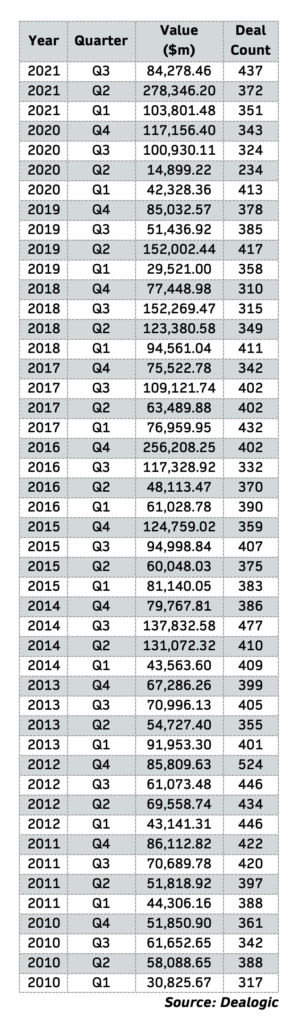

In the third quarter of 2021 there were 437 M&A transactions involving Texas businesses in deals worth more than $84 billion. That’s 65 more than last quarter and 113 more than Q3 2020.

But that’s not even the good part.

According to exclusive data provided to The Texas Lawbook by the independent analytics firm Dealogic (see note below), it’s the best quarter since Q3 2014, when there were 477. Not just the best Q3; the best quarter in the past 28 quarters involving deals by Texas companies.

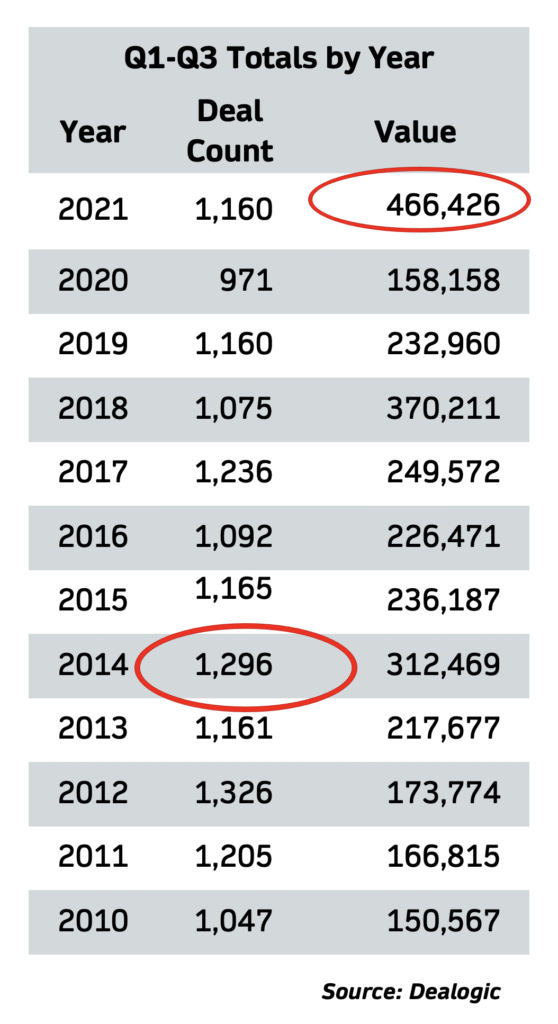

To say the least, it comes at a very good time. As you can see in the chart adjacent, the YTD deal count for the first three quarters (1,160) matches exactly that of 2019, when many were predicting a vibrant market would continue through much of 2020. In fact, deal value at the third pole of 2021 ($466 billion) is double that of 2019 ($233 billion).

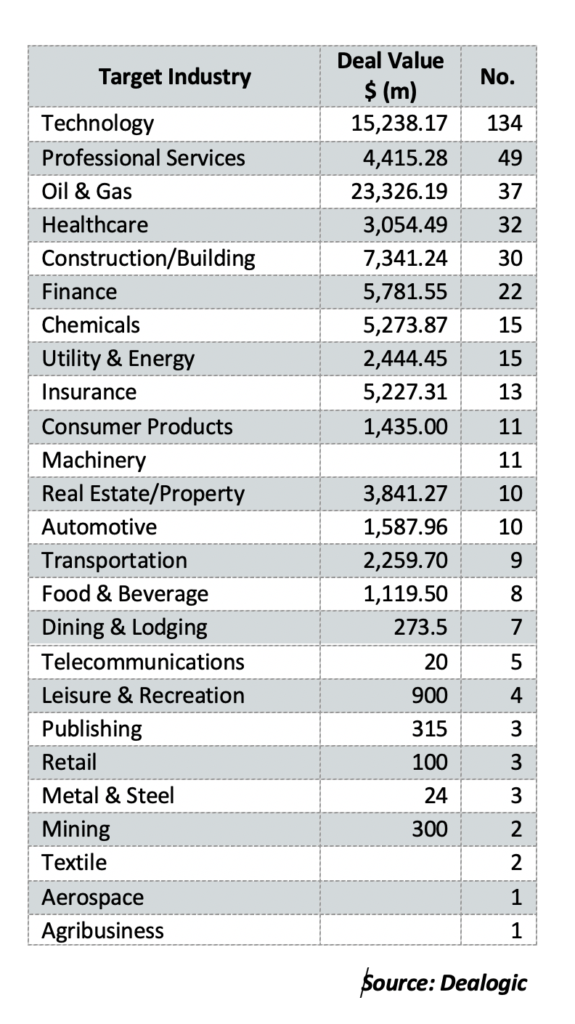

It is probably no coincidence that Texas also saw the return last week of $80ppb oil this past week. But the broad range of deals across the industry spectrum suggests that the reemergence of oil & gas transactions was not the only factor in the new, hopeful numbers. Deals involving Technology (134) and Professional Services (49) accounted for more than 4 of every 10 of the 437 third-quarter deals.

Oil & Gas nailed the third slot with 37 transactions and when combined with Utility & Power deals (8th at 15 deals), the Texas energy business more than held its own.

In fact, at a combined $25.4 billion in value for Q3, the O&G and Utility sectors involved, far and away, the most valuable M&A deals.

Three of the top five deals for the quarter were in O&G. The $9.5 billion ConocoPhillips acquisition of Royal Dutch Shell’s Permian Basin assets topped all Q3 transactions. Brookfield Management’s $5.1 billion acquisition of American National Insurance was the second most valuable, while the TPG Pace purchase of vacation home rental platform Vacasa ran up a $3.9 billion bill. But the next two largest deals, both for $3 billion were in the energy sector: the Quanta Services acquisition of Blattner Energy and the EnCap Investments sale of Moda Midstream to Enbridge Partners.

Editor’s Note: At the suggestion of Ion Analytics, which owns both Dealogic and Mergermarket, The Lawbook’s exclusive data is now being supplied by Dealogic. The company recommended Dealogic for its broader threshold for tracking Texas M&A deals.