In response to imminent threat of invasion of the Ukraine, Germany has announced a halt to its certification of the Nord Stream 2 pipeline, a vital artery in Russia’s plan to capitalize on shifts in Europe’s energy needs. Since Germany is, by far, the largest buyer of Russian natural gas, the move is significant.

Russia’s supply of natural gas to Europe has been down in recent years, according to analysts at Wood Mackenzie, dropping from 191 billion cubic meters in 2019 to 168 Bcm last year. That has led to depleted inventories and a cause for energy anxiety, not only for what is left of this winter on The Continent, but for the next.

“Even if Russian pipeline gas continues to flow through spring and summer, winter 2022/23 will begin much as this one did – with inventories at a record low,” said the Wood Mackenzie report. “Were all gas flows were to stop today, existing gas storage would run out in six weeks.”

What does this have to do with Texas? Well, consider LNG.

Long before the Ukraine crisis, the need in Europe for a broader energy base helped prompt a pretty dramatic change in the North American LNG market — shifting a number of its massive terminal operations from import/buyers to export/sellers.

Where pipelines are fast, they are inflexible; and therein lies the primary advantage of LNG: the ability to deliver energy where there is a demand.

Nowhere is that change more apparent than the Texas-Louisiana coast.

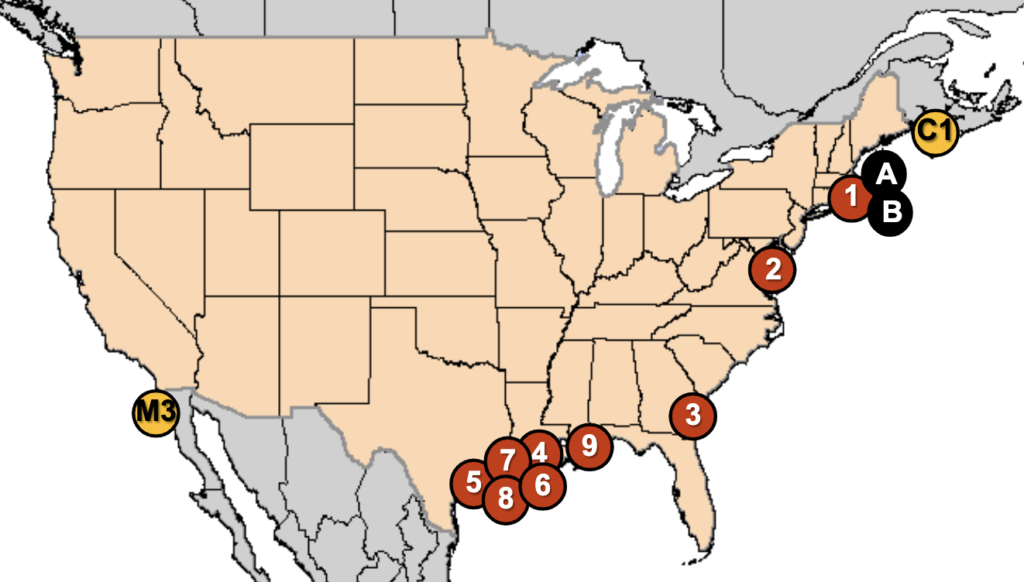

In the Continental U.S., there are nine existing IMPORT terminals for LNG. Behold a map of those terminals below:

Existing U.S. LNG Import Terminals

Onshore U.S. LNG import terminals are in red. (C1 is in Canada; M3 is in Mexico). Five of the import terminals, including three on the Gulf Coast have been converted to allow LNG Export.

Of the nine existing IMPORT terminals, five are on the Texas-Louisiana Coast. Three of those five have been converted to allow liquefaction and LNG export and two of those three are approved to re-export LNG brought in from elsewhere.

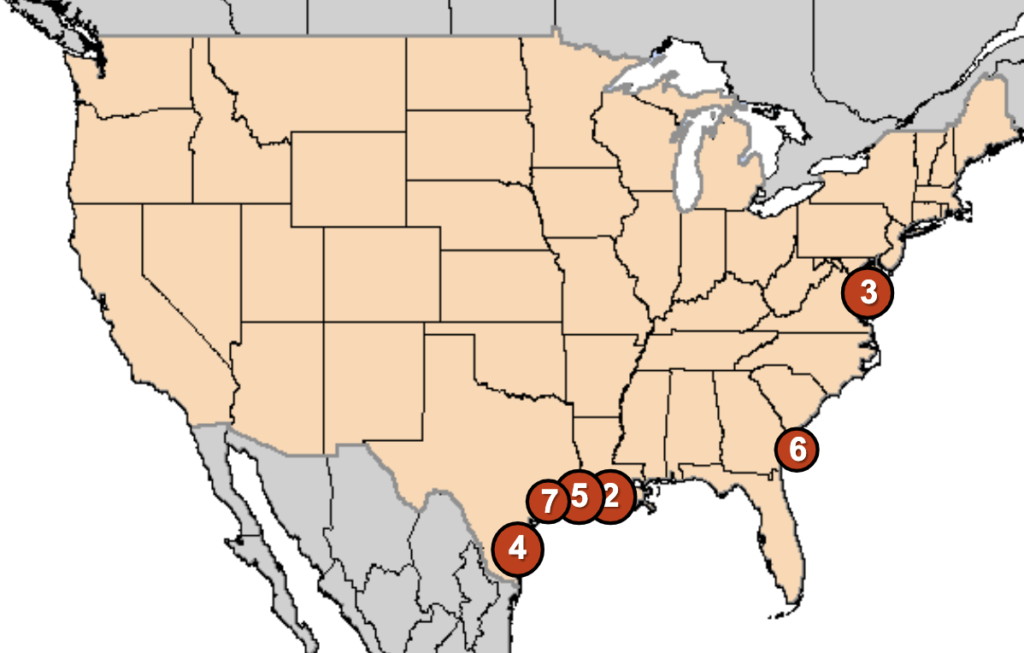

Beyond that, there are six existing EXPORT terminals in the Continental U.S. (excluding Alaska), two of them in Louisiana (Cheniere/Sabine Pass, Sempra/Cameron) and two in Texas (Cheniere/Corpus Christi, Freeport).

Existing U.S. LNG Export Terminals

Four of seven U.S. LNG terminals are on the Texas-Louisiana Coast (Alaska not shown)

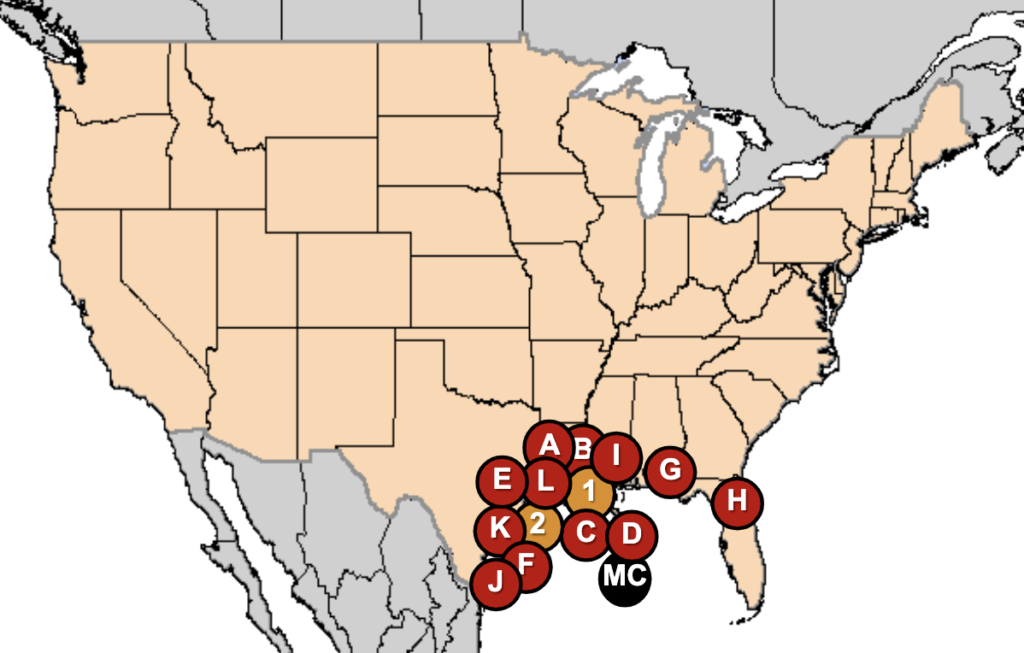

Beyond even those, however, there are 15 LNG plants already approved by the Federal Energy Regulatory Commission and 12 of them (including two already under construction — Venture Global Calcasieu Pass and Exxon Mobil Golden Pass) are on or around the Texas-Louisiana Coast.

