Summer is here — officially, and in every other way: late evening sunshine, 100-degree heat, air-conditioning bills, Texas families packing toward higher altitudes and cooler climes.

But it is also the end of the second quarter and the end of the first half, time to see where a half-gone year has landed us.

Our tool for doing so is the table below, the one we update each week with your timeliest (for the most part) submissions to the Corporate Deal Tracker Roundup — and a little reporting we do on the side. The numbers reflect in large part what you tell us you’re working on, at least from week-to-week. They don’t reflect the CDT Deal Tracker data (which we’ll be revealing next week), but they do give us a first glance at where we are this far in this year.

We know you like numbers, so strap yourself in.

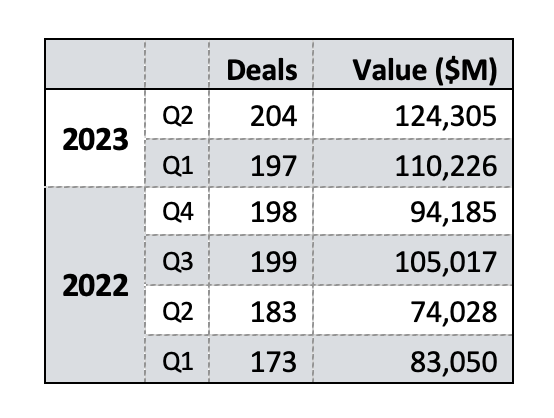

The last 13 weeks (Q2) saw 204 Texas-related transactions worth $124.3 billion, up slightly in count and value from the 197 deals for $110.2 billion reported during the first 13 weeks of the year. On the surface, it was the best quarter since the record-breaking spree that marked the end of the pandemic.

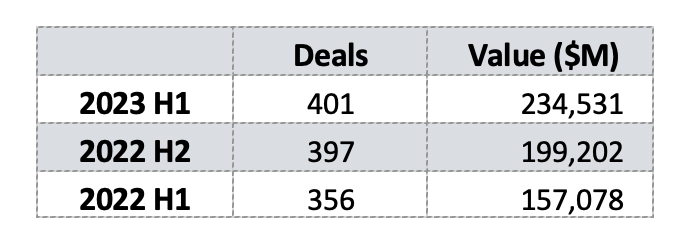

For those of you trying to total H1 numbers in your head, that means we’ve seen 401 deals worth $234.5 billion during the first half of the year. That’s far better than H1 2022, which saw 356 deals for $157 billion (12.6 percent better in deal count and nearly 50 percent better in deal value, year-over-year).

And in case you think we’re cherry-picking, H1 2023 was also better than the second half of last year, which saw 397 transactions valued at $199.2 billion. Here’s what the last 18 months look like:

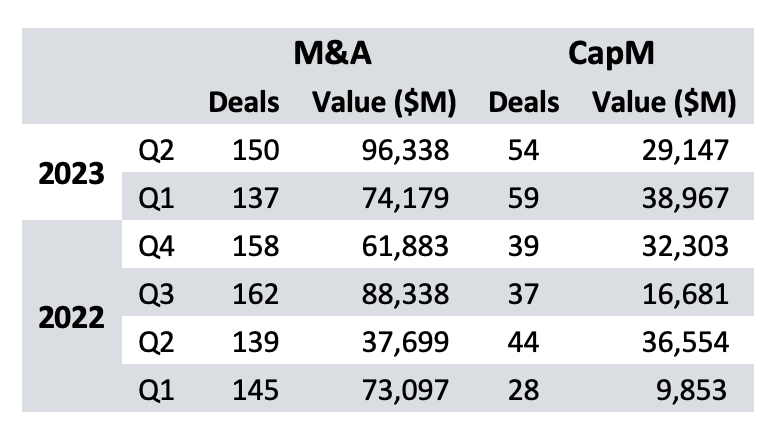

So, where’s the weakness? The sobering news comes in the breakdown of M&A and CapM deals.

While the H1 numbers rank highest as an aggregate over the past three half-years, the Q2 M&A deal count of 150 ranks behind Q4 2022 (158) and even further behind Q3 2022 (162). Moreover, CapM transactions dropped between Q1 and Q2 both in deal count (59 to 54) and deal value ($38.9 billion to $29.1 billion).

There were highlights: The second week of Q2 ended with 12 deals worth $23.8 billion. That eclipsed the $18 billion and 21 deals that marked the final week of Q1.

The lowlight? That would be the week ending July 1. Yes, LAST week.

The 16 deals for $6.9 billion reported for the week ending July 1 included 11 transactions in M&A for $5.4 billion (including Vista’s $4.8 billion sale of Apptio described below) and five CapM deals for $1.4 billion. Compare that with last week’s 13 deals for just under $11 billion or with the 18 deals for $8.6 billion this time last year.

As we said: Summer is upon us.

Weekly Corporate Deal Tracker Roundup Stats

A compilation of weekly stats from The Lawbook's CDT Weekly Roundup

(Deal Values in Millions)

(Deal Values in Millions)

| Deal Count | Amount | Firms | Lawyers | M&A Count | M&A Value $M | CapM Count | ||

