At the CDT Roundup we like numbers; especially big numbers. Look at the headline above: numbers.

We especially like big numbers. If it has the word “billion” behind it; we take notice. Just last week we referred to 2023 in Texas as “The Year of the Billion-Dollar M&A Deal.”

Over the year, dealmakers reported that their deal pipelines remained steady but timetables were sometimes stretched: by fears of inflation, wobbly commodity prices and hard-earned buyer caution.

With 130 M&A deals ringing up at $1 billion or more, the moniker seemed to suit. In 2022, for instance, there were 75. That’s a 73 percent increase in seven-figure transactions in a single year, a sharp increase by any standard. Moreover, it was nearly 20 percent higher than 2021, the record bounce-back year from pandemic paralysis, which saw what seemed at the time an astonishing 110 deals of $1 billion or more.

Q4 2023 even included a string of five Texas-related megadeals ($10 billion or more) and two valued at more than $50 billion (ExxonMobil/Pioneer Natural Resources and Chevron/Hess), adding punctuation to the record-breaking run.

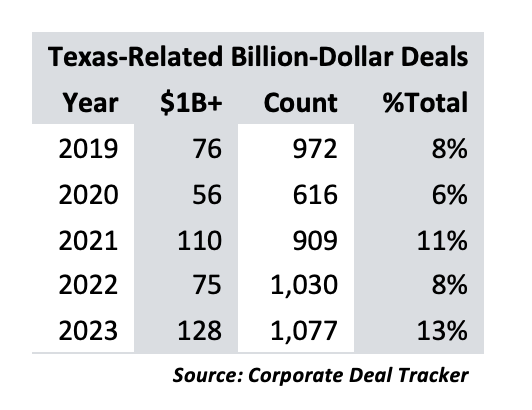

To refresh your memory, here’s what the last five years have looked like. Note: A “Texas-related” M&A transaction is a deal involving Texas-headquartered parties or Texas-based lawyers.

But numbers aren’t always what they seem. And while inflation — or even fear of inflation — can create uncertainty on both sides of a deal, it can also affect the price of a deal. Ask anyone who’s purchased a carton of eggs in the last two years.

Which leads us to this question: Is the astonishing rise in billion-dollar deals a product of inflation? Or is something else going on?

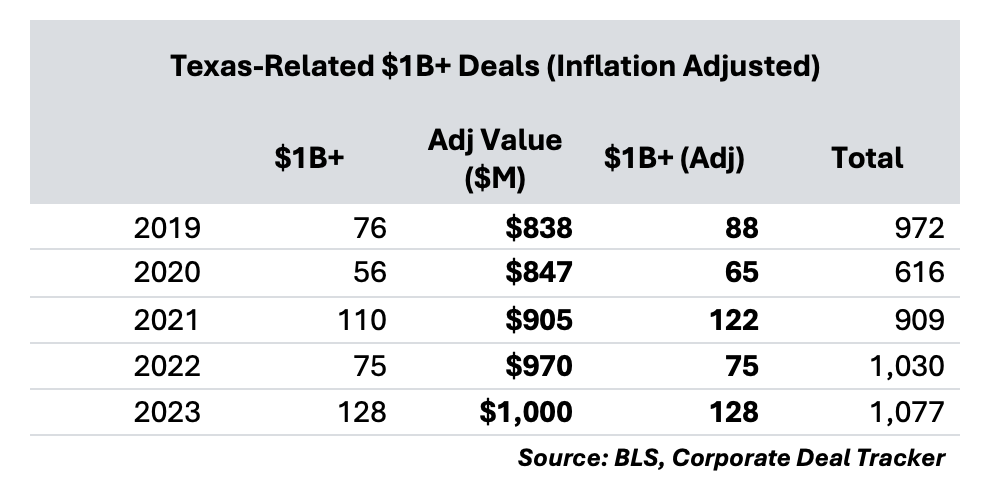

We decided to reexamine our own data on billion-dollar deals to see how many deals over the past five years would have broken the seven-figure threshold when adjusted for inflation.

We kept the math simple. Adjusting for inflation (as calculated by the U.S. Bureau of Labor Statistics), a deal worth $838 million in 2019 would be worth $1 billion in 2023. A deal worth $847 million in 2020 would have been worth $1 billion in 2023. And so on. By returning to our Corporate Deal Tracker data, we’ve readjusted the billion-dollar deal counts for each year. Here’s what that looks like:

Even adjusted for inflation, 2023 still had more billion-dollar deals than any of the past five years. In 2021, that record year, there were 110 deals valued at $1 billion or more. Adjusted for inflation, that rose to 122, still lower than the 128 $1B+ deals recorded in 2023.

So, what does that mean? On the surface, it means that big deals are, in fact, a thing. In coming weeks we’ll have more on where those large-scale deals are coming from and what they mean in such critical sectors like oil & gas, technology and infrastructure. We’ll also report some surprising trends at the lower end of the scale.

But for those who like big numbers, there was much to like about 2023.

Same goes for the early returns of 2024. The week ending Jan. 13 saw 17 deals reported for an aggregate $33.6 billion. That includes four M&A deals valued at $950 million or more. Compare that to last week’s eight deals for $7.9 billion and 11 deals for $2.8 billion this time last year.

Weekly Corporate Deal Tracker Roundup Stats

A compilation of weekly stats from The Lawbook's CDT Weekly Roundup

(Deal Values in Millions)

(Deal Values in Millions)

| Deal Count | Amount | Firms | Lawyers | M&A Count | M&A Value $M | CapM Count | ||

