After a 2020 slump largely because of the Covid pandemic, mergers and acquisitions led by Texas dealmakers boomed in 2021 to record levels, both on a value basis as well as the sheer number of transactions.

Energy, technology and manufacturing companies led the wave of M&A activity last year. And M&A experts say they expect more of the same for 2022.

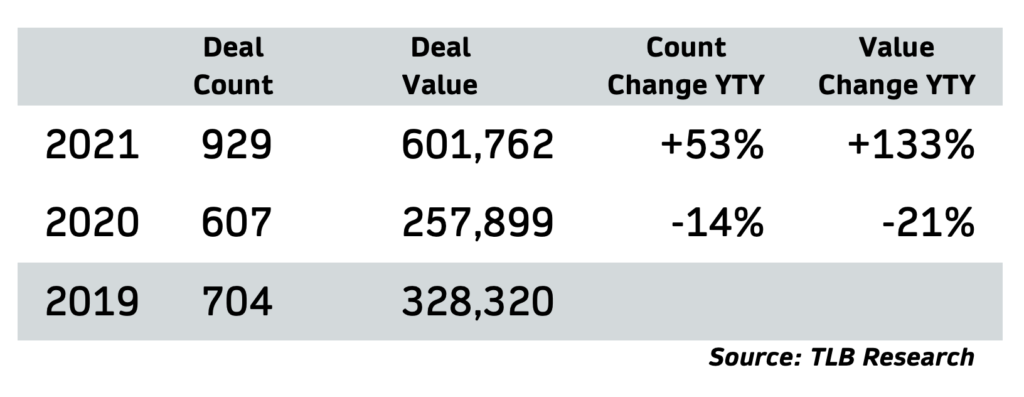

Texas lawyers worked on 929 business M&A transactions in 2021 – up 53% from 2020, according to exclusive new data from The Texas Lawbook’s Corporate Deal Tracker.

CDT data shows corporate dealmaking in 2021 was 32% higher than the 704 transactions in 2019, which was itself a record year.

The price tag of those deals also hit record levels.

M&A deal value in 2021 topped $601.7 billion – an increase of 133% from $258 billion in 2020, according to the CDT data. In fact, the 2021 deal value total was 83% more than in 2019.

The reason, according to dealmakers, is quite simple: The federal government poured $6 trillion into the economy and access to cash has remained easy and cheap.

Brittany Sakowitz, a partner at Kirkland & Ellis in Houston, said mega deals and opportunistic or restructuring-driven transactions lulled a “rocky hum” of M&A activity in 2020, whereas 2021 M&A activity blared “full volume” across most sectors, deal sizes and structures.

“Many predicted that deals would climb in 2021, but the pace of deal making significantly outperformed even the wildest expectations,” Sakowitz said. “Deal activity was boosted by pent-up demand from private equity, public market strength, an abundance of cheap financing, substantial corporate cash, confident board rooms and accommodating Fed policies.”

Eric Otness, a partner at Skadden in Houston, said so much uncertainty existed in late 2020 with Covid in full swing – oil prices remained in the $30’s and natural gas in the mid-$2 range. Some M&A activity was picking up in the fall of 2020, but as prices started to climb with global demand rebounding, the deals started rolling in 2021.

“It was hard to anticipate how busy it would become in 2021, but private equity activity and strategic consolidation fueled a boom in 2021,” Otness said.

