© 2015 The Texas Lawbook.

By Bill Howell and Courtney Gilberg

(April 25) – The market for initial public offerings is off to a slow start in 2016. So slow, in fact, that U.S. IPO activity fell to its lowest level since the height of the financial crisis in 2009.

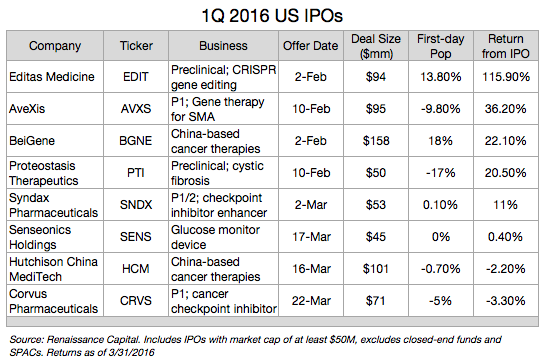

According to IPO investment firm Renaissance Capital (www.renaissancecapital.com), IPO activity during the first quarter of 2016 was less than a quarter of what it was during the same periods in 2015 and 2014. Only eight IPOs priced during the first quarter of 2016 (excluding Special Purpose Acquisition Companies), materially fewer than the 34 IPOs that priced in the first quarter of 2015 and 64 IPOs that priced in the first quarter of 2014. The eight IPOs that priced in the first quarter of 2016 together raised $700 million, representing declines of 87% and 93% compared to the first quarters of 2015 ($5.5 billion) and 2014 ($10.6 billion), respectively.

Filing activity was also low during the first quarter. Only 24 new filings were made during this period, including just seven filings in February and March combined. By contrast, there were 48 and 98 new filings made during the first quarters of 2015 and 2014, respectively.

While concerns about growth in global markets like China and the uncertainties that are always present in a presidential election year likely had an impact on IPO activity, the downward trend was clearly exacerbated by the extreme market volatility and depressed energy prices that dominated the first quarter.

In January 2016, U.S. stocks posted the worst 10-day start to a year on record. Over the course of the quarter the S&P 500 dropped by more than 10 percent, and stock market volatility reached a five-month high.

Volatility was driven in large part by collapsing commodity prices. Oil traded below $30 a barrel for the first time in thirteen years, and prices continued to fluctuate for the duration of the quarter.

This extreme uncertainty deterred a number of companies from making their stock market debuts during the first quarter. Nine companies seeking to raise an aggregate of $1.4 billion postponed their IPOs due to valuation problems, including Texas-based Elevate Credit, Inc. and PLx Pharma (which withdrew its IPO entirely). A number of other companies chose to delay launch while continuing to wait in the pipeline for better timing.

No technology stocks were offered in the first quarter, and for the first time since 2009 not a single private equity-sponsored entity went public during a quarter. Sponsors proved to be reluctant to take a discount to their significantly higher private-market valuations, preferring instead to wait for a better opening in the IPO window.

IPO activity in the energy sector was also negatively impacted by the volatility and depressed commodity prices of the first quarter. The energy industry represented just six percent of IPOs over the last twelve months, and there have not been any U.S. IPOs of energy production companies in more than a year.

The healthcare sector continues to be the one bright spot in the IPO market. Half of all IPOs over the last twelve months have taken place inside the healthcare sector, including the eight healthcare companies that went public during the first quarter of 2016.

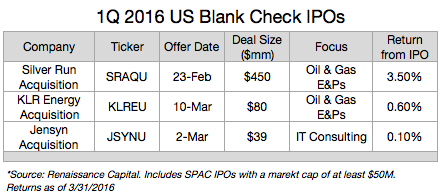

The other three companies that went public during the first quarter were Special Purpose Acquisition Companies, also known as “SPACs” or “blank-check companies.”

SPACs are publicly traded acquisition vehicles that do not have any operations but that go public with the intention of raising cash for future acquisitions. Since the beginning of 2015 more than twenty SPACs have completed IPOs, and first-quarter results indicate that this resurgence of SPACs is likely to continue.

Energy-focused SPACs, in particular, are becoming increasingly more common given the continued declines in the energy market. Silver Run Acquisition, a SPAC that will target distressed oil and gas exploration and production companies, recently raised $450 million in an upsized offering and was the largest IPO by deal size in the first quarter of 2016.

SPACs are attractive IPO candidates for a couple of reasons. First, they offer investors more liquidity than the traditional private equity fund. Second, because SPACs have two years to invest the proceeds raised in an IPO, they can time their investments strategically. Energy-focused SPACs are thus able to manage the risks of their investments by waiting out low oil and gas prices in the short term.

Despite the risks and uncertainties that characterized the IPO market in the first quarter of 2016, there are signs that IPO activity will likely pick up in the second quarter through the rest of 2016.

Stock markets rallied in the second half of the first quarter and volatility has declined to its lowest level in eight months. Oil prices have also stabilized and have recently traded in excess of $40 a barrel.

As the second quarter gets underway, 118 companies seeking to raise $30 billion remain in the IPO pipeline. Forty-two of these companies have made new or updated filings since January, and the upsized IPO of Bats Global Markets, a global stock exchange operator, in early April is an encouraging sign that IPO activity is truly on the rise.

The IPOs slated to price in the coming weeks, bolstered by improving market conditions, are expected to create the momentum needed for the IPO market to shrug off its slow start to 2016. While there is still a lot of uncertainty in the energy sector, this momentum will likely extend beyond the healthcare sector and SPACs and should motivate companies with strong balance sheets and realistic valuations to take advantage of the opening IPO window.

Bill Howell is a partner and Courtney Gilberg is an associate in the M&A, Global Finance and Private Equity groups at Sidley Austin LLP.

The views expressed in this article are exclusively those of the authors and do not necessarily reflect those of Sidley Austin LLP and its partners. This article has been prepared for informational purposes only and does not constitute legal advice. This information is not intended to create, and receipt of it does not constitute, a lawyer-client relationship. Readers should not act upon this without seeking advice from professional advisers.

© 2014 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.