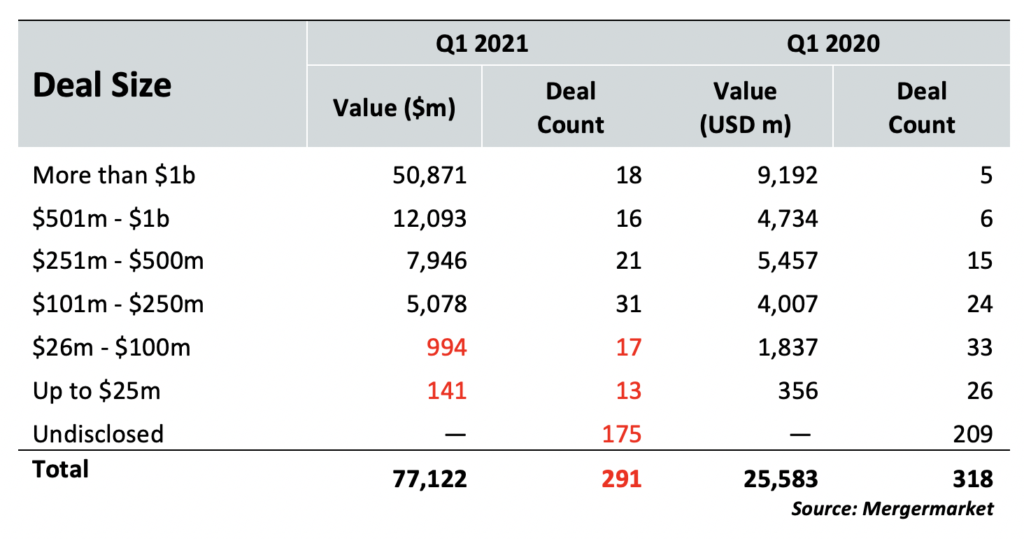

While 175 deals reported to Mergermarket did not disclose values for its Q1 deal report for Texas, the 116 that did revealed more high-dollar transactions year-over-year.

In Q1 2020, Texas companies and private equity firms saw 60% more transactions up to $25 million and 46% more between $26 million and $100 million. During that quarter, of the 318 total deals reported, 109 disclosed deal value.

While the impact of the coronavirus and the ongoing uncertainty that it perpetuates can’t be measured, it is a bit easier to examine the impact of an election year on pent-up deal flow and Q1 figures.

The first quarters of 2013 and 2017 in Texas saw higher deal values by more than 60% with a surge in deal count as well. Q1 2021 fell between 2013 and 2017 with its more than $77 billion in deal value and 291 transactions.

Dealmaking data for the U.S. mirror Texas’ post-election transaction trends – though the percent change spike isn’t as drastic. According to Mergermarket, between Q1 2012 and 2013, deal value for the quarter jumped by more than 38%, while between Q1 2016 and 2017, it grew by over 27%.

For a deeper look at the Q1 2021 deal activity in Texas, click here.