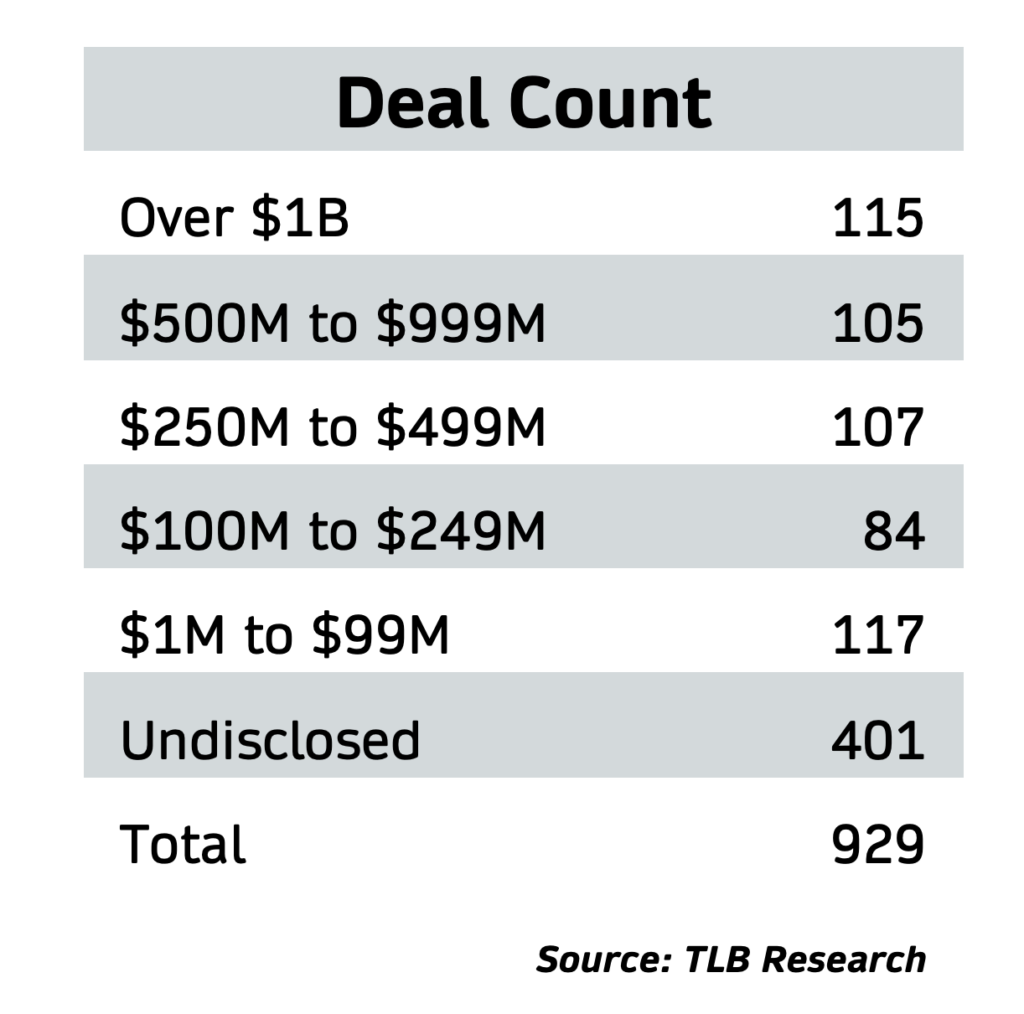

In reality, the $601.7 billion for last year is only part of the deal value because 401 of the reported 929 transactions, or 43%, were confidential and the deal prices were kept secret.

No four Corporate Deal Tracker statistics underscore the significance of the Texas M&A market last year than these:

