Business bankruptcies in Texas this year are down significantly from last year’s record number of court-supervised restructurings, but they remain much higher than the pre-Covid-19 filings and far exceed the number seen any other state in the U.S.

The Southern District of Texas saw fewer than half the number of new bankruptcy filings during the first six months of 2021 compared to the second half of 2020 and 40% fewer than during the first six months of 2020, according to new federal court data provided to The Texas Lawbook by Androvett Legal Media Research.

While corporate bankruptcy lawyers are not working at the fevered pitch of 2020, the new cases filed this year are incredibly complex and are keeping attorneys busy.

“The volume of new cases coming in is certainly down and we are not as busy as last year,” U.S. Bankruptcy Chief Judge David Jones told The Texas Lawbook. “But the cases now are much more difficult and more problematic than in 2020.”

Chief Judge Jones said most of the restructurings last year involved companies with strong asset bases.

“Restacking the capital structure made sense,” he said. “The cases now are much harder because the pie is much smaller. We are no longer talking 60 or 70 cents on the dollar. There’s not enough potential in the businesses to make all sides happy.”

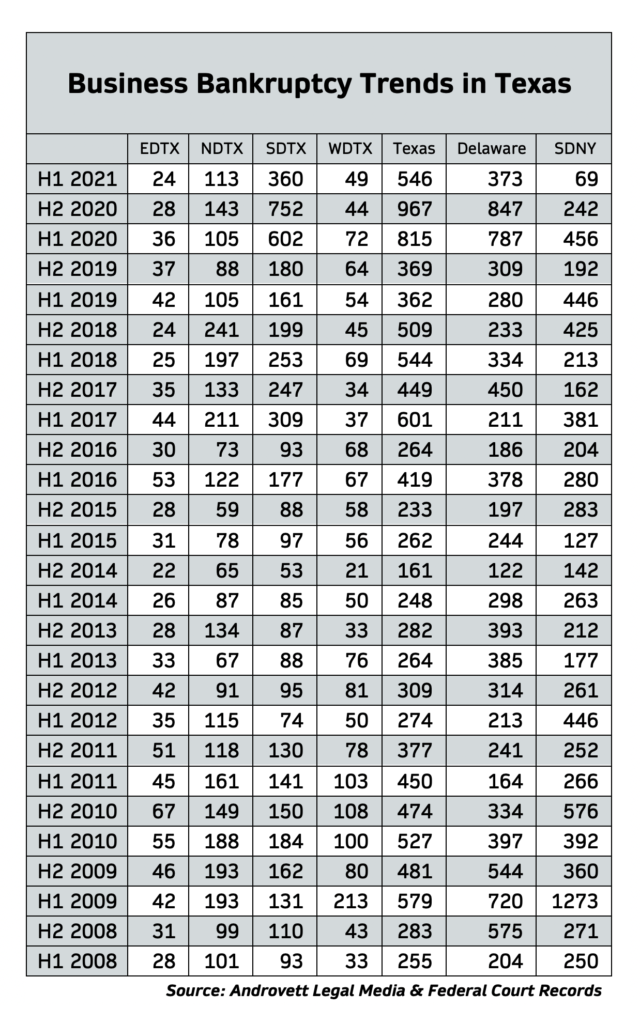

There were 546 businesses that filed for protection under Chapter 11 of the U.S. Bankruptcy Code in Texas from Jan. 1 through June 30 – down from 815 during the same period last year and down from an all-time high of 967 filings in the second half of 2020, the Androvett data shows.

By contrast, there were 373 companies that filed for bankruptcy in Delaware.

“Last year was breathtaking – just so many cases,” said Joe Coleman, a bankruptcy partner at Kane Russell Coleman Logan in Dallas. “I never want to bill as much as I did in 2020 ever again. That being said, we’ve been super busy this year, too.”

The new companies that filed include the Irving-based CiCis Pizza chain, Houston-headquartered Castex Energy, Alamo Drafthouse of Austin, Carrolton-based Katerra and Houston-based Agilon Energy Holdings. London-headquartered Seadrill Ltd. and Sundance Energy of Denver also filed for bankruptcy in Houston.

But the biggest bankruptcies were filed as a result of Winter Storm Uri, including Brazos Electric Cooperative and power retailer Griddy Energy. Both filed in the Southern District of Texas.

“We filed 30 bankruptcies last year – up from six during most years,” said Jackson Walker partner Matt Cavenaugh. “Bankers look at distressed debt. In May 2020, there was about $350 billion in distressed debt. This May, it was $30 billion. There is so much liquidity and access to capital that there is so much M&A.

“Energy is a completely different story,” Cavenaugh said. “The difference is between zero or negative $37 and $70 a barrel – what a difference a year makes.”

Two-thirds of all Texas bankruptcies during the first six months of this year were filed in the Southern District, which has become a national hotbed of corporate restructurings since Chief Judge Jones reformed the procedures to make business bankruptcies more predictable and the system more user-friendly.

The 360 corporate bankruptcies filed in the Southern District, which includes Houston, during the first six months of 2021 were 52% less than the second half of 2020 and 40% less than in H1 2020. But those 360 filings were the third highest ever lodged in the Southern District, according to the Androvett data.

“The Southern District will continue to be an attractive forum for debtors,” said Sidley Austin partner Duston McFaul. “The judges are super smart with business backgrounds. There is not a tighter ship. From the practitioner’s perspective, it has been impressive how Judge Jones and Judge Isgur have handled it.”

Coleman agrees. “The Southern District has been put through the ringer and came out with superlative grades,” he said.

The Northern District of Texas, which includes Dallas and Fort Worth, recorded 113 new business bankruptcies filed during the first six months of 2021, which is eight more filings than during the same period year-over-year but 26% fewer than in the last six months of 2020.

There were 49 bankruptcies filed during H1 2021 in the Western District, which includes Austin and San Antonio. That was a decrease of 32% from H1 2020 but five more than during the second half of 2020.

The Eastern District of Texas, which includes Plano, Sherman and Tyler, recorded 24 business bankruptcies filed during the first half of 2021, which is the lowest of any six-month period since 2014.

But all the bankruptcy experts believe this downturn in Chapter 11 filings will only be temporary.

“The truth is, people don’t know what the hell is coming,” said Munsch Hardt shareholder John Cornwell. “We’ve had a tremendous amount of stimulus poured into the economy and that has extended runways.”

Fellow Munsch Hardt shareholder Jay Ong said 2021 has seen “a lot more out-of-court restructurings” and that the eviction moratorium has had an impact because “landlords have their own lenders to deal with.”

“The businesses that are nimble enough to see the winds blowing and make the adjustments will be the winners, and those that don’t will be the losers,” Ong said.

Coleman said the “consequences of the chip shortage” could still “wreak havoc.”

“There will be a ripple effect that may not be seen for another two years or so,” he said.

McFaul said much of the credit for the decline in corporate bankruptcies is because “the capital markets have been on steroids” and parts of the stock market are overvalued.

“It is simply unsustainable,” he said. “When things turn, it is going to be ugly, and it will be business-sector agnostic. On the macro, things are going to pivot when the capital markets cool, and what starts as a minor correction could become a major correction, which would spur a lot more bankruptcy filings.”

Chief Judge Jones agrees there are dangers lurking.

“Money has been so cheap and so easy to get, which has caused filings to go down,” the judge said. “And we are very worried about the consumer side of things. When the stimulus and moratoriums expire, we fear it is going to get very bad.”