FERC-Approved U.S. LNG Export Terminals

Of 15 approved LNG export terminals, 12 (including two under construction) are on the Texas-Louisiana Coast. Of the others, one is in Mississippi, one in Florida and one is offshore in the Gulf of Mexico.

These are, for the most part, multi-billion dollar projects that are years from completion. But while many have their eyes on the renewable energy sources, in Europe there are more than a few eyes on the Texas Coast.

In December, according to a report by Reuters, about half the U.S. export of LNG found its way to Europe.

The week ending Feb. 19 was explosive, the first big week of the year for M&A with 17 deals valued at more than $22 billion. Fueled by four deals worth more than $1 billion, including an $11 billion purchase by Celanese of a DuPont chemical materials asset, the weekly deal count is the best since Christmas week (believe it or not) and the best week by deal value since a nearly $30 billion week last August.

As you can see from the table below, last week’s deal count included 12 transactions for $2.3 billion and last year at this time there were 9 deals for $8.8 billion.

Weekly Corporate Deal Tracker Roundup Stats

A compilation of weekly stats from The Lawbook's CDT Weekly Roundup

(Deal Values in Millions)

(Deal Values in Millions)

| Deal Count | Amount | Firms | Lawyers | M&A Count | M&A Value $M | CapM Count | ||

