Ricky Torlincasi is one of the youngest general counsel in the oil patch. He’s 35 and been on the job at Blackbeard Operating for less than two years.

But he has been crazy-busy throughout those 19 months.

The moment he started the job in October 2019, Torlincasi was tasked with helping Blackbeard executives integrate the mergers of two comparably sized exploration and production companies and merge with a third a month after he joined the business.

Then he led Blackbeard’s acquisition of Anadarko Basin assets from BP and the purchase of ConocoPhillips’ legacy Waddell Ranch, and then the divestitures of assets in Oklahoma and South Texas. At the same time, he negotiated the settlement of a sticky pipeline and property dispute, is managing two royalty cases pending at the Texas Supreme Court and is overseeing a large trade secrets case against a competitor.

None of those transactions or disputes take into account that a dozen of the months he’s been on the job occurred during the Covid-19 pandemic or the matters he had to address during the winter storm that blasted Texas in February.

“I can’t think of a single issue we haven’t had to deal with during my first 19 months on the job,” Torlincasi said. “It has been the proverbial drinking from a firehose.”

Robert Hargrove, a shareholder of Davis Gerald & Cremer in Austin, offered a different metaphor: “Ricky was thrown head-first into the fire.”

The Association of Corporate Counsel’s DFW Chapter and The Texas Lawbook have named Torlincasi as a finalist for the 2020 DFW Outstanding Corporate Counsel’s Rookie of the Year Award.

Premium Subscribers: For a special Q&A with Ricky Torlencasi Click Here

The finalists will be honored, and the winners announced at the annual awards event on June 3.

“It is hard to imagine a more deserving candidate for the ‘Rookie of the Year’ award than Ricky Torlincasi,” said Thompson & Knight partner Tim Hudson. “Given the scope and breadth of the legal matters he oversees, you would never know if he feels any pressure.

“Ricky has an easy air about him that exudes confidence and trustworthiness — qualities that would befit any general counsel,” Hudson said. “Despite his incredible savvy as an M&A lawyer, I often tell him he missed his calling and should have been a litigator.”

Four law firms – Thompson & Knight, Winstead, Kelly Hart & Hallman and Davis Gerald – nominated Torlincasi for the award.

“Ricky has deep industry knowledge and experience, so he knows industry custom and practice,” said Winstead shareholder Andrew Rosell. “When Ricky looks at issues, it is with the experience of having seen the situation before. He then works hard to explain the issue and bridge any disagreements.

John Thompson, a partner at Kelly Hart in Fort Worth, said Torlincasi’s “business acumen is without question.”

“He is highly skilled in corporate transactions and litigation, and his contribution to Blackbeard far exceeds a one-year reflection,” Thompson said. “To be an effective GC, you must have a broad range of substantive legal skills and demonstrate good judgment. You must be someone who thinks broadly about business and shareholder value. Ricky is one such individual.”

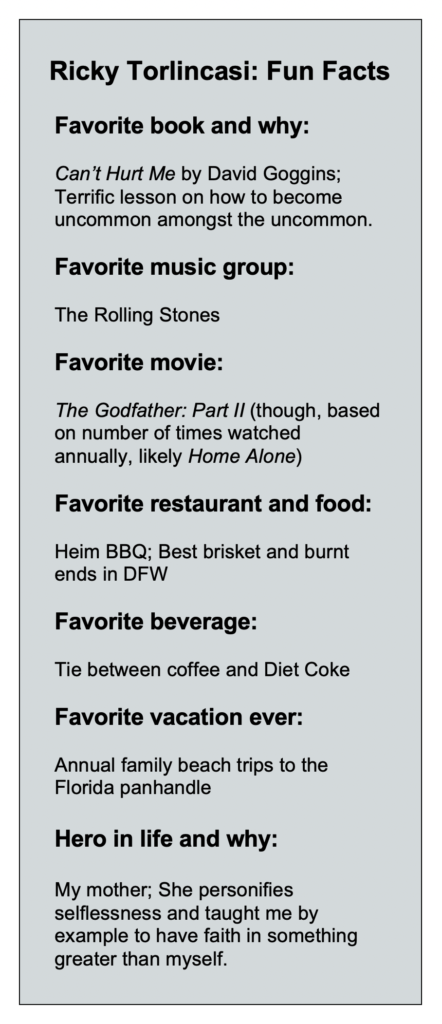

Torlincasi was born, reared and still lives and works in Fort Worth. He was raised by his mother, who is a configuration analyst for a defense contractor. His father is an entrepreneur and has been involved in many businesses. His older brother is a public interest lawyer in California.

“I have wanted to a lawyer since high school,” he said.

Torlincasi went to college at Texas Christian University and then to Texas A&M School of Law. He graduated in 2011 when, as he puts it, “the legal job market was in shambles.”

