*This story includes corrected data.

Corporate law firms operating in Texas went on a hiring spree in 2021, using six-digit signing bonuses, promises of faster promotions to partner and two hikes in base pay in a high-stakes race to build the staffs needed to meet rising client demand for legal work.

The result was the largest – and most expensive – game of musical chairs ever witnessed among the biggest corporate firms in Texas. Exclusive new Texas Lawbook 50 data show lateral hiring grew 60 percent in 2021 – in flesh and blood, that’s nearly 900 attorneys in Austin, Dallas and Houston moving from one firm to another.

In addition, the Lawbook 50 firms added about 450 first-year associates, an increase of a third from 2020. Combining laterals and the newbies, the top firms hired 1,348 lawyers in Texas last year, compared to 890 in 2020.

One in every seven lawyers working at large Texas corporate firms was hired in 2021.

One firm, Kirkland & Ellis, added 135 attorneys to its Texas staff last year, which offset some attrition and fueled the Chicago-founded firm’s extraordinary growth.

The Lawbook article recently reported a net gain of about 330 lawyers among the 50 largest law firms operating in Texas. It was the biggest headcount increase in at least a decade, but this new hiring data documents the much larger churn beneath the surface of Texas corporate law’s labor market.

Firms want to bolster their operations by adding lawyers in practices with growing billable hours – particularly the partners and associates who can deliver for clients. Lawyers may be happy and successful at firms they’ve called home for decades – but they’ll jump to a rival, especially if the rewards are big enough.

Firms have been stealing each other’s lawyers for generations, usually in relatively courteous fashion. But in the past decade, Texas industry veterans tell The Lawbook, routine competition for talent has erupted into a war. The catalyst was the arrival of dozens of deep-pocketed out-of-state law firms willing to pay top dollar to bring Texas’ best lawyers on board.

‘The lateral market in Texas is white hot,” said Michael McKenney, managing director of Citi Private Banking’s Law Firm Group.

It was this ongoing war for talent that made 2021 a banner year for laterals – but all the hiring didn’t catch up to demand. Nearly all Lawbook 50 firms say they wish they could have hired more lawyers last year. Many firms have already added lawyers in 2022, with additional offers going out each month.

“Our biggest challenge is finding lawyers to do the work,” said Simpson Thacher partner Robert Rabalais, who leads the national firm’s Houston office. “We have about 70 lawyers right now, and if we had another 10 to 12 lawyers in Houston we could absolutely keep them busy.”

It’s the same at Ahmad, Zavitsanos & Mensing, a Houston litigation boutique. “We are having a dickens of a time finding experienced lawyers to hire,” said John Zavitsanos, one of AZA’s founding partners. “It’s been a feeding frenzy.”

“I could literally bring in 10 lawyers right now, and we would keep them busy, and we could make a lot more money,” he said.

The lawyers in most demand, according to more than a dozen law firm leaders interviewed by Texas Lawbook, are associates with three to five years of corporate M&A and private equity experience and partners aged 37 to 45.

“Those partners in that age group have gained enough experience that they have started developing their own relationships and building their own book of business, but they also have another 20 to 30 years of practice ahead of them,” said Rob Walters, a partner at Gibson Dunn in Dallas. “Partners in that age span are in the sweet spot.”

By the Numbers

The Texas Lawbook tracks lawyer movements by combining the results of our annual Lawbook 50 survey on lawyer headcounts and lateral moves with our database that records the name and firms involved in every lateral partner hire at corporate law firms operating in Texas.

Lawbook premium subscribers can review lateral partner moves here.

Crunching these numbers yields the Lawbook 50 headcount ranking as well as following portrait of the Texas legal labor market’s comings and goings in the past two years.

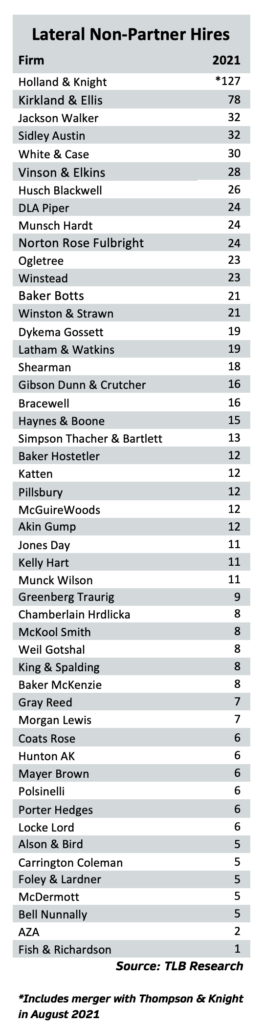

- Two-thirds of the 1,348 hirings involved lateral movements. In 2021, 722 associates and counsel shifted from one corporate law firm to a competitor – up from 436 in 2020.