|---|---|---|---|---|---|---|---|---|

| 21-Feb-26 | 10 | $7,087 | 7 | 180 | 7 | $6,187 | 3 | $899 |

| 14-Feb-26 | 14 | $20,460 | 9 | 151 | 9 | $16,440 | 5 | $4,020 |

| 7-Feb-26 | 8 | $316,505 | 11 | 203 | 8 | $316,505 | 0 | 0 |

| 31-Jan-26 | 11 | $3,985 | 8 | 72 | 7 | $135 | 4 | $3,850 |

| 24-Jan-26 | 8 | $1,340 | 5 | 120 | 7 | $985 | 1 | $355 |

| 17-Jan-26 | 19 | $18,440 | 10 | 203 | 13 | $12,963 | 6 | $5,477 |

| 10-Jan-26 | 18 | $8,958 | 12 | 182 | 17 | $8,358 | 1 | $600 |

| 03-Jan-26 | 2 | $1,519 | 2 | 17 | 1 | $18.8 | 1 | $1,500 |

| 27-Dec-25 | 2 | $3,200 | 2 | 15 | 2 | $3,200 | 0 | 0 |

| 20-Dec-25 | 11 | $10,167 | 8 | 96 | 7 | $7,411 | 4 | $2,756 |

| 13-Dec-25 | 15 | $9,952 | 10 | 211 | 11 | $6,267 | 4 | $3,686 |

| 06-Dec-25 | 16 | $9,947 | 11 | 94 | 13 | $8,091 | 3 | $1,856 |

| 29-Nov-25 | 6 | $4,075 | 5 | 60 | 2 | $175 | 4 | $3,900 |

| 22-Nov-25 | 20 | $5,546 | 14 | 166 | 14 | $3,309 | 6 | $2,238 |

| 15-Nov-25 | 16 | $16,373 | 11 | 136 | 8 | $4,790 | 8 | $11,583 |

| 08-Nov-25 | 21 | $75,919 | 15 | 191 | 15 | $70,630 | 6 | $5,289 |

| 01-Nov-25 | 20 | $25,927 | 12 | 152 | 14 | $21,455 | 6 | $4,472 |

| 25-Oct-25 | 19 | $61,470 | 14 | 262 | 18 | $60,894 | 1 | $576 |

| 18-Oct-25 | 14 | $47,792 | 12 | 130 | 13 | $46,592 | 1 | $1,200 |

| 11-Oct-25 | 14 | $17,361 | 9 | 104 | 7 | $14,444 | 7 | $2,917 |

| 04-Oct-25 | 21 | $20,843 | 15 | 236 | 10 | $15,376 | 11 | $5,467 |

| 27-Sept-25 | 16 | $22,774 | 12 | 219 | 10 | $19,103 | 6 | $3,671 |

| 20-Sept-25 | 24 | $11,305 | 13 | 238 | 16 | $6,209 | 8 | $5,096 |

| 13-Sept-25 | 20 | $26,575 | 11 | 225 | 12 | $20,971 | 8 | $5,604 |

| 06-Sept-25 | 19 | $8,622 | 12 | 190 | 13 | $2,880 | 6 | $8,622 |

| 30-Aug-25 | 10 | $6,569 | 9 | 109 | 7 | $3,519 | 3 | $3,050 |

| 23-Aug-25 | 23 | $15,207 | 10 | 129 | 18 | $14,500 | 5 | $707 |

| 16-Aug-25 | 13 | $26,405 | 12 | 149 | 7 | $3,180 | 6 | $23,225 |

| 09-Aug-25 | 19 | $16,066 | 16 | 245 | 15 | $11,307 | 4 | $4,759 |

| 02-Aug-25 | 17 | $19,480 | 11 | 104 | 13 | $18,002 | 4 | $1,478 |

| 26-Jul-25 | 15 | $3,164 | 12 | 96 | 12 | $3,0023 | 3 | $162 |

| 19-Jul-25 | 14 | $6,080 | 14 | 97 | 9 | $4,165 | 5 | $1,915 |

| 12-Jul-25 | 15 | $13,012 | 14 | 208 | 12 | $10,902 | 3 | $2,110 |

| 05-Jul-25 | 9 | $15,778 | 8 | 91 | 4 | $7,280 | 5 | $8,498 |

| 28-Jun-25 | 13 | $7,777 | 8 | 154 | 7 | $2,031 | 6 | $5,746 |

| 21-Jun-25 | 16 | $5,984 | 10 | 113 | 11 | $3,087 | 5 | $2,897 |

| 14-Jun-25 | 9 | $478 | 8 | 133 | 6 | 0 | 3 | $478 |

| 07-Jun-25 | 16 | $26,210 | 11 | 196 | 11 | $24,744 | 5 | $1,466 |

| 31-May-25 | 19 | $23,381 | 11 | 166 | 12 | $18,665 | 7 | $4,717 |

| 24-May-25 | 15 | $24,033 | 11 | 121 | 13 | $23,624 | 2 | $409 |

| 17-May-25 | 16 | $21,760 | 12 | 145 | 11 | $18,615 | 5 | $3,145 |

| 10-May-25 | 24 | $33,175 | 16 | 206 | 19 | $30,765 | 5 | $2,410 |

| 03-May-25 | 11 | $4,249 | 13 | 90 | 11 | $2,226.5 | 2 | $2,022.5 |

| 26-Apr-25 | 12 | $8,787 | 9 | 168 | 9 | $6,011 | 3 | $2,776 |

| 19-Apr-25 | 11 | $8,097 | 7 | 138 | 9 | $7,985 | 2 | $112 |

| 12-Apr-25 | 13 | $2,392 | 8 | 152 | 10 | $2,065 | 3 | $327 |

| 05-Apr-25 | 19 | $27,762 | 15 | 188 | 16 | $25,473 | 3 | $2,289 |

| 29-Mar-25 | 21 | $8,188 | 10 | 258 | 16 | $4,125 | 5 | $4,064 |

| 22-Mar-25 | 19 | $6,485 | 14 | 231 | 15 | $4,128 | 4 | $2,857 |

| 15-Mar-25 | 13 | $13,737 | 13 | 151 | 10 | $9,932 | 4 | $3,805 |

| 8-Mar-25 | 7 | $2,234 | 5 | 66 | 5 | $224 | 2 | $2,100 |

| 1-Mar-25 | 11 | $3,050 | 8 | 75 | 10 | $2,550 | 1 | $500 |

| 22-Feb-25 | 12 | $16,397 | 7 | 149 | 6 | $6,635 | 6 | $9,862 |

| 15-Feb-25 | 17 | $12,136 | 13 | 134 | 10 | $9,411 | 2 | $2,725 |

| 8-Feb-25 | 14 | $7,154 | 9 | 179 | 9 | $4,950 | 5 | $2,204 |

| 1-Feb-25 | 16 | $10,068 | 7 | 200 | 11 | $7,553 | 5 | $2,515 |

| 25-Jan-25 | 14 | $10,261 | 10 | 125 | 9 | $2,207 | 5 | $8,054 |

| 18-Jan-25 | 19 | $7,382 | 15 | 316 | 12 | $2,300 | 7 | $5,082 |

| 11-Jan-25 | 21 | $33,560 | 16 | 187 | 16 | $32,521 | 5 | $1,039 |

| 4-Jan-25 | 9 | $6,827 | 9 | 80 | 9 | $6,827 | 0 | 0 |

| 21-Dec-24 | 11 | $2,798 | 11 | 92 | 8 | $2,229 | 3 | $570 |

| 14-Dec-24 | 15 | $5,323 | 12 | 186 | 12 | $3,812 | 3 | $1,511 |

| 07-Dec-24 | 16 | $4,766 | 10 | 231 | 11 | $2,321 | 5 | 2,445 |

| 30-Nov-24 | 10 | $10,291 | 9 | 103 | 4 | $8,290 | 6 | $2.001 |

| 23-Nov-24 | 15 | $4,553 | 15 | 153 | 11 | $3,379 | 4 | $1,174 |

| 16-Nov-24 | 17 | $11,488 | 11 | 245 | 13 | $10,186 | 4 | $1,303 |

| 09-Nov-24 | 14 | $2,110 | 12 | 139 | 12 | $1,410 | 2 | $700 |

| 02-Nov-24 | 12 | $52,788 | 11 | 107 | 11 | $52,738 | 1 | $50 |

| 26-Oct-24 | 8 | $3,160 | 8 | 65 | 7 | $3,065 | 1 | $75 |

| 19-Oct-24 | 12 | $5,304 | 11 | 136 | 11 | $4,554 | 1 | $750 |

| 12-Oct-24 | 17 | $8,438 | 12 | 150 | 15 | $8,116 | 2 | $322 |

| 05-Oct-24 | 22 | $23,181 | 12 | 189 | 15 | $19,980 | 7 | $3,201 |

| 28-Sep-24 | 11 | $2,356 | 7 | 144 | 7 | $53 | 4 | $2,303 |

| 21-Sep-24 | 12 | $9,568 | 10 | 169 | 5 | $4,101 | 7 | $5,467 |

