© 2012 The Texas Lawbook.

By Mark Curriden, JD

Senior Writer for The Texas Lawbook

The number of companies that filed for bankruptcy in Texas declined dramatically during the first six months of 2012, but legal experts say that is not necessarily good news for businesses in the state.

In fact, many legal experts say that Texas Bankruptcy Courts could see a wave of new businesses filing for Chapter 11 protection if the economy gets better. If the economy worsens, the state would likely see an increase in Chapter 7 liquidations.

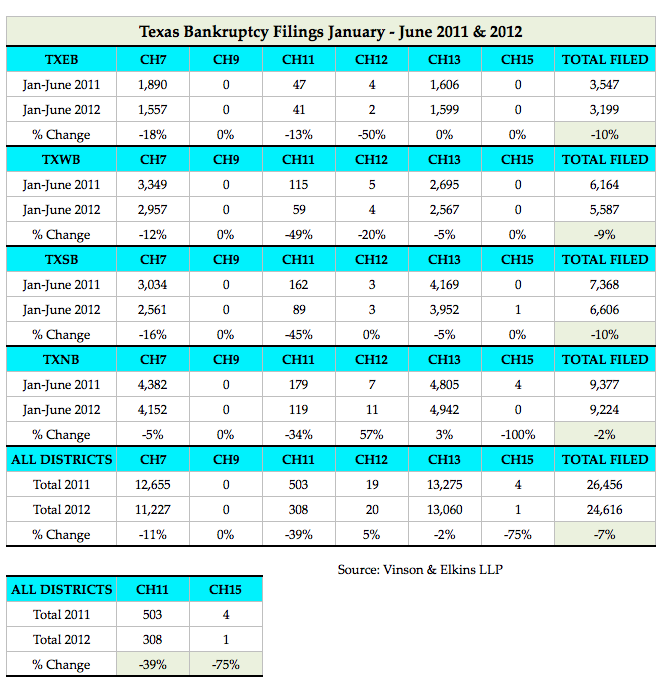

Businesses seeking to restructure and reorganize through Chapter 11 plummeted 39 percent in the first half of this year compared to a year earlier. Meanwhile, corporate liquidations under Chapter 7 were down 11 percent in the state’s four federal districts.

The Western District, which includes Austin, San Antonio and all points west, saw a 49 percent decline in business bankruptcy filings. The Southern District, which includes Houston, witnessed a 45 percent decline. The Northern District, comprising Dallas and Fort Worth, was down by one-third.

Bankruptcy Expert

“The reasons for these declines are a combination of the Fed’s monetary interest rate policy, the strength of the Texas economy, and the fact that a number of Texas companies have filed their Chapter 11 bankruptcy cases in other jurisdictions,” says Bill Wallander, a partner in the bankruptcy section of Vinson & Elkins in Dallas.

Wallander says that the bankruptcy cycle “appears to be in a trough,” but he says he would not be surprised if Chapter 11 filings increased in the not too distant future.

Legal experts say there are a lot of Texas companies teetering on bankruptcy and some businesses that would be helped significantly by seeking Chapter 11 protection.

Bankruptcy Filings Decline in All Texas Districts:

“The downturn has lasted so long that the bad companies have already been flushed out of the system,” says Mark Ralston, a bankruptcy partner at Taber Estes Thorne & Carr. “If the economy improves, we are likely to see an uptick in Chapter 11 filings.”

Ralston and other bankruptcy lawyers say that’s because banks don’t want to take large financial risks right now, but they also don’t want to shut companies down.

“Companies are unable to get the large exit financing that is required in most Chapter 11 cases,” says Michael McConnell, a bankruptcy partner at Kelly Hart & Hallman in Fort Worth. “But those companies have been able to get smaller loans that allow them to kick the can down the road.

“At some point, it is all going to run out and I get the feeling that is about to happen,” says McConnell. “The status quo mentality is running out.”

Charles Gibbs, a bankruptcy partner at Akin Gump Strauss Hauer & Feld, agrees that the bankruptcy practice is in an “extend and pretend” time period, instead of fixing or refinancing the debt, which is the root of the problem.

“We’ve had such a high level of bankruptcy filings for such a long period of time that we now find ourselves in a trough between two highs,” says Gibbs.

Gibbs and Martin Sosland, a partner in the bankruptcy section at Weil, Gotshal & Manges in Dallas, point to the huge wall of high yield and institutional debt, especially in the commercial real estate sector, scheduled to mature between 2013 and 2015.

“We have seen a number of extensions negotiated between borrowers and lenders,” says Sosland. “The wall has already shifted out a couple of years, and it may continue to do so. Our finance attorneys have been incredibly busy, and much of their work is “amend and extend” agreements.”

Sosland says there is “a lot of capital out there that would rather be working than on the sidelines.”

“For many lenders, extending a loan and continuing to earn fees and interest is a lot more appealing than calling the question with a less certain outcome,” he says.

Wallander says that even when the capital markets start loosening and the financing becomes more available, allowing businesses to seek restructuring, it remains to be seen whether those corporations will file in the Texas courts instead of fleeing to New York or Delaware.

“No offense to other jurisdictions where we also practice, but there is certainly a rational case to be made for Texas-centered firms to file their complex business cases in Texas, and we have enjoyed many positive results in our Bankruptcy Courts in Texas,” says Wallander.

© 2012 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.