© 2013 The Texas Lawbook.

By Mark Curriden, JD

Senior Writer for The Texas Lawbook

(January 10) – The number of federal lawsuits filed in Texas accusing businesses of anticompetitive practices and price-fixing surged in 2013, giving some legal experts belief that antitrust litigation could be making a comeback in the state.

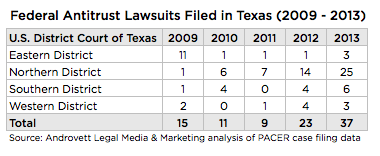

Federal antitrust complaints lodged by both individuals and companies against other corporations hit a six-year high in 2013 and is more than triple the number of such lawsuits filed just two years earlier.

The belief that Texas courts might be coming more receptive to such claims was buoyed four months ago when a jury in Marshall handed down a nine-digit judgment for a Texas-based company that sued a competitor over illegal anti-competitive practices.

While federal courts in nearly all four districts have witnessed an increase in antitrust cases during the past two years, the Northern District of Texas, which includes Dallas and Fort Worth, has experienced the most significant increase – from just one case in 2009 to seven filings in 2011 and now 25 new suits last year.

“Antitrust litigation is an economic phenomenon,” says Greg Huffman, an antitrust expert at Thompson & Knight in Dallas. “When the recession hit, the number of antitrust cases dropped in Texas and nationally.

Dell and Hewlett Packard each filed lawsuits in Texas in 2013 against some of their suppliers claiming that the companies conspired to fix prices on various parts, including LCD screens.

But more than one-half of the new antitrust lawsuits filed in Texas last year accused online travel websites, including Fort Worth-based Travelocity and Dallas-based Hotels.com, of conspiring with hotels in price-fixing schemes.

“Antitrust litigation has been mostly dormant for several years until this surge, which can be largely attributed to a rush of cases filed against online hotel booking services, such as Travelocity, Expedia and Priceline,” says Dallas antitrust attorney Kimberly Priest-Johnson.

“Many of the same issues in these cases may be traceable to the arguments and efforts made in American Airlines’ antitrust case against [airline ticket distributor] Sabre,” she says.

American accused Sabre of using its global distribution system to squelch competition – a case that ended 14 months ago in a settlement agreement.

Plaintiffs’ lawyers in 22 separate lawsuits claim that online travel booking sites conspired with hotel chains such as Hilton and Marriott to keep lower prices from the consumers.

“The individuals claim that Expedia, Travelocity and others agreed through contracts with each other to what’s called ‘favored nation clauses’ which prevent them from advertising prices that were lower than competitors,” says Allan Van Fleet, a partner in the Houston office of McDermott Will & Emery who has been following the litigation.

While the lead lawyers for the plaintiffs and the defendants are not from Texas, all have hired Texas-based lawyers to serve as local counsel. Marc Stanley of Dallas is the lead local counsel for the plaintiffs and will likely be paid a contingency fee or a percentage of any damages won for his clients in the case.

Lawyers for the defense are being paid hourly. For Texas attorneys at Baker Botts, Haynes and Boone, Husch Blackwell, Locke Lord and Weil, the litigation is likely to provide a couple hundred thousand dollars in revenues every year that the cases go on.

“Antitrust cases are expensive to bring,” says Huffman. “Each case can consume millions of dollars in expenses and fees.”

Despite the surge, Texas is not considered a favorable jurisdiction in which to sue over price-fixing and other anti-competitive allegations. In fact, even with the increase, less than four percent of all antitrust lawsuits filed in the U.S. are litigated in Texas. And hardly any antitrust cases at all are tried in state courts.

“That’s because the Texas Supreme Court destroyed antitrust law in this state,” says Nelson Roach, a lawyer with Nix, Patterson & Roach in Daingerfield, Texas.

Roach was the lead lawyer in a landmark case in which he represented Texas-based RC Cola franchises in an antitrust lawsuit against Coca-Cola bottling companies. In 2001, a Texas court awarded the RC Cola companies $15 million in damages.

“If I was to pick the perfect monopoly case, it would be this one,” says Roach. “The evidence was undisputed. It was a slam dunk.”

But on appeal, the Texas Supreme Court, in a five to four decision, threw out the judgment and said that plaintiffs could not recover damages from anticompetitive actions committed outside of Texas, even if both companies – the plaintiff and the defendant – are based in Texas.

“Nobody in their right mind is going to file an antitrust case in Texas courts,” says Roach. “I’ve been offered to lead several other potentially huge antitrust cases with great facts, but I will not touch those cases anymore.”

Paul Rogers, a law professor at SMU Dedman School of Law, agrees that plaintiffs face “a tough row to hoe” in winning antitrust cases in Texas state and federal courts.

He points to a series of U.S. Supreme Court decisions in 2007 in which the justices ruled that the free market system produces proper business outcomes and that antitrust challenges frequently cost more than they achieve in benefits.

“Substantive antitrust law is shrinking,” says Rogers. “The new standard is that pleadings have to be plausible, not just possible. As a result, more cases get thrown out before trial.”

Rogers believes the jump in federal antitrust filings the past two years is the result of strategic moves by plaintiffs’ lawyers hoping to force corporate defendants to come to the negotiating table.

“The rocket dockets in our Texas federal courts allow cases to go to trial faster and that means plaintiffs can put more pressure on defendants to settle earlier and cases are less likely to be dismissed pretrial on procedural grounds,” he says.

Then, there’s the case of Little Elm-based Retractable Technologies, a safety medical device maker that sued its larger rival, Becton Dickinson, for “engaging in anti-competitive conduct that allowed it to acquire and maintain monopoly power.”

BD refused the pressure to settle and opted instead to go to trial. The result: In September, an East Texas jury awarded Retractable $113 million in damages – a verdict that could be tripled under federal antitrust law if the judge so chooses.

“It was an extraordinary win for our client,” says Bradley Weber, a partner at Locke Lord who was one of the lead lawyers for Retractable. Weber is also one of the lawyers representing Priceline.com in the ongoing online hotel booking litigation in Dallas.

While Weber is confident that the Retractable Technologies verdict will be upheld, he admits the team will face challenges as the case moves to the U.S. Court of Appeals for the Fifth Circuit.

“The Fifth Circuit scares away most plaintiffs lawyers in antitrust cases because it is a very conservative court and is pro-business,” he says.

“We looked at Fifth Circuit jurisprudence to make sure that there was not a specific case that would hurt our claim,” he says.

“Antitrust law has become much more sophisticated in recent years and it isn’t just lawyers in the debate any longer but economists, too,” says Wark, who played a leading role defending American Airlines last year against the U.S. Department of Justice’s antitrust lawsuit trying to block the merger with US Airways.

“As a result, we’ve developed a better understanding about what harms competition and consumers,” he says. “Antitrust law is not there to protect competitors, which many lawyers believed for a long time, but it is there to protect consumers and competition.”

Most legal experts predict the uptick in antitrust litigation will continue in Texas and across the U.S. in 2014.

“The Obama Administration is certainly more aggressive than its predecessor in seeking antitrust charges against international business cartels and additional private litigation almost always follows cases brought by the U.S. and the European Union,” says Van Fleet. “I think we will see an increase in antitrust filing in the health care industry.”

© 2013 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.