| 14-Sep-24 | 24 | $10,988 | 12 | 235 | 16 | $7,175 | 8 | $3,813 |

| 7-Sep-24 | 12 | $20,420 | 16 | 168 | 11 | $20,307 | 1 | $112.9 |

| 31-Aug-24 | 13 | $20,631 | 9 | 134 | 12 | $14,775 | 1 | $5,856 |

| 24-Aug-24 | 19 | $8,452 | 21 | 325 | 16 | $7,102 | 3 | $1,350 |

| 17-Aug-24 | 25 | $49,196 | 16 | 304 | 11 | $39,386 | 14 | $9,810 |

| 10-Aug-24 | 20 | $12,264 | 15 | 312 | 16 | $9,794 | 4 | $2,470 |

| 03-Aug-24 | 26 | $16,498 | 16 | 334 | 18 | $8,137 | 8 | $8,361 |

| 27-Jul-24 | 19 | $16,442 | 21 | 271 | 15 | $13,838 | 4 | $2,604 |

| 20-Jul-24 | 15 | $16,016 | 14 | 184 | 10 | $14,232 | 5 | $1,784 |

| 13-Jul-24 | 20 | $17,220 | 14 | 265 | 18 | $7,146 | 2 | $10,074 |

| 6-Jul-24 | 11 | $3,941 | 11 | 95 | 8 | $2,650 | 3 | $1,291 |

| 29-Jun-24 | 14 | $6,296 | 15 | 224 | 8 | $6,296 | 6 | $1,927 |

| 22-Jun-24 | 12 | $5,679 | 8 | 137 | 5 | $210 | 7 | $5,469 |

| 15-Jun-24 | 13 | $9,895 | 16 | 214 | 10 | $5,280 | 3 | $4,615 |

| 8-Jun-24 | 19 | $23,859 | 13 | 239 | 12 | $19,436 | 7 | $4,423 |

| 1-Jun-24 | 12 | $34,510 | 11 | 147 | 9 | $26,110 | 3 | $8,400 |

| 25-May-24 | 13 | $9,684 | 15 | 171 | 10 | $4,434 | 3 | $5,250 |

| 18-May-24 | 11 | $5,490 | 11 | 173 | 8 | $3,129 | 3 | $2,361 |

| 11-May-24 | 22 | $14,855 | 14 | 227 | 16 | $11,105 | 6 | $3,750 |

| 4-May-24 | 13 | $3,139 | 9 | 87 | 10 | $1,297 | 3 | $1,842 |

| 27-Apr-24 | 10 | $6,684 | 6 | 28 | 10 | $6,684 | 0 | 0 |

| 20-Apr-24 | 19 | $15,989 | 11 | 147 | 9 | $5,208 | 10 | $10,781 |

| 13-Apr-24 | 13 | $8,952 | 9 | 76 | 10 | $1,652 | 3 | $7,300 |

| 6-Apr-24 | 23 | $26,616 | 14 | 222 | 14 | $13,501 | 8 | $13,116 |

| 30-Mar-24 | 12 | $9,286 | 8 | 136 | 8 | $4,299 | 4 | $4,987 |

| 23-Mar-24 | 18 | $5,451 | 17 | 266 | 16 | $4,759 | 2 | $692 |

| 16-Mar-24 | 21 | $11,437 | 13 | 186 | 14 | $9,316 | 6 | $2,070 |

| 9-Mar-24 | 23 | $4,695 | 21 | 218 | 19 | $2,723 | 4 | $1,972 |

| 2-Mar-24 | 20 | $9,108 | 19 | 372 | 14 | $4,558 | 6 | $4,550 |

| 24-Feb-24 | 19 | $16,382 | 12 | 248 | 15 | $9,507 | 4 | $6,875 |

| 17-Feb-24 | 16 | $29,932 | 15 | 157 | 12 | $29,216 | 4 | $716 |

| 10-Feb-24 | 25 | $10,750 | 17 | 196 | 19 | $5,372 | 6 | $5,379 |

| 3-Feb-24 | 12 | $8,416 | 18 | 125 | 9 | $3,416 | 3 | $5,000 |

| 27-Jan-24 | 9 | $8,165 | 9 | 87 | 8 | $7,815 | 1 | $800 |

| 20-Jan-24 | 14 | $4,084 | 12 | 109 | 12 | $3,219 | 2 | $865 |

| 13-Jan-24 | 17 | $33,588 | 12 | 256 | 12 | $26,765 | 5 | $6,823 |

| 6-Jan-24 | 8 | $7,915 | 8 | 84 | 6 | $7,265 | 2 | $650 |

| 30-Dec-23 | 17 | $14,599 | 12 | 99 | 15 | $2,714 | 2 | $11,885 |

| 23-Dec-23 | 23 | $4,182 | 13 | 219 | 16 | $1,813 | 7 | $2,370 |

| 16-Dec-23 | 13 | $16,436 | 13 | 280 | 7 | $15,150 | 5 | $1,286 |

| 9-Dec-23 | 26 | $14,633.90 | 17 | 244 | 16 | $8,095 | 10 | $6,538.90 |

| 2-Dec-23 | 13 | $6,720 | 9 | 57 | 12 | $6,630 | 1 | $90 |

| 25-Nov-23 | 9 | $4,835 | 9 | 131 | 6 | $1,785 | 3 | $3,050 |

| 18-Nov-23 | 22 | $6,568.70 | 17 | 184 | 14 | $4,709.20 | 8 | $1,859.50 |

| 11-Nov-23 | 15 | $9,825 | 13 | 179 | 12 | $6,581 | 3 | $3,244 |

| 4-Nov-23 | 15 | $20,582.50 | 14 | 193 | 12 | $19,417.50 | 3 | $1,165 |

| 28-Oct-23 | 18 | $68,419.10 | 18 | 152 | 15 | $66,646 | 3 | $1,773.10 |

| 21-Oct-23 | 16 | $6,755.90 | 16 | 165 | 15 | $6,755.90 | 1 | $3 |

| 14-Oct-23 | 14 | $67,851.20 | 13 | 125 | 9 | $61,998.50 | 5 | $5,852.70 |

| 7-Oct-23 | 17 | $6,595.50 | 13 | 228 | 16 | $5,995.50 | 1 | $600 |

| 30-Sep-23 | 17 | $1,896.45 | 13 | 189 | 14 | $806.45 | 3 | $1,090 |

| 23-Sep-23 | 23 | $6,432.70 | 17 | 230 | 16 | $1,402.80 | 7 | $5,029.90 |

| 16-Sep-23 | 25 | $23,226.70 | 23 | 353 | 16 | $17,239 | 9 | $5,987.70 |

| 9-Sep-23 | 12 | $6,369 | 8 | 102 | 7 | $4,311 | 5 | $2,058 |

| 2-Sep-23 | 14 | $2,522 | 6 | 92 | 13 | $1,322 | 1 | $1,200 |

| 26-Aug-23 | 17 | $12,160.25 | 13 | 202 | 15 | $6,573.25 | 2 | $5,587.00 |

| 19-Aug-23 | 19 | $11,505 | 13 | 213 | 15 | $11,255 | 4 | $250 |

| 12-Aug-23 | 19 | $9,698.80 | 13 | 184 | 7 | $3,270 | 12 | $6,428.80 |

| 5-Aug-23 | 13 | $5,201 | 12 | 118 | 12 | $5,051 | 1 | $150 |

| 29-Jul-23 | 15 | $21,031.60 | 13 | 196 | 11 | $18,292.00 | 4 | $2,739.60 |

| 22-Jul-23 | 18 | $3,992 | 12 | 130 | 13 | $2,808 | 5 | $1,184 |

| 15-Jul-23 | 13 | $8,254.95 | 13 | 81 | 13 | $8,254.95 | 0 | 0 |

| 8-Jul-23 | 16 | $5,441.45 | 12 | 172 | 11 | $2,443 | 5 | $2,998.45 |

| 1-Jul-23 | 16 | $6,872 | 10 | 105 | 12 | $5,474 | 4 | $1,398 |

| 24-Jun-23 | 13 | $10,914 | 16 | 201 | 10 | $7,874 | 3 | $3,040 |

| 17-Jun-23 | 17 | $5,880.70 | 15 | 151 | 15 | $4,705.70 | 2 | $1,175 |

| 10-Jun-23 | 19 | $8,516.10 | 13 | 111 | 16 | $6,252.40 | 3 | $2,263.70 |

| June 3 2023 | 12 | $6,104.42 | 12 | 138 | 8 | $4,256.92 | 4 | $1,847.50 |

| 27-May-23 | 17 | $12,200 | 10 | 67 | 11 | $6,165 | 6 | $6,035 |

| 20-May-23 | 11 | $22,458.10 | 8 | 103 | 4 | $19,455 | 7 | $3,003 |

| 13-May-23 | 12 | $7,034 | 10 | 101 | 8 | $5,460 | 4 | $1,574 |

