White & Case septupled the number of mergers, acquisitions, divestitures and joint ventures involving Texas-based companies and private equity firms during the first six months of 2021 compared to the same period a year ago, which witnessed the start of the Covid-19 pandemic.

Skadden Arps nearly quadrupled its M&A deal count in Texas in the first half of this year over the first six months of 2020 while Alston & Bird and Shearman & Sterling tripled the number of Texas transactions it handled, according to new data from the independent research firm Mergermarket provided exclusively to The Texas Lawbook.

Gibson Dunn increased by 143%. Willkie Farr jumped 125%. Weil Gotshal and Simpson Thacher more than doubled. Vinson & Elkins and Akin Gump both up 43%. Baker Botts increased 31%. Latham & Watkins and Sidley Austin climbed by about one-fourth.

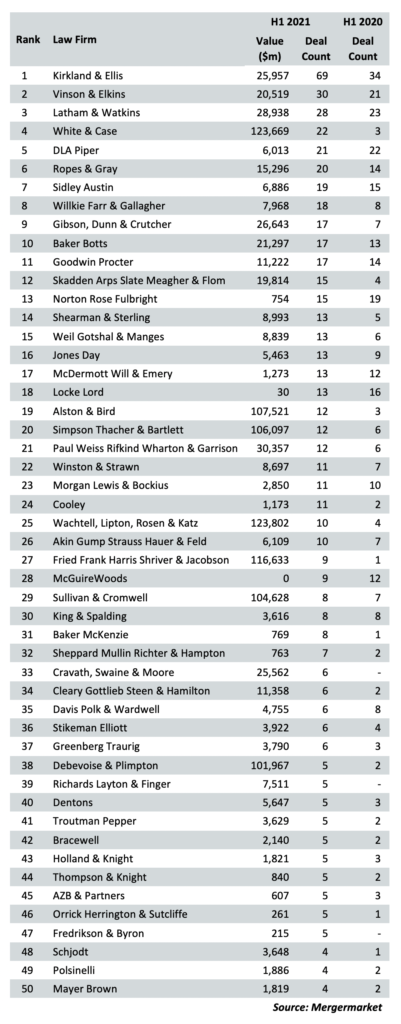

But Kirkland & Ellis broke the all-time record from Jan. 1 to June 30 for most M&A deals by a single law firm, according to Mergermarket.

The Chicago-founded law firm worked on 69 corporate transactions during H1 2021 – up from 34 during the first six months of 2020 and beating its prior record of 63 during H1 2019. No two other law firms combined come close to the deal activity that Kirkland has seen this year. Kirkland represented the private equity firm KKR in its $4.475 billion purchase of Atlantic Aviation and TPG Capital’s $4 billion acquisition of technology company Boomi Inc.

Kirkland’s record deal activity also explains why the firm’s lawyers in Texas generated $528 million in revenue in 2020, according to The Texas Lawbook 50 report.

Editor’s note: All the data in this article is from Mergermarket and involves M&A activity in which Texas-based companies or private equity firms were the buyer, seller or target during the first six months – or H1 – of 2021 and 2020.

V&E (30 transactions) and Latham (28 deals) ranked second and third in the Mergermarket top 50 for Texas. Both firms also did more transactions in H1 2021 than they did in the first halves of 2019 and 2018. Kirkland, V&E and Latham have ranked first, second and third for seven consecutive years.

V&E represented Switchback II Corporation in its $2.7 billion acquisition of technology company Bird Rides, which was advised by Latham. The Texas Lawbook 50 shows that V&E’s Texas operations generated $498 million in 2020, while Latham’s lawyers in Texas brought in nearly $141.

The biggest increase in M&A activity was White & Case, which jumped from three transactions during H1 2020 and eight deals during the first half of 2019 to 22 during the first six months of this year. White & Case was ranked 38th in last year’s top 50 but jumped to fourth this year.