|---|---|---|---|---|---|---|---|---|

| 7-Feb-26 | 8 | $316,505 | 11 | 203 | 8 | $316,505 | 0 | 0 |

| 31-Jan-26 | 11 | $3,985 | 8 | 72 | 7 | $135 | 4 | $3,850 |

| 24-Jan-26 | 8 | $1,340 | 5 | 120 | 7 | $985 | 1 | $355 |

| 17-Jan-26 | 19 | $18,440 | 10 | 203 | 13 | $12,963 | 6 | $5,477 |

| 10-Jan-26 | 18 | $8,958 | 12 | 182 | 17 | $8,358 | 1 | $600 |

| 03-Jan-26 | 2 | $1,519 | 2 | 17 | 1 | $18.8 | 1 | $1,500 |

| 27-Dec-25 | 2 | $3,200 | 2 | 15 | 2 | $3,200 | 0 | 0 |

| 20-Dec-25 | 11 | $10,167 | 8 | 96 | 7 | $7,411 | 4 | $2,756 |

| 13-Dec-25 | 15 | $9,952 | 10 | 211 | 11 | $6,267 | 4 | $3,686 |

| 06-Dec-25 | 16 | $9,947 | 11 | 94 | 13 | $8,091 | 3 | $1,856 |

| 29-Nov-25 | 6 | $4,075 | 5 | 60 | 2 | $175 | 4 | $3,900 |

| 22-Nov-25 | 20 | $5,546 | 14 | 166 | 14 | $3,309 | 6 | $2,238 |

| 15-Nov-25 | 16 | $16,373 | 11 | 136 | 8 | $4,790 | 8 | $11,583 |

| 08-Nov-25 | 21 | $75,919 | 15 | 191 | 15 | $70,630 | 6 | $5,289 |

| 01-Nov-25 | 20 | $25,927 | 12 | 152 | 14 | $21,455 | 6 | $4,472 |

| 25-Oct-25 | 19 | $61,470 | 14 | 262 | 18 | $60,894 | 1 | $576 |

| 18-Oct-25 | 14 | $47,792 | 12 | 130 | 13 | $46,592 | 1 | $1,200 |

| 11-Oct-25 | 14 | $17,361 | 9 | 104 | 7 | $14,444 | 7 | $2,917 |

| 04-Oct-25 | 21 | $20,843 | 15 | 236 | 10 | $15,376 | 11 | $5,467 |

| 27-Sept-25 | 16 | $22,774 | 12 | 219 | 10 | $19,103 | 6 | $3,671 |

| 20-Sept-25 | 24 | $11,305 | 13 | 238 | 16 | $6,209 | 8 | $5,096 |

| 13-Sept-25 | 20 | $26,575 | 11 | 225 | 12 | $20,971 | 8 | $5,604 |

| 06-Sept-25 | 19 | $8,622 | 12 | 190 | 13 | $2,880 | 6 | $8,622 |

| 30-Aug-25 | 10 | $6,569 | 9 | 109 | 7 | $3,519 | 3 | $3,050 |

| 23-Aug-25 | 23 | $15,207 | 10 | 129 | 18 | $14,500 | 5 | $707 |

| 16-Aug-25 | 13 | $26,405 | 12 | 149 | 7 | $3,180 | 6 | $23,225 |

| 09-Aug-25 | 19 | $16,066 | 16 | 245 | 15 | $11,307 | 4 | $4,759 |

| 02-Aug-25 | 17 | $19,480 | 11 | 104 | 13 | $18,002 | 4 | $1,478 |

| 26-Jul-25 | 15 | $3,164 | 12 | 96 | 12 | $3,0023 | 3 | $162 |

| 19-Jul-25 | 14 | $6,080 | 14 | 97 | 9 | $4,165 | 5 | $1,915 |

| 12-Jul-25 | 15 | $13,012 | 14 | 208 | 12 | $10,902 | 3 | $2,110 |

| 05-Jul-25 | 9 | $15,778 | 8 | 91 | 4 | $7,280 | 5 | $8,498 |

| 28-Jun-25 | 13 | $7,777 | 8 | 154 | 7 | $2,031 | 6 | $5,746 |

| 21-Jun-25 | 16 | $5,984 | 10 | 113 | 11 | $3,087 | 5 | $2,897 |

| 14-Jun-25 | 9 | $478 | 8 | 133 | 6 | 0 | 3 | $478 |

| 07-Jun-25 | 16 | $26,210 | 11 | 196 | 11 | $24,744 | 5 | $1,466 |

| 31-May-25 | 19 | $23,381 | 11 | 166 | 12 | $18,665 | 7 | $4,717 |

| 24-May-25 | 15 | $24,033 | 11 | 121 | 13 | $23,624 | 2 | $409 |

| 17-May-25 | 16 | $21,760 | 12 | 145 | 11 | $18,615 | 5 | $3,145 |

| 10-May-25 | 24 | $33,175 | 16 | 206 | 19 | $30,765 | 5 | $2,410 |

| 03-May-25 | 11 | $4,249 | 13 | 90 | 11 | $2,226.5 | 2 | $2,022.5 |

| 26-Apr-25 | 12 | $8,787 | 9 | 168 | 9 | $6,011 | 3 | $2,776 |

| 19-Apr-25 | 11 | $8,097 | 7 | 138 | 9 | $7,985 | 2 | $112 |

| 12-Apr-25 | 13 | $2,392 | 8 | 152 | 10 | $2,065 | 3 | $327 |

| 05-Apr-25 | 19 | $27,762 | 15 | 188 | 16 | $25,473 | 3 | $2,289 |

| 29-Mar-25 | 21 | $8,188 | 10 | 258 | 16 | $4,125 | 5 | $4,064 |

| 22-Mar-25 | 19 | $6,485 | 14 | 231 | 15 | $4,128 | 4 | $2,857 |

| 15-Mar-25 | 13 | $13,737 | 13 | 151 | 10 | $9,932 | 4 | $3,805 |

| 8-Mar-25 | 7 | $2,234 | 5 | 66 | 5 | $224 | 2 | $2,100 |

| 1-Mar-25 | 11 | $3,050 | 8 | 75 | 10 | $2,550 | 1 | $500 |

| 22-Feb-25 | 12 | $16,397 | 7 | 149 | 6 | $6,635 | 6 | $9,862 |

| 15-Feb-25 | 17 | $12,136 | 13 | 134 | 10 | $9,411 | 2 | $2,725 |

| 8-Feb-25 | 14 | $7,154 | 9 | 179 | 9 | $4,950 | 5 | $2,204 |

| 1-Feb-25 | 16 | $10,068 | 7 | 200 | 11 | $7,553 | 5 | $2,515 |

| 25-Jan-25 | 14 | $10,261 | 10 | 125 | 9 | $2,207 | 5 | $8,054 |

| 18-Jan-25 | 19 | $7,382 | 15 | 316 | 12 | $2,300 | 7 | $5,082 |

| 11-Jan-25 | 21 | $33,560 | 16 | 187 | 16 | $32,521 | 5 | $1,039 |

| 4-Jan-25 | 9 | $6,827 | 9 | 80 | 9 | $6,827 | 0 | 0 |

| 21-Dec-24 | 11 | $2,798 | 11 | 92 | 8 | $2,229 | 3 | $570 |

| 14-Dec-24 | 15 | $5,323 | 12 | 186 | 12 | $3,812 | 3 | $1,511 |

| 07-Dec-24 | 16 | $4,766 | 10 | 231 | 11 | $2,321 | 5 | 2,445 |

| 30-Nov-24 | 10 | $10,291 | 9 | 103 | 4 | $8,290 | 6 | $2.001 |

| 23-Nov-24 | 15 | $4,553 | 15 | 153 | 11 | $3,379 | 4 | $1,174 |

| 16-Nov-24 | 17 | $11,488 | 11 | 245 | 13 | $10,186 | 4 | $1,303 |

| 09-Nov-24 | 14 | $2,110 | 12 | 139 | 12 | $1,410 | 2 | $700 |

| 02-Nov-24 | 12 | $52,788 | 11 | 107 | 11 | $52,738 | 1 | $50 |

| 26-Oct-24 | 8 | $3,160 | 8 | 65 | 7 | $3,065 | 1 | $75 |

| 19-Oct-24 | 12 | $5,304 | 11 | 136 | 11 | $4,554 | 1 | $750 |

| 12-Oct-24 | 17 | $8,438 | 12 | 150 | 15 | $8,116 | 2 | $322 |

| 05-Oct-24 | 22 | $23,181 | 12 | 189 | 15 | $19,980 | 7 | $3,201 |

| 28-Sep-24 | 11 | $2,356 | 7 | 144 | 7 | $53 | 4 | $2,303 |

| 21-Sep-24 | 12 | $9,568 | 10 | 169 | 5 | $4,101 | 7 | $5,467 |

| 14-Sep-24 | 24 | $10,988 | 12 | 235 | 16 | $7,175 | 8 | $3,813 |

| 7-Sep-24 | 12 | $20,420 | 16 | 168 | 11 | $20,307 | 1 | $112.9 |

| 31-Aug-24 | 13 | $20,631 | 9 | 134 | 12 | $14,775 | 1 | $5,856 |

| 24-Aug-24 | 19 | $8,452 | 21 | 325 | 16 | $7,102 | 3 | $1,350 |

| 17-Aug-24 | 25 | $49,196 | 16 | 304 | 11 | $39,386 | 14 | $9,810 |

| 10-Aug-24 | 20 | $12,264 | 15 | 312 | 16 | $9,794 | 4 | $2,470 |

| 03-Aug-24 | 26 | $16,498 | 16 | 334 | 18 | $8,137 | 8 | $8,361 |

| 27-Jul-24 | 19 | $16,442 | 21 | 271 | 15 | $13,838 | 4 | $2,604 |

| 20-Jul-24 | 15 | $16,016 | 14 | 184 | 10 | $14,232 | 5 | $1,784 |

| 13-Jul-24 | 20 | $17,220 | 14 | 265 | 18 | $7,146 | 2 | $10,074 |

| 6-Jul-24 | 11 | $3,941 | 11 | 95 | 8 | $2,650 | 3 | $1,291 |

| 29-Jun-24 | 14 | $6,296 | 15 | 224 | 8 | $6,296 | 6 | $1,927 |

| 22-Jun-24 | 12 | $5,679 | 8 | 137 | 5 | $210 | 7 | $5,469 |

| 15-Jun-24 | 13 | $9,895 | 16 | 214 | 10 | $5,280 | 3 | $4,615 |

| 8-Jun-24 | 19 | $23,859 | 13 | 239 | 12 | $19,436 | 7 | $4,423 |

| 1-Jun-24 | 12 | $34,510 | 11 | 147 | 9 | $26,110 | 3 | $8,400 |

| 25-May-24 | 13 | $9,684 | 15 | 171 | 10 | $4,434 | 3 | $5,250 |

| 18-May-24 | 11 | $5,490 | 11 | 173 | 8 | $3,129 | 3 | $2,361 |

| 11-May-24 | 22 | $14,855 | 14 | 227 | 16 | $11,105 | 6 | $3,750 |

| 4-May-24 | 13 | $3,139 | 9 | 87 | 10 | $1,297 | 3 | $1,842 |

| 27-Apr-24 | 10 | $6,684 | 6 | 28 | 10 | $6,684 | 0 | 0 |

| 20-Apr-24 | 19 | $15,989 | 11 | 147 | 9 | $5,208 | 10 | $10,781 |

| 13-Apr-24 | 13 | $8,952 | 9 | 76 | 10 | $1,652 | 3 | $7,300 |

| 6-Apr-24 | 23 | $26,616 | 14 | 222 | 14 | $13,501 | 8 | $13,116 |