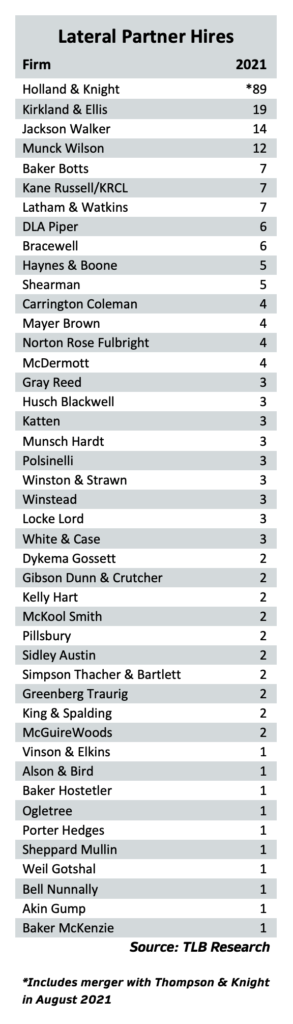

- At least 172 partners joined new firms in 2021 – an increase from 116 the year before.

- The remaining third of hires were newly-minted lawyers. The top 50 firms hired 454 newbie attorneys with no prior experience – up from 342 in 2020.

- In 2021, 15 firms added 20 or more new attorneys through lateral hiring in their Texas offices – up from only three such firms in 2020.

- Five firms – Kirkland & Ellis, Sidley Austin, Jackson Walker, DLA Piper and White & Case – added 30 or more. Only Kirkland hired that many laterals in 2020 in Texas.

- None of the 1,348 lawyers include a single attorney involved in the merger of Florida’s Holland & Knight with Dallas-based Thompson & Knight. Counting those as laterals would have added another 216 lawyers to the total.

The Covid-19 pandemic shackled lateral recruiting in 2020. During a time of great uncertainty, firms and lawyers both hunkered down. Compared to 2019, laterals declined 27 percent in the survey and 34 percent in the partner database.

The pandemic persisted throughout 2021, but vaccines and other factors limited its impact on the legal sector and firms’ recruiting for the most part returned to normal.

Some of last year’s resurgence no doubt represents the tardy realization of some laterals that might have occurred in 2020. Even taking Covid into account, hiring activity was off the charts in 2021 – about twice as large as the previous year’s decline.

Some Expand, Some Defend

The Texas Lawbook 50 identified five law firms that added the most lawyers in 2021 – Sidley Austin, Kirkland & Ellis, White & Case, Gibson Dunn and Vinson & Elkins. All posted net gains of at least 30 lawyers; all were active on the lateral market and in recruiting new law school graduates.

By far, Kirkland and Sidley gained the most lawyers in 2021.

Kirkland added 78 associates or counsel and 19 partners via lateral hiring last year, and then hired another 38 lawyers straight out of law school. In all, Kirkland employed 135 new Texas lawyers in 2021. The result, the Chicago-founded law firm grew from 290 attorneys in 2020 to 371 in 2021 – a 27.9 percent increase.

Sidley, also a corporate law firm founded in Chicago, jumped from 139 Texas lawyers in 2020 to 192 last year, which is a 38.1 percent increase. The firm hired 32 associates, two partners and 26 new first-year attorneys in 2021.

“We are hiring in Texas and in every office in every city in every practice area,” said Yvette Ostolaza, who is chair-elect of Sidley’s management committee and a partner in Dallas.

White & Case and DLA Piper each hired 30 associates and partners away from competitors last year.

The four firms have at least one characteristic in common – out-of-state roots. Sidley, Kirkland, White & Case and DLA Piper were all part of the past decade’s rapid Texas expansion by national and global firms, which used aggressive hiring and promotion strategies to grow in a fast-growing state with a deepening roster of big companies.