He started practicing law at a smaller law firm and developed “my own book of business.”

“I developed my own clients as early as I could in my career,” he said. “I took the ‘eat what you kill’ approach. This experience shaped my entire outlook on the legal profession, and I came to realize that success isn’t guaranteed, legal services are a commodity that is bought and sold and the closest thing to job security is having your own clients.”

In 2014, Torlincasi caught the attention of several larger firms and he joined Haynes and Boone. Two years later, he joined Winstead in its corporate transactions practice.

In 2016, he was part of the Haynes and Boone team that represented a private equity-backed management team that sought to purchase Chesapeake Energy’s assets in the Barnett Shale. Throughout the entire negotiations, lawyers for all sides, including Chesapeake, believed that energy giant Total, which was a non-operational joint owner of the assets, would not be exercising its preferential rights.

“It would have been the largest transaction of my career, but Total killed the deal at the eleventh hour,” he said. “I know we were all surprised.”

While at Winstead, he worked on a few matters involving Blackbeard with a partner.

“I enjoyed working with the Blackbeard team and admired the company for being contrarians,” he said. “It is crazy that we are contrarian, because we are trying to build a profitable and successful company and not trying to build it just for the purpose of selling it to private equity.”

When the main partner for Blackbeard left Winstead, Torlincasi approached company officials saying he hoped that they would still consider hiring him for legal work.

“They completely turned the tables on me and said that they had come to trust me and they liked my work and they asked me to be their first ever general counsel,” he said. “I was really surprised. I was up to make partner that year and I had mixed emotions.”

In October 2019, Torlincasi made the decision to join Blackbeard.

“When presented with the opportunity to join the Blackbeard team at a period of exponential growth, I couldn’t pass it up,” he said. “Since the summer of 2019, the company has quadrupled in size.”

Two months before Torlincasi joined Blackbeard, the company did merger agreements with Bluestone Natural Resources and Bravo Natural Resources, which were about the same size as Blackbeard. Then, in November 2019, Blackbeard did another M&A deal with Tecolote Energy.

“In the time since I started, Blackbeard has navigated the consolidation of the merged companies to become a multibasin and multistate operator, acquired BP’s Anadarko Basin position, acquired Conoco Phillips’ legacy Waddell Ranch asset and divested multiple noncore asset packages,” he said.

“As GC, I have handled more substantive legal work in the past 17 months than some GCs handle in a decade, and I know more [now] than I had in the prior eight years of private practice,” he said. “I have enjoyed every minute of the learning experience, but I am often too focused on new work to realize how great the workday was.”

The combined price tag of the deals since he has been at Blackbeard totaled more than $600 million.

“Ricky has a keen instinct for what makes people and deals tick,” Hudson said. “His intellect and personality makes him a worthy adversary for any opposing general counsel, but also makes him incredibly fun to work with. He is creative, thinks well on his feet and always has an eye out for management.”

Torlincasi has significant litigation experience, too.

Blackbeard inherited several large litigation matters thanks to the merger with Bluestone, including a contentious pipeline dispute with a very prominent South Texas family. The case claims involved alleged underpayment of royalties and the exposure to the company was material.

“The prior management team [Bluestone] had done us no favors,” he said. “They had sought to get the land condemned. The family was one of the largest landowners in that county, so you can imagine that didn’t go well.”

The case went to mediation and the mediator finally decided to put Torlincasi and a transactional lawyer for the family in a room with no litigators.

“Rather than focus on the litigation and the disputes, let’s look at what we can do together and maybe be joint owners and give the family an interest in the pipeline,” he said. “We were able to settle for a fraction for what they sought.”

“I actually like it when negotiations get uncomfortable,” he said. “That is when I do my best work. Candor is not an issue for me.”

Like nearly every corporate general counsel, Torlincasi has dealt with the effects of Covid-19.

“In the past 12 months, we have navigated shutdowns and shut-ins, employees and their families’ exposure to the virus and large swings in commodity pricing – all while a majority of our employees have worked remotely,” he said. “All in all, Blackbeard and our employees have done an exceptional job navigating the situation due to our company culture.”

Torlincasi said Blackbeard is looking at possible solar options to provide its own electricity for its operations.

“As we learned in February, electricity is a big deal and can be an issue,” he said. “We are focusing on ESG because it is profitable and makes good business sense – not because it is the trendy thing to do.”

Rob Vartabedian, a partner at Alston & Bird, said Torlincasi knows the areas of the law where he has expertise, and he is aware when he needs to solicit the views of others.

“Ricky is great at getting to the point — and helping others get to the point,” Vartabedian said. “When an issue arises, he thoughtfully but quickly identifies what’s important to his company — and what isn’t — and gets everyone focused on finding a sensible solution.”

What do people need to know about Torlincasi?

“The dude loves barbecue,” Vartabedian said. “And has strong opinions on the subject.”