| 6-May-23 | 20 | $3,297.60 | 18 | 196 | 17 | $2,985.60 | 3 | $312 |

| 29-Apr-23 | 23 | $3,691.20 | 18 | 135 | 17 | $1,969.70 | 6 | $1,721.50 |

| 22-Apr-23 | 16 | $5,570 | 14 | 104 | 14 | $4,750 | 2 | $1,000 |

| 15-Apr-23 | 12 | $23,818.10 | 9 | 59 | 10 | $21,618.10 | 2 | $2,200 |

| 8-Apr-23 | 16 | $7,949 | 9 | 173 | 9 | $5,472 | 7 | $3,477 |

| 1-Apr-23 | 21 | $18,676.70 | 12 | 175 | 11 | $10,926.70 | 10 | $7,750 |

| 25-Mar-23 | 15 | $8,779.50 | 10 | 141 | 5 | $2,362 | 10 | $6,416.50 |

| 18-Mar-23 | 7 | $14,048.80 | 6 | 69 | 5 | $13,345 | 2 | $703.80 |

| 11-Mar-23 | 21 | $11,576 | 16 | 165 | 16 | $8,131 | 5 | $3,445 |

| 4-Mar-23 | 20 | $9,668 | 11 | 228 | 16 | $8,209 | 4 | $1,459 |

| 25-Feb-23 | 13 | $5,335 | 13 | 130 | 12 | $4,235 | 1 | $1,200 |

| 18-Feb-23 | 14 | $5,743.70 | 13 | 158 | 8 | $898.70 | 6 | $4,845 |

| 11-Feb-23 | 16 | $12,088 | 12 | 137 | 12 | $9,965 | 4 | $2,123 |

| 4-Feb-23 | 17 | $8,066 | 15 | 140 | 13 | $5,614 | 4 | $2,452 |

| 28-Jan-23 | 7 | $2,180 | 7 | 75 | 5 | $1,692.75 | 2 | $488 |

| 21-Jan-23 | 17 | $5,768 | 16 | 174 | 12 | $1,918 | 5 | $3,850 |

| 14-Jan-23 | 11 | $2, 800 | 10 | 102 | 8 | $421 | 3 | $2,400 |

| 7-Jan-23 | 18 | $8,296 | 11 | 167 | 14 | $6,461 | 3 | $1,835 |

| 31-Dec-22 | 14 | $2,732 | 11 | 99 | 12 | $2,092 | 2 | $640 |

| 17-Dec | 14 | $7,919 | 13 | 115 | 12 | $7,419 | 1 | $500 |

| 10-Dec-22 | 14 | $10,093 | 12 | 88 | 11 | $7,093 | 3 | $3,000 |

| 3-Dec-22 | 26 | $12,800.90 | 11 | 172 | 20 | $4,141 | 6 | $8,659.90 |

| 26-Nov-22 | 8 | $2,266.70 | 8 | 5 | 3 | $76 | 5 | $2,190.70 |

| 19-Nov-22 | 21 | $2,886 | 15 | 212 | 19 | $2,550 | 2 | $336 |

| 12-Nov-22 | 13 | $15,093.70 | 9 | 81 | 9 | $14,200 | 4 | $893.70 |

| 5-Nov-22 | 25 | 19,337.20 | 16 | 509 | 22 | $8,267.20 | 3 | $11,070 |

| 29-Oct-22 | 15 | $7,805.30 | 9 | 116 | 14 | $7,180.30 | 1 | $625 |

| 22-Oct-22 | 20 | $8,193.50 | 13 | 253 | 13 | $5,442 | 7 | $2,751.50 |

| 15-Oct-22 | 9 | $3,046.10 | 9 | 139 | 7 | $2,588.30 | 2 | $457.80 |

| 8-Oct-22 | 19 | $2,011.80 | 12 | 114 | 16 | $833.80 | 3 | $1,178 |

| 1-Oct-22 | 23 | $5,532.90 | 16 | 156 | 18 | $4,952.30 | 5 | $580.60 |

| 24-Sep-22 | 18 | $5,194 | 14 | 216 | 15 | $4,050 | 3 | $1,144 |

| 17-Sep-22 | 21 | $8,352.30 | 12 | 320 | 15 | $4,759.60 | 6 | $3,592.70 |

| 10-Sep-22 | 15 | $19,853.50 | 10 | 126 | 13 | $19,403.60 | 2 | $450 |

| 3-Sep-22 | 9 | $2,312 | 9 | 62 | 9 | $2,312 | 0 | 0 |

| 27-Aug-22 | 16 | $30,891.70 | 10 | 135 | 15 | $30,666.40 | 1 | 227.7 |

| 20-Aug-22 | 12 | $1,977 | 8 | 152 | 9 | 925 | 3 | $1,052 |

| 13-Aug-22 | 18 | $8,004.70 | 11 | 242 | 11 | $2,844.70 | 7 | $5,160 |

| 6-Aug-22 | 24 | $7,948.90 | 12 | 240 | 17 | $3,577 | 7 | $4,371.90 |

| 30-Jul-22 | 8 | $6,941 | 9 | 78 | 7 | $6,839 | 1 | $102 |

| 23-Jul-22 | 11 | $801 | 11 | 92 | 10 | $801 | 1 | 0 |

| 16-Jul-22 | 14 | $3,650 | 10 | 122 | 14 | $3,650 | 0 | 0 |

| 9-Jul-22 | 10 | $3,557.70 | 7 | 68 | 9 | $3,557.70 | 1 | 0 |

| 2-Jul-22 | 18 | $8,609.40 | 13 | 152 | 15 | $2,754.40 | 3 | $5,855 |

| 25-Jun-22 | 15 | $6,142 | 13 | 146 | 9 | $2,017 | 6 | $4,125 |

| 18-Jun-22 | 17 | $11,890.10 | 14 | 228 | 15 | $11,410 | 2 | 479.7 |

| 11-Jun-22 | 17 | $7,600 | 12 | 123 | 10 | $2,300 | 7 | $5,300 |

| 4-Jun-22 | 12 | $2,937 | 10 | 127 | 9 | $692 | 3 | $2,245 |

| 28-May-22 | 9 | $3,197.60 | 11 | 86 | 9 | $3,197.60 | 0 | 0 |

| 21-May-22 | 14 | $7,284.50 | 12 | 185 | 11 | $6,609 | 3 | $675.50 |

| 14-May-22 | 11 | $306.60 | 9 | 80 | 10 | $306.60 | 1 | $225 |

| 7-May-22 | 16 | $10,451.75 | 12 | 108 | 12 | $1,827 | 4 | $8,624.75 |

| 30-Apr-22 | 16 | $2,296.50 | 16 | 157 | 12 | $895.50 | 4 | $1,401 |

| 23-Apr-22 | 10 | $2,241 | 11 | 58 | 8 | $1,641 | 2 | $600 |

| 16-Apr-22 | 11 | $6,643 | 7 | 156 | 8 | $2,359 | 3 | $4,284 |

| 9-Apr-22 | 17 | $4,429 | 14 | 184 | 11 | $1,690 | 6 | $2,739 |

| 2-Apr-22 | 13 | $1,755 | 8 | 84 | 10 | $1,145 | 3 | $610 |

| 26-Mar-22 | 11 | $3,205 | 8 | 65 | 6 | $200 | 5 | $3,005 |

| 19-Mar-22 | 13 | $2,239.17 | 9 | 106 | 13 | $2,239.17 | 0 | 0 |

| 12-Mar-22 | 18 | $12,016 | 11 | 239 | 15 | $11,965 | 2 | $51.35 |

| 5-Mar-22 | 17 | $6,786 | 13 | 137 | 13 | $5,161 | 4 | $1,625 |

| 26-Feb-22 | 12 | $5,095 | 8 | 149 | 9 | $4,437.50 | 3 | $658 |

| 19-Feb-22 | 17 | $22,229 | 17 | 174 | 14 | $21,354 | 3 | $875 |

| 12-Feb-22 | 12 | $2,344.70 | 10 | 73 | 8 | $641.70 | 4 | $1,703 |

| 5-Feb-22 | 11 | $2,503 | 8 | 99 | 11 | $2,503 | 0 | 0 |

| 29-Jan-22 | 11 | $3,872 | 12 | 101 | 12 | $3,872 | 0 | 0 |

| 22-Jan-22 | 13 | $5,143.50 | 10 | 99 | 12 | $4,842.50 | 1 | $301 |

| 15-Jan-22 | 12 | $7,605 | 9 | 155 | 9 | $6,480 | 3 | $1,025 |

| 8-Jan-22 | 13 | $8,256.20 | 11 | 102 | 13 | $8,256.20 | 0 | 0 |

| 1-Jan-22 | 9 | $1,273.80 | 6 | 50 | 9 | $1,273.80 | 0 | 0 |

| 25-Dec-21 | 21 | $4,734.75 | 11 | 176 | 16 | $3,410 | 5 | $1,324.75 |

| 18-Dec-21 | 26 | $7,325.20 | 15 | 193 | 18 | $3,640.20 | 8 | $3,685.20 |

| 11-Dec-21 | 16 | $5,017 | 10 | 109 | 13 | $1,417 | 3 | $3,600 |

