© 2017 The Texas Lawbook.

By Natalie Posgate

(March 30) – Gibson Dunn managing partner Rob Walters in Dallas is a direct competitor of Andy Calder, the head of Kirkland & Ellis’s Houston office.

They fight for the same talent, the same clients and the same billable hours. Both men are viewed as two of the most successful lawyers in their practice areas. Despite the fierce competition, Walters says it is time to recognize Calder’s extraordinary accomplishments.

“Quite simply, Andy has worked very hard and experienced amazing success,” he says.

The 38-year-old Calder spent the past three years luring top corporate lawyers in Texas to leave the law firms who trained and raised them to join Kirkland’s Houston office. The three-year-old office now has over 100 lawyers and continues to aggressively recruit laterals.

The most obvious gauge of success is the bottom line: Revenue per lawyer in Kirkland’s Houston office tops $1.4 million, which is the best of any legal operation in Texas.

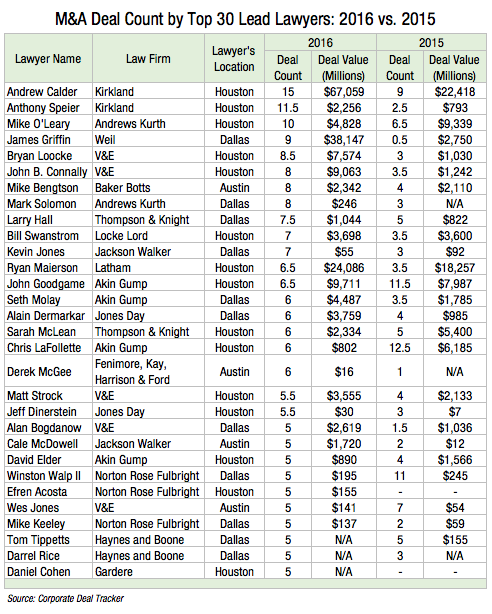

Amazingly, Calder’s efforts to build and expand Kirkland’s operations in Texas have not hindered his deal-making. In 2016, he led or co-led more M&A transactions than any attorney in the state.

The Texas Lawbook’s Corporate Deal Tracker shows that Calder ranks No. 1 among 368 Texas corporate lawyers — leading or co-leading 20 mergers, acquisitions, divestitures or joint ventures last year. The 20 deals are a third more than No. 2 on the list, colleague Anthony Speier, who Calder recruited away from Baker Botts in May 2014 to be his partner at Kirkland’s then-new office.

The Scottish-born Calder is also in first place among those 368 lawyers in terms of cumulative value of the deals he worked on in 2016: $67 billion.

To put this success into perspective, Calder’s deal value was more than every entire law firm’s individual total in the Corporate Deal Tracker except Vinson & Elkins, Jones Day and his own law firm. He was the legal adviser in seven billion-dollar-plus transactions.

For example:

- Calder was the lead adviser for Energy Future Holdings in its $33 billion spinoff of TXU Energy and Luminant;

- He also represented EFH in its divestiture of Oncor for $18.4 billion;

- Talen Energy hired Calder to lead its $5.4 billion sale to Riverstone Holdings; and

- Blackstone chose Calder to advise the private equity firm in its $2.17 acquisition of American Electric Power.

Financial adviser Evercore Group also hired Calder to represent it in its consultation of Silver Run Acquisition Corp.’s purchase of a majority interest in Denver-based Centennial Resource Production for $1.58 billion. (Editor’s note: That deal did not go toward his overall deal count, since Evercore did not play the role of the buyer or seller in the deal.)

But not all of Calder’s transactions involved the “B” word. He advised on several deals valued below $1 billion, including Energy Capital Partners in its $90 million equity investment in coal miner Ramaco Development.

Calder’s legal practice focuses heavily on major companies and private equity firms doing transactions in the energy sector.

In fact, Calder said he worked on more private equity deals in 2016 “than any year” in his career, including the 2007 boom.

“The spread of deals was satisfying,” he said. “This last year, we really crossed every sector – from upstream through the midstream space. There was some downstream, which was maybe less than other years. Power was very busy.”

On the oil and gas side, Calder said deal flow erupted last year after oil prices stabilized because buyers “had a pent-up demand” after being “on the sidelines for the better part of 18 months.”

On the power side, M&A deals were driven by such factors such as commodity prices, increasing deregulation throughout the industry and greater private equity involvement in owning generation assets.

As a lawyer at Kirkland, which often marries its strong restructuring and M&A practice groups to score high-profile bankruptcy deal work, the two largest deals Calder handled last year were tied to Chapter 11 proceedings.

EFH’s TXU-Luminant-TCEH spinoff was certainly the largest example — the third largest deal reported to the Corporate Deal Tracker in 2016. But Calder also handled EFH’s $18.7 billion sale of Oncor to NextEra Energy, which was the sixth largest deal in the database. The Oncor sale was also the fifth largest deal involving a Texas-based company, according to a previous report on Mergermarket’s 2016 data.

“Buyers were falling all over themselves [for Oncor],” Calder said. “It was just a crown jewel asset in Texas that a ton of buyers were interested in.”

Asked what unique challenges a bankruptcy-related deal might pose, Calder answered that the biggest would be the “range of constituency that you have to deal with,” with an interest in the outcome.

“In a normal deal, where you’re representing a seller or a buyer, you have to worry about answering to the management team and ultimately the investors,” Calder said. “When doing a bankruptcy deal, you have to maximize the value for the whole estate – sometimes taking into account what the creditors will want. At the same time, you still have to protect the management team and owners.”

Calder said he decided to become an M&A lawyer because he likes problem solving.

“I like that there’s not [a set] structure around it, so it suited my personality,” Calder said. “I like to create solutions. Some M&A lawyers prefer to waste time pounding on the table for the client. I prefer seeing a deal get done.”

With respect to his favorite aspect of M&A work, Calder said he most enjoys the initial phone call to the client – particularly if the work is for a new client that could “lead to a broader relationship.

“The other exciting part is when you have a brand-new client that becomes a very loyal, institutional client,” he said.

Something unique about Calder’s institutional clients is that many are his age or younger. In private equity particularly, the demographic of the industry’s decision makers tends to lean younger, consisting of leaders in their early forties or thirties – some even in their late twenties.

Calder said the age profile of attorneys in Kirkland’s Houston office matches up with the firm’s clients, which is something that those who have recently joined Kirkland find attractive.

“The folks that are in the trenches of the field with us every day are the same age,” Calder said. “It’s something we offer to associates that is unique. In many cases, the client they will interface with at a private equity fund is a junior associate their age.”

As early as this spring, Kirkland will be able to lure prospective hires —including the 27 first-year lawyers on their way in December — with another perk: brand new office space as the anchor tenant of one of Houston’s newest skyscrapers, 609 Main at Texas.

Calder attributes the firm’s success in Houston to “a combination of very loyal clients and hardworking talent.”

And perhaps there is no greater testament to Kirkland’s growth in the Bayou City than its choice of venues for holiday parties. The first year, Calder said the firm held the party at a small venue in the Galleria area. For this past holiday season, Kirkland rented out the Museum of Fine Arts to accommodate the 200 or 300 guests.

“For everybody here, it’s been incredibly rewarding,” Calder said. “We all remember what we opened… we built it from the ground out.”

Senior writer Mark Curriden contributed to this report.

(Editor’s Note: The Corporate Deal Tracker gives one full credit to lawyers who led an M&A transaction for the buyer or the seller and a 0.5 credit to each of two lawyers from the same firm who co-lead a deal. The full 2016 Corporate Deal Tracker data can be found at the bottom of our homepage.)

© 2017 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.