|---|---|---|---|---|---|---|---|---|

| 21-Feb-26 | 10 | $7,087 | 7 | 180 | 7 | $6,187 | 3 | $899 |

| 14-Feb-26 | 14 | $20,460 | 9 | 151 | 9 | $16,440 | 5 | $4,020 |

| 7-Feb-26 | 8 | $316,505 | 11 | 203 | 8 | $316,505 | 0 | 0 |

| 31-Jan-26 | 11 | $3,985 | 8 | 72 | 7 | $135 | 4 | $3,850 |

| 24-Jan-26 | 8 | $1,340 | 5 | 120 | 7 | $985 | 1 | $355 |

| 17-Jan-26 | 19 | $18,440 | 10 | 203 | 13 | $12,963 | 6 | $5,477 |

| 10-Jan-26 | 18 | $8,958 | 12 | 182 | 17 | $8,358 | 1 | $600 |

| 03-Jan-26 | 2 | $1,519 | 2 | 17 | 1 | $18.8 | 1 | $1,500 |

| 27-Dec-25 | 2 | $3,200 | 2 | 15 | 2 | $3,200 | 0 | 0 |

| 20-Dec-25 | 11 | $10,167 | 8 | 96 | 7 | $7,411 | 4 | $2,756 |

| 13-Dec-25 | 15 | $9,952 | 10 | 211 | 11 | $6,267 | 4 | $3,686 |

| 06-Dec-25 | 16 | $9,947 | 11 | 94 | 13 | $8,091 | 3 | $1,856 |

| 29-Nov-25 | 6 | $4,075 | 5 | 60 | 2 | $175 | 4 | $3,900 |

| 22-Nov-25 | 20 | $5,546 | 14 | 166 | 14 | $3,309 | 6 | $2,238 |

| 15-Nov-25 | 16 | $16,373 | 11 | 136 | 8 | $4,790 | 8 | $11,583 |

| 08-Nov-25 | 21 | $75,919 | 15 | 191 | 15 | $70,630 | 6 | $5,289 |

| 01-Nov-25 | 20 | $25,927 | 12 | 152 | 14 | $21,455 | 6 | $4,472 |

| 25-Oct-25 | 19 | $61,470 | 14 | 262 | 18 | $60,894 | 1 | $576 |

| 18-Oct-25 | 14 | $47,792 | 12 | 130 | 13 | $46,592 | 1 | $1,200 |

| 11-Oct-25 | 14 | $17,361 | 9 | 104 | 7 | $14,444 | 7 | $2,917 |

| 04-Oct-25 | 21 | $20,843 | 15 | 236 | 10 | $15,376 | 11 | $5,467 |

| 27-Sept-25 | 16 | $22,774 | 12 | 219 | 10 | $19,103 | 6 | $3,671 |

| 20-Sept-25 | 24 | $11,305 | 13 | 238 | 16 | $6,209 | 8 | $5,096 |

| 13-Sept-25 | 20 | $26,575 | 11 | 225 | 12 | $20,971 | 8 | $5,604 |

| 06-Sept-25 | 19 | $8,622 | 12 | 190 | 13 | $2,880 | 6 | $8,622 |

| 30-Aug-25 | 10 | $6,569 | 9 | 109 | 7 | $3,519 | 3 | $3,050 |

| 23-Aug-25 | 23 | $15,207 | 10 | 129 | 18 | $14,500 | 5 | $707 |

| 16-Aug-25 | 13 | $26,405 | 12 | 149 | 7 | $3,180 | 6 | $23,225 |

| 09-Aug-25 | 19 | $16,066 | 16 | 245 | 15 | $11,307 | 4 | $4,759 |

| 02-Aug-25 | 17 | $19,480 | 11 | 104 | 13 | $18,002 | 4 | $1,478 |

| 26-Jul-25 | 15 | $3,164 | 12 | 96 | 12 | $3,0023 | 3 | $162 |

| 19-Jul-25 | 14 | $6,080 | 14 | 97 | 9 | $4,165 | 5 | $1,915 |

| 12-Jul-25 | 15 | $13,012 | 14 | 208 | 12 | $10,902 | 3 | $2,110 |

| 05-Jul-25 | 9 | $15,778 | 8 | 91 | 4 | $7,280 | 5 | $8,498 |

| 28-Jun-25 | 13 | $7,777 | 8 | 154 | 7 | $2,031 | 6 | $5,746 |

| 21-Jun-25 | 16 | $5,984 | 10 | 113 | 11 | $3,087 | 5 | $2,897 |

| 14-Jun-25 | 9 | $478 | 8 | 133 | 6 | 0 | 3 | $478 |

| 07-Jun-25 | 16 | $26,210 | 11 | 196 | 11 | $24,744 | 5 | $1,466 |

| 31-May-25 | 19 | $23,381 | 11 | 166 | 12 | $18,665 | 7 | $4,717 |

| 24-May-25 | 15 | $24,033 | 11 | 121 | 13 | $23,624 | 2 | $409 |

| 17-May-25 | 16 | $21,760 | 12 | 145 | 11 | $18,615 | 5 | $3,145 |

| 10-May-25 | 24 | $33,175 | 16 | 206 | 19 | $30,765 | 5 | $2,410 |

| 03-May-25 | 11 | $4,249 | 13 | 90 | 11 | $2,226.5 | 2 | $2,022.5 |

| 26-Apr-25 | 12 | $8,787 | 9 | 168 | 9 | $6,011 | 3 | $2,776 |

| 19-Apr-25 | 11 | $8,097 | 7 | 138 | 9 | $7,985 | 2 | $112 |

| 12-Apr-25 | 13 | $2,392 | 8 | 152 | 10 | $2,065 | 3 | $327 |

| 05-Apr-25 | 19 | $27,762 | 15 | 188 | 16 | $25,473 | 3 | $2,289 |

| 29-Mar-25 | 21 | $8,188 | 10 | 258 | 16 | $4,125 | 5 | $4,064 |

| 22-Mar-25 | 19 | $6,485 | 14 | 231 | 15 | $4,128 | 4 | $2,857 |

| 15-Mar-25 | 13 | $13,737 | 13 | 151 | 10 | $9,932 | 4 | $3,805 |

| 8-Mar-25 | 7 | $2,234 | 5 | 66 | 5 | $224 | 2 | $2,100 |

| 1-Mar-25 | 11 | $3,050 | 8 | 75 | 10 | $2,550 | 1 | $500 |

| 22-Feb-25 | 12 | $16,397 | 7 | 149 | 6 | $6,635 | 6 | $9,862 |

| 15-Feb-25 | 17 | $12,136 | 13 | 134 | 10 | $9,411 | 2 | $2,725 |

| 8-Feb-25 | 14 | $7,154 | 9 | 179 | 9 | $4,950 | 5 | $2,204 |

| 1-Feb-25 | 16 | $10,068 | 7 | 200 | 11 | $7,553 | 5 | $2,515 |

| 25-Jan-25 | 14 | $10,261 | 10 | 125 | 9 | $2,207 | 5 | $8,054 |

| 18-Jan-25 | 19 | $7,382 | 15 | 316 | 12 | $2,300 | 7 | $5,082 |

| 11-Jan-25 | 21 | $33,560 | 16 | 187 | 16 | $32,521 | 5 | $1,039 |

| 4-Jan-25 | 9 | $6,827 | 9 | 80 | 9 | $6,827 | 0 | 0 |

| 21-Dec-24 | 11 | $2,798 | 11 | 92 | 8 | $2,229 | 3 | $570 |

| 14-Dec-24 | 15 | $5,323 | 12 | 186 | 12 | $3,812 | 3 | $1,511 |

| 07-Dec-24 | 16 | $4,766 | 10 | 231 | 11 | $2,321 | 5 | 2,445 |

| 30-Nov-24 | 10 | $10,291 | 9 | 103 | 4 | $8,290 | 6 | $2.001 |

| 23-Nov-24 | 15 | $4,553 | 15 | 153 | 11 | $3,379 | 4 | $1,174 |

| 16-Nov-24 | 17 | $11,488 | 11 | 245 | 13 | $10,186 | 4 | $1,303 |

| 09-Nov-24 | 14 | $2,110 | 12 | 139 | 12 | $1,410 | 2 | $700 |

| 02-Nov-24 | 12 | $52,788 | 11 | 107 | 11 | $52,738 | 1 | $50 |

| 26-Oct-24 | 8 | $3,160 | 8 | 65 | 7 | $3,065 | 1 | $75 |

| 19-Oct-24 | 12 | $5,304 | 11 | 136 | 11 | $4,554 | 1 | $750 |

| 12-Oct-24 | 17 | $8,438 | 12 | 150 | 15 | $8,116 | 2 | $322 |

| 05-Oct-24 | 22 | $23,181 | 12 | 189 | 15 | $19,980 | 7 | $3,201 |

| 28-Sep-24 | 11 | $2,356 | 7 | 144 | 7 | $53 | 4 | $2,303 |

| 21-Sep-24 | 12 | $9,568 | 10 | 169 | 5 | $4,101 | 7 | $5,467 |

| 14-Sep-24 | 24 | $10,988 | 12 | 235 | 16 | $7,175 | 8 | $3,813 |

| 7-Sep-24 | 12 | $20,420 | 16 | 168 | 11 | $20,307 | 1 | $112.9 |

| 31-Aug-24 | 13 | $20,631 | 9 | 134 | 12 | $14,775 | 1 | $5,856 |

| 24-Aug-24 | 19 | $8,452 | 21 | 325 | 16 | $7,102 | 3 | $1,350 |

| 17-Aug-24 | 25 | $49,196 | 16 | 304 | 11 | $39,386 | 14 | $9,810 |

| 10-Aug-24 | 20 | $12,264 | 15 | 312 | 16 | $9,794 | 4 | $2,470 |

| 03-Aug-24 | 26 | $16,498 | 16 | 334 | 18 | $8,137 | 8 | $8,361 |

| 27-Jul-24 | 19 | $16,442 | 21 | 271 | 15 | $13,838 | 4 | $2,604 |

| 20-Jul-24 | 15 | $16,016 | 14 | 184 | 10 | $14,232 | 5 | $1,784 |

| 13-Jul-24 | 20 | $17,220 | 14 | 265 | 18 | $7,146 | 2 | $10,074 |

| 6-Jul-24 | 11 | $3,941 | 11 | 95 | 8 | $2,650 | 3 | $1,291 |

| 29-Jun-24 | 14 | $6,296 | 15 | 224 | 8 | $6,296 | 6 | $1,927 |

| 22-Jun-24 | 12 | $5,679 | 8 | 137 | 5 | $210 | 7 | $5,469 |

| 15-Jun-24 | 13 | $9,895 | 16 | 214 | 10 | $5,280 | 3 | $4,615 |

| 8-Jun-24 | 19 | $23,859 | 13 | 239 | 12 | $19,436 | 7 | $4,423 |

| 1-Jun-24 | 12 | $34,510 | 11 | 147 | 9 | $26,110 | 3 | $8,400 |

| 25-May-24 | 13 | $9,684 | 15 | 171 | 10 | $4,434 | 3 | $5,250 |

| 18-May-24 | 11 | $5,490 | 11 | 173 | 8 | $3,129 | 3 | $2,361 |

