By Mark Curriden

Senior Writer for The Texas Lawbook

© Copyright 2012 – The Texas Lawbook

HOUSTON (June 12) – For decades, most corporate lawyers wearing the fancy suits in the tall buildings in Dallas and Houston considered their brethren who did oil and gas law a class level below.

Not any more.

In an era when new law school graduates face the toughest hiring market in 30 years and seasoned veterans in litigation, M&A and capital markets see their billable hours shrinking and revenues declining, lawyers in the energy sector are smack-dab in the middle of their Golden Age.

New data shows that lawyers with strong energy transactional practices are experiencing record profits due to the heated pace of mergers, acquisitions, joint ventures and asset divestitures in the oil and gas sector.

Between January 1, 2010 and May 1, 2012, Texas-based energy companies were buyers or sellers in 487 transactions valued at $347.4 billion, according to new research conducted by mergermarket at the request of The Texas Lawbook.

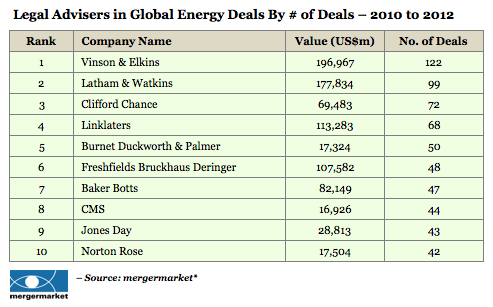

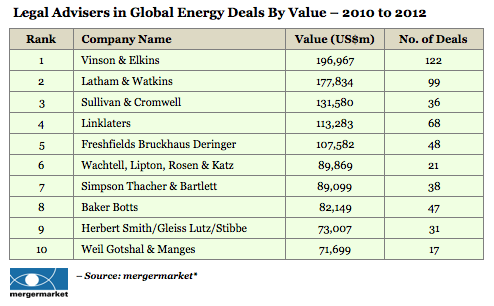

Globally, there were 2,540 energy deals announced during the 28-month time period. The value of those deals: $1.35 trillion.

“These numbers are a reflection of the resurgence in domestic oil and gas operations,” says David Poole, General Counsel of Dallas-based Range Resources. “We’ve been constantly retuning our assets, looking for good opportunities but also selling assets that don’t fit into our focused strategy.”

“This is a great time to be a lawyer in Texas with experience in oil and gas matters,” says Poole.

In addition, there are several hundred deals not included in the statistics because neither the buyer nor the seller included an estimated value, according to Chad Watt, who monitors M&A activity in Texas for mergermarket.

“The trajectory for energy companies is only upward because they are better at finding more assets and more efficient at getting those assets,” says Watt. “None of the energy companies are in danger of becoming Myspace. They will always have significant value because their assets will always have significant value, and the lawyers who represent them will always have work.”

