heart of the Great Recession when 1,060 businesses went to bankruptcy court to reorganize, according to Androvett.

But a Texas Lawbook analysis of the 2020 bankruptcy data shows that nearly all the increase in Chapter 11s in Texas involved companies that cited assets or debts of $500 million or more.

By contrast, bankruptcy filings by Texas middle market and lower middle market businesses – those citing $250 million of assets or liabilities – grew by only 3.5%, the Texas Lawbook research shows.

Yet bankruptcy experts see no reason to celebrate. The lack of formal restructurings among lower revenue generating companies, according to analysts, is a bad sign because it likely means that business owners are exhausting their cash reserves, hurting their long-term credit by missing vendor payments or, worst of all, turning to predatory lenders instead of seeking court-protected reorganization.

“We’ve been surprised that we haven’t seen more bankruptcy activity in the middle market,” said Jeff Prostok, a partner at Fort Worth bankruptcy boutique Forshey Prostok. “But keep in mind, it is hard to restructure when the future is so unknown.”

More than a dozen prominent bankruptcy lawyers who focus on middle market businesses told The Texas Lawbook that they expect a record number of small and mid-sized companies to seek reorganize under Chapter 11 in the second and third quarters of 2021.

Many banks temporary extended existing loans to smaller and mid-sized businesses – or at least delayed foreclosure proceedings. Other middle market companies were given reprieves through government assistance programs or Small Business Association loans. Many found temporary relief through private lenders, including some hedge funds but also some predatory lenders.

“A lot of band aids have been put on small and middle market businesses,” said Joe Coleman, a partner at Kane Russell Coleman & Logan. “PPP money helped delay the inevitable.

“But a day of reckoning is coming and it is coming soon for many middle and smaller market companies,” Coleman said. “I think we are going to have an absolutely crazy year ahead. We’ve recently added two bankruptcy lawyers and I hope that’s enough.”

Federal bankruptcy judges agree.

“There are huge issues in the mid-market that we haven’t seen yet,” Chief Bankruptcy Judge David Jones of the Southern District of Texas recently told 200 corporate in-house counsel, investment bankers and business lawyers who attended a Texas Lawbook CLE webcast. “I don’t know what those are going to look like. I don’t know if things can be saved. There’s a lot of uncertainty.”

Judge Jones said the business bankruptcy cases that have yet to be filed “are going to get harder” to resolve. Many trying to restructure may end up becoming liquidations.

“There are an awful lot of forbearances out there with no resolution on the horizon,” he said. “We’ve seen a lot of cases filed where we have a pie and we just need to rearrange the pie and give everybody a different slice. A lot of cases are now a cupcake and people at the table expect a pie.”

According to John Cornwell, a bankruptcy partner at Munsch Hardt in Houston, it is difficult to understand why more middle market and lower middle market companies have been slow to restructure.

Judge Jones “is rightfully concerned about the middle market,” said Cornwell, who represents landlords and creditors in bankruptcies involving 24 Hour Fitness, J.C. Penney and Pier 1. “We know these businesses are experiencing significant distress and there are restructuring tools that are available to help them. Maybe we need to do a better job of educating [small and mid-sized business] owners.”

Sid Scheinberg, a bankruptcy partner at Godwin Bowman, said there are multiple factors that are temporarily keeping the small and mid-sized companies from going the Chapter 11 reorganization route, including government assistance programs and a decision by many financial institutions to be lax on borrowers.

“Many of the banks are not calling in loans, and not foreclosing or evicting and car dealers are not repossessing – at least not yet,” he said. “But once the pandemic is in the rearview mirror, the banks will start calling in the loans and we will see a flood of middle market and smaller company bankruptcies.”

Part of the problem, according to bankruptcy experts, is that owners and CEOs of family-owned and mid-sized companies wait too long before seeking legal advice about financial restructuring.

“Most small and middle market businesses try to do it on their own and then they have to use a nuclear option and it is just too late for many of them,” Houston bankruptcy lawyer Chip Lane said.

“We saw a significant uptick in business at the end of 2020,” said Lane. “I don’t see it getting back to normal any time soon. A huge wave is coming. This new round of PPP funding is just delaying the inevitable.”