| 11-May-24 | 22 | $14,855 | 14 | 227 | 16 | $11,105 | 6 | $3,750 |

| 4-May-24 | 13 | $3,139 | 9 | 87 | 10 | $1,297 | 3 | $1,842 |

| 27-Apr-24 | 10 | $6,684 | 6 | 28 | 10 | $6,684 | 0 | 0 |

| 20-Apr-24 | 19 | $15,989 | 11 | 147 | 9 | $5,208 | 10 | $10,781 |

| 13-Apr-24 | 13 | $8,952 | 9 | 76 | 10 | $1,652 | 3 | $7,300 |

| 6-Apr-24 | 23 | $26,616 | 14 | 222 | 14 | $13,501 | 8 | $13,116 |

| 30-Mar-24 | 12 | $9,286 | 8 | 136 | 8 | $4,299 | 4 | $4,987 |

| 23-Mar-24 | 18 | $5,451 | 17 | 266 | 16 | $4,759 | 2 | $692 |

| 16-Mar-24 | 21 | $11,437 | 13 | 186 | 14 | $9,316 | 6 | $2,070 |

| 9-Mar-24 | 23 | $4,695 | 21 | 218 | 19 | $2,723 | 4 | $1,972 |

| 2-Mar-24 | 20 | $9,108 | 19 | 372 | 14 | $4,558 | 6 | $4,550 |

| 24-Feb-24 | 19 | $16,382 | 12 | 248 | 15 | $9,507 | 4 | $6,875 |

| 17-Feb-24 | 16 | $29,932 | 15 | 157 | 12 | $29,216 | 4 | $716 |

| 10-Feb-24 | 25 | $10,750 | 17 | 196 | 19 | $5,372 | 6 | $5,379 |

| 3-Feb-24 | 12 | $8,416 | 18 | 125 | 9 | $3,416 | 3 | $5,000 |

| 27-Jan-24 | 9 | $8,165 | 9 | 87 | 8 | $7,815 | 1 | $800 |

| 20-Jan-24 | 14 | $4,084 | 12 | 109 | 12 | $3,219 | 2 | $865 |

| 13-Jan-24 | 17 | $33,588 | 12 | 256 | 12 | $26,765 | 5 | $6,823 |

| 6-Jan-24 | 8 | $7,915 | 8 | 84 | 6 | $7,265 | 2 | $650 |

| 30-Dec-23 | 17 | $14,599 | 12 | 99 | 15 | $2,714 | 2 | $11,885 |

| 23-Dec-23 | 23 | $4,182 | 13 | 219 | 16 | $1,813 | 7 | $2,370 |

| 16-Dec-23 | 13 | $16,436 | 13 | 280 | 7 | $15,150 | 5 | $1,286 |

| 9-Dec-23 | 26 | $14,633.90 | 17 | 244 | 16 | $8,095 | 10 | $6,538.90 |

| 2-Dec-23 | 13 | $6,720 | 9 | 57 | 12 | $6,630 | 1 | $90 |

| 25-Nov-23 | 9 | $4,835 | 9 | 131 | 6 | $1,785 | 3 | $3,050 |

| 18-Nov-23 | 22 | $6,568.70 | 17 | 184 | 14 | $4,709.20 | 8 | $1,859.50 |

| 11-Nov-23 | 15 | $9,825 | 13 | 179 | 12 | $6,581 | 3 | $3,244 |

| 4-Nov-23 | 15 | $20,582.50 | 14 | 193 | 12 | $19,417.50 | 3 | $1,165 |

| 28-Oct-23 | 18 | $68,419.10 | 18 | 152 | 15 | $66,646 | 3 | $1,773.10 |

| 21-Oct-23 | 16 | $6,755.90 | 16 | 165 | 15 | $6,755.90 | 1 | $3 |

| 14-Oct-23 | 14 | $67,851.20 | 13 | 125 | 9 | $61,998.50 | 5 | $5,852.70 |

| 7-Oct-23 | 17 | $6,595.50 | 13 | 228 | 16 | $5,995.50 | 1 | $600 |

| 30-Sep-23 | 17 | $1,896.45 | 13 | 189 | 14 | $806.45 | 3 | $1,090 |

| 23-Sep-23 | 23 | $6,432.70 | 17 | 230 | 16 | $1,402.80 | 7 | $5,029.90 |

| 16-Sep-23 | 25 | $23,226.70 | 23 | 353 | 16 | $17,239 | 9 | $5,987.70 |

| 9-Sep-23 | 12 | $6,369 | 8 | 102 | 7 | $4,311 | 5 | $2,058 |

| 2-Sep-23 | 14 | $2,522 | 6 | 92 | 13 | $1,322 | 1 | $1,200 |

| 26-Aug-23 | 17 | $12,160.25 | 13 | 202 | 15 | $6,573.25 | 2 | $5,587.00 |

| 19-Aug-23 | 19 | $11,505 | 13 | 213 | 15 | $11,255 | 4 | $250 |

| 12-Aug-23 | 19 | $9,698.80 | 13 | 184 | 7 | $3,270 | 12 | $6,428.80 |

| 5-Aug-23 | 13 | $5,201 | 12 | 118 | 12 | $5,051 | 1 | $150 |

| 29-Jul-23 | 15 | $21,031.60 | 13 | 196 | 11 | $18,292.00 | 4 | $2,739.60 |

| 22-Jul-23 | 18 | $3,992 | 12 | 130 | 13 | $2,808 | 5 | $1,184 |

| 15-Jul-23 | 13 | $8,254.95 | 13 | 81 | 13 | $8,254.95 | 0 | 0 |

| 8-Jul-23 | 16 | $5,441.45 | 12 | 172 | 11 | $2,443 | 5 | $2,998.45 |

| 1-Jul-23 | 16 | $6,872 | 10 | 105 | 12 | $5,474 | 4 | $1,398 |

| 24-Jun-23 | 13 | $10,914 | 16 | 201 | 10 | $7,874 | 3 | $3,040 |

| 17-Jun-23 | 17 | $5,880.70 | 15 | 151 | 15 | $4,705.70 | 2 | $1,175 |

| 10-Jun-23 | 19 | $8,516.10 | 13 | 111 | 16 | $6,252.40 | 3 | $2,263.70 |

| June 3 2023 | 12 | $6,104.42 | 12 | 138 | 8 | $4,256.92 | 4 | $1,847.50 |

| 27-May-23 | 17 | $12,200 | 10 | 67 | 11 | $6,165 | 6 | $6,035 |

| 20-May-23 | 11 | $22,458.10 | 8 | 103 | 4 | $19,455 | 7 | $3,003 |

| 13-May-23 | 12 | $7,034 | 10 | 101 | 8 | $5,460 | 4 | $1,574 |

| 6-May-23 | 20 | $3,297.60 | 18 | 196 | 17 | $2,985.60 | 3 | $312 |

| 29-Apr-23 | 23 | $3,691.20 | 18 | 135 | 17 | $1,969.70 | 6 | $1,721.50 |

| 22-Apr-23 | 16 | $5,570 | 14 | 104 | 14 | $4,750 | 2 | $1,000 |

| 15-Apr-23 | 12 | $23,818.10 | 9 | 59 | 10 | $21,618.10 | 2 | $2,200 |

| 8-Apr-23 | 16 | $7,949 | 9 | 173 | 9 | $5,472 | 7 | $3,477 |

| 1-Apr-23 | 21 | $18,676.70 | 12 | 175 | 11 | $10,926.70 | 10 | $7,750 |

| 25-Mar-23 | 15 | $8,779.50 | 10 | 141 | 5 | $2,362 | 10 | $6,416.50 |

| 18-Mar-23 | 7 | $14,048.80 | 6 | 69 | 5 | $13,345 | 2 | $703.80 |

| 11-Mar-23 | 21 | $11,576 | 16 | 165 | 16 | $8,131 | 5 | $3,445 |

| 4-Mar-23 | 20 | $9,668 | 11 | 228 | 16 | $8,209 | 4 | $1,459 |

| 25-Feb-23 | 13 | $5,335 | 13 | 130 | 12 | $4,235 | 1 | $1,200 |

| 18-Feb-23 | 14 | $5,743.70 | 13 | 158 | 8 | $898.70 | 6 | $4,845 |

| 11-Feb-23 | 16 | $12,088 | 12 | 137 | 12 | $9,965 | 4 | $2,123 |

| 4-Feb-23 | 17 | $8,066 | 15 | 140 | 13 | $5,614 | 4 | $2,452 |

| 28-Jan-23 | 7 | $2,180 | 7 | 75 | 5 | $1,692.75 | 2 | $488 |

| 21-Jan-23 | 17 | $5,768 | 16 | 174 | 12 | $1,918 | 5 | $3,850 |

| 14-Jan-23 | 11 | $2, 800 | 10 | 102 | 8 | $421 | 3 | $2,400 |

| 7-Jan-23 | 18 | $8,296 | 11 | 167 | 14 | $6,461 | 3 | $1,835 |

| 31-Dec-22 | 14 | $2,732 | 11 | 99 | 12 | $2,092 | 2 | $640 |

| 17-Dec | 14 | $7,919 | 13 | 115 | 12 | $7,419 | 1 | $500 |

| 10-Dec-22 | 14 | $10,093 | 12 | 88 | 11 | $7,093 | 3 | $3,000 |

| 3-Dec-22 | 26 | $12,800.90 | 11 | 172 | 20 | $4,141 | 6 | $8,659.90 |

| 26-Nov-22 | 8 | $2,266.70 | 8 | 5 | 3 | $76 | 5 | $2,190.70 |

| 19-Nov-22 | 21 | $2,886 | 15 | 212 | 19 | $2,550 | 2 | $336 |

| 12-Nov-22 | 13 | $15,093.70 | 9 | 81 | 9 | $14,200 | 4 | $893.70 |

| 5-Nov-22 | 25 | 19,337.20 | 16 | 509 | 22 | $8,267.20 | 3 | $11,070 |

| 29-Oct-22 | 15 | $7,805.30 | 9 | 116 | 14 | $7,180.30 | 1 | $625 |

| 22-Oct-22 | 20 | $8,193.50 | 13 | 253 | 13 | $5,442 | 7 | $2,751.50 |

| 15-Oct-22 | 9 | $3,046.10 | 9 | 139 | 7 | $2,588.30 | 2 | $457.80 |

| 8-Oct-22 | 19 | $2,011.80 | 12 | 114 | 16 | $833.80 | 3 | $1,178 |

| 1-Oct-22 | 23 | $5,532.90 | 16 | 156 | 18 | $4,952.30 | 5 | $580.60 |

| 24-Sep-22 | 18 | $5,194 | 14 | 216 | 15 | $4,050 | 3 | $1,144 |

| 17-Sep-22 | 21 | $8,352.30 | 12 | 320 | 15 | $4,759.60 | 6 | $3,592.70 |

| 10-Sep-22 | 15 | $19,853.50 | 10 | 126 | 13 | $19,403.60 | 2 | $450 |

| 3-Sep-22 | 9 | $2,312 | 9 | 62 | 9 | $2,312 | 0 | 0 |

| 27-Aug-22 | 16 | $30,891.70 | 10 | 135 | 15 | $30,666.40 | 1 | 227.7 |

| 20-Aug-22 | 12 | $1,977 | 8 | 152 | 9 | 925 | 3 | $1,052 |

