A mostly Houston team from Kirkland & Ellis advised Tulsa-based buyer and A&O Shearman assisted the Scottish target, which would establish H&P as a global leader in onshore drilling.

CDT Roundup: 20 Deals, 14 Firms, 268 Lawyers, $17.2B

We’ve passed the halfway point of 2024, so it seems like a good time to make a periodic check of our own metrics. This week we look at the table that hides in plain sight inside our column and actually use it to measure what we’ve done; specifically, a statistical survey of the deal summaries we’ve published so far this year. As usual, the numbers are surprising, even to us; especially the number of names of lawyers that have showed up in the column. And, of course, we include even more names from the deals we received last week.

CDT Roundup: 11 Deals, 11 Firms, 95 Lawyers, $3.9B

Deals are deals, unless they turn out not to be. The proposed $4 billion acquisition of Houston-based Mattress Firm by rival Tempur Sealy seemed like a deal. But the Federal Trade Commission last week voted 5-0 to stop the negotiations and sought to do so in a Houston federal court. The FTC complaint contains the usual language about protecting the U.S. consumer, but it also features allegations of retail bullying by Tempur Sealy along with 182-redactions to back that up. A discussion of that, and the usual fare of Texas-related deal summaries and the firms and lawyers involved, is in this week’s CDT Roundup.

CDT Roundup: 21 Deals, 13 Firms, 186 Lawyers, $11.4B

Even with an economy that seems headed for a soft landing, there are bumps on the runway. And one of the biggest and most obvious bumps to dealmakers is in real estate — especially commercial real estate, which had problems even before Covid sent workers home. The tumble in CRE hasn’t reached a crash, but a correction is coming, according to a recent report by PitchBook. The Roundup this week takes a look at the report and its relevance to Texas, where even a surge in employment hasn’t managed to fill a growing number of office buildings. Those details and the usual rundown of last week’s Texas-related deals.

CDT Roundup: 16 Deals, 15 Firms, 157 Lawyers, $29.9B

A policy “pause” in the expansion of LNG exports announced late last month by the Biden Administration came as a shock to many. U.S. LNG exports are not only regarded as strategic help for Western allies following the Russian invasion of Ukraine, but a viable climate-friendly alternative to coal. But life in the energy biz is never so simple, especially when it comes to fossil fuels. And this week’s CDT Roundup takes a quick look at the factors that seems to have led to the pause, and the potential it could have on Texas M&A. That, and the usual review of last week’s Texas-related corporate transactions.

CDT Roundup: 15 Deals, 13 Firms, 19 Lawyers, $21B

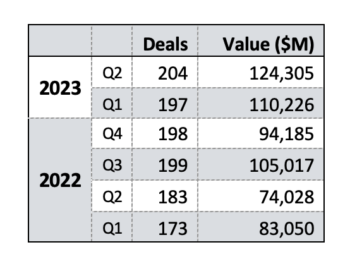

According to a recent report by PitchBook, private equity deals are a mixed bag of late: deal count up a wisp from Q1; deal value down double-digits. Is that terrible? Maybe not. The Roundup looked at the numbers from PitchBook and there are a few surprises and maybe a little perspective; that, along with the usual run-down of the week’s M&A deals.

CDT Roundup: 18 Deals, 14 Firms, 130 Lawyers, $4B

Texas dealmakers don’t do pessimism. There’s no point. Downtimes provoke creativity. Uptimes demand energy. And even during times of lean money markets, Texas seems to maintain an ample supply of both. As we move past a mediocre first half in 2023, the CDT Roundup looks at sources of optimism for what’s coming — with the assistance of a new report from Intralinks. And, course, there are the names of the Texas lawyers behind 18 deals reported last week.

CDT Roundup: 16 Deals, 10 Firms, 105 Lawyers, $6.9B

In addition to warmer temperatures, the end of spring brings us the end of Q2/H1, and a good time to check on the mid-year status of dealmaking. This week is our roundup of what the CDT Roundup has been reporting for the past six months. That, and a roster of lawyers involved in the 11 M&A/Funding deals and five CapM transactions reported last week.

CDT Roundup: 23 Deals, 18 Firms, 135 Lawyers, $3.7B

If oil and gas producers (and their lenders, and their investors) seem ill-at-ease these days, it’s not imaginary. Haynes Boone’s Spring 2023 survey of the O&G deal community suggests they are pessimistic about the near-term availability of capital and are looking at a variety of sources to maintain growth and profitability — sources that increasingly include their own cash flow. This week’s CDT Roundup has the specifics of the survey, which included 96 top executives from the industry and the banks that lend to them. And, as usual, there are the names of the Texas firms and lawyers behind the 23 deals reported last week.

Omar Samji Departs Shearman for Weil

Omar Samji’s departure follows the recent high-profile exits of Hugh Tucker and Jeremy Kennedy who left Shearman for Haynes and Boone. Samji plans to tool his energy practice towards the rapidly-evolving transitional sectors, like decarbonization, that are gaining significant ground within the traditional oil & gas industry.