| 4-Dec-21 | 14 | $2,310 | 8 | 86 | 8 | $2,310 | 6 | $1,882.05 |

| 27-Nov-21 | 9 | $3.460.1 | 10 | 101 | 6 | $1,758 | 3 | $1,702.60 |

| 20-Nov-21 | 20 | $22,792 | 15 | 157 | 12 | $18,864.50 | 8 | $3,928 |

| 13-Nov-21 | 21 | $26,729 | 12 | 178 | 13 | $11,822 | 8 | $14,907 |

| 6-Nov-21 | 12 | $8,303 | 13 | 157 | 10 | $6,682 | 3 | $1,621 |

| 30-Oct-21 | 21 | $10,368 | 15 | 218 | 15 | $9,24.4 | 6 | $1,103.00 |

| 23-Oct-21 | 21 | $18.783.1 | 15 | 222 | 11 | $12,314 | 10 | $6,468.60 |

| 16-Oct-21 | 15 | $3,868 | 11 | 118 | 15 | $2,293 | 2 | $1,575 |

| 9-Oct-21 | 20 | $8,610 | 16 | 175 | 16 | $7,795 | 4 | $815 |

| 2-Oct-21 | 14 | $6,250 | 11 | 137 | 10 | $5,200 | 4 | $1,050 |

| 25-Sep-21 | 11 | $11,460 | 9 | 93 | 7 | $10,200 | 4 | $1,250 |

| 18-Sep-21 | 11 | $16,603 | 8 | 99 | 8 | $15,084 | 3 | $1,519 |

| 11-Sep-21 | 17 | $10,653 | 11 | 103 | 13 | $8,503 | 4 | $2,150 |

| 4-Sep-21 | 13 | $7,222 | 10 | 89 | 11 | $6,715 | 2 | $507 |

| 28-Aug-21 | 12 | $763 | 9 | 63 | 11 | $663 | 1 | $100 |

| 21-Aug-21 | 12 | $29,659 | 7 | 79 | 11 | $29,579 | 1 | $80 |

| 14-Aug-21 | 22 | $17,845 | 11 | 199 | 12 | $12,805 | 10 | $5,04 |

| 7-Aug-21 | 17 | $13,670 | 12 | 139 | 15 | $11,766 | 2 | $1,904 |

| 31-Jul-21 | 21 | $8,160 | 11 | 134 | 10 | $3,574 | 10 | $4,586 |

| July 24,2021 | 21 | $6,367 | 11 | 139 | 15 | $3,712 | 6 | $2,655 |

| 17-Jul-21 | 14 | $4,009 | 11 | 124 | 12 | $2,015 | 2 | $1,994 |

| 10-Jul-21 | 16 | $3,997 | 13 | 143 | 11 | $1,597 | 4 | $2,4 |

| 3-Jul-21 | 24 | $7,492 | 13 | 94 | 16 | $3,769 | 8 | $3,722 |

| 26-Jun-21 | 10 | $4,995 | 7 | 85 | 8 | $3,847 | 2 | $1,148 |

| 19-Jun-21 | 28 | $16,830 | 8 | 228 | 9 | $1,861 | 19 | $14,968 |

| 12-Jun-21 | 26 | $27,238 | 15 | 209 | 19 | $25,602 | 7 | $1,636 |

| 5-Jun-21 | 15 | $15,539 | 13 | 100 | 13 | $14,709 | 2 | $600 |

| 29-May-21 | 35 | $20,279 | 11 | 145 | 28 | $18,64 | 7 | $1,639 |

| 22-May-21 | 24 | $53,208 | 14 | 174 | 17 | $51,047 | 7 | $2,161 |

| 15-May-21 | 18 | $10,620 | 13 | 220 | 11 | $5,870 | 7 | $4,809 |

| 8-May-21 | 17 | $10,400 | 11 | 156 | 15 | $8,386 | 2 | $2,500 |

| 1-May-21 | 21 | $7,200 | 16 | 115 | 12 | $3,808 | 9 | $3,392 |

| 24-Apr-21 | 8 | $20,200 | 9 | 31 | 8 | $20,200 | 0 | 0 |

| 17-Apr-21 | 14 | $6,270 | 8 | 102 | 11 | $40,180 | 3 | $2,260 |

| 10-Apr-21 | 15 | $8,940 | 13 | 129 | 14 | $7,990 | 1 | $950 |

| 3-Apr-21 | 18 | $19,513 | 10 | 151 | 12 | $16,923 | 6 | $2,590 |

| 27-Mar-21 | 27 | $13,942 | 15 | 244 | 14 | $4,300 | 13 | $9,633.50 |

| 20-Mar-21 | 11 | $2,046 | 4 | 102 | 3 | $270 | 8 | $1,776 |

| 13-Mar-21 | 15 | $3,270 | 9 | 109 | 6 | $538 | 9 | $2,732 |

| 6-Mar-21 | 24 | $13,617 | 10 | 196 | 13 | $10,395 | 11 | $3,222 |

| 27-Feb-21 | 19 | $8,105 | 12 | 139 | 15 | $4,970 | 4 | $3,135 |

| 20-Feb-21 | 9 | $8,820 | 9 | 153 | 8 | $8,520 | 1 | $300 |

| 13-Feb-21 | 12 | $4,852.60 | 7 | 81 | 7 | 2,766 | 5 | $2,086.60 |

| 6-Feb-21 | 18 | $9,752 | 13 | 153 | 14 | $5,222 | 4 | $4,530 |

| 30-Jan-21 | 18 | $9,449 | 9 | 182 | 15 | $8,753.80 | 3 | $695.30 |

| 23-Jan-21 | 14 | $8,150 | 8 | 118 | 6 | $4,000 | 8 | $4,150 |

| 16-Jan-21 | 17 | $6,783 | 13 | 138 | 11 | $2,400 | 6 | $4,382.90 |

| 9-Jan-21 | 22 | $6,829 | 14 | 135 | 18 | $3,139.30 | 4 | $3,690 |

| 2-Jan-21 | 7 | $1,466 | 7 | 60 | 7 | $1,466 | 0 | 0 |

| 26-Dec-20 | 18 | $15,900 | 12 | 163 | 16 | $5,300 | 1 | $600 |

| 19-Dec-20 | 18 | $9,769 | 14 | 110 | 14 | $8,426 | 4 | $1,343 |

| 12-Dec-20 | 10 | $7,200 | 9 | 100 | 9 | $3,325 | 1 | $3,830 |

| 5-Dec-20 | 15 | $4,261 | 9 | 122 | 9 | $2,780 | 6 | $1,481 |

| 28-Nov-20 | 19 | $7,758 | 10 | 110 | 13 | $4,003 | 6 | $3,755 |

| 14-Nov-20 | 14 | $864.10 | 14 | 157 | 12 | $289.10 | 2 | $575 |

| 7-Nov-20 | 13 | $6,332 | 9 | 129 | 9 | $2,483.50 | 4 | $3,849 |

| 31-Oct-20 | 10 | $3,995.80 | 8 | 103 | 6 | $3,231.10 | 4 | $754.70 |

| 24-Oct-20 | 6 | $18,100 | 6 | 58 | 5 | $17,709 | 1 | $350 |

| 17-Oct-20 | 8 | $351.90 | 5 | 55 | 8 | $351.90 | 0 | 0 |

| 10-Oct-20 | 7 | $5,229 | 3 | 50 | 4 | $735 | 3 | $4,494 |

| 3-Oct-20 | 14 | $21,428 | 9 | 173 | 9 | $17,535 | 5 | $3,893 |

| 26-Sep-20 | 10 | $12,770 | 8 | 93 | 5 | $10,300 | 5 | $2,470 |

| 19-Sep-20 | 14 | $8,365 | 9 | 101 | 6 | $1,020 | 8 | $7,345 |

| 12-Sep-20 | 6 | $4,406 | 8 | 59 | 3 | $1,270 | 3 | $3,136 |

| 5-Sep-20 | 11 | $5,191 | 8 | 117 | 9 | $4,061 | 2 | $1,130 |

| 29-Aug-20 | 11 | $2,531 | 9 | 94 | 5 | $1,130 | 6 | $1,401 |

| 22-Aug-20 | 18 | $6,574 | 12 | 140 | 7 | $1,930 | 11 | $4,644 |

| 15-Aug-20 | 13 | $4,991 | 10 | 97 | 7 | $1,216 | 6 | $3,775 |

| 8-Aug-20 | 12 | $32,092 | 11 | 112 | 9 | $30,457 | 3 | $1,635 |

| 1-Aug-20 | 7 | $5,287 | 8 | 76 | 5 | $3,687 | 2 | $1,600 |

| 25-Jul-20 | 9 | $18,751 | 6 | 67 | 7 | $18,403 | 2 | $348 |

| 18-Jul-20 | 6 | $1,982.50 | 5 | 50 | 4 | $1,407.50 | 2 | $575 |

| 11-Jul-20 | 11 | $565.10 | 12 | 75 | 10 | $65.10 | 1 | $500 |

| 4-Jul-20 | 10 | $8,889 | 8 | 98 | 9 | $8,788 | 1 | $100.30 |