| 30-Mar-24 | 12 | $9,286 | 8 | 136 | 8 | $4,299 | 4 | $4,987 |

| 23-Mar-24 | 18 | $5,451 | 17 | 266 | 16 | $4,759 | 2 | $692 |

| 16-Mar-24 | 21 | $11,437 | 13 | 186 | 14 | $9,316 | 6 | $2,070 |

| 9-Mar-24 | 23 | $4,695 | 21 | 218 | 19 | $2,723 | 4 | $1,972 |

| 2-Mar-24 | 20 | $9,108 | 19 | 372 | 14 | $4,558 | 6 | $4,550 |

| 24-Feb-24 | 19 | $16,382 | 12 | 248 | 15 | $9,507 | 4 | $6,875 |

| 17-Feb-24 | 16 | $29,932 | 15 | 157 | 12 | $29,216 | 4 | $716 |

| 10-Feb-24 | 25 | $10,750 | 17 | 196 | 19 | $5,372 | 6 | $5,379 |

| 3-Feb-24 | 12 | $8,416 | 18 | 125 | 9 | $3,416 | 3 | $5,000 |

| 27-Jan-24 | 9 | $8,165 | 9 | 87 | 8 | $7,815 | 1 | $800 |

| 20-Jan-24 | 14 | $4,084 | 12 | 109 | 12 | $3,219 | 2 | $865 |

| 13-Jan-24 | 17 | $33,588 | 12 | 256 | 12 | $26,765 | 5 | $6,823 |

| 6-Jan-24 | 8 | $7,915 | 8 | 84 | 6 | $7,265 | 2 | $650 |

| 30-Dec-23 | 17 | $14,599 | 12 | 99 | 15 | $2,714 | 2 | $11,885 |

| 23-Dec-23 | 23 | $4,182 | 13 | 219 | 16 | $1,813 | 7 | $2,370 |

| 16-Dec-23 | 13 | $16,436 | 13 | 280 | 7 | $15,150 | 5 | $1,286 |

| 9-Dec-23 | 26 | $14,633.90 | 17 | 244 | 16 | $8,095 | 10 | $6,538.90 |

| 2-Dec-23 | 13 | $6,720 | 9 | 57 | 12 | $6,630 | 1 | $90 |

| 25-Nov-23 | 9 | $4,835 | 9 | 131 | 6 | $1,785 | 3 | $3,050 |

| 18-Nov-23 | 22 | $6,568.70 | 17 | 184 | 14 | $4,709.20 | 8 | $1,859.50 |

| 11-Nov-23 | 15 | $9,825 | 13 | 179 | 12 | $6,581 | 3 | $3,244 |

| 4-Nov-23 | 15 | $20,582.50 | 14 | 193 | 12 | $19,417.50 | 3 | $1,165 |

| 28-Oct-23 | 18 | $68,419.10 | 18 | 152 | 15 | $66,646 | 3 | $1,773.10 |

| 21-Oct-23 | 16 | $6,755.90 | 16 | 165 | 15 | $6,755.90 | 1 | $3 |

| 14-Oct-23 | 14 | $67,851.20 | 13 | 125 | 9 | $61,998.50 | 5 | $5,852.70 |

| 7-Oct-23 | 17 | $6,595.50 | 13 | 228 | 16 | $5,995.50 | 1 | $600 |

| 30-Sep-23 | 17 | $1,896.45 | 13 | 189 | 14 | $806.45 | 3 | $1,090 |

| 23-Sep-23 | 23 | $6,432.70 | 17 | 230 | 16 | $1,402.80 | 7 | $5,029.90 |

| 16-Sep-23 | 25 | $23,226.70 | 23 | 353 | 16 | $17,239 | 9 | $5,987.70 |

| 9-Sep-23 | 12 | $6,369 | 8 | 102 | 7 | $4,311 | 5 | $2,058 |

| 2-Sep-23 | 14 | $2,522 | 6 | 92 | 13 | $1,322 | 1 | $1,200 |

| 26-Aug-23 | 17 | $12,160.25 | 13 | 202 | 15 | $6,573.25 | 2 | $5,587.00 |

| 19-Aug-23 | 19 | $11,505 | 13 | 213 | 15 | $11,255 | 4 | $250 |

| 12-Aug-23 | 19 | $9,698.80 | 13 | 184 | 7 | $3,270 | 12 | $6,428.80 |

| 5-Aug-23 | 13 | $5,201 | 12 | 118 | 12 | $5,051 | 1 | $150 |

| 29-Jul-23 | 15 | $21,031.60 | 13 | 196 | 11 | $18,292.00 | 4 | $2,739.60 |

| 22-Jul-23 | 18 | $3,992 | 12 | 130 | 13 | $2,808 | 5 | $1,184 |

| 15-Jul-23 | 13 | $8,254.95 | 13 | 81 | 13 | $8,254.95 | 0 | 0 |

| 8-Jul-23 | 16 | $5,441.45 | 12 | 172 | 11 | $2,443 | 5 | $2,998.45 |

| 1-Jul-23 | 16 | $6,872 | 10 | 105 | 12 | $5,474 | 4 | $1,398 |

| 24-Jun-23 | 13 | $10,914 | 16 | 201 | 10 | $7,874 | 3 | $3,040 |

| 17-Jun-23 | 17 | $5,880.70 | 15 | 151 | 15 | $4,705.70 | 2 | $1,175 |

| 10-Jun-23 | 19 | $8,516.10 | 13 | 111 | 16 | $6,252.40 | 3 | $2,263.70 |

| June 3 2023 | 12 | $6,104.42 | 12 | 138 | 8 | $4,256.92 | 4 | $1,847.50 |

| 27-May-23 | 17 | $12,200 | 10 | 67 | 11 | $6,165 | 6 | $6,035 |

| 20-May-23 | 11 | $22,458.10 | 8 | 103 | 4 | $19,455 | 7 | $3,003 |

| 13-May-23 | 12 | $7,034 | 10 | 101 | 8 | $5,460 | 4 | $1,574 |

| 6-May-23 | 20 | $3,297.60 | 18 | 196 | 17 | $2,985.60 | 3 | $312 |

| 29-Apr-23 | 23 | $3,691.20 | 18 | 135 | 17 | $1,969.70 | 6 | $1,721.50 |

| 22-Apr-23 | 16 | $5,570 | 14 | 104 | 14 | $4,750 | 2 | $1,000 |

| 15-Apr-23 | 12 | $23,818.10 | 9 | 59 | 10 | $21,618.10 | 2 | $2,200 |

| 8-Apr-23 | 16 | $7,949 | 9 | 173 | 9 | $5,472 | 7 | $3,477 |

| 1-Apr-23 | 21 | $18,676.70 | 12 | 175 | 11 | $10,926.70 | 10 | $7,750 |

| 25-Mar-23 | 15 | $8,779.50 | 10 | 141 | 5 | $2,362 | 10 | $6,416.50 |

| 18-Mar-23 | 7 | $14,048.80 | 6 | 69 | 5 | $13,345 | 2 | $703.80 |

| 11-Mar-23 | 21 | $11,576 | 16 | 165 | 16 | $8,131 | 5 | $3,445 |

| 4-Mar-23 | 20 | $9,668 | 11 | 228 | 16 | $8,209 | 4 | $1,459 |

| 25-Feb-23 | 13 | $5,335 | 13 | 130 | 12 | $4,235 | 1 | $1,200 |

| 18-Feb-23 | 14 | $5,743.70 | 13 | 158 | 8 | $898.70 | 6 | $4,845 |

| 11-Feb-23 | 16 | $12,088 | 12 | 137 | 12 | $9,965 | 4 | $2,123 |

| 4-Feb-23 | 17 | $8,066 | 15 | 140 | 13 | $5,614 | 4 | $2,452 |

| 28-Jan-23 | 7 | $2,180 | 7 | 75 | 5 | $1,692.75 | 2 | $488 |

| 21-Jan-23 | 17 | $5,768 | 16 | 174 | 12 | $1,918 | 5 | $3,850 |

| 14-Jan-23 | 11 | $2, 800 | 10 | 102 | 8 | $421 | 3 | $2,400 |

| 7-Jan-23 | 18 | $8,296 | 11 | 167 | 14 | $6,461 | 3 | $1,835 |

| 31-Dec-22 | 14 | $2,732 | 11 | 99 | 12 | $2,092 | 2 | $640 |

| 17-Dec | 14 | $7,919 | 13 | 115 | 12 | $7,419 | 1 | $500 |

| 10-Dec-22 | 14 | $10,093 | 12 | 88 | 11 | $7,093 | 3 | $3,000 |

| 3-Dec-22 | 26 | $12,800.90 | 11 | 172 | 20 | $4,141 | 6 | $8,659.90 |

| 26-Nov-22 | 8 | $2,266.70 | 8 | 5 | 3 | $76 | 5 | $2,190.70 |

| 19-Nov-22 | 21 | $2,886 | 15 | 212 | 19 | $2,550 | 2 | $336 |

| 12-Nov-22 | 13 | $15,093.70 | 9 | 81 | 9 | $14,200 | 4 | $893.70 |

| 5-Nov-22 | 25 | 19,337.20 | 16 | 509 | 22 | $8,267.20 | 3 | $11,070 |

| 29-Oct-22 | 15 | $7,805.30 | 9 | 116 | 14 | $7,180.30 | 1 | $625 |

| 22-Oct-22 | 20 | $8,193.50 | 13 | 253 | 13 | $5,442 | 7 | $2,751.50 |

| 15-Oct-22 | 9 | $3,046.10 | 9 | 139 | 7 | $2,588.30 | 2 | $457.80 |

| 8-Oct-22 | 19 | $2,011.80 | 12 | 114 | 16 | $833.80 | 3 | $1,178 |

| 1-Oct-22 | 23 | $5,532.90 | 16 | 156 | 18 | $4,952.30 | 5 | $580.60 |

| 24-Sep-22 | 18 | $5,194 | 14 | 216 | 15 | $4,050 | 3 | $1,144 |

| 17-Sep-22 | 21 | $8,352.30 | 12 | 320 | 15 | $4,759.60 | 6 | $3,592.70 |

| 10-Sep-22 | 15 | $19,853.50 | 10 | 126 | 13 | $19,403.60 | 2 | $450 |

| 3-Sep-22 | 9 | $2,312 | 9 | 62 | 9 | $2,312 | 0 | 0 |

| 27-Aug-22 | 16 | $30,891.70 | 10 | 135 | 15 | $30,666.40 | 1 | 227.7 |

| 20-Aug-22 | 12 | $1,977 | 8 | 152 | 9 | 925 | 3 | $1,052 |

| 13-Aug-22 | 18 | $8,004.70 | 11 | 242 | 11 | $2,844.70 | 7 | $5,160 |

| 6-Aug-22 | 24 | $7,948.90 | 12 | 240 | 17 | $3,577 | 7 | $4,371.90 |

| 30-Jul-22 | 8 | $6,941 | 9 | 78 | 7 | $6,839 | 1 | $102 |

| 23-Jul-22 | 11 | $801 | 11 | 92 | 10 | $801 | 1 | 0 |

| 16-Jul-22 | 14 | $3,650 | 10 | 122 | 14 | $3,650 | 0 | 0 |

| 9-Jul-22 | 10 | $3,557.70 | 7 | 68 | 9 | $3,557.70 | 1 | 0 |

| 2-Jul-22 | 18 | $8,609.40 | 13 | 152 | 15 | $2,754.40 | 3 | $5,855 |

| 25-Jun-22 | 15 | $6,142 | 13 | 146 | 9 | $2,017 | 6 | $4,125 |

| 18-Jun-22 | 17 | $11,890.10 | 14 | 228 | 15 | $11,410 | 2 | 479.7 |