| 13-Aug-22 | 18 | $8,004.70 | 11 | 242 | 11 | $2,844.70 | 7 | $5,160 |

| 6-Aug-22 | 24 | $7,948.90 | 12 | 240 | 17 | $3,577 | 7 | $4,371.90 |

| 30-Jul-22 | 8 | $6,941 | 9 | 78 | 7 | $6,839 | 1 | $102 |

| 23-Jul-22 | 11 | $801 | 11 | 92 | 10 | $801 | 1 | 0 |

| 16-Jul-22 | 14 | $3,650 | 10 | 122 | 14 | $3,650 | 0 | 0 |

| 9-Jul-22 | 10 | $3,557.70 | 7 | 68 | 9 | $3,557.70 | 1 | 0 |

| 2-Jul-22 | 18 | $8,609.40 | 13 | 152 | 15 | $2,754.40 | 3 | $5,855 |

| 25-Jun-22 | 15 | $6,142 | 13 | 146 | 9 | $2,017 | 6 | $4,125 |

| 18-Jun-22 | 17 | $11,890.10 | 14 | 228 | 15 | $11,410 | 2 | 479.7 |

| 11-Jun-22 | 17 | $7,600 | 12 | 123 | 10 | $2,300 | 7 | $5,300 |

| 4-Jun-22 | 12 | $2,937 | 10 | 127 | 9 | $692 | 3 | $2,245 |

| 28-May-22 | 9 | $3,197.60 | 11 | 86 | 9 | $3,197.60 | 0 | 0 |

| 21-May-22 | 14 | $7,284.50 | 12 | 185 | 11 | $6,609 | 3 | $675.50 |

| 14-May-22 | 11 | $306.60 | 9 | 80 | 10 | $306.60 | 1 | $225 |

| 7-May-22 | 16 | $10,451.75 | 12 | 108 | 12 | $1,827 | 4 | $8,624.75 |

| 30-Apr-22 | 16 | $2,296.50 | 16 | 157 | 12 | $895.50 | 4 | $1,401 |

| 23-Apr-22 | 10 | $2,241 | 11 | 58 | 8 | $1,641 | 2 | $600 |

| 16-Apr-22 | 11 | $6,643 | 7 | 156 | 8 | $2,359 | 3 | $4,284 |

| 9-Apr-22 | 17 | $4,429 | 14 | 184 | 11 | $1,690 | 6 | $2,739 |

| 2-Apr-22 | 13 | $1,755 | 8 | 84 | 10 | $1,145 | 3 | $610 |

| 26-Mar-22 | 11 | $3,205 | 8 | 65 | 6 | $200 | 5 | $3,005 |

| 19-Mar-22 | 13 | $2,239.17 | 9 | 106 | 13 | $2,239.17 | 0 | 0 |

| 12-Mar-22 | 18 | $12,016 | 11 | 239 | 15 | $11,965 | 2 | $51.35 |

| 5-Mar-22 | 17 | $6,786 | 13 | 137 | 13 | $5,161 | 4 | $1,625 |

| 26-Feb-22 | 12 | $5,095 | 8 | 149 | 9 | $4,437.50 | 3 | $658 |

| 19-Feb-22 | 17 | $22,229 | 17 | 174 | 14 | $21,354 | 3 | $875 |

| 12-Feb-22 | 12 | $2,344.70 | 10 | 73 | 8 | $641.70 | 4 | $1,703 |

| 5-Feb-22 | 11 | $2,503 | 8 | 99 | 11 | $2,503 | 0 | 0 |

| 29-Jan-22 | 11 | $3,872 | 12 | 101 | 12 | $3,872 | 0 | 0 |

| 22-Jan-22 | 13 | $5,143.50 | 10 | 99 | 12 | $4,842.50 | 1 | $301 |

| 15-Jan-22 | 12 | $7,605 | 9 | 155 | 9 | $6,480 | 3 | $1,025 |

| 8-Jan-22 | 13 | $8,256.20 | 11 | 102 | 13 | $8,256.20 | 0 | 0 |

| 1-Jan-22 | 9 | $1,273.80 | 6 | 50 | 9 | $1,273.80 | 0 | 0 |

| 25-Dec-21 | 21 | $4,734.75 | 11 | 176 | 16 | $3,410 | 5 | $1,324.75 |

| 18-Dec-21 | 26 | $7,325.20 | 15 | 193 | 18 | $3,640.20 | 8 | $3,685.20 |

| 11-Dec-21 | 16 | $5,017 | 10 | 109 | 13 | $1,417 | 3 | $3,600 |

| 4-Dec-21 | 14 | $2,310 | 8 | 86 | 8 | $2,310 | 6 | $1,882.05 |

| 27-Nov-21 | 9 | $3.460.1 | 10 | 101 | 6 | $1,758 | 3 | $1,702.60 |

| 20-Nov-21 | 20 | $22,792 | 15 | 157 | 12 | $18,864.50 | 8 | $3,928 |

| 13-Nov-21 | 21 | $26,729 | 12 | 178 | 13 | $11,822 | 8 | $14,907 |

| 6-Nov-21 | 12 | $8,303 | 13 | 157 | 10 | $6,682 | 3 | $1,621 |

| 30-Oct-21 | 21 | $10,368 | 15 | 218 | 15 | $9,24.4 | 6 | $1,103.00 |

| 23-Oct-21 | 21 | $18.783.1 | 15 | 222 | 11 | $12,314 | 10 | $6,468.60 |

| 16-Oct-21 | 15 | $3,868 | 11 | 118 | 15 | $2,293 | 2 | $1,575 |

| 9-Oct-21 | 20 | $8,610 | 16 | 175 | 16 | $7,795 | 4 | $815 |

| 2-Oct-21 | 14 | $6,250 | 11 | 137 | 10 | $5,200 | 4 | $1,050 |

| 25-Sep-21 | 11 | $11,460 | 9 | 93 | 7 | $10,200 | 4 | $1,250 |

| 18-Sep-21 | 11 | $16,603 | 8 | 99 | 8 | $15,084 | 3 | $1,519 |

| 11-Sep-21 | 17 | $10,653 | 11 | 103 | 13 | $8,503 | 4 | $2,150 |

| 4-Sep-21 | 13 | $7,222 | 10 | 89 | 11 | $6,715 | 2 | $507 |

| 28-Aug-21 | 12 | $763 | 9 | 63 | 11 | $663 | 1 | $100 |

| 21-Aug-21 | 12 | $29,659 | 7 | 79 | 11 | $29,579 | 1 | $80 |

| 14-Aug-21 | 22 | $17,845 | 11 | 199 | 12 | $12,805 | 10 | $5,04 |

| 7-Aug-21 | 17 | $13,670 | 12 | 139 | 15 | $11,766 | 2 | $1,904 |

| 31-Jul-21 | 21 | $8,160 | 11 | 134 | 10 | $3,574 | 10 | $4,586 |

| July 24,2021 | 21 | $6,367 | 11 | 139 | 15 | $3,712 | 6 | $2,655 |

| 17-Jul-21 | 14 | $4,009 | 11 | 124 | 12 | $2,015 | 2 | $1,994 |

| 10-Jul-21 | 16 | $3,997 | 13 | 143 | 11 | $1,597 | 4 | $2,4 |

| 3-Jul-21 | 24 | $7,492 | 13 | 94 | 16 | $3,769 | 8 | $3,722 |

| 26-Jun-21 | 10 | $4,995 | 7 | 85 | 8 | $3,847 | 2 | $1,148 |

| 19-Jun-21 | 28 | $16,830 | 8 | 228 | 9 | $1,861 | 19 | $14,968 |

| 12-Jun-21 | 26 | $27,238 | 15 | 209 | 19 | $25,602 | 7 | $1,636 |

| 5-Jun-21 | 15 | $15,539 | 13 | 100 | 13 | $14,709 | 2 | $600 |

| 29-May-21 | 35 | $20,279 | 11 | 145 | 28 | $18,64 | 7 | $1,639 |

| 22-May-21 | 24 | $53,208 | 14 | 174 | 17 | $51,047 | 7 | $2,161 |

| 15-May-21 | 18 | $10,620 | 13 | 220 | 11 | $5,870 | 7 | $4,809 |

| 8-May-21 | 17 | $10,400 | 11 | 156 | 15 | $8,386 | 2 | $2,500 |

| 1-May-21 | 21 | $7,200 | 16 | 115 | 12 | $3,808 | 9 | $3,392 |

| 24-Apr-21 | 8 | $20,200 | 9 | 31 | 8 | $20,200 | 0 | 0 |

| 17-Apr-21 | 14 | $6,270 | 8 | 102 | 11 | $40,180 | 3 | $2,260 |

| 10-Apr-21 | 15 | $8,940 | 13 | 129 | 14 | $7,990 | 1 | $950 |

| 3-Apr-21 | 18 | $19,513 | 10 | 151 | 12 | $16,923 | 6 | $2,590 |

| 27-Mar-21 | 27 | $13,942 | 15 | 244 | 14 | $4,300 | 13 | $9,633.50 |

| 20-Mar-21 | 11 | $2,046 | 4 | 102 | 3 | $270 | 8 | $1,776 |

| 13-Mar-21 | 15 | $3,270 | 9 | 109 | 6 | $538 | 9 | $2,732 |

| 6-Mar-21 | 24 | $13,617 | 10 | 196 | 13 | $10,395 | 11 | $3,222 |

| 27-Feb-21 | 19 | $8,105 | 12 | 139 | 15 | $4,970 | 4 | $3,135 |

| 20-Feb-21 | 9 | $8,820 | 9 | 153 | 8 | $8,520 | 1 | $300 |

| 13-Feb-21 | 12 | $4,852.60 | 7 | 81 | 7 | 2,766 | 5 | $2,086.60 |

| 6-Feb-21 | 18 | $9,752 | 13 | 153 | 14 | $5,222 | 4 | $4,530 |

| 30-Jan-21 | 18 | $9,449 | 9 | 182 | 15 | $8,753.80 | 3 | $695.30 |

| 23-Jan-21 | 14 | $8,150 | 8 | 118 | 6 | $4,000 | 8 | $4,150 |

| 16-Jan-21 | 17 | $6,783 | 13 | 138 | 11 | $2,400 | 6 | $4,382.90 |

| 9-Jan-21 | 22 | $6,829 | 14 | 135 | 18 | $3,139.30 | 4 | $3,690 |

| 2-Jan-21 | 7 | $1,466 | 7 | 60 | 7 | $1,466 | 0 | 0 |

| 26-Dec-20 | 18 | $15,900 | 12 | 163 | 16 | $5,300 | 1 | $600 |

| 19-Dec-20 | 18 | $9,769 | 14 | 110 | 14 | $8,426 | 4 | $1,343 |

| 12-Dec-20 | 10 | $7,200 | 9 | 100 | 9 | $3,325 | 1 | $3,830 |

| 5-Dec-20 | 15 | $4,261 | 9 | 122 | 9 | $2,780 | 6 | $1,481 |

| 28-Nov-20 | 19 | $7,758 | 10 | 110 | 13 | $4,003 | 6 | $3,755 |

| 14-Nov-20 | 14 | $864.10 | 14 | 157 | 12 | $289.10 | 2 | $575 |

| 7-Nov-20 | 13 | $6,332 | 9 | 129 | 9 | $2,483.50 | 4 | $3,849 |

