Imagine a series of megamergers that unites the Texas corporate law work of Chicago firms and does the same down the line for firms from Los Angeles, Atlanta, Richmond, Kansas City and the six other cities with more than one out-of-state firm operating in Texas.

Then do what comes second nature to lawyers – follow the money! – to reveal the financial geography of the wave of new entrants that roiled Texas’ legal market over the past decade.

This is just a speculative exercise, of course. The Texas Lawbook would never countenance flouting antitrust law, but our results suggest the out-of-state financial muscle that mattered most came mainly from three U.S. cities – one Midwest, one West Coast, one East Coast.

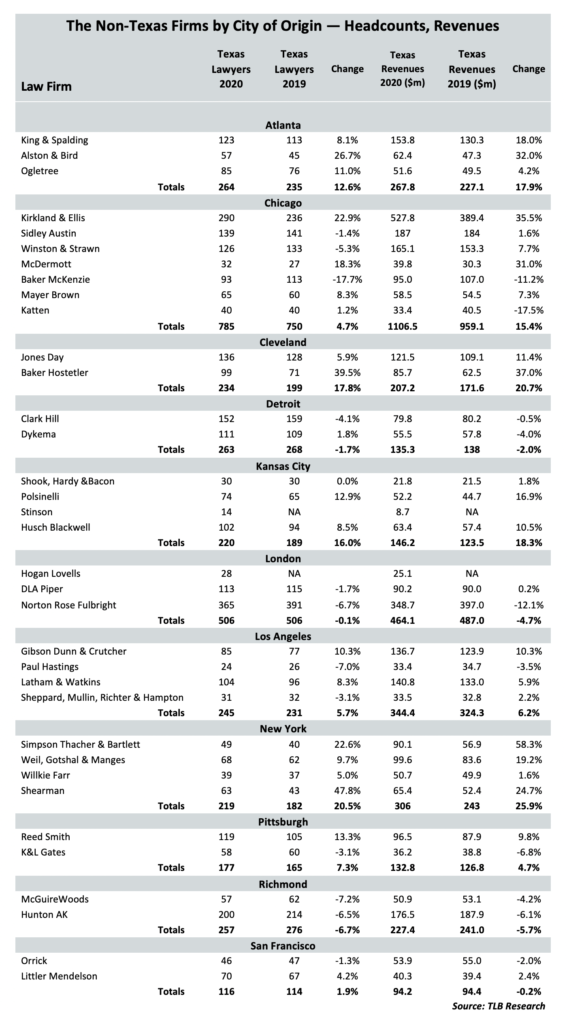

The Texas Lawbook 50 financial data on Texas revenues and lawyer headcounts for 2020 yielded 11 cities with multiple firms operating in the state. Chicago stood head and shoulders above the rest. Its seven firms employed 785 Texas lawyers last year – more by far than any of the other out-of-state cities (See Chart 1).

More telling, the Texas lawyers working for those Chicago firms generated revenues exceeding $1.1 billion, more than double any other city. And, somewhat surprising, just $150 million behind the seven Houston-based firms in The Lawbook 50.

Chart 1

Along with their counterparts from Los Angeles and New York, the Chicago firms were part of an out-of-state wave that in the past decade turbocharged the finances of Texas corporate law. For both the newcomers and surviving Texas-based firms, hourly rates, lawyer salaries and firm revenues and profits all rose to unprecedented heights.

The national firms came to Texas to cash in on a fast-growing economy with a thriving energy sector and pro-business policies that attract big companies relocating from other states. The most aggressive national firms came from big business centers, armed with enough financial clout to pay salaries high enough to acquire Texas’ top legal talent.

Kent Zimmermann, a law firm consultant at Zeughauser Group in Chicago, said the top out-of-state firms elbowed their way into the Texas market through a combination of culture, discipline, leadership and strategy.

“They were not trying to be all things to all people,” he said. “They prioritized their time and money – that’s helped them become successful in Texas.”

The Texas economy also lured law firms from smaller cities. They arrived with modest ambitions, and they’ve grown their Texas lawyer ranks and revenues over the years – but they weren’t factors in roiling the industry’s finances.

Firms from Detroit, Kansas City and Pittsburgh can’t generate the financial resources to hire the talent to compete for the lucrative business at the top of the Texas market. They found their niches in the practices and work that don’t produce the gaudy financial results sought by the Chicago, Los Angeles and New York firms.