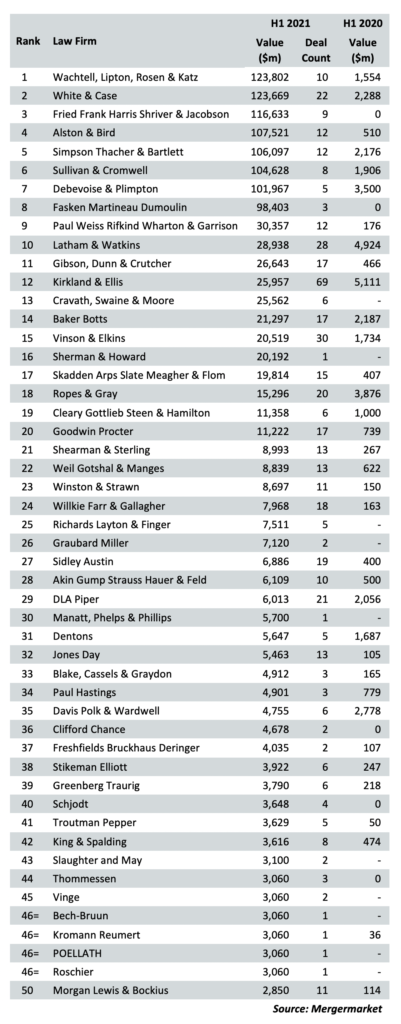

White & Case and Wachtell Lipton topped Mergermarket’s M&A rankings for deal value during H1 2021 – each with more than $123 billion. Ranked third is Fried Frank, which registered only one transaction in 2020 but did nine deals this year with a combined value of $116 billion. Alston & Bird and Simpson Thacher ranked fourth and fifth in deal value, according to Mergermarket.

Alston & Bird, Fried Frank, Paul Weiss, Simpson Thacher and White & Case were legal advisors in AT&T’s $96 billion sale of Time Warner to Discovery – a transaction that was 10 times larger than second place Cabot Oil and Gas’ $9 billion acquisition of Cimarex Energy.

Lawyers at White & Case and Latham also served as legal advisors in FAST Acquisitions purchase of Fertitta Entertainment for $8.6 billion and Energy Transfer’s $6.8 billion acquisition of Enable Midstream. Skadden was also involved in the Fertitta deal while Gibson Dunn, Baker Botts and Jones Day worked on the Enable transaction.

Sidley ranked seventh in the Mergermarket M&A rankings with 19 transactions. The Chicago-founded firm, which recently named Dallas partner Yvette Ostolaza as its new global chair, advised technology company Apex Clearing in its $4.8 billion sale to Northern Star Investment Corp.

Mergermarket ranks Willkie Farr eighth. The firm was the legal advisor on 18 transactions in H1 2021 – up from eight a year earlier. Willkie lawyers worked on the $4.2 billion sale of At Home Group to Hellman & Friedman, which was represented by Simpson Thacher.

Ninth ranked Gibson Dunn lawyers were the advisors on 17 deals (a jump from seven in H1 2020), including the $9 billion Cimarex Energy – Cabot transaction and Contango Oil & Gas’ $4.2 billion purchase of Independence Energy, which was represented by Alston & Bird and V&E.

Rounding out the top 10 is Baker Botts, which worked on 17 transactions in H1 2021 – up from 13 a year earlier. Besides the Cabot deal, Baker Botts lawyers advised Westlake Chemical in its $2.15 billion acquisition of construction company Boral Limited.

In all, 42 of the top 50 law firms increased their deal count this year over last year – a clear sign that the M&A world is well over the coronavirus shutdown. Only five law firms – DLA Piper, Norton Rose Fulbright, Locke Lord, McGuireWoods and Davis Polk – saw their transaction totals decline in H1 2021 v. H1 2020.

DLA Piper saw the number of deals it handled involving Texas business and PE firms drop only one – from 22 in H1 2020 to 21 this year.

Of the top 50 law firms, only six – V&E, Baker Botts, Locke Lord, Akin Gump, Bracewell and Thompson & Knight – are headquartered In Texas. Baker Botts worked on 17 transactions during H1 – a 31% jump from 2020 and exactly the same number they handled during H1 2019 and up from 10 in 2017. The lawyers at Akin Gump worked on 10 deals so far this year – up from seven during H1 2020.

Bracewell and Thompson & Knight, which is scheduled to merge with Holland & Knight in August, both increased their Texas M&A activity from two during the first half of 2020 to five this year.

Seventeen of the top 50, including Ropes & Gray, Goodwin Proctor, Paul Weiss, Fried Frank and Cleary Gottlieb, don’t even have offices in Texas.

Fourteen law firms in the H1 2021 top 50 – including Cooley, Sheppard Mullin, Polsinelli and Mayer Brown – were not in the Mergermarket top 50 last year.

The three law firms that made the biggest leaps were Fried Frank (jumped from No. 149 to 27th), Baker McKenzie (leaped 100 spots from 131 to 31st) and Orrick (173rd to 46th).