| 11-Jun-22 | 17 | $7,600 | 12 | 123 | 10 | $2,300 | 7 | $5,300 |

| 4-Jun-22 | 12 | $2,937 | 10 | 127 | 9 | $692 | 3 | $2,245 |

| 28-May-22 | 9 | $3,197.60 | 11 | 86 | 9 | $3,197.60 | 0 | 0 |

| 21-May-22 | 14 | $7,284.50 | 12 | 185 | 11 | $6,609 | 3 | $675.50 |

| 14-May-22 | 11 | $306.60 | 9 | 80 | 10 | $306.60 | 1 | $225 |

| 7-May-22 | 16 | $10,451.75 | 12 | 108 | 12 | $1,827 | 4 | $8,624.75 |

| 30-Apr-22 | 16 | $2,296.50 | 16 | 157 | 12 | $895.50 | 4 | $1,401 |

| 23-Apr-22 | 10 | $2,241 | 11 | 58 | 8 | $1,641 | 2 | $600 |

| 16-Apr-22 | 11 | $6,643 | 7 | 156 | 8 | $2,359 | 3 | $4,284 |

| 9-Apr-22 | 17 | $4,429 | 14 | 184 | 11 | $1,690 | 6 | $2,739 |

| 2-Apr-22 | 13 | $1,755 | 8 | 84 | 10 | $1,145 | 3 | $610 |

| 26-Mar-22 | 11 | $3,205 | 8 | 65 | 6 | $200 | 5 | $3,005 |

| 19-Mar-22 | 13 | $2,239.17 | 9 | 106 | 13 | $2,239.17 | 0 | 0 |

| 12-Mar-22 | 18 | $12,016 | 11 | 239 | 15 | $11,965 | 2 | $51.35 |

| 5-Mar-22 | 17 | $6,786 | 13 | 137 | 13 | $5,161 | 4 | $1,625 |

| 26-Feb-22 | 12 | $5,095 | 8 | 149 | 9 | $4,437.50 | 3 | $658 |

| 19-Feb-22 | 17 | $22,229 | 17 | 174 | 14 | $21,354 | 3 | $875 |

| 12-Feb-22 | 12 | $2,344.70 | 10 | 73 | 8 | $641.70 | 4 | $1,703 |

| 5-Feb-22 | 11 | $2,503 | 8 | 99 | 11 | $2,503 | 0 | 0 |

| 29-Jan-22 | 11 | $3,872 | 12 | 101 | 12 | $3,872 | 0 | 0 |

| 22-Jan-22 | 13 | $5,143.50 | 10 | 99 | 12 | $4,842.50 | 1 | $301 |

| 15-Jan-22 | 12 | $7,605 | 9 | 155 | 9 | $6,480 | 3 | $1,025 |

| 8-Jan-22 | 13 | $8,256.20 | 11 | 102 | 13 | $8,256.20 | 0 | 0 |

| 1-Jan-22 | 9 | $1,273.80 | 6 | 50 | 9 | $1,273.80 | 0 | 0 |

| 25-Dec-21 | 21 | $4,734.75 | 11 | 176 | 16 | $3,410 | 5 | $1,324.75 |

| 18-Dec-21 | 26 | $7,325.20 | 15 | 193 | 18 | $3,640.20 | 8 | $3,685.20 |

| 11-Dec-21 | 16 | $5,017 | 10 | 109 | 13 | $1,417 | 3 | $3,600 |

| 4-Dec-21 | 14 | $2,310 | 8 | 86 | 8 | $2,310 | 6 | $1,882.05 |

| 27-Nov-21 | 9 | $3.460.1 | 10 | 101 | 6 | $1,758 | 3 | $1,702.60 |

| 20-Nov-21 | 20 | $22,792 | 15 | 157 | 12 | $18,864.50 | 8 | $3,928 |

| 13-Nov-21 | 21 | $26,729 | 12 | 178 | 13 | $11,822 | 8 | $14,907 |

| 6-Nov-21 | 12 | $8,303 | 13 | 157 | 10 | $6,682 | 3 | $1,621 |

| 30-Oct-21 | 21 | $10,368 | 15 | 218 | 15 | $9,24.4 | 6 | $1,103.00 |

| 23-Oct-21 | 21 | $18.783.1 | 15 | 222 | 11 | $12,314 | 10 | $6,468.60 |

| 16-Oct-21 | 15 | $3,868 | 11 | 118 | 15 | $2,293 | 2 | $1,575 |

| 9-Oct-21 | 20 | $8,610 | 16 | 175 | 16 | $7,795 | 4 | $815 |

| 2-Oct-21 | 14 | $6,250 | 11 | 137 | 10 | $5,200 | 4 | $1,050 |

| 25-Sep-21 | 11 | $11,460 | 9 | 93 | 7 | $10,200 | 4 | $1,250 |

| 18-Sep-21 | 11 | $16,603 | 8 | 99 | 8 | $15,084 | 3 | $1,519 |

| 11-Sep-21 | 17 | $10,653 | 11 | 103 | 13 | $8,503 | 4 | $2,150 |

| 4-Sep-21 | 13 | $7,222 | 10 | 89 | 11 | $6,715 | 2 | $507 |

| 28-Aug-21 | 12 | $763 | 9 | 63 | 11 | $663 | 1 | $100 |

| 21-Aug-21 | 12 | $29,659 | 7 | 79 | 11 | $29,579 | 1 | $80 |

| 14-Aug-21 | 22 | $17,845 | 11 | 199 | 12 | $12,805 | 10 | $5,04 |

| 7-Aug-21 | 17 | $13,670 | 12 | 139 | 15 | $11,766 | 2 | $1,904 |

| 31-Jul-21 | 21 | $8,160 | 11 | 134 | 10 | $3,574 | 10 | $4,586 |

| July 24,2021 | 21 | $6,367 | 11 | 139 | 15 | $3,712 | 6 | $2,655 |

| 17-Jul-21 | 14 | $4,009 | 11 | 124 | 12 | $2,015 | 2 | $1,994 |

| 10-Jul-21 | 16 | $3,997 | 13 | 143 | 11 | $1,597 | 4 | $2,4 |

| 3-Jul-21 | 24 | $7,492 | 13 | 94 | 16 | $3,769 | 8 | $3,722 |

| 26-Jun-21 | 10 | $4,995 | 7 | 85 | 8 | $3,847 | 2 | $1,148 |

| 19-Jun-21 | 28 | $16,830 | 8 | 228 | 9 | $1,861 | 19 | $14,968 |

| 12-Jun-21 | 26 | $27,238 | 15 | 209 | 19 | $25,602 | 7 | $1,636 |

| 5-Jun-21 | 15 | $15,539 | 13 | 100 | 13 | $14,709 | 2 | $600 |

| 29-May-21 | 35 | $20,279 | 11 | 145 | 28 | $18,64 | 7 | $1,639 |

| 22-May-21 | 24 | $53,208 | 14 | 174 | 17 | $51,047 | 7 | $2,161 |

| 15-May-21 | 18 | $10,620 | 13 | 220 | 11 | $5,870 | 7 | $4,809 |

| 8-May-21 | 17 | $10,400 | 11 | 156 | 15 | $8,386 | 2 | $2,500 |

| 1-May-21 | 21 | $7,200 | 16 | 115 | 12 | $3,808 | 9 | $3,392 |

| 24-Apr-21 | 8 | $20,200 | 9 | 31 | 8 | $20,200 | 0 | 0 |

| 17-Apr-21 | 14 | $6,270 | 8 | 102 | 11 | $40,180 | 3 | $2,260 |

| 10-Apr-21 | 15 | $8,940 | 13 | 129 | 14 | $7,990 | 1 | $950 |

| 3-Apr-21 | 18 | $19,513 | 10 | 151 | 12 | $16,923 | 6 | $2,590 |

| 27-Mar-21 | 27 | $13,942 | 15 | 244 | 14 | $4,300 | 13 | $9,633.50 |

| 20-Mar-21 | 11 | $2,046 | 4 | 102 | 3 | $270 | 8 | $1,776 |

| 13-Mar-21 | 15 | $3,270 | 9 | 109 | 6 | $538 | 9 | $2,732 |

| 6-Mar-21 | 24 | $13,617 | 10 | 196 | 13 | $10,395 | 11 | $3,222 |

| 27-Feb-21 | 19 | $8,105 | 12 | 139 | 15 | $4,970 | 4 | $3,135 |

| 20-Feb-21 | 9 | $8,820 | 9 | 153 | 8 | $8,520 | 1 | $300 |

| 13-Feb-21 | 12 | $4,852.60 | 7 | 81 | 7 | 2,766 | 5 | $2,086.60 |

| 6-Feb-21 | 18 | $9,752 | 13 | 153 | 14 | $5,222 | 4 | $4,530 |

| 30-Jan-21 | 18 | $9,449 | 9 | 182 | 15 | $8,753.80 | 3 | $695.30 |

| 23-Jan-21 | 14 | $8,150 | 8 | 118 | 6 | $4,000 | 8 | $4,150 |

| 16-Jan-21 | 17 | $6,783 | 13 | 138 | 11 | $2,400 | 6 | $4,382.90 |

| 9-Jan-21 | 22 | $6,829 | 14 | 135 | 18 | $3,139.30 | 4 | $3,690 |

| 2-Jan-21 | 7 | $1,466 | 7 | 60 | 7 | $1,466 | 0 | 0 |

| 26-Dec-20 | 18 | $15,900 | 12 | 163 | 16 | $5,300 | 1 | $600 |

| 19-Dec-20 | 18 | $9,769 | 14 | 110 | 14 | $8,426 | 4 | $1,343 |

| 12-Dec-20 | 10 | $7,200 | 9 | 100 | 9 | $3,325 | 1 | $3,830 |

| 5-Dec-20 | 15 | $4,261 | 9 | 122 | 9 | $2,780 | 6 | $1,481 |

| 28-Nov-20 | 19 | $7,758 | 10 | 110 | 13 | $4,003 | 6 | $3,755 |

| 14-Nov-20 | 14 | $864.10 | 14 | 157 | 12 | $289.10 | 2 | $575 |

| 7-Nov-20 | 13 | $6,332 | 9 | 129 | 9 | $2,483.50 | 4 | $3,849 |

| 31-Oct-20 | 10 | $3,995.80 | 8 | 103 | 6 | $3,231.10 | 4 | $754.70 |

| 24-Oct-20 | 6 | $18,100 | 6 | 58 | 5 | $17,709 | 1 | $350 |

| 17-Oct-20 | 8 | $351.90 | 5 | 55 | 8 | $351.90 | 0 | 0 |

| 10-Oct-20 | 7 | $5,229 | 3 | 50 | 4 | $735 | 3 | $4,494 |

| 3-Oct-20 | 14 | $21,428 | 9 | 173 | 9 | $17,535 | 5 | $3,893 |

| 26-Sep-20 | 10 | $12,770 | 8 | 93 | 5 | $10,300 | 5 | $2,470 |

| 19-Sep-20 | 14 | $8,365 | 9 | 101 | 6 | $1,020 | 8 | $7,345 |

| 12-Sep-20 | 6 | $4,406 | 8 | 59 | 3 | $1,270 | 3 | $3,136 |

| 5-Sep-20 | 11 | $5,191 | 8 | 117 | 9 | $4,061 | 2 | $1,130 |

| 29-Aug-20 | 11 | $2,531 | 9 | 94 | 5 | $1,130 | 6 | $1,401 |

| 22-Aug-20 | 18 | $6,574 | 12 | 140 | 7 | $1,930 | 11 | $4,644 |

| 15-Aug-20 | 13 | $4,991 | 10 | 97 | 7 | $1,216 | 6 | $3,775 |

| 8-Aug-20 | 12 | $32,092 | 11 | 112 | 9 | $30,457 | 3 | $1,635 |

| 1-Aug-20 | 7 | $5,287 | 8 | 76 | 5 | $3,687 | 2 | $1,600 |