“As long as new companies move into the market, there will be a need for more lawyers,” said Einat Sadka, a director in Citi Private Bank’s Law Firm Group. “And as long as there are new [law firm] entrants willing to pay more than the existing law firms, there will be movement.”

Houston-based V&E grew organically and through lateral hiring. The firm hired 53 first-year lawyers for their Texas operations in 2021, which was more than any other law firm. V&E also added 28 associates and one partner last year via the lateral market. That’s 81 new hires in Texas, but the firm’s lawyer headcount increased by just 30 – from 424 in 2020 to 454 last year.

Some firms were active in the lateral market to fill holes created by departures to other firms or to go in-house or simply to retire.

Jackson Walker, Norton Rose Fulbright and Baker Botts are perfect examples.

Jackson Walker ranked second to Kirkland in hiring laterals in 2021 – 32 associates or counsel and 14 partners. The Dallas-headquartered firm also nabbed 16 rookie attorneys. Despite those 62 additions, Jackson Walker had a net gain of only two lawyers, according to the Texas Lawbook 50 ranking of law firms by headcount.

Norton Rose Fulbright hired 24 associates or counsel and four partners on the lateral market, then added 24 first-year lawyers. After defections, it was nearly a wash. The global corporate firm’s Texas legal staff grew by just a single lawyer – from 365 attorneys in 2020 to 366 last year.

Houston-based Baker Botts aggressively added 21 associates and counsel and seven partners in Texas in 2021 via lateral hiring and another 31 rookie lawyers last fall from law schools. Yet the firm’s Texas lawyer count still declined by nine.

Leaders at all three firms say their partners and experienced associates are being aggressively pursued by out of state firms opening or expanding in Austin, Dallas and Houston.

“We are a natural target for talent,” said Baker Botts managing partner John Martin. “Talented associates are in high demand. As firms come into Texas, it is natural for them to look at us and our lawyers.”

‘The Bubble Breaks’

The Texas war for talent has been raging for the better part of a decade, pushing lawyer compensation to record heights. First-year associates directly out of law school now have a base salary of $215,000 and last year received multiple bonuses that added between $30,000 and $75,000 to their annual compensation. Compensation for eighth-year lawyers now hits $500,000 at several Texas Lawbook 50 firms.

With each new round of higher pay and bonuses, legal industry insiders see potential dangers in what appears to be an overheated market.

“I don’t recall a time when firms paid signing bonuses like 2021. I don’t know how it is sustainable,” Simpson Thacher’s Rabalais said. “The price of talent is no longer cheaper in Texas.”

Altman Weil law firm consultant James Cotterman compares the heated lateral market to the current homebuying market, where purchasers are willing to overpay for a house. He said firms “have to know where the line is” and the cap when bidding for lawyers.

“The problem you have with a bidding war is overbidding for the asset,” Cotterman said. “If you throw enough money at someone, it is going to get their attention. Lawyers start thinking that they can do it for a few years and put a rather significant amount of money aside.

“At some point, the bubble breaks,” he said.

A handful of Texas law firm leaders agree. It’s no surprise that the worriers mostly come from firms that are unwilling or unable to enter the high-stakes bidding war for talent.

“I think a downturn is coming, and I think some firms have overplayed their hand,” said Bill Munck, managing partner at Munck Wilson in Dallas. “The market has gotten crazy on associate compensation and on rates.”

AZA’s Zavitsanos said many big corporate firms overreacted at the start of Covid in March 2020 by either laying off lawyers or under-hiring. Now, he said, those firms are making up for their mistakes by making new mistakes.

“It has gone from a complete buyer’s market to a complete seller’s market,” Zavitsanos said. “Big firms are paying signing bonuses, retention bonuses, increased salaries. We are not going to pay a signing bonus just to get a lawyer, because that’s not a good reason to join a law firm.”

Zavitsanos and Munck say their opposition to signing bonuses has not kept their firms from being active on the lateral market. Both are believers in success bonuses.

“I prefer a lower base salary that is still highly competitive but that comes with much more significant bonuses for achievement,” Munck said. “If we have an associate tells us that they want to make a specific compensation being offered by other law firms, we can put together a model for those associates that will get them to that compensation level. Or even higher.”

*Correction: The previous version of this article reported the wrong lawyer count numbers for Kirkland & Ellis. The firm actually grew from 290 Texas lawyers in 2020 to 371 last year. The Lawbook apologizes for this error.