Editor’s Note: Multiple law firms contacted The Texas Lawbook this week stating that the Dealogic data provided to The Lawbook under-reported the number of transactions they worked on during the third quarter of 2021. We have forwarded those concerns to Dealogic, which has promised to provide updated data. As soon as The Lawbook receives the data, we will publish it immediately. The Lawbook apologizes for any confusion.

In a quarter that saw more mergers and acquisitions than any three-month period in the past seven years, Kirkland & Ellis once again demonstrated its legal dealmaking prowess in the Texas market.

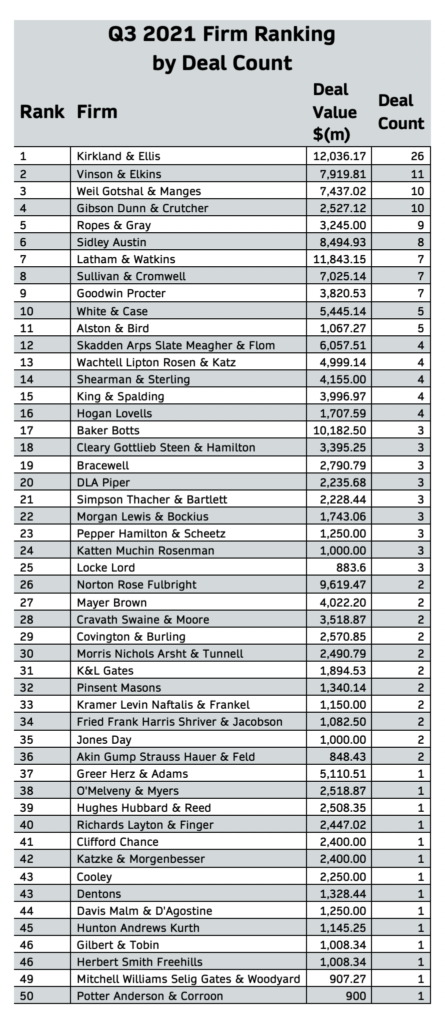

In July, August and September, five law firms represented clients in 10 or more M&A transactions in which the buyers, sellers or targets were headquartered in Texas, according to Dealogic, an independent research firm that provides M&A data on Texas-based companies exclusively to The Texas Lawbook.

Dealogic data shows that lawyers at Gibson Dunn, Weil Gotshal and Ropes & Gray were each advisors in 10 transactions during Q3 2021. Vinson & Elkins handled 11 deals.

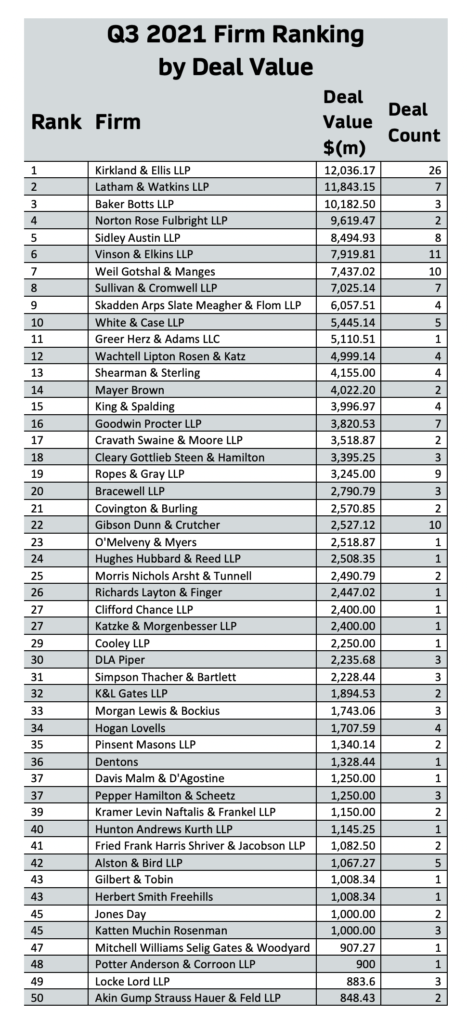

Sidley Austin lawyers led eight Texas M&A deals, while Latham & Watkins advised on seven. Latham ranked second in the category of deal value with $11.84 billion.

Kirkland is in a whole different category. Kirkland lawyers was first in M&A transactions during the past three-month period. The Chicago-founded firm represented companies or private equity firms in 26 deals valued at more than $12 billion, which also ranked number one in Dealogic’s deal value ratings.

Twenty-one law firms were involved in four or more deals during Q3, but V&E was the only Texas-based firm in that group. Four of the 21 law firms, including Ropes & Gray (10) and Sullivan & Cromwell (7), do not have a Texas office.

Five Texas-headquartered law firms – Baker Botts, Bracewell, V&E, Locke Lord and Akin Gump – ranked in the top 50 for deal count.

Dealogic data shows that Baker Botts led three transactions during the third quarter, but they were big deals with a combined value of $10.2 billion. Baker Botts advised ConocoPhillips in its $9.5 billion acquisition of Permian Basin assets own by Royal Dutch Shell. Norton Rose Fulbright advised Shell.

Note that Dealogic excludes the purchase of debt as part of the acquisition price tag.