| 31-Oct-20 | 10 | $3,995.80 | 8 | 103 | 6 | $3,231.10 | 4 | $754.70 |

| 24-Oct-20 | 6 | $18,100 | 6 | 58 | 5 | $17,709 | 1 | $350 |

| 17-Oct-20 | 8 | $351.90 | 5 | 55 | 8 | $351.90 | 0 | 0 |

| 10-Oct-20 | 7 | $5,229 | 3 | 50 | 4 | $735 | 3 | $4,494 |

| 3-Oct-20 | 14 | $21,428 | 9 | 173 | 9 | $17,535 | 5 | $3,893 |

| 26-Sep-20 | 10 | $12,770 | 8 | 93 | 5 | $10,300 | 5 | $2,470 |

| 19-Sep-20 | 14 | $8,365 | 9 | 101 | 6 | $1,020 | 8 | $7,345 |

| 12-Sep-20 | 6 | $4,406 | 8 | 59 | 3 | $1,270 | 3 | $3,136 |

| 5-Sep-20 | 11 | $5,191 | 8 | 117 | 9 | $4,061 | 2 | $1,130 |

| 29-Aug-20 | 11 | $2,531 | 9 | 94 | 5 | $1,130 | 6 | $1,401 |

| 22-Aug-20 | 18 | $6,574 | 12 | 140 | 7 | $1,930 | 11 | $4,644 |

| 15-Aug-20 | 13 | $4,991 | 10 | 97 | 7 | $1,216 | 6 | $3,775 |

| 8-Aug-20 | 12 | $32,092 | 11 | 112 | 9 | $30,457 | 3 | $1,635 |

| 1-Aug-20 | 7 | $5,287 | 8 | 76 | 5 | $3,687 | 2 | $1,600 |

| 25-Jul-20 | 9 | $18,751 | 6 | 67 | 7 | $18,403 | 2 | $348 |

| 18-Jul-20 | 6 | $1,982.50 | 5 | 50 | 4 | $1,407.50 | 2 | $575 |

| 11-Jul-20 | 11 | $565.10 | 12 | 75 | 10 | $65.10 | 1 | $500 |

| 4-Jul-20 | 10 | $8,889 | 8 | 98 | 9 | $8,788 | 1 | $100.30 |

| 27-Jun-20 | 8 | $6,874 | 10 | 50 | 5 | $4,972.50 | 3 | $2,081.50 |

| 20-Jun-20 | 12 | $4,444 | 9 | 115 | 7 | $2,829 | 5 | $1,615 |

| 13-Jun-20 | 6 | $3,582 | 4 | 37 | 2 | $350 | 4 | $3,232 |

| 6-Jun-20 | 11 | $3,213.70 | 8 | 65 | 7 | $470 | 4 | $2,743.70 |

| 30-May-20 | 8 | $7,335 | 7 | 48 | 6 | $4,639 | 2 | $2,697 |

| 23-May-20 | 4 | $432.40 | 4 | 34 | 3 | $432.40 | 1 | 0 |

| 16-May-20 | 6 | $310 | 6 | 34 | 5 | $310 | 1 | 0 |

| 9-May-20 | 18 | $5,630 | 16 | 124 | 14 | $3,180 | 4 | $2,450 |

| 2-May-20 | 15 | 10,400 | 10 | 90 | 8 | $1,900 | 7 | $,8,500 |

| 25-Apr-20 | 8 | $3,400 | 9 | 36 | 5 | $1,000 | 3 | $2,450 |

| 18-Apr-20 | 19 | $9,500 | 14 | 92 | 8 | $185.70 | 11 | $9,360 |

| 11-Apr-20 | 12 | $6,000 | 9 | 40 | 5 | $190 | 7 | $5,800 |

| 4-Apr-20 | 14 | $8,200 | 11 | 68 | 10 | $2,200 | 4 | $6,000 |

| 28-Mar-20 | 16 | $6,500 | 13 | 96 | 10 | $3,700 | 6 | $2,800 |

| 21-Mar-20 | 11 | $11,910 | 7 | 33 | 7 | $2,250 | 4 | $9,960 |

| 14-Mar-20 | 7 | 809.8 | 6 | 34 | 6 | 684.8 | 1 | 125 |

| 7-Mar-20 | 16 | $2,500 | 15 | 70 | 13 | $669 | 3 | $1,400 |

| 29-Feb-20 | 13 | $15,260 | 13 | 128 | 11 | $11,760 | 2 | $3,500 |

| 22-Feb-20 | 12 | $3,700 | 10 | 92 | 10 | $2,560 | 2 | $1,130 |

| 15-Feb-20 | 16 | $1,250 | 10 | 84 | 12 | $35 | 4 | $1,222 |

| 8-Feb-20 | 18 | $6,080 | 14 | 123 | 14 | $2,595 | 4 | $3,485 |

| 1-Feb-20 | 21 | $20,900 | 12 | 101 | 14 | $17,860 | 7 | $3,060 |

| 25-Jan-20 | 13 | $7,430 | 13 | 62 | 12 | $6,430 | 1 | $1,000 |

| 18-Jan-20 | 23 | $9,580 | 15 | 120 | 19 | $6,580 | 4 | $3,000 |

| 11-Jan-20 | 21 | $14,200 | 18 | 199 | 16 | $1,020 | 5 | $13,200 |

| 4-Jan-20 | 22 | $6,400 | 11 | 119 | 16 | $3,204 | 6 | $3,245 |

| 28-Dec-19 | 22 | $7,150 | 19 | 175 | 18 | $6,800 | 4 | $327.40 |

| 14-Dec-19 | 24 | $36,300 | 23 | 167 | 19 | $9,500 | 5 | $26,800 |

| 7-Dec-19 | 11 | $10,400 | 11 | 55 | 7 | $1,082 | 4 | $9,370 |

| November 30. 2019 | 14 | $2,450 | 12 | 126 | 12 | $1,760 | 2 | $692.50 |

| 23-Nov-19 | 16 | $1,995 | 10 | 41 | 11 | $615 | 5 | $1,380 |

| 16-Nov-19 | 15 | $3,820 | 13 | 135 | 11 | $2,500 | 4 | $1,271 |

| 9-Nov-19 | 25 | $12,900 | 17 | 182 | 23 | $12,200 | 2 | $575 |

| 2-Nov-19 | 10 | $2,470 | 12 | 61 | 9 | 2,450 | 3 | $22 |

| 26-Oct-19 | 12 | $5,560 | 14 | 70 | 11 | $3,860 | 1 | $1,700 |

| 19-Oct-19 | 8 | $6,600 | 8 | 138 | 8 | $6,600 | 0 | 0 |

| 12-Oct-19 | 19 | $4,300 | 14 | 55 | 16 | $3,800 | 3 | $500 |

| 5-Oct-19 | 18 | $14,500 | 19 | 166 | 15 | $11,100 | 3 | $3,400 |

| 28-Sep-19 | 19 | $8,100 | 18 | 132 | 18 | $7,560 | 1 | $550 |

| 21-Sep-19 | 14 | $6,300 | 16 | 66 | 11 | $2,160 | 3 | $4,170 |

| 14-Sep-19 | 15 | $23,800 | 12 | 56 | 11 | $21,250 | 4 | $2,570 |

| 7-Sep-19 | 17 | $3,500 | 15 | 98 | 14 | $1,900 | 3 | $1,600 |

| 31-Aug-19 | 5 | $8,700 | 6 | 50 | 5 | $8,700 | 0 | 0 |

| 24-Aug-19 | 16 | $10,000 | 14 | 82 | 15 | $4,250 | 1 | $5,750 |

| 16-Aug-19 | 10 | $1,680 | 5 | 52 | 7 | $650 | 3 | $950 |

| 9-Aug-19 | 17 | $17,700 | 15 | 68 | 14 | $3,900 | 3 | $13,800 |

| 2-Aug-19 | 13 | $5,760 | 12 | 108 | 13 | $5,760 | NA | NA |

| 27-Jul-19 | 11 | $7,300 | 13 | 76 | 8 | $6,570 | 3 | $730 |

| 20-Jul-19 | 13 | $11,800 | 13 | 125 | 11 | $5,300 | 2 | $6,500 |

| 13-Jul-19 | 10 | $775 | 7 | 46 | 8 | $542.50 | 2 | $233 |

| 6-Jul-19 | 7 | $2,500 | 9 | 85 | 7 | $2,500 | 0 | 0 |

| 29-Jun-19 | 23 | $8,290 | 15 | 154 | 17 | $2,300 | 6 | $5,970 |

| 22-Jun-19 | 17 | $10,700 | 10 | 139 | 14 | $7,700 | 3 | $3,000 |

| 15-Jun-19 | 11 | $13,500 | 14 | 160 | 11 | $13,500 | NA | NA |

| 8-Jun-19 | 13 | $2,870 | 17 | 55 | 11 | $1,570 | 2 | $1,300 |

| 1-Jun-19 | 10 | $4,460 | 11 | 60 | 8 | $4,140 | 2 | $315 |

| 25-May-19 | 17 | $4,360 | 14 | 79 | 14 | $3,700 | 3 | $612 |

| 18-May-19 | 22 | $9,000 | 17 | 150 | 16 | $3,400 | 6 | $5,600 |

| 11-May-19 | 18 | $19,800 | 17 | 177 | 15 | $18,300 | 3 | $1,500 |

| 4-May-19 | 10 | $7,075 | 6 | 32 | 8 | $6,900 | 2 | $175 |

| 27-Apr-19 | 15 | $3,200 | 14 | 117 | 14 | $3,160 | 1 | $40 |

| 20-Apr-19 | 13 | $13,500 | 10 | 90 | 9 | $12,200 | 4 | $1,300 |

| 13-Apr-19 | 16 | $38,900 | 14 | 91 | 14 | $37,800 | 2 | $1,100 |

| 6-Apr-19 | 12 | $6,870 | 11 | 94 | 10 | $6,730 | 2 | $50 |

| 30-Mar-19 | 15 | $6,470 | 12 | 84 | 10 | $7,91.5 | 5 | $5,677 |

| 23-Mar-19 | 18 | $6,450 | 14 | 91 | 14 | $5,042 | 4 | $1,408 |

| 16-Mar-19 | 14 | $10,180 | 12 | 115 | 11 | $8,800 | 3 | $1,300 |

| 9-Mar-19 | 9 | $1,800 | 6 | 49 | 8 | $1,300 | 1 | $500 |

| 2-Mar-19 | 20 | $3,033 | 16 | 107 | 14 | $1,817 | 6 | $1,262 |

| 23-Feb-19 | 12 | $2,040 | 8 | 69 | 9 | $614.60 | 3 | $1,430 |

| 16-Feb-19 | 16 | $9,970 | 18 | 77 | 16 | $9,970 | 0 | 0 |

| 9-Feb-19 | 14 | $6,400 | 10 | 110 | 14 | $6,400 | 0 | 0 |

| 2-Feb-19 | 18 | $6,740 | 15 | 99 | 16 | $5,720 | 2 | $950 |

| 26-Jan-19 | 13 | $2,770 | 11 | 67 | 11 | $918.95 | 2 | $1,850 |

| 19-Jan-19 | 15 | $3,819 | 16 | 76 | 12 | $2,594 | 3 | $1,225 |

| 12-Jan-19 | 18 | $7,283 | 14 | 92 | 15 | $1,683 | 3 | $5,600 |

| 5-Jan-19 | 10 | $529 | 12 | 50 | 10 | $529 | 0 | 0 |