For example, Kansas City-based Polsinelli has deep expertise in healthcare law, while Atlanta’s Ogletree and Littler Mendelson of San Francisco specialize in employment law.

“There’s room for all kinds of firms in Texas,” Zimmerman said. “Not every deal or transaction commands the rates of the most expensive firms.”

A weird irony lurking behind our city data is that many national law firms often disclaim, or at least downplay, their roots. Public relations folks regularly complain to Texas Lawbook reporters that their firms – from Kirkland to King & Spalding – are not Chicago-based or Atlanta-headquartered. Instead, they insist that they are “international law firms” without a home or HQ.

Retired AT&T General Counsel Wayne Watts once told The Lawbook that large corporate law firms should be “proud of their roots, not running away” from their past.

Now for the numbers.

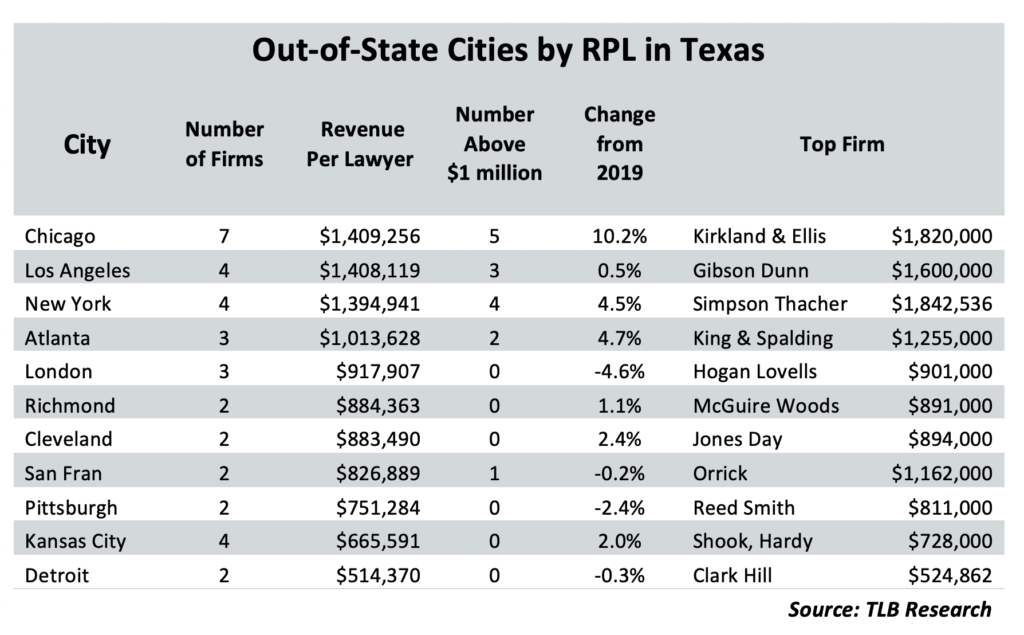

Chart 2

Calculating revenue per lawyer, the analysts preferred metric for firm finance, found Chicago’s firms at the top with a weighted average of $1,409,256, up 10% from 2019 (See Chart 2). Five of the Windy City’s seven firms had Texas RPLs exceeding $1,000,000, led by Kirkland & Ellis at $1,820,000. Sidley Austin and Winston & Strawn both topped $1,300,000.

Nipping at Midwest cities’ heels were firms from opposite coasts. With three of its four Texas operations yielding $1,000,000-plus RPLs, Los Angeles was second at $1,408.119, up only a half percentage point from 2019. Its heavy hitters were Gibson Dunn ($1,600,000), Paul Hastings ($1,383,000) and Latham & Watkins ($1,353,846).

New York gained 4.5% to take third place at $1,394,941. All four Big Apple firms were above $1,000,000 in RPL, led by Simpson Thacher’s $1,842,536, tops among all firms in Texas. Weil, Gotshal & Manges was fourth among national firms in Texas at $1,465,000.

Two cities with three firms each had Texas RPLs around $1,000,000 – Atlanta $13,000 above and London $82,000 below. Both cities were more than $380 million below New York, suggesting the top three cities were in a class by themselves in 2020. The same three cities were at the top in 2019, but the pecking order was Los Angeles, New York and Chicago.

Six cities inhabited the space below Atlanta and London, and they produced 2020 RPLs as high as $884,363 for Richmond and as low as $514,370 for Detroit.