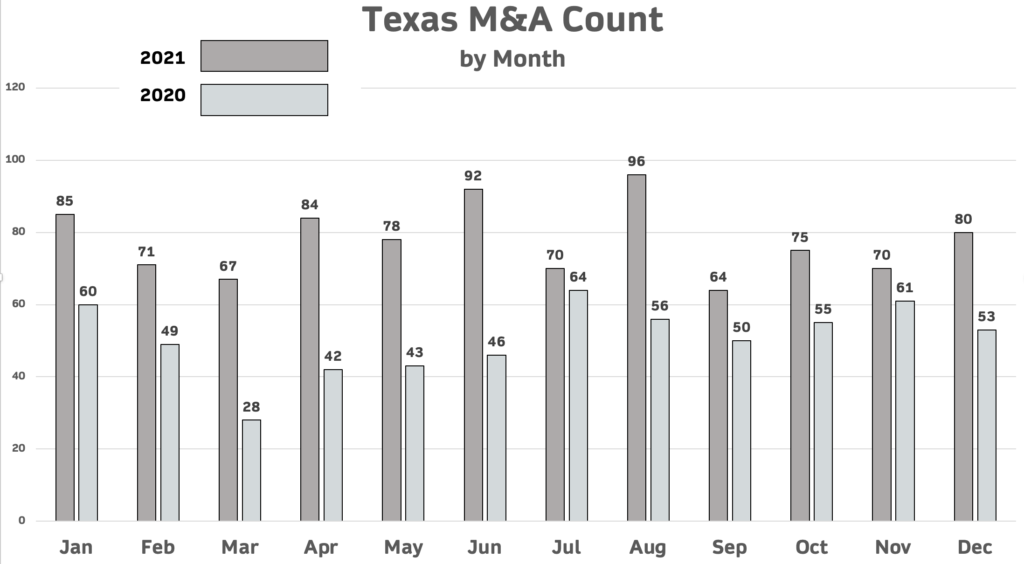

- Texas dealmakers worked on more mergers, acquisitions and joint ventures in every single month of 2021 than they did in those same months one year earlier.

- 115 M&A deals handled by law firms in Texas were valued at $1 billion or more – up from 64 such deals in 2020 and 66 in 2019.

- Of the 929 transactions last year, 105 had prices between $500 million and $999 million, which was more than double the 51 in that range a year earlier.

- M&A transactions handled by Texas lawyers with values between $250 million and $499 million also doubled last year – from 53 in 2020 to 107 in 2021.

Janice Davis, a partner at Morgan Lewis in Dallas, said 2021 was the busiest M&A season in her 30-plus-year career, even though much of the M&A process had to be done virtually.

“It was exhilarating,” she said.

Business Sectors Breakdown

Healthcare M&A continues to be strong, especially with private-equity firms purchasing physician-practice groups and the consolidation of certain healthcare businesses, such as hospice and home health, orthopedic and dermatologist physician practice groups, dental and orthodontist practice groups, Davis said.

“The PE firms are devoting significant resources to buying healthcare companies and physician-practice groups,” she said. “There seemed to be a significant number of roll-ups and add-on acquisitions in both the healthcare and cybersecurity space.”

The health and wellness sector and technology-enabled companies with a scalable business model witnessed elevated activity, according to Greenberg Traurig partner Tom Woolsey in Dallas.

“During 2021, we again saw that many buyers were willing to pay a premium for assets with lower fixed costs and low-cost scalability,” he said.

Corporate Deal Tracker data shows Texas dealmakers worked on 33 healthcare-related deals in 2021 – up from 15 in 2020 and 11 in 2019.

Lawyers say they also saw more deal flow in the retail and consumer products sectors in 2021.

“Consumer products in particular had a historic year of deal activity,” said Katy Lukaszewski, a partner in Sidley’s Houston office. “We saw a renewed interest from strategics to bring innovative brands in-house to their brand portfolios, along with continued interest from private equity firms with an emphasis on skin care.”

Technology transactions also skyrocketed last year, according to CDT data. Lawyers in Texas handled 132 technology industry deals in 2021 – a 53% increase from 2020 and quadruple the number from 2019.

Manufacturing M&A was up 88%. Transactions involving business services companies quintupled – from nine deals in 2020 to 45 last year. In 2018, the CDT shows Texas lawyers worked on only two such deals. Construction M&A jumped by 400% year over year.

Only one business sector – financial services, which includes banking – significantly declined in M&A activity last year, according to CDT data. Thirty deals involving financial services – down from 42 transactions in 2020.

The energy sector continued to dominate M&A transactions. In 2021, Texas dealmakers did 328 energy deals – a 25% jump from the prior year.

Stephanie Chandler, a partner at Jackson Walker in San Antonio, said her activity last year was heavily driven by strategics adding to their footprint geographically or broadening their service offerings through acquisitions of ancillary product or service lines – versus 2020, in which her deal flow was more driven more by PE looking for opportunities to put money to work.

“So we saw an interesting slight shift in the nature of the buyer from 2020 to 2021,” she said.

