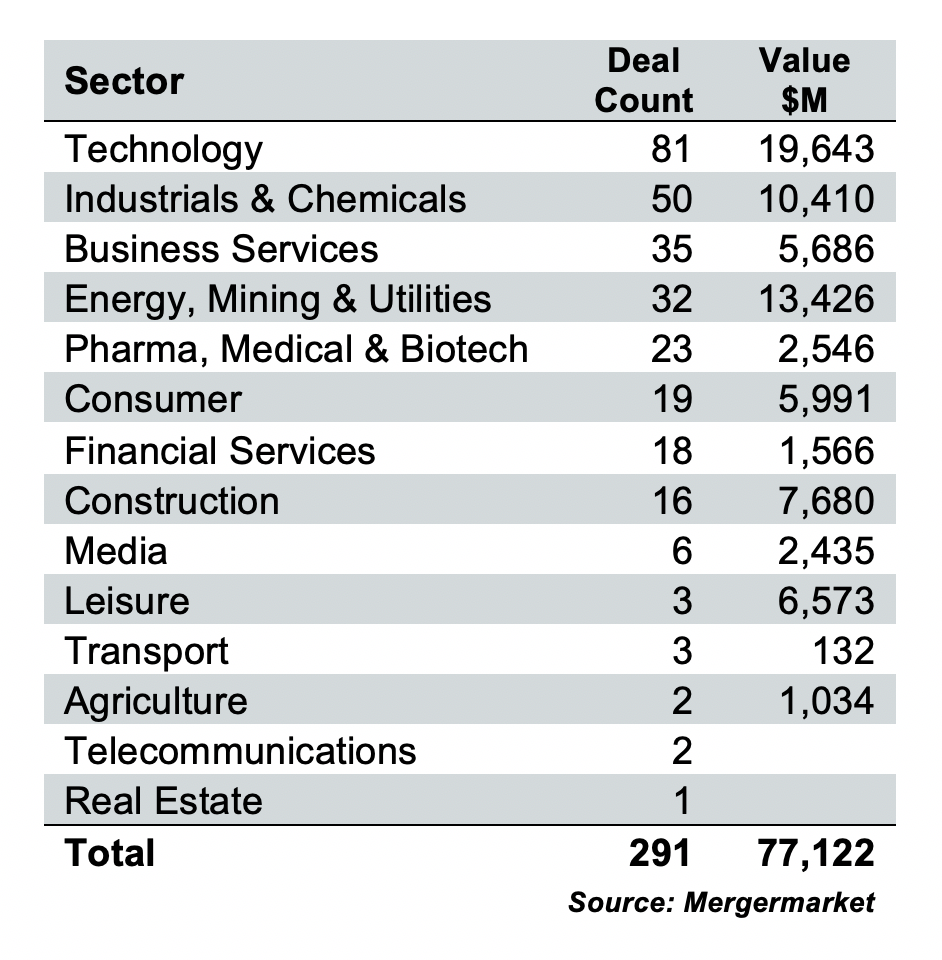

The hottest sectors in first-quarter transactions in Texas were technology; energy, mining and utilities; and industrials and chemicals.

That’s according to Mergermarket data provided exclusively to The Texas Lawbook, which examines deals tied to Texas-based companies and private equity.

The figures, ranked by deal value, align with the overall activity seen in the United States and worldwide in the Q1 2021. Technology M&A, which accounted for 25.5% Texas deals, led the way globally with 24.3% and in North America.

Industrials and chemicals and financial services took the second and third spots in global and U.S. M&A for Q1.

In the first quarter, Mergermarket reported 417 tech deals that added up to 29% of all U.S. deal value at $164 billion. In Texas, the tech deal value total was just shy of $20 billion of Texas’ overall $77 billion in activity. Globally, the number was $282.4 billion.

For a deeper look at how Texas M&A activity fared for the quarter, click here.