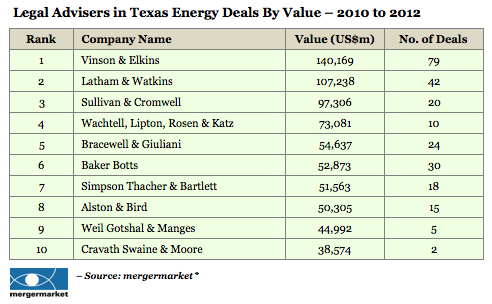

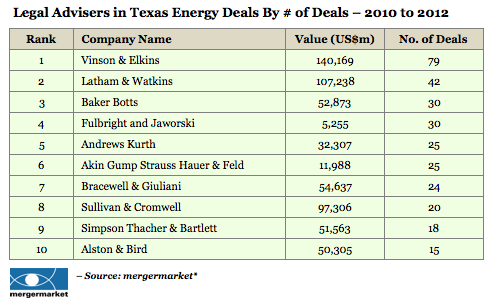

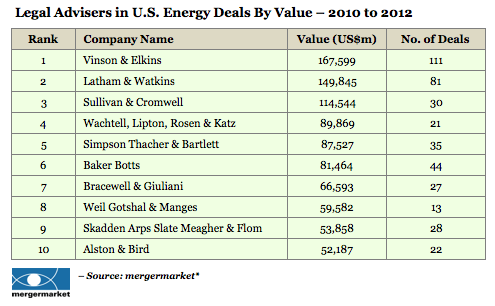

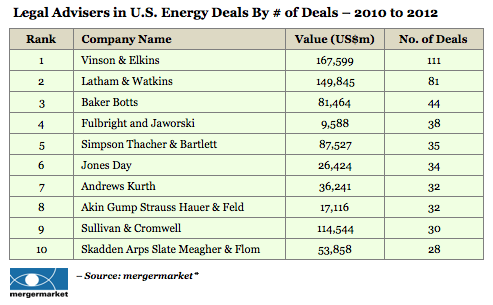

Data compiled for The Texas Lawbook by mergermarket shows that a small but slowly expanding number of corporate law firms in Texas dominate the energy transactional space and are reaping huge financial rewards from the oil and gas resurgence.

A large majority of the Texas-based energy transactions and a significant portion of the global energy deals were handled by lawyers in Houston and Dallas.

Two law firms in particular, Vinson & Elkins and Latham & Watkins, dominated as legal advisers in number of transactions and value of those deals in 2010, 2011, and so far in 2012.

V&E had key roles in 79 transactions valued at $140 billion. Latham was second with 42 deals valued at $107 billion, according to mergermarket.

The same two law firms witnessed similar strength in global energy deals. Combined, V&E and Latham handled 221 transactions with a market value of $375 billion.

“The technology shift has provided a sea change in the U.S. in developing and producing energy, and, as a result, the energy business has become capital intensive,” says Mark Kelly, firm chairman of Vinson & Elkins and a long-time energy lawyer.

“U.S. companies frequently need capital and a lot of foreign companies, including state-owned energy companies are looking to invest,” says Kelly, who specializes in capital markets.

In all, 16 law firms represented the buyers or sellers in nearly 90 percent of the Texas energy transactions since January 1, 2010.

A majority of the 16 are legacy corporate firms with deep roots in the oil patch, including V&E, Baker Botts, Fulbright & Jaworski, Andrews Kurth, Akin Gump, and Bracewell & Giuliani.

However, a growing number of New York-based firms, including perennial Wall Street giants Cravath Swaine & Moore, Wachtell, Lipton, Rosen & Katz, Sullivan & Cromwell and Simpson Thacher & Bartlett, are grabbing some of the larger energy deals.

Just two weeks ago, Weil Gotshal & Manges helped Houston-based Kinder Morgan close its $23 billion purchase of El Paso Corporation.

Energy lawyers are not only in demand; they are paid top rates, which can range from $700 to $950 an hour. Even experienced associates in energy practice groups are reportedly billing at rates exceeding $450 an hour. In the Kinder Morgan transaction, Weil lawyers put in more than 16,000 hours.

“In the big M&A transactions, the cost of the legal team doesn’t matter nearly as much,” says Andrew Wright, associate general counsel at Dallas-based Energy Future Holdings. “You want the best. You want lawyers who have done these kinds of deals before. They have the expertise.

“Most in-house lawyers have a handful of lawyers they know and trust and we call them over and over,” says Wright. “I hire lawyers, not law firms.”

General counsels say that legal tabs for energy transactions can range from a few hundred thousand dollars for the simplest of deals to $10 million and up for the more complex deals involving publicly traded companies where complicated tax structures are in place and approval by state and federal agencies are required.

“I consider industry expertise first, and then costs,” says Curtis Henderson, the General Counsel at Houston-based Approach Resources. “Factors include the complexity of the transaction and whether, as a public company, we will be required to disclose the transaction and pro forma financials in an SEC filing.

“Billable rates are very important to me,” says Henderson. “I am looking for the best combination of expertise and value available.”

Poole agrees, saying that he looks for the “been there, done that” expertise when hiring outside counsel.

“I don’t want lawyers learning on my dime,” he says. “While a lot of GCs are consolidating the firms they deal with, I’m actually expanding the number of firms who work with me.”

The fact that V&E and Latham are the top two energy transaction law firms in Texas demonstrates the evolving legal market, according to industry analysts.