| 25-Jul-20 | 9 | $18,751 | 6 | 67 | 7 | $18,403 | 2 | $348 |

| 18-Jul-20 | 6 | $1,982.50 | 5 | 50 | 4 | $1,407.50 | 2 | $575 |

| 11-Jul-20 | 11 | $565.10 | 12 | 75 | 10 | $65.10 | 1 | $500 |

| 4-Jul-20 | 10 | $8,889 | 8 | 98 | 9 | $8,788 | 1 | $100.30 |

| 27-Jun-20 | 8 | $6,874 | 10 | 50 | 5 | $4,972.50 | 3 | $2,081.50 |

| 20-Jun-20 | 12 | $4,444 | 9 | 115 | 7 | $2,829 | 5 | $1,615 |

| 13-Jun-20 | 6 | $3,582 | 4 | 37 | 2 | $350 | 4 | $3,232 |

| 6-Jun-20 | 11 | $3,213.70 | 8 | 65 | 7 | $470 | 4 | $2,743.70 |

| 30-May-20 | 8 | $7,335 | 7 | 48 | 6 | $4,639 | 2 | $2,697 |

| 23-May-20 | 4 | $432.40 | 4 | 34 | 3 | $432.40 | 1 | 0 |

| 16-May-20 | 6 | $310 | 6 | 34 | 5 | $310 | 1 | 0 |

| 9-May-20 | 18 | $5,630 | 16 | 124 | 14 | $3,180 | 4 | $2,450 |

| 2-May-20 | 15 | 10,400 | 10 | 90 | 8 | $1,900 | 7 | $,8,500 |

| 25-Apr-20 | 8 | $3,400 | 9 | 36 | 5 | $1,000 | 3 | $2,450 |

| 18-Apr-20 | 19 | $9,500 | 14 | 92 | 8 | $185.70 | 11 | $9,360 |

| 11-Apr-20 | 12 | $6,000 | 9 | 40 | 5 | $190 | 7 | $5,800 |

| 4-Apr-20 | 14 | $8,200 | 11 | 68 | 10 | $2,200 | 4 | $6,000 |

| 28-Mar-20 | 16 | $6,500 | 13 | 96 | 10 | $3,700 | 6 | $2,800 |

| 21-Mar-20 | 11 | $11,910 | 7 | 33 | 7 | $2,250 | 4 | $9,960 |

| 14-Mar-20 | 7 | 809.8 | 6 | 34 | 6 | 684.8 | 1 | 125 |

| 7-Mar-20 | 16 | $2,500 | 15 | 70 | 13 | $669 | 3 | $1,400 |

| 29-Feb-20 | 13 | $15,260 | 13 | 128 | 11 | $11,760 | 2 | $3,500 |

| 22-Feb-20 | 12 | $3,700 | 10 | 92 | 10 | $2,560 | 2 | $1,130 |

| 15-Feb-20 | 16 | $1,250 | 10 | 84 | 12 | $35 | 4 | $1,222 |

| 8-Feb-20 | 18 | $6,080 | 14 | 123 | 14 | $2,595 | 4 | $3,485 |

| 1-Feb-20 | 21 | $20,900 | 12 | 101 | 14 | $17,860 | 7 | $3,060 |

| 25-Jan-20 | 13 | $7,430 | 13 | 62 | 12 | $6,430 | 1 | $1,000 |

| 18-Jan-20 | 23 | $9,580 | 15 | 120 | 19 | $6,580 | 4 | $3,000 |

| 11-Jan-20 | 21 | $14,200 | 18 | 199 | 16 | $1,020 | 5 | $13,200 |

| 4-Jan-20 | 22 | $6,400 | 11 | 119 | 16 | $3,204 | 6 | $3,245 |

| 28-Dec-19 | 22 | $7,150 | 19 | 175 | 18 | $6,800 | 4 | $327.40 |

| 14-Dec-19 | 24 | $36,300 | 23 | 167 | 19 | $9,500 | 5 | $26,800 |

| 7-Dec-19 | 11 | $10,400 | 11 | 55 | 7 | $1,082 | 4 | $9,370 |

| November 30. 2019 | 14 | $2,450 | 12 | 126 | 12 | $1,760 | 2 | $692.50 |

| 23-Nov-19 | 16 | $1,995 | 10 | 41 | 11 | $615 | 5 | $1,380 |

| 16-Nov-19 | 15 | $3,820 | 13 | 135 | 11 | $2,500 | 4 | $1,271 |

| 9-Nov-19 | 25 | $12,900 | 17 | 182 | 23 | $12,200 | 2 | $575 |

| 2-Nov-19 | 10 | $2,470 | 12 | 61 | 9 | 2,450 | 3 | $22 |

| 26-Oct-19 | 12 | $5,560 | 14 | 70 | 11 | $3,860 | 1 | $1,700 |

| 19-Oct-19 | 8 | $6,600 | 8 | 138 | 8 | $6,600 | 0 | 0 |

| 12-Oct-19 | 19 | $4,300 | 14 | 55 | 16 | $3,800 | 3 | $500 |

| 5-Oct-19 | 18 | $14,500 | 19 | 166 | 15 | $11,100 | 3 | $3,400 |

| 28-Sep-19 | 19 | $8,100 | 18 | 132 | 18 | $7,560 | 1 | $550 |

| 21-Sep-19 | 14 | $6,300 | 16 | 66 | 11 | $2,160 | 3 | $4,170 |

| 14-Sep-19 | 15 | $23,800 | 12 | 56 | 11 | $21,250 | 4 | $2,570 |

| 7-Sep-19 | 17 | $3,500 | 15 | 98 | 14 | $1,900 | 3 | $1,600 |

| 31-Aug-19 | 5 | $8,700 | 6 | 50 | 5 | $8,700 | 0 | 0 |

| 24-Aug-19 | 16 | $10,000 | 14 | 82 | 15 | $4,250 | 1 | $5,750 |

| 16-Aug-19 | 10 | $1,680 | 5 | 52 | 7 | $650 | 3 | $950 |

| 9-Aug-19 | 17 | $17,700 | 15 | 68 | 14 | $3,900 | 3 | $13,800 |

| 2-Aug-19 | 13 | $5,760 | 12 | 108 | 13 | $5,760 | NA | NA |

| 27-Jul-19 | 11 | $7,300 | 13 | 76 | 8 | $6,570 | 3 | $730 |

| 20-Jul-19 | 13 | $11,800 | 13 | 125 | 11 | $5,300 | 2 | $6,500 |

| 13-Jul-19 | 10 | $775 | 7 | 46 | 8 | $542.50 | 2 | $233 |

| 6-Jul-19 | 7 | $2,500 | 9 | 85 | 7 | $2,500 | 0 | 0 |

| 29-Jun-19 | 23 | $8,290 | 15 | 154 | 17 | $2,300 | 6 | $5,970 |

| 22-Jun-19 | 17 | $10,700 | 10 | 139 | 14 | $7,700 | 3 | $3,000 |

| 15-Jun-19 | 11 | $13,500 | 14 | 160 | 11 | $13,500 | NA | NA |

| 8-Jun-19 | 13 | $2,870 | 17 | 55 | 11 | $1,570 | 2 | $1,300 |

| 1-Jun-19 | 10 | $4,460 | 11 | 60 | 8 | $4,140 | 2 | $315 |

| 25-May-19 | 17 | $4,360 | 14 | 79 | 14 | $3,700 | 3 | $612 |

| 18-May-19 | 22 | $9,000 | 17 | 150 | 16 | $3,400 | 6 | $5,600 |

| 11-May-19 | 18 | $19,800 | 17 | 177 | 15 | $18,300 | 3 | $1,500 |

| 4-May-19 | 10 | $7,075 | 6 | 32 | 8 | $6,900 | 2 | $175 |

| 27-Apr-19 | 15 | $3,200 | 14 | 117 | 14 | $3,160 | 1 | $40 |

| 20-Apr-19 | 13 | $13,500 | 10 | 90 | 9 | $12,200 | 4 | $1,300 |

| 13-Apr-19 | 16 | $38,900 | 14 | 91 | 14 | $37,800 | 2 | $1,100 |

| 6-Apr-19 | 12 | $6,870 | 11 | 94 | 10 | $6,730 | 2 | $50 |

| 30-Mar-19 | 15 | $6,470 | 12 | 84 | 10 | $7,91.5 | 5 | $5,677 |

| 23-Mar-19 | 18 | $6,450 | 14 | 91 | 14 | $5,042 | 4 | $1,408 |

| 16-Mar-19 | 14 | $10,180 | 12 | 115 | 11 | $8,800 | 3 | $1,300 |

| 9-Mar-19 | 9 | $1,800 | 6 | 49 | 8 | $1,300 | 1 | $500 |

| 2-Mar-19 | 20 | $3,033 | 16 | 107 | 14 | $1,817 | 6 | $1,262 |

| 23-Feb-19 | 12 | $2,040 | 8 | 69 | 9 | $614.60 | 3 | $1,430 |

| 16-Feb-19 | 16 | $9,970 | 18 | 77 | 16 | $9,970 | 0 | 0 |

| 9-Feb-19 | 14 | $6,400 | 10 | 110 | 14 | $6,400 | 0 | 0 |

| 2-Feb-19 | 18 | $6,740 | 15 | 99 | 16 | $5,720 | 2 | $950 |

| 26-Jan-19 | 13 | $2,770 | 11 | 67 | 11 | $918.95 | 2 | $1,850 |

| 19-Jan-19 | 15 | $3,819 | 16 | 76 | 12 | $2,594 | 3 | $1,225 |

| 12-Jan-19 | 18 | $7,283 | 14 | 92 | 15 | $1,683 | 3 | $5,600 |

| 5-Jan-19 | 10 | $529 | 12 | 50 | 10 | $529 | 0 | 0 |

| 22-Dec-18 | 17 | $2,570 | 13 | 87 | 14 | $941 | 3 | $1,629 |

| 15-Dec-18 | 10 | $2,860 | 8 | 26 | 8 | $264 | 2 | $2,600 |

| 8-Dec-18 | 15 | $1,819 | 16 | 65 | 12 | $552 | 3 | $1,267 |

| 1-Dec-18 | 12 | $7,500 | 10 | 90 | 9 | $1,200 | 3 | $6,200 |

| 28-Nov-18 | 15 | $4,500 | 11 | 107 | 14 | $4,000 | 1 | $500 |

| 19-Nov-18 | 18 | $6,137 | 13 | 98 | 13 | $2,142 | 5 | $3,995 |

| 14-Nov-18 | 18 | $9,200 | 13 | 152 | 15 | $8,500 | 3 | $694 |

| 6-Nov-18 | 16 | $17,300 | 16 | 183 | 14 | $16,361 | 2 | $950 |

| 29-Oct-18 | 14 | $14,400 | 18 | 127 | 17 | $13,800 | 1 | $600 |

| 24-Oct-18 | 13 | $6,140 | 13 | 126 | 11 | $5,122 | 2 | $1,018 |

| 17-Oct-18 | 18 | $18,390 | 15 | 125 | 14 | $12,292 | 4 | $6,098 |

| 10-Oct-18 | 29 | $3,149 | 18 | 104 | 20 | $1,647 | 9 | $819 |

| 2-Oct-18 | 18 | $9,300 | 11 | 67 | 14 | $7,300 | 4 | $2,000 |

| 25-Sep-18 | 13 | $7,000 | 11 | 75 | 10 | $6,000 | 3 | $995 |

| 18-Sep-18 | 9 | $3,570 | 7 | 44 | 9 | $3,570 | 0 | 0 |

| 11-Sep-18 | 13 | $5,900 | 10 | 132 | 13 | $5,900 | 0 | 0 |

| 7-Sep-18 | 14 | $5,000 | 15 | 86 | 11 | $4,000 | 3 | $1,000 |

| 29-Aug-18 | 15 | $20,700 | 14 | 79 | 13 | $4,700 | 2 | $16,000 |