| 22-Dec-18 | 17 | $2,570 | 13 | 87 | 14 | $941 | 3 | $1,629 |

| 15-Dec-18 | 10 | $2,860 | 8 | 26 | 8 | $264 | 2 | $2,600 |

| 8-Dec-18 | 15 | $1,819 | 16 | 65 | 12 | $552 | 3 | $1,267 |

| 1-Dec-18 | 12 | $7,500 | 10 | 90 | 9 | $1,200 | 3 | $6,200 |

| 28-Nov-18 | 15 | $4,500 | 11 | 107 | 14 | $4,000 | 1 | $500 |

| 19-Nov-18 | 18 | $6,137 | 13 | 98 | 13 | $2,142 | 5 | $3,995 |

| 14-Nov-18 | 18 | $9,200 | 13 | 152 | 15 | $8,500 | 3 | $694 |

| 6-Nov-18 | 16 | $17,300 | 16 | 183 | 14 | $16,361 | 2 | $950 |

| 29-Oct-18 | 14 | $14,400 | 18 | 127 | 17 | $13,800 | 1 | $600 |

| 24-Oct-18 | 13 | $6,140 | 13 | 126 | 11 | $5,122 | 2 | $1,018 |

| 17-Oct-18 | 18 | $18,390 | 15 | 125 | 14 | $12,292 | 4 | $6,098 |

| 10-Oct-18 | 29 | $3,149 | 18 | 104 | 20 | $1,647 | 9 | $819 |

| 2-Oct-18 | 18 | $9,300 | 11 | 67 | 14 | $7,300 | 4 | $2,000 |

| 25-Sep-18 | 13 | $7,000 | 11 | 75 | 10 | $6,000 | 3 | $995 |

| 18-Sep-18 | 9 | $3,570 | 7 | 44 | 9 | $3,570 | 0 | 0 |

| 11-Sep-18 | 13 | $5,900 | 10 | 132 | 13 | $5,900 | 0 | 0 |

| 7-Sep-18 | 14 | $5,000 | 15 | 86 | 11 | $4,000 | 3 | $1,000 |

| 29-Aug-18 | 15 | $20,700 | 14 | 79 | 13 | $4,700 | 2 | $16,000 |

| 20-Aug-18 | 10 | $12,400 | 11 | 53 | 8 | $11,380 | 3 | $1,057 |

| 14-Aug-18 | 12 | $19,900 | 12 | 132 | 9 | $18,889 | 3 | $1,011 |

| 7-Aug-18 | 16 | $68,600 | 11 | 106 | 13 | $67,259 | 3 | $1,340 |

| 31-Jul-18 | 15 | $15,100 | 15 | 95 | 11 | $13,060 | 4 | $2,060 |

| 23-Jul-18 | 13 | $2,130 | 15 | 60 | 10 | $1,804 | 3 | $1,100 |

| 17-Jul-18 | 14 | $5,370 | 17 | 98 | 9 | $4,310 | 5 | $1,100 |

| 9-Jul-18 | 16 | $11,200 | 15 | 74 | 10 | $11,080 | 6 | $862 |

| 3-Jul-18 | 13 | $7,000 | 7 | 81 | 12 | $6,330 | 1 | $750 |

| 25-Jun-18 | 15 | $8,800 | 13 | 97 | 9 | $4,970 | 6 | $3,930 |

| 18-Jun-18 | 13 | $14,200 | 14 | 80 | 7 | $221 | 6 | $14,290 |

| 11-Jun-18 | 12 | $6,300 | 8 | 96 | 8 | $5,910 | 4 | $803 |

| 6-Jun-18 | 13 | $14,500 | 10 | 88 | 8 | $14,154 | 5 | $579 |

| 31-May-18 | 11 | $4,890 | 10 | 63 | 8 | $3,240 | 3 | $1,790 |

| 22-May-18 | 15 | $20,400 | 11 | 63 | 9 | $19,808 | 6 | $885 |

| 15-May-18 | 15 | $4,700 | 15 | 106 | 10 | $3,900 | 5 | $643 |

| 9-May-18 | 11 | $1,400 | 13 | 88 | 9 | $1,300 | 2 | $560 |

| 1-May-18 | 8 | $14,250 | 7 | 88 | 7 | $13,400 | 1 | $450 |

| 24-Apr-18 | 12 | $5,300 | 6 | 61 | 11 | $4,470 | 1 | $800 |

| 17-Apr-18 | 9 | $1,800 | 10 | 44 | 7 | $2,330 | 2 | $1,434 |

| 11-Apr-18 | 11 | $2,500 | 8 | 32 | 6 | $1,690 | 5 | $809 |

| 3-Apr-18 | 15 | $13,400 | 11 | 121 | 9 | $12,020 | 6 | $1,090 |

| 28-Mar-18 | 10 | $4,000 | 10 | 92 | 7 | $3,870 | 3 | $215 |

| 19-Mar-18 | 17 | $5,800 | 13 | 51 | 10 | $590 | 7 | $5,165 |

| 12-Mar-18 | 15 | $3,130 | 11 | 43 | 11 | $2,360 | 4 | $788 |

| 6-Mar-18 | 19 | $5,400 | 13 | 116 | 10 | $1,530 | 9 | $4,860 |

| 27-Feb-18 | 20 | $6,600 | 13 | 69 | 14 | $5,530 | 6 | $1,030 |

| 19-Feb-18 | 15 | $5,500 | 14 | 111 | 10 | $3,990 | 6 | $1,980 |

| 12-Feb-18 | 23 | $10,900 | 17 | 157 | 12 | $7,110 | 11 | $3,840 |

| 5-Feb-18 | 16 | $8,600 | 13 | 100 | 7 | $1,330 | 9 | $7,800 |

| 30-Jan-18 | 11 | $12,600 | 11 | 68 | 5 | $7,300 | 6 | $4,982 |

| 24-Jan-18 | 19 | $9,400 | 15 | 129 | 5 | $2,010 | 14 | $7,337 |

| 18-Jan-18 | 10 | $6,280 | 8 | 49 | 2 | $2,100 | 8 | $4,188 |

| 9-Jan-18 | 12 | $16,500 | 12 | 92 | 9 | $15,890 | 3 | $475 |

| 3-Jan-18 | 10 | $2,500 | 9 | 47 | 8 | $2,350 | 2 | $150 |

| 27-Dec-17 | 15 | $9,000 | 15 | 113 | 9 | $7,568 | 6 | $1,784 |

| 18-Dec-17 | 15 | $13,800 | 16 | 164 | 9 | $13,010 | 7 | $1,118 |

| 11-Dec-17 | 14 | $9,700 | 10 | 126 | 12 | $2,940 | 4 | $8,500 |

| 4-Dec-17 | 6 | $1,800 | 6 | 31 | 5 | $1,510 | 1 | $300 |

| 28-Nov-17 | 7 | $3,850 | 8 | 76 | 4 | $3,260 | 3 | $285 |

| 16-Nov-17 | 10 | $2,700 | 10 | 48 | 6 | $1,840 | 4 | $856 |

| 8-Nov-17 | 15 | $2,380 | 17 | 91 | 10 | $1,860 | 5 | $516 |

| 1-Nov-17 | 12 | $4,700 | 17 | 94 | 9 | $3,400 | 4 | $1,300 |

| 23-Oct-17 | 15 | $10,500 | 10 | 67 | 10 | $9,780 | 4 | $1,530 |

| 18-Oct-17 | 6 | $2,000 | 37 | 3 | $225 | 3 | $1,820 | |

| 10-Oct-17 | 12 | $6,570 | 100 | 9 | $3,880 | 3 | $3,360 | |

| 2-Oct-17 | 8 | $3,100 | 11 | 19 | 3 | $1,630 | 5 | $1,750 |

| 25-Sep-17 | 8 | $4,880 | 8 | 79 | 5 | $2,660 | 5 | $2,070 |

| 18-Sep-17 | 9 | $4,770 | 3 | $300 | 6 | $4,470 | ||

| 12-Sep-17 | 11 | $4,430 | 8 | $2,030 | 3 | $2,400 | ||

| 1-Sep-17 | 4 | $1,310 | 3 | $317 | 1 | $1,000 | ||

| 23-Aug-17 | 11 | $13,640 | 9 | 8 | $11,840 | 3 | $1,800 |

M&A/FUNDINGS

Vista sells Apptio to IBM for $4.6B

Deal Descriptionss: IBM announced Monday that it reached an agreement with Vista Equity Partners to purchase Apptio Inc. for $4.6 billion. Kirkland & Ellis advised Vista and Paul Weiss was outside counsel to IBM. For more on the transaction, click here.

Baird Medical merges with SPAC ExcelFin in $370M deal

Deal Description: Baird Medical Investment Holdings Ltd., a medical technology company, and ExcelFin Acquisition Corp., a publicly traded special purpose acquisition company, announced June 26 it entered into a definitive business combination agreement that would result in Baird Medical becoming a publicly traded company. Upon closing, the combined company will operate as Baird Medical Investment Holdings Ltd. and be listed on the Nasdaq under the new ticker symbol BDMD. The combined company will have an estimated post-transaction enterprise value of $370 million, assuming 50 percent redemptions by ExcelFin public shareholders. Proceeds from the transaction will be used to fund growth. The transaction includes a $15 million minimum closing cash condition. To facilitate the transaction, Grand Fortune Capital, sponsor affiliate of ExcelFin, has agreed to purchase $8.8 million of Baird Medical’s current debt from BOCI Investment Limited, one of Betters’ current preferred shareholders. Baird Medical is a microwave ablation medical device developer and provider in China to treat for several tumor types. According to Frost & Sullivan, Baird Medical is the largest MWA medical device provider for thyroid nodules and breast lump treatment in China.

Expected Closing: Q4 2023 if it clears regulators and shareholders