| 27-Jun-20 | 8 | $6,874 | 10 | 50 | 5 | $4,972.50 | 3 | $2,081.50 |

| 20-Jun-20 | 12 | $4,444 | 9 | 115 | 7 | $2,829 | 5 | $1,615 |

| 13-Jun-20 | 6 | $3,582 | 4 | 37 | 2 | $350 | 4 | $3,232 |

| 6-Jun-20 | 11 | $3,213.70 | 8 | 65 | 7 | $470 | 4 | $2,743.70 |

| 30-May-20 | 8 | $7,335 | 7 | 48 | 6 | $4,639 | 2 | $2,697 |

| 23-May-20 | 4 | $432.40 | 4 | 34 | 3 | $432.40 | 1 | 0 |

| 16-May-20 | 6 | $310 | 6 | 34 | 5 | $310 | 1 | 0 |

| 9-May-20 | 18 | $5,630 | 16 | 124 | 14 | $3,180 | 4 | $2,450 |

| 2-May-20 | 15 | 10,400 | 10 | 90 | 8 | $1,900 | 7 | $,8,500 |

| 25-Apr-20 | 8 | $3,400 | 9 | 36 | 5 | $1,000 | 3 | $2,450 |

| 18-Apr-20 | 19 | $9,500 | 14 | 92 | 8 | $185.70 | 11 | $9,360 |

| 11-Apr-20 | 12 | $6,000 | 9 | 40 | 5 | $190 | 7 | $5,800 |

| 4-Apr-20 | 14 | $8,200 | 11 | 68 | 10 | $2,200 | 4 | $6,000 |

| 28-Mar-20 | 16 | $6,500 | 13 | 96 | 10 | $3,700 | 6 | $2,800 |

| 21-Mar-20 | 11 | $11,910 | 7 | 33 | 7 | $2,250 | 4 | $9,960 |

| 14-Mar-20 | 7 | 809.8 | 6 | 34 | 6 | 684.8 | 1 | 125 |

| 7-Mar-20 | 16 | $2,500 | 15 | 70 | 13 | $669 | 3 | $1,400 |

| 29-Feb-20 | 13 | $15,260 | 13 | 128 | 11 | $11,760 | 2 | $3,500 |

| 22-Feb-20 | 12 | $3,700 | 10 | 92 | 10 | $2,560 | 2 | $1,130 |

| 15-Feb-20 | 16 | $1,250 | 10 | 84 | 12 | $35 | 4 | $1,222 |

| 8-Feb-20 | 18 | $6,080 | 14 | 123 | 14 | $2,595 | 4 | $3,485 |

| 1-Feb-20 | 21 | $20,900 | 12 | 101 | 14 | $17,860 | 7 | $3,060 |

| 25-Jan-20 | 13 | $7,430 | 13 | 62 | 12 | $6,430 | 1 | $1,000 |

| 18-Jan-20 | 23 | $9,580 | 15 | 120 | 19 | $6,580 | 4 | $3,000 |

| 11-Jan-20 | 21 | $14,200 | 18 | 199 | 16 | $1,020 | 5 | $13,200 |

| 4-Jan-20 | 22 | $6,400 | 11 | 119 | 16 | $3,204 | 6 | $3,245 |

| 28-Dec-19 | 22 | $7,150 | 19 | 175 | 18 | $6,800 | 4 | $327.40 |

| 14-Dec-19 | 24 | $36,300 | 23 | 167 | 19 | $9,500 | 5 | $26,800 |

| 7-Dec-19 | 11 | $10,400 | 11 | 55 | 7 | $1,082 | 4 | $9,370 |

| November 30. 2019 | 14 | $2,450 | 12 | 126 | 12 | $1,760 | 2 | $692.50 |

| 23-Nov-19 | 16 | $1,995 | 10 | 41 | 11 | $615 | 5 | $1,380 |

| 16-Nov-19 | 15 | $3,820 | 13 | 135 | 11 | $2,500 | 4 | $1,271 |

| 9-Nov-19 | 25 | $12,900 | 17 | 182 | 23 | $12,200 | 2 | $575 |

| 2-Nov-19 | 10 | $2,470 | 12 | 61 | 9 | 2,450 | 3 | $22 |

| 26-Oct-19 | 12 | $5,560 | 14 | 70 | 11 | $3,860 | 1 | $1,700 |

| 19-Oct-19 | 8 | $6,600 | 8 | 138 | 8 | $6,600 | 0 | 0 |

| 12-Oct-19 | 19 | $4,300 | 14 | 55 | 16 | $3,800 | 3 | $500 |

| 5-Oct-19 | 18 | $14,500 | 19 | 166 | 15 | $11,100 | 3 | $3,400 |

| 28-Sep-19 | 19 | $8,100 | 18 | 132 | 18 | $7,560 | 1 | $550 |

| 21-Sep-19 | 14 | $6,300 | 16 | 66 | 11 | $2,160 | 3 | $4,170 |

| 14-Sep-19 | 15 | $23,800 | 12 | 56 | 11 | $21,250 | 4 | $2,570 |

| 7-Sep-19 | 17 | $3,500 | 15 | 98 | 14 | $1,900 | 3 | $1,600 |

| 31-Aug-19 | 5 | $8,700 | 6 | 50 | 5 | $8,700 | 0 | 0 |

| 24-Aug-19 | 16 | $10,000 | 14 | 82 | 15 | $4,250 | 1 | $5,750 |

| 16-Aug-19 | 10 | $1,680 | 5 | 52 | 7 | $650 | 3 | $950 |

| 9-Aug-19 | 17 | $17,700 | 15 | 68 | 14 | $3,900 | 3 | $13,800 |

| 2-Aug-19 | 13 | $5,760 | 12 | 108 | 13 | $5,760 | NA | NA |

| 27-Jul-19 | 11 | $7,300 | 13 | 76 | 8 | $6,570 | 3 | $730 |

| 20-Jul-19 | 13 | $11,800 | 13 | 125 | 11 | $5,300 | 2 | $6,500 |

| 13-Jul-19 | 10 | $775 | 7 | 46 | 8 | $542.50 | 2 | $233 |

| 6-Jul-19 | 7 | $2,500 | 9 | 85 | 7 | $2,500 | 0 | 0 |

| 29-Jun-19 | 23 | $8,290 | 15 | 154 | 17 | $2,300 | 6 | $5,970 |

| 22-Jun-19 | 17 | $10,700 | 10 | 139 | 14 | $7,700 | 3 | $3,000 |

| 15-Jun-19 | 11 | $13,500 | 14 | 160 | 11 | $13,500 | NA | NA |

| 8-Jun-19 | 13 | $2,870 | 17 | 55 | 11 | $1,570 | 2 | $1,300 |

| 1-Jun-19 | 10 | $4,460 | 11 | 60 | 8 | $4,140 | 2 | $315 |

| 25-May-19 | 17 | $4,360 | 14 | 79 | 14 | $3,700 | 3 | $612 |

| 18-May-19 | 22 | $9,000 | 17 | 150 | 16 | $3,400 | 6 | $5,600 |

| 11-May-19 | 18 | $19,800 | 17 | 177 | 15 | $18,300 | 3 | $1,500 |

| 4-May-19 | 10 | $7,075 | 6 | 32 | 8 | $6,900 | 2 | $175 |

| 27-Apr-19 | 15 | $3,200 | 14 | 117 | 14 | $3,160 | 1 | $40 |

| 20-Apr-19 | 13 | $13,500 | 10 | 90 | 9 | $12,200 | 4 | $1,300 |

| 13-Apr-19 | 16 | $38,900 | 14 | 91 | 14 | $37,800 | 2 | $1,100 |

| 6-Apr-19 | 12 | $6,870 | 11 | 94 | 10 | $6,730 | 2 | $50 |

| 30-Mar-19 | 15 | $6,470 | 12 | 84 | 10 | $7,91.5 | 5 | $5,677 |

| 23-Mar-19 | 18 | $6,450 | 14 | 91 | 14 | $5,042 | 4 | $1,408 |

| 16-Mar-19 | 14 | $10,180 | 12 | 115 | 11 | $8,800 | 3 | $1,300 |

| 9-Mar-19 | 9 | $1,800 | 6 | 49 | 8 | $1,300 | 1 | $500 |

| 2-Mar-19 | 20 | $3,033 | 16 | 107 | 14 | $1,817 | 6 | $1,262 |

| 23-Feb-19 | 12 | $2,040 | 8 | 69 | 9 | $614.60 | 3 | $1,430 |

| 16-Feb-19 | 16 | $9,970 | 18 | 77 | 16 | $9,970 | 0 | 0 |

| 9-Feb-19 | 14 | $6,400 | 10 | 110 | 14 | $6,400 | 0 | 0 |

| 2-Feb-19 | 18 | $6,740 | 15 | 99 | 16 | $5,720 | 2 | $950 |

| 26-Jan-19 | 13 | $2,770 | 11 | 67 | 11 | $918.95 | 2 | $1,850 |

| 19-Jan-19 | 15 | $3,819 | 16 | 76 | 12 | $2,594 | 3 | $1,225 |