| 20-Aug-18 | 10 | $12,400 | 11 | 53 | 8 | $11,380 | 3 | $1,057 |

| 14-Aug-18 | 12 | $19,900 | 12 | 132 | 9 | $18,889 | 3 | $1,011 |

| 7-Aug-18 | 16 | $68,600 | 11 | 106 | 13 | $67,259 | 3 | $1,340 |

| 31-Jul-18 | 15 | $15,100 | 15 | 95 | 11 | $13,060 | 4 | $2,060 |

| 23-Jul-18 | 13 | $2,130 | 15 | 60 | 10 | $1,804 | 3 | $1,100 |

| 17-Jul-18 | 14 | $5,370 | 17 | 98 | 9 | $4,310 | 5 | $1,100 |

| 9-Jul-18 | 16 | $11,200 | 15 | 74 | 10 | $11,080 | 6 | $862 |

| 3-Jul-18 | 13 | $7,000 | 7 | 81 | 12 | $6,330 | 1 | $750 |

| 25-Jun-18 | 15 | $8,800 | 13 | 97 | 9 | $4,970 | 6 | $3,930 |

| 18-Jun-18 | 13 | $14,200 | 14 | 80 | 7 | $221 | 6 | $14,290 |

| 11-Jun-18 | 12 | $6,300 | 8 | 96 | 8 | $5,910 | 4 | $803 |

| 6-Jun-18 | 13 | $14,500 | 10 | 88 | 8 | $14,154 | 5 | $579 |

| 31-May-18 | 11 | $4,890 | 10 | 63 | 8 | $3,240 | 3 | $1,790 |

| 22-May-18 | 15 | $20,400 | 11 | 63 | 9 | $19,808 | 6 | $885 |

| 15-May-18 | 15 | $4,700 | 15 | 106 | 10 | $3,900 | 5 | $643 |

| 9-May-18 | 11 | $1,400 | 13 | 88 | 9 | $1,300 | 2 | $560 |

| 1-May-18 | 8 | $14,250 | 7 | 88 | 7 | $13,400 | 1 | $450 |

| 24-Apr-18 | 12 | $5,300 | 6 | 61 | 11 | $4,470 | 1 | $800 |

| 17-Apr-18 | 9 | $1,800 | 10 | 44 | 7 | $2,330 | 2 | $1,434 |

| 11-Apr-18 | 11 | $2,500 | 8 | 32 | 6 | $1,690 | 5 | $809 |

| 3-Apr-18 | 15 | $13,400 | 11 | 121 | 9 | $12,020 | 6 | $1,090 |

| 28-Mar-18 | 10 | $4,000 | 10 | 92 | 7 | $3,870 | 3 | $215 |

| 19-Mar-18 | 17 | $5,800 | 13 | 51 | 10 | $590 | 7 | $5,165 |

| 12-Mar-18 | 15 | $3,130 | 11 | 43 | 11 | $2,360 | 4 | $788 |

| 6-Mar-18 | 19 | $5,400 | 13 | 116 | 10 | $1,530 | 9 | $4,860 |

| 27-Feb-18 | 20 | $6,600 | 13 | 69 | 14 | $5,530 | 6 | $1,030 |

| 19-Feb-18 | 15 | $5,500 | 14 | 111 | 10 | $3,990 | 6 | $1,980 |

| 12-Feb-18 | 23 | $10,900 | 17 | 157 | 12 | $7,110 | 11 | $3,840 |

| 5-Feb-18 | 16 | $8,600 | 13 | 100 | 7 | $1,330 | 9 | $7,800 |

| 30-Jan-18 | 11 | $12,600 | 11 | 68 | 5 | $7,300 | 6 | $4,982 |

| 24-Jan-18 | 19 | $9,400 | 15 | 129 | 5 | $2,010 | 14 | $7,337 |

| 18-Jan-18 | 10 | $6,280 | 8 | 49 | 2 | $2,100 | 8 | $4,188 |

| 9-Jan-18 | 12 | $16,500 | 12 | 92 | 9 | $15,890 | 3 | $475 |

| 3-Jan-18 | 10 | $2,500 | 9 | 47 | 8 | $2,350 | 2 | $150 |

| 27-Dec-17 | 15 | $9,000 | 15 | 113 | 9 | $7,568 | 6 | $1,784 |

| 18-Dec-17 | 15 | $13,800 | 16 | 164 | 9 | $13,010 | 7 | $1,118 |

| 11-Dec-17 | 14 | $9,700 | 10 | 126 | 12 | $2,940 | 4 | $8,500 |

| 4-Dec-17 | 6 | $1,800 | 6 | 31 | 5 | $1,510 | 1 | $300 |

| 28-Nov-17 | 7 | $3,850 | 8 | 76 | 4 | $3,260 | 3 | $285 |

| 16-Nov-17 | 10 | $2,700 | 10 | 48 | 6 | $1,840 | 4 | $856 |

| 8-Nov-17 | 15 | $2,380 | 17 | 91 | 10 | $1,860 | 5 | $516 |

| 1-Nov-17 | 12 | $4,700 | 17 | 94 | 9 | $3,400 | 4 | $1,300 |

| 23-Oct-17 | 15 | $10,500 | 10 | 67 | 10 | $9,780 | 4 | $1,530 |

| 18-Oct-17 | 6 | $2,000 | 37 | 3 | $225 | 3 | $1,820 | |

| 10-Oct-17 | 12 | $6,570 | 100 | 9 | $3,880 | 3 | $3,360 | |

| 2-Oct-17 | 8 | $3,100 | 11 | 19 | 3 | $1,630 | 5 | $1,750 |

| 25-Sep-17 | 8 | $4,880 | 8 | 79 | 5 | $2,660 | 5 | $2,070 |

| 18-Sep-17 | 9 | $4,770 | 3 | $300 | 6 | $4,470 | ||

| 12-Sep-17 | 11 | $4,430 | 8 | $2,030 | 3 | $2,400 | ||

| 1-Sep-17 | 4 | $1,310 | 3 | $317 | 1 | $1,000 | ||

| 23-Aug-17 | 11 | $13,640 | 9 | 8 | $11,840 | 3 | $1,800 |

M&A/FUNDING

BlackRock Acquires GIP in $12B Merger Agreement

In a union of investment giants, BlackRock Inc. — the sometimes controversial investment behemoth — announced Jan. 12 it is acquiring Global Infrastructure Partners for $3 billion in cash and approximately 12 million shares of BlackRock. The result will be a stand-alone infrastructure business valued at $150 billion led by GIP’s Bayo Ogunlesi and the current GIP management team. It would also become, by some estimates, the largest infrastructure investor in the world. Outside legal counsel included Skadden, Arps, Slate, Meagher & Flom and Fried, Frank, Harris, Shriver & Jacobson for BlackRock. Kirkland & Ellis and Debevoise & Plimpton acted as legal counsel to GIP. For more details see The Lawbook’s daily coverage here.

Chesapeake and Southwestern to Merge in $7.4B Deal

In a move that continues the consolidation of upstream energy resources, Chesapeake Energy and Southwestern Energy announced Thursday that they have agreed to a $7.4 billion all-stock merger. The combined company, as yet unnamed, would have an enterprise value of $24 billion and would be headquartered in Oklahoma City. It would also be the largest natural gas producer in the U.S., poised to feed the emerging LNG plants and terminals along the Texas-Louisiana Gulf Coast. Chesapeake’s legal advisors were Latham & Watkins and Wachtell, Lipton, Rosen & Katz. Kirkland & Ellis advised Southwestern. For more details on the transaction view our prior coverage here.

DigitalBridge Plans $6.4B Investment in Vantage Data Centers

Deal Description: Vantage Data Centers, a major provider of scalable data centers across the planet, announced Jan. 9 a major equity investment by global investment managers DigitalBridge and Silver Lake. The deal follows the recently announced €1.5 billion ($1.65 billion) investment by AustralianSuper. Vantage owns or controls 25 data sites in North America and EMEA. DigitalBridge acquired Vantage in 2017 and plans to take advantage of the escalation of digital capacity required by cloud storage and AI.

Outside Legal Counsel/DigitalBridge: Simpson Thacher advised DigitalBridge includes partners Gabriel Silva in New York and Shamus Crosby in Houston, along with Mark Kunzman, Gabriela Astolphi, Jonathan Schwartz, Lawrence Page and E.R. Rolwes (M&A); David Rubinsky and Megan Arrowsmith (Executive Compensation and Employee Benefits); Andrew Purcell, Brian Mendick and Emma Wang (Tax); and Steven DeLott (Insurance).

7-Eleven Acquires 204 Stores from Sunoco for $950M

Deal Description: Irving-based convenience store chain 7-Eleven Inc. has agreed to purchase 204 stores from Sunoco LP that include the Stripes and Laredo Taco Company brands. With locations in New Mexico, Oklahoma and West Texas, the 204 stores join 7-Eleven’s more than 13,000-store portfolio. The purchase is one of the latest expansions for the retailer, which bought Ohio-based Speedway, the third largest convenience chain at the time, in early 2021 for $21 billion. Akin and Vinson & Elkins advised the parties. For more see The Lawbook’s daily coverage here.