Chandler also witnessed clients benefiting from higher value multiples last year; traditional businesses executing on the strategy of adding a “bit economy” component to their business models; and buyers having a renewed interest in purchasing high-growth companies “that had not yet achieved revenues outpacing expenses,” she said.

Energy Transitioning

On the oil and gas front, there was a lot of activity in the oilfield services and midstream segments, according to Steve Gill, a partner at Vinson & Elkins and recently installed co-head of the firm’s M&A and capital markets-practice group.

“We saw a decline in upstream deals, but that doesn’t mean people were not talking,” he said. “The general rise — albeit choppy and volatile — in commodity prices likely played a role in upstream deals as stock prices run ahead of what buyers felt were reasonable premiums.”

But Gill also saw a dramatic increase in energy transition and digital infrastructure deals.

“For our firm in particular, we did five times the number of energy transition deals in 2021 than we did in 2018 and double the digital infrastructure deals,” he said.

Sidley’s Lukaszewski said traditional upstream oil-and-gas M&A wasn’t at the levels she was used to seeing pre-pandemic, “but Texas certainly shared in the M&A boom.”

She notes the $5.1 billion sale of publicly traded American National Group, founded by the Moody family in Galveston over 100 years ago, to Brookfield Asset Management Reinsurance Partners is just one example of the major M&A deals Texas saw last year (she represented American National Group with partners Mark Metts in Houston and Amanda Todd in Chicago).

“Based on my work with industry leaders in that transaction, it appears that insurance M&A had a historic year as well,” she said.

Deal activity remains extremely active across the market, says James Garrett, a partner at Latham & Watkins. He notes energy-transition transactions such as carbon capture, renewable fuels, battery storage, electric vehicles and offshore wind because of the capital available for clean investments from private equity firms, venture capital firms and energy companies. The existing regulatory and political environment doesn’t hurt, either.

Garrett also mentioned midstream activity is at a level not seen in many years as a result of higher commodity prices as private equity firms seek to monetize investments held in their portfolios for five or six years or longer and public companies with available cash actively evaluating accretive opportunities.

“PE funds continue to seek divestitures due to a combination of high commodity prices and fund mandates to re-allocate capital to other industries, including energy transition, and away from traditional oil and gas,” he said.

Christina Tate, a Winston & Strawn partner in Dallas who focuses her practice on food and beverage and consumer products, noted how quickly the M&A market rebounded to the seller-friendly deal terms that had dominated in recent years pre-2020.

“The M&A market very quickly picked up where it left off in many respects and continues to be very competitive, so there was no delay in reverting generally to seller-friendly terms, both on economic points and on broader deal terms,” she said.

Tate said that the sheer number of transactions in 2021 even had an effect on “rep and warranty” insurance — an increasingly popular form of indemnification against perceived misrepresentation in M&A transactions. Carriers were so overwhelmed by the volume of demand that timely underwriting became extremely difficult.

“As I understand it, this was largely due to capacity constraints at the underwriter level given the heavy deal flow, which some had thought would ease up after the end of the year 2021 but appear to remain unchanged right now,” she said.

Michael Blankenship, also a partner at Winston & Strawn in Houston, saw large consolidations in energy (mostly public company acquisitions of private explorers and producers) as well as new tech deals and health care.

“Commodity prices showed remarkable improvements in 2021, so I would say I was surprised that the number of transactions did not rebound back to the pre-2020 levels,” he said. “That suggests that the sector continues to be plagued by a lack of access to traditional financing sources — i.e., buyers are having difficulty finding lenders willing to complete transactions — and perhaps a more measured approach to M&A strategies.”

Blankenship said the firm represented several clients in renewable/clean energy deals, including Houston-based Nauticus Robotics’ merger with CleanTech Acquisition Corp. (Baker Boots represented Transocean, one of the investors).

“I believe we will see more traditional oilfield services companies pivot to clean-energy services for the renewables to service solar panels and wind farms,” he said.

Interestingly, Blankenship said the firm has been assisting clients in forming several joint ventures to pursue the development of carbon-capture projects.