V&E has long and deep ties to the oil patch. Several of its partners worked for energy companies in positions ranging from roughnecks to engineers. Several former V&E lawyers are now general counsels at energy companies, including Richard McGee at Plains All America Pipeline, Mark Berg at Pioneer Natural Resources, Jim Matthews at Denbury Resources, and Stacey Dore at Energy Future Holdings.

By contrast, Latham only opened its Houston office in February 2010. Founded in Los Angeles, the 2,000-lawyer firm has successfully lured elite energy transactional partners away from Texas-based firms, including V&E. Latham now has more than 50 lawyers in Houston and plans to expand to 65 by the end of the year.

“The deal numbers don’t surprise me, because we find ourselves sitting across the table from V&E lawyers in many of our deals,” says Michael Dillard, who is managing partner of Latham’s Houston office. “I think it has become a two-horse race [for the larger energy deals].”

Dillard says that V&E’s institutional roots in Texas and the oil and gas industry make it a strong competitor.

“One big advantage V&E has that is frequently overlooked, is that it has boots on the ground,” he says. “With only 50 lawyers in Houston, it is not as easy for us to fill the philanthropic positions, such as seats on boards, as they do.”

Legal industry analysts say that Latham’s move into Texas is the ideal example of how a global law firm can successfully expand into a new market. Dillard says selecting the right partners for the right business sector also helps.

“Energy has been off-the-charts hot,” he says. “Houston has been the busiest office on a per lawyer basis of any of Latham’s 31 offices. And the past couple months have been the busiest we’ve ever experienced.”

V&E partner Keith Fullenweider, who leads the firm’s M&A and private equity practice, says 2012 is on track to be another record year for his firm’s energy practice.

“Latham was strong in the energy league tables long before they opened an office in Houston,” says Fullenweider, who has represented Fort Worth-based TPG Capital in numerous recent energy transactions. “The M&A energy work at these firms is among the best and most sophisticated in the world.

“Keep in mind that expertise in the energy sector goes beyond M&A to practices such as tax and regulatory, and those are also huge strengths for us,” he says.

Latham’s emergence as a powerhouse in Houston shines the spotlight on the fact that so many of the national law firms have burst into the Texas legal market in recent years. And legal industry analysts say that there are at least a half-dozen more national firms actively trying to find a way to open a presence in the state in hopes of grabbing some of the oil and gas work.

“Lawyers are smart people who are opportunistic,” says Poole. “We went through a long period of time in Texas where there wasn’t a lot of interest by younger lawyers in oil and gas.”

Poole says that he employs V&E often for deals, but that he has never used Latham. But that, too, could soon change.

“Robin Fredrickson has handled a couple of our deals and she’s good,” he says.

Fredrickson, a prominent oil and gas lawyer who had been at V&E for 23 years, jumped to Latham in May.

None of this, of course, means that the other Texas firms with energy practices are exactly suffering. Baker Botts and Bracewell each handled more than two-dozen deals topping $50 billion. Andrews Kurth, Akin Gump and Fulbright were also very active.

And all of the law firms say they are in hiring mode.

“We see a great deal of demand for attorneys with energy experience, especially with our corporate in-house legal department clients,” says Cortland Grynwald of Pye Legal Group. “A lot of GCs at small and mid-sized energy companies are adding deputies. Meanwhile, larger energy companies are strategically expanding their legal departments because they are seeing so much work.”

Adds Robin Fredrickson of Latham, “I hated being called an oil and gas lawyer for many years because it was meant to be demeaning. Now, everyone wants to claim they’re an oil and gas lawyer.”

Additional mergermarket Legal Advisors data:

*Notes:

– Based on announced deals, including lapsed and withdrawn bids

– Based on dominant target or bidder geography being Global

– Based on dominant target or bidder sector being Energy

– Date range from 01 Jan 2010 to 04 May 2012

– Data correct as of 04-May-2012

– Includes all deals valued over USD 5m. Where deal value not disclosed, deal has been entered based on turnover of target exceeding USD 10m

– Activities excluded from table include property transactions and restructurings where the ultimate shareholders’ interests are not changed

PLEASE NOTE: Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.