CDT Roundup: 22 Deals, 11 Firms, 119 Lawyers, $6.4B

Globally, 2019 came in as the fourth highest dealmaking year ever, thanks to U.S. buyers, but a slight slowdown in deal value and count over 2018 could portend a different-looking 2020.

Free Speech, Due Process and Trial by Jury

Globally, 2019 came in as the fourth highest dealmaking year ever, thanks to U.S. buyers, but a slight slowdown in deal value and count over 2018 could portend a different-looking 2020.

The year-end rush to ink deals continued before the holidays began, with transactions down on a volume and value basis over the previous week but up on both metrics over the same time last year.

Despite the malaise in the oilfield services sector, which has put the kibosh on M&A, boutique investment bank PPHB is still managing to eke out deals. Co-founder Joe Hoepfl talked with The Texas Lawbook about the state of the market and his outlook for next year.

Texas business leaders are bullish on dealmaking for next year, with technology front-of-mind on the diligence front, plus a transaction rush by Texas lawyers before year-end. Claire Poole explains.

Analysts say the deal is attractive for WPX compared with other recent transactions in the consolidating oil patch and may lead to asset sales to help with financing.

The deal increases the buyer's presence in Dallas, which is considered one of the country’s most desirable luxury car markets, with Texas becoming 36% of its sales.

Energy service and equipment deals are sagging, much like the rest of the sector, with strategic companies the most active acquirers and private equity buyers remaining focused on transactions with diversified exposure across the value chain. Claire Poole explores that plus the continued slide in deal activity by Texas lawyers.

Texas Capital GC Kelly Rentzel chose Sullivan & Cromwell to lead its side of the transaction, while Independent GC Mark Haynie selected Wachtell Lipton. The Texas Lawbook has the details.

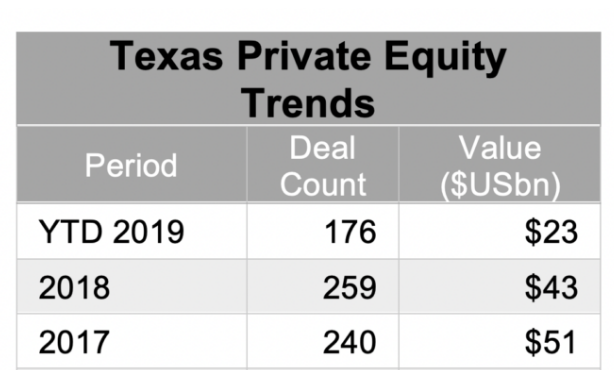

Private equity investment is down this year in Texas, and oil and gas have been particularly affected, according to exclusive data provided to The Texas Lawbook by Mergermarket. How low? Claire Poole has an analysis.

M&A picked up globally in November, pushing yearly totals close to last year’s, and one forecaster expects more good times ahead. Claire Poole reports on that plus dealmaking among Texas lawyers.

© Copyright 2026 The Texas Lawbook

The content on this website is protected under federal Copyright laws. Any use without the consent of The Texas Lawbook is prohibited.