ExcelFin’s Financial and Capital Markets Advisor: Cohen & Co. Capital Markets, a division of J.V.B. Financial Group, and Exos Securities

ExcelFin’s Outside Counsel: Shearman & Sterling led by Bill Nelson, Emily Leitch, Alain Dermarkar, and Larry Crouch. The team included Michael Walraven, Emily Kelly, Emily Greenwood, John Kurtz, Samantha Favela, Tim Doyle, Dillon Tan, Michael Buiteweg, John Menke, Judy Little, Crystal Gao, Leo Wong and Rami Marginean.

Baird Medical’s Outside Counsel: Dechert

Cohen’s Outside Counsel: Ropes & Gray

NextDecade receives $219.4M in equity investments from TotalEnergies

Deal Description: NextDecade Corp. announced June 14 that it entered into framework agreements with Global Infrastructure Partners and TotalEnergies to enable the final investment decision for the Rio Grande LNG project Trains 1, 2 and 3 and to provide momentum for the further development of Train 4 and Train 5 as well as a future carbon capture and sequestration project. As part of such transaction, TotalEnergies agreed to acquire in three tranches a 17.5 percent common stock position in NextDecade for $219.4 million. NextDecade continues to target FID on Phase 1 by the end of the second quarter with FIDs of its remaining trains to follow.

NextDecade’s Outside Counsel: Latham & Watkins on the private investment into public equity by Houston partner Ryan Maierson with associates Om Pandya, Anthony Tan and Tasbiha Batool; and on framework and financing by New York and Houston partners Jason Webber, Hamad Al-Hoshan, and Chris Peponis.

Faraday Future attracts $105M from ATW, Senyun

Deal Description: Sidley Austin said June 27 it represented Faraday Future Intelligent Electric Inc., a California-based global shared intelligent electric mobility ecosystem company, on its additional funding commitment of $90 million plus the acceleration of an existing commitment of $15 million from affiliates of ATW Partners and Senyun International, a unit of Hong Kong’s Daguan International.

From Sidley: Partners Vijay Sekhon in San Francisco, Banks Bruce in Dallas and Michael Heinz in Chicago and associates Kendra Smith and Caroline Roberts in Dallas, Christine Duque in Chicago and Feifei Bian in Century City

Opposing counsel: Kelley Drye & Warren and Blank Rome for ATW and Olshan Frome Wolosky for Senyun

Hess Midstream repurchases $100M in units from Hess Corp., GIP

Deal Description: Hess Midstream Partners announced June 27 the execution of a definitive agreement providing for the $100 million repurchase of Class B units of HESM by its subsidiary, Hess Midstream Operations, from affiliates of Hess Corp. and Global Infrastructure Partners, HESM’s sponsors. The purchase price per Class B unit is $29.85, the closing price of the Class A shares on June 26. As a result of the unit repurchase transaction, public ownership of HESM on a consolidated basis will increase to 24 percent. The unit repurchase is expected to close on June 29. HESM expects to fund the unit repurchase through borrowings under its existing revolving credit facility.

Hess Midstream Conflicts Committee’s Outside Counsel: Gibson, Dunn & Crutcher led by partner Hillary Holmes and includes associates Stella Tang and Iris Hill Crabtree.

Counsel to Conflicts Committee’s Financial Advisor: Baker Botts led by partner Josh Davidson and associate Catherine Baker Ellis

Cart.com raises $60M from B. Riley, others

Deal Description: Cart.com, an Austin-based provider of e-commerce enablement solutions, raised $60 million in Series C funding. The investors included B. Riley Venture Capital, Kingfisher Investment Advisors, Snowflake Ventures, Prosperity7 Ventures, Legacy Knight and other strategic corporate and financial investors. It gives the company a valuation of $1.2 billion, an increase of nearly 50 percent since its Series B funding in February 2022. Cart.com will use the new investment to meet increased demand from enterprise and B2B clients, accelerate its international expansion and expand product development across its software portfolio. Founded in November 2020, Cart.com has almost 6,000 brands on its platform and the company claims it grew 2022 revenue by more than 500 percent across its software, services and fulfillment offerings and doubled its gross merchandise value and fulfillment footprint. The lead investor, Dallas-based Legacy Knight, provides capital ranging from $10 million to $50 million to growth stage companies throughout the U.S.

Cart.com’s In-House Counsel: Gregg Goldstein is general counsel

Cart.com’s Outside Counsel: Wes Watts at Gunderson Dettmer

Strategic/Financial Advisor: FT Partners

Legacy Knight’s Outside Counsel: Blank Rome

MVP Index scores $20M in Series B funding

Deal Description: Albany, N.Y.- based investment firm Verance Capital announced June 26 that it agreed to contribute $20 million in Series B funding to MVP Index, an Austin-based data provider that specializes in benchmarking the value of branded products, endorsements, media rights and other marketing channels. MVP’s roster of partners includes Fortune 500 brands such as Amazon, Apple/Beats by Dre, Ally Financial and Ford. MVP has established itself as the trusted currency for the NHL, PGA TOUR, Dallas Cowboys and Fenway Sports Group. Verance is focused on sports, media, and live entertainment.

Verance Outside Legal Advisor: Winston & Strawn advised Albany-headquartered Verance, led by Chicago partner Benjamin Kern supported from Texas by Houston associate Nnamdi Ezenwa

OneRock Energy to acquire Powder River Basin assets

Deal Description: OneRock Energy Holdings, a Houston upstream oil and gas private equity firm backed by Pan Management, announced June 28 that it is acquiring Northwoods Management Co. along with several related entities. No terms were disclosed, but Northwoods owns 160,000 acres of productive assets in the Powder River Basin, most of them contiguous across three counties in Wyoming. Daniel Fan, who heads E&P investments at Pan, said the company isn’t finished acquiring assets, particularly in resource-rich, unconventional plays, with the intesion of leveraging the OneRock platform to strategically expand its footprint.