Landsea Homes to Acquire Antares Homes for $232.2M

Deal Description: Landsea Homes, a publicly traded homebuilder based in Dallas, announced Jan. 9 that it is acquiring Texas homebuilder Antares Homes. The deal is priced at $232.2 million, which includes Landsea’s assumption of $47.2 million in Antares debt. Landsea said it will pay for the acquisition, expected to close in February, with a combination of cash and borrowing through its existing revolving credit facility. Landsea entered the Texas market in 2021 and earlier this year moved its headquarters to Dallas from Newport Beach, California. Landsea CEO says the firm has been eyeing acquisitions in the rapidly growing Texas market, and that Antares is building homes in 19 different communities across the Dallas-Fort Worth metro area.

Financial Advisors/Landsea: Vetra Advisors

Note: Kelly Rentzel, a veteran M&A attorney and former general counsel for Texas Capital Bank, is GC for Landsea.

Praxis, Tenacia Sign $15M Biopharmaceutical Development Agreement

Deal Description: International biopharmaceuticals firms, Praxis Precision Medicines and Tenacia Biotechnology, announced Jan. 5 a collaborative agreement for the development and commercialization of ulixacaltamide for the treatment of tremors associated with neuronal excitation-inhibition imbalance. To do so, Boston-based Praxis and Tenacia, a Bain Capital portfolio company headquartered in Shanghai, have structured an exclusive licensing agreement that includes a $5 million cash payment to Praxis and a $10 million purchase of Praxis stock. The deal also includes milestone payments of up to $264 million.

Outside Legal Counsel/Praxis: Sidley Austin advised Praxis with a team led from Baltimore by partners Asher Rubin and Adrian Tibbitts, along with managing associate Collin Marshall and senior managing associate in Dallas, managing associate BinQuan Zhuang in Palo Alto and emerging companies partner Frank Rahmani in Palo Alto.

Outside Legal Counsel/Tenacia: Ropes & Gray

3E to Acquire ChemChain

Deal Description: Compliance solutions provider 3E announced Jan. 11 that it is acquiring ChemChain, a Luxembourg-based firm with a portfolio of tech-driven products that track and secure supply chain operations. Terms were undisclosed. 3E is based in Carlsbad, California.

Outside Legal Counsel/3E: Shearman & Sterling advised 3E led by Dallas partner Alain Dermarkar with Dallas associates Brody Hinds and Tim Doyle.

Note: The acquisition is the fourth since New Mountain Capital acquired 3E in January 2022 from Verisk.

Pacolet Milliken Agrees to Acquire Biomass Generation Facility

Deal Description: Family-owned investment company Pacolet Milliken announced Jan. 8 that it has agreed to acquire a 55 MW biomass-powered plant in Barnesville, Georgia, known as Piedmont Green Power. The plant is currently owned by Atlantic Power & Utilities. Terms were undisclosed. Pacolet Milliken is headquartered in Greenville, South Carolina.

Piedmont utilizes 600,000 tons of wood waste each year as a source of renewable power and sells renewable energy credits on the open market. Piedmont achieved commercial operations in 2013 and sells power to Georgia Power under a long-term power purchase agreement.

Debt Management/Pacolet Milliken: Genesis Capital helped arrange debt financing provided by Manulife.

Outside Counsel/Pacolet Milliken: The Vinson & Elkins corporate team was led by partner Doug Bland and associate Ryan Logan, with assistance from associates Zach Parker and Pete Berquist, and the finance team was led by partners Eamon Nolan and Lauren Davies, with assistance from associates Helena Zhang and Dan Lee. Other key team members include partners Jason McIntosh and Wendy Salinas and associate Paige Rapp (tax); partner Courtney Hammond, senior associate Mark Kramer and paralegals Ashley Curatolo and Sydney Finelli (real estate); partner Sarah Mitchell and senior associate Alexander Baker (insurance); partner John Decker and senior associate Andrew DeVore (energy regulatory); partner Matt Dobbins and associates Kelly Rondinelli and Tom Aird (environmental); partner Sean Becker and associates Peter Goetschel and Ashley Plunk (employment); partner Dario Mendoza, counsels Missy Spohn and Heather Reynolds Johnson, senior associate Nicole Waterstradt and associate Cassie Zarate (executive compensation/benefits); partners Dave Oelman and Nettie Downs and associate Carli Gish (corporate); counsel Noelle Alix (finance); partner Rick Sofield and associate Connor Wilson (FCC); partner Darren Tucker (antitrust); and counsels Brian Howard and Elizabeth Krabill McIntyre (sanctions).

Energy Capital Partners Acquires Triple Oak Power from EnCap

Deal Description: New Jersey-headquartered Energy Capital Partners said Jan. 9 that it has agreed to acquire renewable energy provider Triple Oak Power from Texas-based EnCap Investments and its co-investors, Yorktown Partners and Mercuria Energy. Portland-based Triple Oak manages a pipeline of more than 8 gigawatts of utility scale wind projects across the central and western states. Yorktown Partners is based in New York; Mercuria is headquartered in Geneva, Switzerland. Terms of the deal were undisclosed.

Financial Advisor/EnCap and Triple Oak: Marathon Capital

Legal Advisors/EnCap and Triple Oak: Sidley Austin led by energy partners Robert Stephens in Houston and Christopher Hutchison in Washington, D.C. The team also included senior managing associate Jeff Kinney and associate John Zappia, both in Houston.

Legal Advisors/Energy Capital: Latham & Watkins

Comply365 and Vistair Agree to Merger

Deal Description: Comply365, a provider of digital content solutions for aviation and rail regulatory and safety requirements, announced Jan. 8, that it is merging with Vistair Limited, a UK-based provider of data services for complex flight operations and defense-related compliance regimes. The combination will create a global provider of compliance technology to aviation, defense and rail operations represented by over 120 customers located in over thirty countries on six continents. Terms of the transaction were not announced, but Vistair CEO Rob Morgan will preside over the integration of the two businesses and Insight Partners will join Liberty Hall Capital Partners as co-equal investors. Liberty Hall is the current controlling stockholder of Comply365.