The first round of PPP funding was “the saving grace for many middle market businesses,” said Thomas Berghman, also a partner at Munsch Hardt. “But PPP is giving business owners false confidence. And there is still a negative stigma about filing to restructure.”

Berghman and Prostok said the newest round of PPP loans are available for businesses that have filed for bankruptcy, which was not true for last year’s PPP.

DFW bankruptcy partner Robert Forshey said management of larger companies are more proactive in identifying the early factors of financial distress that may require restructuring.

“Many small and middle market business owners are in denial,” Forshey said. “They wait too long to see about reorganizing. If they don’t have the cash, it is very difficult to reorganize. You need cash to effectively reorganize.”

Forshey said cash flow issues are a clear signal that business should consider the Chapter 11 route.

“The business isn’t paying its vendors on a timely basis and is surviving on a robbing Peter to pay Paul basis,” he said. “Many middle market managers play that game as long as possible until the cash runs out. The problem by then is that their credibility may be lost with the lender and vendors and they often lack the necessary cash to make a bankruptcy case work.

“It puts management in the rather difficult situation of knowing there is a problem, and while wanting to avoid premature action, waiting until they don’t have many options left before seeking professional advice,” Forshey said.

He said bankruptcy lawyers need to walk business leaders through all options to find the best one.

“Sometimes that is a bankruptcy filing,” Forshey said. “Sometimes that is a work-out; sometimes it is a sale; and sometimes it’s just too late to do much of anything. Cash is king in a bankruptcy case. If the business has hit the Peter/Paul stage, the managers should begin to explore all options.

“That, and accepting the fact that hope isn’t a business strategy,” he said.

The seven bankruptcy experts say that they have seen an increase in activity by predatory lenders during the past year.

Lawyers say that they have encountered dozens of desperate small business owners of restaurants, bars and liquor stores who turned to financial lending companies for a quick infusion of cash ranging from $25,000 to $500,000. In return, the finance company demands a percentage of receipts.

“The terms seem fine to unsuspecting business managers, who are not lawyers and who don’t get lawyers involved,” said Lane. “But then the predatory lenders want daily cuts and weekly cuts. The interest rate in one of my current cases ended up being 1184%.”

“It is modern day loansharking,” he said.

In some such loan agreements, the lenders get access to the business’s bank accounts and they can get liens and then can freeze activity.

“When a predatory lender is involved, it is usually the death knell of the business,” Berghman said.

All of this is taking place even as a special provision that significantly helps small businesses restructure their debt quicker and cheaper is about to expire. In 2019, Congress passed a law commonly referred to as Subchapter V of Chapter 11 of the U.S. Bankruptcy Code that expanded the ability of companies with debts of $7.5 million or less to restructure in a much simpler one-step petition and confirmation proceeding.

Subchapter V, according to the seven bankruptcy experts, is perfect for small businesses struggling during the pandemic.

“The process moves fast,” Prostok said. “A plan must be filed in 90 days. No creditors committee is usually appointed. Only a debtor can file a plan and no disclosure statement is required, which all reduce costs. A debtor can confirm a plan without acceptance by any creditors as long as it does not discriminate unfairly and is fair and equitable.”

The law allows small businesses that otherwise could not afford a Chapter 11 restructuring to extend their payments to creditors in an amount based on their ability to repay.

“The great thing about Subchapter V is that it allows the ownership to remain with the owners,” said Berghman, who is effectively using the provision to restructure his client, Austin-based Snap Kitchen. “Snap Kitchen was already shifting from brick-and-mortar to electronic prior to the pandemic. Subchapter V allowed them to fix its balance sheet and keep it viable.”

The problem, they say, is that very few small businesses have taken advantage of the procedure and it is set to expire in March, unless Congress extends it.

Coleman, Prostok and other bankruptcy experts say the next escalation in Chapter 11 filings will involve middle market companies in healthcare, elderly care, hospitality, entertainment, fitness and commercial real estate.

“The question for many in these industries is, what are their businesses going to look like at the end of this?” Coleman said. “I don’t think bankruptcy filings by oil and gas companies are going to slow down in the near future. There are a lot of middle market oil and gas service companies, suppliers and even E&P companies that are barely surviving.”