“However, these projects are still in their early stages, so it may be several more years until we see a buildout of the inventory required to support a healthy M&A market in this space,” he said

Morgan Lewis partner Sameer Mohan in Houston has seen a significant activity in healthcare and life sciences private equity transactions, particularly in digital health and other modes of technologies in support of those sectors.

“The continuing transformation of the delivery of healthcare in the U.S. system along with cutting-edge technological developments have led to an enhanced focus by investors on finding valuable opportunities to deploy their capital,” he said.

What’s ahead in 2022?

What are the deal prospects for this year? More of the same, expects Kirkland’s Sakowitz.

“Healthy M&A agendas for private equity sponsors and management teams, increased cross-border M&A, robust add-on strategies, the rise in spinoffs, a steady number of de-SPAC transactions (with a significant amount of SPAC capital set to expire at the end of this year and early 2023) and the potential return of larger strategic deals all point to a very strong pace for 2022 deal flow,” she says.

Lukaszewski agrees. “I have seen no indications that the high M&A volumes we experienced in 2021 will slow down any time soon,” she says. “Also, higher commodity prices are permitting upstream companies to pay down debt, so the improved balance sheets should pave the way for more M&A down the road.”

The Sidley partner said she is working on two oilfield services deals, one upstream deal, one energy-transition deal and one real estate transaction.

M&A activity involving renewable and clean energy “is exploding,” she said. “We think of it as six verticals – electrification of transport, grid flexibility/resilience, carbon mitigation, traditional renewables, nextgen liquid fuels and industrial applications. We are seeing activity in all six of these areas.”

Skadden’s Otness concurs that M&A activity will be brisk, with a very high continuing level of private equity activity across the energy sector.

Will the higher price of oil lead to more M&A in the oil patch or less? Otness thinks the market may see the deal activity in oil start to plateau. “There has been so much consolidation already that eventually the reduced number of strategic players has to limit the number of available deals, right?” he said.

Higher gas prices are also driving more regulatory scrutiny of upstream deals, according to Jackson Walker’s Chandler.

“Interestingly, a former acting chair of the Federal Trade Commission commented that the new chair of the FTC may actually want to deter mergers in the oil and gas industry,” she said. “It’s too early to tell whether this will slow the pace of transactions in 2022, but buyers and sellers should make sure they are managing the review process effectively.”

Chandler said the M&A markets often see a lull at the beginning of the year, but each of the firm’s team members have multiple acquisitions in the pipeline for early in 2022.

“Additionally, we thought expected changes in capital-gains rates might push transactions to close in 2021, but deals are continuing at the same pace as 2022,” she said.

The Jackson Walker partner believes utilities are likely to be sellers with respect to some of their renewables assets.

“Multiples are really attractive, so sales — especially with respect to assets that are outliers in their portfolio and no longer fit within the strategy moving forward — seem to be likely to be the trend in 2022.”

In the M&A pipeline, Blankenship is starting to see a spike in activity in the lower to middle energy markets as cash buyers rush to get their hands on non-core assets that are starting to look “better and better” thanks to improved commodity prices. The firm also has some convenience store and large car wash deals in the pipeline.

Blankenship expects continued shedding of non-core inventory by larger E&Ps, a trend that will continue well into 2022 and maybe even 2023, “especially with the ESG [environmental, social and governance] pressures being exerted on the sector in the public-equity markets.”

Greenberg Traurig’s Woolsey said some clients with software-enabled assets in the health and wellness sectors continue to enjoy interest from financial and strategic partners. In one instance, a client with a software-enabled solution has seen its valuation double in the last 90 days.

“As a result, that client has decided to forego a sale and pivoted instead to a minority recap that will provide the founders with a significant liquidity event,” he said.

Morgan Lewis’ Mohan sees potential headwinds ahead with inflation concerns, interest-rate monetary policy decision-making and the impact of the mid-term elections later this year.

“Nevertheless, the U.S. M&A market remains attractive and I have not heard any slowdown in deal-making plans on the part of clients looking ahead to the next 12 months or so,” he said.

His colleague Davis agrees: “M&A deals are in the 2022 pipeline—perhaps the pace is not as fast as the last four months in 2021, but still very active.”

Mark Curriden contributed to this post.