Financial Advisors: Lincoln International advised Comply365. Lincoln International and Harris Williams advised Insight Partners and Liberty Hall.

Outside Legal Counsel/Insight Partners: Willkie Farr & Gallagher with a team led by Morgan Elwyn and Ziyad Aziz in New York, Philip Coletto in London and Ryan Giggs in Houston

Outside Legal Counsel/Liberty Hall: Gibson, Dunn & Crutcher

Ridgewood Infrastructure to Acquire Waste Resources Management

Deal Description: Ridgewood Infrastructure announced Jan. 8 that it is acquiring Houston’s Waste Resources Management, a provider of industrial wastewater collection and disposal services. Terms of the deal were not undisclosed. Based in New York, Ridgewood is an investor specializing in water, energy transition, transportation and other industrial infrastructure projects and services.

Financial Advisor: Houlihan Lokey

Outside Legal Counsel: Kirkland & Ellis advised Ridgewood with a team led from Houston by Bill Benitez and Robert Goodin, along with asociates Gabrielle Sumich and Brennon Nelson. Also involved were debt finance partners Lucas Spivey and Osaro Aifuwa along with associate Brittany Taylor. Partner Mark Dundon and associate Griffin Peeples advised on tax issues.

Stephens Group to Sell Summit Industrial Construction

Deal Description: The Stephens Group announced Jan. 2 the sale one of its portfolio companies, Houston-based Summit Industrial Construction to publicly traded Comfort Systems, another Houston-headquartered company. Terms of the deal were not announced. Summit is a specialty mechanical contractor that designs and constructs modular systems for advanced technology, power and industrial sectors, and is involved in several chip fabrication projects.

Based in Little Rock, the Stephens Group is backed by the Witt Stephens Jr. and Elizabeth Campbell families. Comfort, a provider of mechanical, electrical and plumbing systems, owns more than 45 operating companies in 170 locations across the U.S.

Outside Counsel: Jones Day advised the Stephens Group with a team led from Atlanta that includes partners Bryan Davis and Patrick Baldwin.

CAPITAL MARKETS/DEBT

Energy Transfer Offers $3.8B in Notes

Deal Description: Dallas-based Energy Transfer announced Jan. 11 the pricing of three notes offerings. The company plans to use proceeds from the offerings to refinance existing debt. The three offerings include a $1.25 billion series of 5.550 percent senior notes due 2034 at 99.660 percent of principal; $1.75 billion of 5.950 percent senior notes due 2054 at 99.523 percent of principal, and $800 million of 8.00 percent of fixed-to-fixed reset rate subordinated notes due 2054 at 100 percent of face value.

Financial Advisors: Citigroup Global Markets, Credit Agricole Securities, Deutsche Bank Securities, PNC Capital Markets and RBC Capital Markets are acting as joint book-running managers for the senior notes offering and the junior subordinated notes offering.

Legal Advisors/Energy Transfer: Latham & Watkins with a corporate deal team led by Austin partner Samuel Rettew and Houston partner Kevin Richardson, with associates Lucas Balchun, Michael Pascual, Janhavi Das, and Kevin Donovan. Advice was also provided on tax matters by Houston partners Tim Fenn and Bryant Lee, with associate Dylan White; and on environmental matters by Los Angeles/Houston partner Joshua Marnitz, with associate Jacqueline Zhang.

Entrprise Products Partners in $2B in Senior Notes Offerings

Deal Description: Houston-based midstream services provider Enterprise Products Partners announced Jan. 2 the pricing of two notes offerings totaling $2 billion. The says it expects to use the proceeds in the repayment of prior notes offerings and the outstanding balance that remains on their commercial paper program. The first offering (“Senior Notes HHH”) due Jan. 11, 2027, will be issued at 99.897 percent of principal with a fixed-rate coupon of 4.60 percent. The second offering, (“Senior Notes III”) will be issued at 99.705 percent of principal with a fixed rate coupon of 4.85 percent.

Book Running Managers: MUFG Securities, Citigroup Global Markets, Credit Agricole Securities, PNC Capital Markets and TD Securities

Outside Legal Counsel/Underwriters: Vinson & Elkins advised Enterprise with a team led from Houston by partners Doug McWilliams and David Stone and counsel Brett Peace, with assistance from senior associate Markeya Brown and associates Connor Rabalais and Waleed Vohra. Other key team members included partner Matt Dobbins and associate Ryan Vanderlip (environmental); partners Wendy Salinas and Ryan Carney and associate Steve Campbell (tax); and senior associate Andrew DeVore and associate Jake Silver (energy regulation).

CenterPoint Energy Opens $500M ATM Program

Deal Description: On Jan. 10 CenterPoint Energy announced the establishment of an at-the-market program to sell its common shares at some point in the future. The Houston-based company intends to use the proceeds for general corporate purposes. CenterPoint owns and operates electric transmission, distribution and generation facilities and natural gas distribution facilities.

Outside Counsel/Managers Forward Purchasers: Hunton Andrews Kurth advised with a team led from New York by Peter K. O’Brien, Brendan P. Harney, Reuben H. Pearlman and Jingyi “Alice” Yao. Joseph B. Buonanno provided advice on the forward component. Robert McNamara, William Freeman and Caitlin Scipioni provided tax advice.

Outside Counsel/CenterPoint: Baker Botts with a team led by Houston partners Tim Taylor and Clint Rancher, along with Houston associates Rob Cowan and Sarah Dyer. New York partner Jonathan Goldstein provided finance advice with tax advice from partner Mike Bresson and senior associate Jared Meier, both in Houston.

Mid-America Apartment Communities Offers $350M in Notes

Deal Description: Mid-America Apartment Communities announced Jan. 4 that its operating partnership, Mid-America Apartments priced a $350,000,000 offering of MAALP’s 5.000 percent senior unsecured notes due March 15, 2034. The notes were priced at 99.019 percent of the principal amount. MAALP intends to use net proceeds from the offering to repay outstanding borrowings.

Deal Managers: Wells Fargo Securities, LLC, J.P. Morgan Securities LLC, Mizuho Securities USA LLC, Truist Securities, Inc. and U.S. Bancorp Investments, Inc. were the joint book-running managers for the offering.

Outside Legal Advisors/MAALP: Bass, Berry & Sims

Outside Legal Advisors/Underwriters: Sidley Austin with a team led by New York capital markets partner Samir Gandhi. Also advising were New York partner Nicholas R. Brown, senior managing associate Tanner L. Groce in Houston, senior managing associate Christian D. Barraza in Miami and New York associate Henry R. Ludwig.

NETSTREIT Corp. Announces Upsized $173M Offering

Deal Description: NETSTREIT Corp., announced Jan. 12 the pricing of its public offering of 9.6 million shares of its common stock at a public offering price of $18.00 per share in connection with the forward sale agreements described below. NETSREIT is a Dallas-headquartered real estate investment trust that specializes in commercial assets leased to single occupant tenants like Dollar General, CVS, 7-Eleven, Walmart, Kroger, Dick’s Sporting Goods and Winn Dixie.

Forward Purchasers/Managers: Wells Fargo Securities and BofA Securities are acting as book-running managers. Jefferies, Truist Securities, Capital One Securities, Scotiabank, Regions Securities LLC, TD Securities, Mizuho, Stifel and Citigroup are acting as joint book-running managers for the offering. Baird, BTIG, Raymond James, Wolfe Capital Markets and Advisory, Ramirez & Co., Inc., Roberts & Ryan and Comerica Securities are acting as co-managers for the offering.

Outside Legal Counsel/Underwriters: Vinson & Elkins with a team led by partners Daniel LeBey and Chris Green and counsel Caroline Bailey, with assistance from associates Selena Govan, Bekah Briggs and Glen Taylor. Other key team members include partners Paige Anderson and Chris Mangin and associate Tyler Underwood (tax).

OTHER MATTERS

In the continuing global up-ramp of LNG capacity Ksi Lisims LNG LP, a co-development of three entities — the Nisga’a Nation, Rockies LNG LP and Western LNG — announced a 20-year LNG sale and purchase agreement with Shell Eastern Trading. The SPA secures 2 million tonnes of LNG per year from the Ksi Lisims project on a free-on-board basis. The net-zero LNG production project, located on Pearse Island in British Columbia, expected to be in operation by 2030, will produce 12 million tonnes per year from two floating storage facilities. Baker Botts said they were involved in the drafting and negotiation of the SPA with a team led from Houston by partner David Jetter with London partner Rob Butler, Houston associate Arsalan Eftekhar and Houston tax partner Jon Lobb.

Simpson Thacher announced that it advised DigitalBridge on the formation, Dec. 30, of Articul8, an independent company offering secure generative artificial intelligence software platform. The platform delivers AI capabilities that keep customer data, training and inference within the enterprise security perimeter. The platform also provides customers the choice of cloud, on-prem or hybrid deployment. The Simpson Thacher team included several of the same lawyers involved in DigitalBridge’s planned $6.4 billion investment in Vantage Data Centers (described above), including partners Gabriel Silva and Shamus Crosby (Houston) (M&A); Partner Parker Kelsey and Associates Nick Brown, Tarek Hussamy and Sung Won Choi (Funds); Partner Lori Lesser and Associate Sarika Pandrangi (Palo Alto) (IP); and Partner Andrew Purcell and Associate Brian Mendick (Tax). All attorneys are based in New York unless otherwise stated.