Firms from cities like Chicago, Los Angeles and New York arrived in Texas with lofty financial expectations. They didn’t hire highly paid Texas attorneys for a share of the state’s lower RPL work. But it looked good to firms from cities like Detroit, Kansas City or Pittsburgh. They found their version of Texas opportunity in grabbing a share of the state’s less lucrative legal work.

In sorting themselves out on RPLs, firms end up on a Texas rung comparable with the finances of their city of origin.

“You’re going to grow in a way that enhances your profits and gets the rates you had already established for the firm,” Zimmerman said.

An examination of the city-based data also found:

- Behind Chicago in total 2020 Texas revenues were London ($464 million), Los Angeles ($344 million) and New York ($306 million). London got a leg up when Norton Rose merged with Houston’s Fulbright & Jaworski in 2012.

- Behind Chicago in lawyer headcount were London (506), Detroit (263) and Richmond (257). In each, at least one firm gobbled up a lot of talent through merger: the above-mentioned Norton Rose Fulbright union, followed by Clark Hill with Dallas’ Strasburger & Price and Hunton with Houston’s Andrews Kurth, both in 2018.

- One metric where Chicago didn’t lead was revenue growth from 2019 to 2020. Among the five cities posting double-digit gains were New York at 26%, Cleveland at 21% and Kansas City and Atlanta at 18%. Then comes Chicago at 15%.

- Other gainers were Los Angeles at 6.2% and Pittsburgh at 4.7%.

- That leaves four cities with revenue declines from 2019 to 2020 – Richmond, London, Detroit and San Francisco.

- Firms in seven cities increased their collective RPL from 2019 to 2020, led by Chicago’s 10%. Atlanta was up 4.7% and New York 4.5% – and no other city did above 2.5%.

- Four cities saw lower overall RPLs in 2020. The headliner was London (-4.6%), largely due to a decline of nearly $50 million at Norton Rose Fulbright.

- Looking at the average lawyer headcounts in Texas operations – six cities were below 100 lawyers and five cities were above.

- Leading with the most lawyers per firm were London at 169 (Norton Rose Fulbright) and Richmond at 129 (Hunton AK). Tied for fewest were New York and Kansas City at 55, with Los Angeles slightly higher at 61.

- Chicago’s average size was 112 lawyers. RPL didn’t push Chicago to its big edge over Los Angeles and New York in total Texas revenues; the Windy City leaped ahead via more firms with higher average headcounts.

Events in the first half of 2021 point to further growth among the law firms from cities outside Texas. In April, Kirkland added an office in Austin, its third in Texas. In June, Los Angeles’ O’Melveny & Myers opened its first Texas offices in Austin and Dallas. The out-of-state firms have added to their ranks with prestige hires, highlighted by Kirkland’s June hiring of Erin Nealy Cox, former U.S. attorney for the Northern District of Texas.

In August, Thompson & Knight will merge with Tampa-based Holland & Knight. The conjoined firm’s Texas revenues – $254 million in 2020 – will appear on the out-of-state side of the The Texas Lawbook 50 ledger starting in 2021.

With a few simple calculations, the city-based numbers might offer a glimpse of a future Texas Lawbook headline. It starts with Chicago – by far the leader among the out-of-state cities. If its seven firms matched last year’s collective growth rate of 15%, the city’s Texas revenues would rise to $1.27 billion for 2021.

The seven Houston-based firms in the Texas Lawbook 50 revenue rankings – from Vinson & Elkins and Baker Botts on down to Coats Rose – saw collective Texas revenues decline 6% to $1.26 billion in 2020.

Will we see Houston slip behind Chicago in Texas corporate law revenues? All it would take is another stellar year for the Chicago firms combined with another down year, or even a flat one, for the Houston firms. Chicago isn’t close to Dallas-Fort Worth’s home-grown firms, which had 2020 revenues of $1.76 billion, a gain of nearly 3%.

The horserace between Houston and Chicago – that will be something to watch. The Lawbook certainly will.

Editor’s Note: Over the next month, The Texas Lawbook will continue to publish a series of in-depth articles focusing on the intense battle for talent, clients and revenues within the Texas corporate legal market. The subjects include: (1) Several Texas-based firms scored big successes in 2020 by focusing on Texas; (2) A handful of Texas-based law firms used 2020 to aggressively expand outside of Texas; (3) Some national law firms still want to open in Texas, but is there enough business – or enough lawyers – to do it successfully; (4) About a dozen law firms made The Texas Lawbook 50 Elite Status; and (5) 2011 to 2020 – The decade that dramatically changed the Texas legal market.