Expected Closing: Q3 2023

OneRock’s Outside Counsel: Willkie, Farr & Gallagher led by partners Brad Honeycutt and Tan Lu along with associates Sidney Nunez and Hayden Kursh

Northwoods’ Outside Counsel: Vinson & Elkins with a team led by John Grand, Elena Sauber, Dan Komarek, Patrick Whelan and Maram Mahajna

Dataprise buys RevelSec

Deal Description: O’Melveny said June 27 it advised Dataprise, a Rockville, Md., provider of managed IT, cybersecurity and cloud solutions, on its acquisition of RevelSec, a security-first managed service provider in Houston. Terms weren’t disclosed. The transaction, which was announced on June 21, will expand Dataprise’s national footprint and add vertical expertise while providing RevelSec clients access to Dataprise’s services. Founded in 1995, Dataprise delivers managed cybersecurity, disaster recovery as a service, managed infrastructure, cloud and managed end-user services. It is a portfolio company of Trinity Hunt Partners, a growth-oriented private equity firm. Since 2011, RevelSec has been helping clients protect their data through cybersecurity, cloud and managed services.

From O’Melveny: The team was led by partner and Dallas office head Chrissy Metcalf and associate Kelsey French and included partners Kim Williams and Ryan Cicero, counsel Cody Dreibelbis and associate Sarah Nelson.

Lapis Energy inks carbon capture/sequestration JV with Denbury

Deal Description: Lapis Energy announced June 27 that it formed a joint venture with a subsidiary of Denbury Inc. to design, implement and operate a carbon dioxide sequestration project at its 14,000-acre carbon storage site in St Charles Parish, Louisiana, about 20 miles west of New Orleans. Terms weren’t disclosed. Each party will have a 50 percent interest in a newly formed project company, Libra CO2 Storage Solutions. Lapis will lead implementation of the project for Libra through the Class VI permitting process, pre-FID phase and initial construction, with Denbury assuming operatorship and later construction management when it begins injection. Denbury intends to connect the sequestration site to its CO2 pipeline network in southeast Louisiana with a 45-mile pipeline connection. Denbury has committed volumes to support the initial development of the site contingent on achieving Class VI injection approval and project sanction, with first injection scheduled for 2027. Libra believes that the site has the potential to hold at least 200 million metric tons of CO2 and, because of its close proximity to industrial hubs, has the potential to become a regional hub decarbonization site. Lapis is backed by Cresta Fund Management, a Dallas investment manager with more than $1.4 billion of assets under management specializing in middle market sustainable infrastructure.

Lapis/Libra Outside Counsel: Baker Botts with transaction leads Jason Bennett, Sarah Dodson, Kyle Doherty, Natasha Gandhi and Taylor López. On real estate matters: Daniel Kruger; and on Tax: Jon Lobb, Barbara De Marigny and Jared Meier.

Aeglea BioTherapeutics acquires Spyre Therapeutics

Deal Description: Aeglea BioTherapeutics Inc. of Austin announced June 22 it completed the acquisition of Waltham, Mass.-based Spyre Therapeutics Inc., a privately held biotechnology company advancing a pipeline of antibody therapeutics with the potential to transform the treatment of inflammatory bowel disease. Concurrent with the acquisition of Spyre, Aeglea entered into a definitive agreement for the sale of Series A non-voting convertible preferred stock in a private placement to a group of institutional accredited investors led by Fairmount Funds Management with participation from Fidelity Management & Research Co., Venrock Healthcare Capital Partners, Commodore Capital, Deep Track Capital, Perceptive Advisors, RTW Investments, Cormorant Asset Management, Driehaus Capital Management, Ecor1 Capital, RA Capital Management, Citadel unit Surveyor Capital and Wellington Management Company and additional undisclosed institutional investors. The private placement is expected to result in gross proceeds to Aeglea of $210 million before deducting placement agent and other offering expenses. The proceeds from the private placement are intended to be used to advance Spyre’s portfolio of potentially best-in-class IBD products through multiple data milestones and are expected to fund operations into 2026.

Aeglea Board’s Financial Advisor: Wedbush PacGrow and Houlihan Lokey Financial Advisors

Aeglea’s Outside Counsel: Cooley led by Bill Sorabella in New York

Spyre’s Placement Agents: Jefferies, TD Cowen, Stifel and Guggenheim Securities

Spyre’s Outside Counsel: Gibson, Dunn & Crutcher led by Ryan Murr in San Francisco

Firefly buys Spaceflight

Deal Description: Texas-based Firefly Aerospace announced June 8 the acquisition of Spaceflight Inc. to strengthen Firefly’s on-orbit solutions and service the lifecycle of customers’ satellites and spacecraft. Terms of the transaction were not disclosed. The acquisition further supports Firefly’s portfolio of low-cost space transportation services, including responsive launch and in-space mobility, on-orbit hosting and servicing, and lunar delivery operations. Firefly also bought Virgin Orbit’s remaining assets out of bankruptcy for $3.8 million, according to reports. Firefly, founded by a former SpaceX engineer, is a portfolio company of AE Industrial Partners, a U.S.-based private equity firm specializing in aerospace, defense and government services, space, power and utility services and industrial markets.

CAPITAL MARKETS/FINANCINGS

Earthstone finances earlier acquisition with $500M notes offer

Deal Description: In a financing followup to its $1.5 billion in deals announced two weeks ago, Earthstone Energy Holdings announced pricing for its $500 million private offering of 9.875% senior notes due 2031 at 97.968% of their principal amount. The private offering, announced June 27, closed on June 30. The company intends to use the proceeds to help pay for the transaction. Earthstone, based in The Woodlands, announced that it was acquiring privately held Novo Oil & Gas for $1.5 billion and selling a one-third interest in the deal to Northern Oil & Gas. Details on those deals are available here.

Initial Purchasers’ Outside Counsel: Latham & Watkins with a Texas-based team led by Austin partners David Miller and Michael Chambers and Houston partner Monica White, with associates Michael Pascual, David Socol de la Osa, and Carol Bale. Tax matters were covered by Houston partner Bryant Lee, with associate Dylan White; and on environmental matters by Houston partner Joshua Marnitz.

Howard Midstream offers $500M in notes

Deal Description: In a Rule 144A private offering completed June 29, San Antonio-based Howard Midstream Energy Partners announced that it had placed $500 million of 8.875% senior notes due 2028. The notes will pay interest semi-annually and are guaranteed on an unsecured basis by the company. Howard Midstream intends to use net proceeds to pay down its revolving credit facility.

Initial Purchasers’ Outside Counsel: Baker Botts with a team led from Houston by corporate partners Josh Davidson and Doug Getten along with Houston associates Catherine Ellis, Chandler Block and Sarah Dyer and Austin associate Will Cozzens. The team also included Austin finance partner Clint Culpepper and Houston finance associate Reagan Vicknair.

Kodiak Gas Services prices IPO at $256M

Deal Description: In a rare oil and gas services IPO, contract compression infrastructure provider Kodiak Gas Services set the price of its offering of 16 million common shares at $16 per share. The Montgomery, Texas-based company opened its first day of trading on the NYSE on June 29 slightly below $16 per share, but rebounded just past the target on its second day to $16.24.

Book Running Managers: Goldman Sachs, J.P. Morgan and Barclays are serving as lead book-running managers for the offering. BofA Securities, Raymond James, RBC Capital Markets, Stifel, Truist Securities and TPH&Co., the energy business of Perella Weinberg Partners, are book-running managers while Comerica Securities, Fifth Third Securities, Regions Securities, Texas Capital Securities, AmeriVet Securities, Guzman & Company, R. Seelaus & Co, and Siebert Williams Shank are co-managers.

Underwriters‘ Outside Counsel: Latham & Watkins with a corporate team led by Houston partners Ryan Maierson and Nick Dhesi, along with associates Om Pandya, Sydney Verner and Brian Bruzzo. Tax matters were advised by Houston partner Bryant Lee with associate Chelsea Muñoz-Patchen; benefits matters by Washington, D.C. partner Adam Kestenbaum and Houston counsel Krisa Benskin; and environmental matters by Los Angeles/Houston partner Josh Marnitz with associate Jacqueline Zhang.

Kodiak’s Outside Counsel: Kirkland & Ellis led by capital markets partners Matt Pacey, Jennifer Wu and Atma Kabad and associates Nick Wetzeler, Taylor Santori, Logan Krulish and Ben Sharp with debt finance partners Lucas Spivey and Jordan Roberts and associate Steven Keithley; corporate partners John Pitts, Brittany Sakowitz and Ahmed Sidik; tax partner Mark Dundon; and executive compensation partner Stephen Jacobson.

Gulfport closes $142M offering of shares by selling stockholders

Deal Description: Kirkland & Ellis said June 27 it counseled Gulfport Energy Corp. on the closing of the previously announced underwritten offering of 1.5 million shares of its common stock by selling stockholders, resulting in gross proceeds of $142 million. BofA Securities, J.P. Morgan and Evercore ISI were book-running managers. Gulfport is an independent exploration and production company focused on the exploration, acquisition and production of natural gas, crude oil and NGL in the U.S. with primary focus in the Appalachia and Anadarko basins. Our principal properties are located in Ohio targeting the Utica formation and in Oklahoma targeting the SCOOP Woodford and SCOOP Springer formations.

From Kirkland: The team was led by capital markets partners Michael Rigdon, Sean Wheeler and Atma Kabad and associates Nick Wetzeler, Robbie Dillard and Taylor Santori with assistance from tax partners David Wheat and Rebecca Fine and associate Lauren Deutsch.