| 12-Jan-19 | 18 | $7,283 | 14 | 92 | 15 | $1,683 | 3 | $5,600 |

| 5-Jan-19 | 10 | $529 | 12 | 50 | 10 | $529 | 0 | 0 |

| 22-Dec-18 | 17 | $2,570 | 13 | 87 | 14 | $941 | 3 | $1,629 |

| 15-Dec-18 | 10 | $2,860 | 8 | 26 | 8 | $264 | 2 | $2,600 |

| 8-Dec-18 | 15 | $1,819 | 16 | 65 | 12 | $552 | 3 | $1,267 |

| 1-Dec-18 | 12 | $7,500 | 10 | 90 | 9 | $1,200 | 3 | $6,200 |

| 28-Nov-18 | 15 | $4,500 | 11 | 107 | 14 | $4,000 | 1 | $500 |

| 19-Nov-18 | 18 | $6,137 | 13 | 98 | 13 | $2,142 | 5 | $3,995 |

| 14-Nov-18 | 18 | $9,200 | 13 | 152 | 15 | $8,500 | 3 | $694 |

| 6-Nov-18 | 16 | $17,300 | 16 | 183 | 14 | $16,361 | 2 | $950 |

| 29-Oct-18 | 14 | $14,400 | 18 | 127 | 17 | $13,800 | 1 | $600 |

| 24-Oct-18 | 13 | $6,140 | 13 | 126 | 11 | $5,122 | 2 | $1,018 |

| 17-Oct-18 | 18 | $18,390 | 15 | 125 | 14 | $12,292 | 4 | $6,098 |

| 10-Oct-18 | 29 | $3,149 | 18 | 104 | 20 | $1,647 | 9 | $819 |

| 2-Oct-18 | 18 | $9,300 | 11 | 67 | 14 | $7,300 | 4 | $2,000 |

| 25-Sep-18 | 13 | $7,000 | 11 | 75 | 10 | $6,000 | 3 | $995 |

| 18-Sep-18 | 9 | $3,570 | 7 | 44 | 9 | $3,570 | 0 | 0 |

| 11-Sep-18 | 13 | $5,900 | 10 | 132 | 13 | $5,900 | 0 | 0 |

| 7-Sep-18 | 14 | $5,000 | 15 | 86 | 11 | $4,000 | 3 | $1,000 |

| 29-Aug-18 | 15 | $20,700 | 14 | 79 | 13 | $4,700 | 2 | $16,000 |

| 20-Aug-18 | 10 | $12,400 | 11 | 53 | 8 | $11,380 | 3 | $1,057 |

| 14-Aug-18 | 12 | $19,900 | 12 | 132 | 9 | $18,889 | 3 | $1,011 |

| 7-Aug-18 | 16 | $68,600 | 11 | 106 | 13 | $67,259 | 3 | $1,340 |

| 31-Jul-18 | 15 | $15,100 | 15 | 95 | 11 | $13,060 | 4 | $2,060 |

| 23-Jul-18 | 13 | $2,130 | 15 | 60 | 10 | $1,804 | 3 | $1,100 |

| 17-Jul-18 | 14 | $5,370 | 17 | 98 | 9 | $4,310 | 5 | $1,100 |

| 9-Jul-18 | 16 | $11,200 | 15 | 74 | 10 | $11,080 | 6 | $862 |

| 3-Jul-18 | 13 | $7,000 | 7 | 81 | 12 | $6,330 | 1 | $750 |

| 25-Jun-18 | 15 | $8,800 | 13 | 97 | 9 | $4,970 | 6 | $3,930 |

| 18-Jun-18 | 13 | $14,200 | 14 | 80 | 7 | $221 | 6 | $14,290 |

| 11-Jun-18 | 12 | $6,300 | 8 | 96 | 8 | $5,910 | 4 | $803 |

| 6-Jun-18 | 13 | $14,500 | 10 | 88 | 8 | $14,154 | 5 | $579 |

| 31-May-18 | 11 | $4,890 | 10 | 63 | 8 | $3,240 | 3 | $1,790 |

| 22-May-18 | 15 | $20,400 | 11 | 63 | 9 | $19,808 | 6 | $885 |

| 15-May-18 | 15 | $4,700 | 15 | 106 | 10 | $3,900 | 5 | $643 |

| 9-May-18 | 11 | $1,400 | 13 | 88 | 9 | $1,300 | 2 | $560 |

| 1-May-18 | 8 | $14,250 | 7 | 88 | 7 | $13,400 | 1 | $450 |

| 24-Apr-18 | 12 | $5,300 | 6 | 61 | 11 | $4,470 | 1 | $800 |

| 17-Apr-18 | 9 | $1,800 | 10 | 44 | 7 | $2,330 | 2 | $1,434 |

| 11-Apr-18 | 11 | $2,500 | 8 | 32 | 6 | $1,690 | 5 | $809 |

| 3-Apr-18 | 15 | $13,400 | 11 | 121 | 9 | $12,020 | 6 | $1,090 |

| 28-Mar-18 | 10 | $4,000 | 10 | 92 | 7 | $3,870 | 3 | $215 |

| 19-Mar-18 | 17 | $5,800 | 13 | 51 | 10 | $590 | 7 | $5,165 |

| 12-Mar-18 | 15 | $3,130 | 11 | 43 | 11 | $2,360 | 4 | $788 |

| 6-Mar-18 | 19 | $5,400 | 13 | 116 | 10 | $1,530 | 9 | $4,860 |

| 27-Feb-18 | 20 | $6,600 | 13 | 69 | 14 | $5,530 | 6 | $1,030 |

| 19-Feb-18 | 15 | $5,500 | 14 | 111 | 10 | $3,990 | 6 | $1,980 |

| 12-Feb-18 | 23 | $10,900 | 17 | 157 | 12 | $7,110 | 11 | $3,840 |

| 5-Feb-18 | 16 | $8,600 | 13 | 100 | 7 | $1,330 | 9 | $7,800 |

| 30-Jan-18 | 11 | $12,600 | 11 | 68 | 5 | $7,300 | 6 | $4,982 |

| 24-Jan-18 | 19 | $9,400 | 15 | 129 | 5 | $2,010 | 14 | $7,337 |

| 18-Jan-18 | 10 | $6,280 | 8 | 49 | 2 | $2,100 | 8 | $4,188 |

| 9-Jan-18 | 12 | $16,500 | 12 | 92 | 9 | $15,890 | 3 | $475 |

| 3-Jan-18 | 10 | $2,500 | 9 | 47 | 8 | $2,350 | 2 | $150 |

| 27-Dec-17 | 15 | $9,000 | 15 | 113 | 9 | $7,568 | 6 | $1,784 |

| 18-Dec-17 | 15 | $13,800 | 16 | 164 | 9 | $13,010 | 7 | $1,118 |

| 11-Dec-17 | 14 | $9,700 | 10 | 126 | 12 | $2,940 | 4 | $8,500 |

| 4-Dec-17 | 6 | $1,800 | 6 | 31 | 5 | $1,510 | 1 | $300 |

| 28-Nov-17 | 7 | $3,850 | 8 | 76 | 4 | $3,260 | 3 | $285 |

| 16-Nov-17 | 10 | $2,700 | 10 | 48 | 6 | $1,840 | 4 | $856 |

| 8-Nov-17 | 15 | $2,380 | 17 | 91 | 10 | $1,860 | 5 | $516 |

| 1-Nov-17 | 12 | $4,700 | 17 | 94 | 9 | $3,400 | 4 | $1,300 |

| 23-Oct-17 | 15 | $10,500 | 10 | 67 | 10 | $9,780 | 4 | $1,530 |

| 18-Oct-17 | 6 | $2,000 | 37 | 3 | $225 | 3 | $1,820 | |

| 10-Oct-17 | 12 | $6,570 | 100 | 9 | $3,880 | 3 | $3,360 | |

| 2-Oct-17 | 8 | $3,100 | 11 | 19 | 3 | $1,630 | 5 | $1,750 |

| 25-Sep-17 | 8 | $4,880 | 8 | 79 | 5 | $2,660 | 5 | $2,070 |

| 18-Sep-17 | 9 | $4,770 | 3 | $300 | 6 | $4,470 | ||

| 12-Sep-17 | 11 | $4,430 | 8 | $2,030 | 3 | $2,400 | ||

| 1-Sep-17 | 4 | $1,310 | 3 | $317 | 1 | $1,000 | ||

| 23-Aug-17 | 11 | $13,640 | 9 | 8 | $11,840 | 3 | $1,800 |

M&A/FUNDINGS

Celanese picks up materials business from DuPont for $11B

Dallas-based chemical company Celanese Corp. announced Feb. 18 it was buying a majority of the mobility and materials, or M&M, business of DuPont for $11 billion. Texas lawyers from Kirkland and Gibson Dunn advised the buyer on acquiring the business, which represented $3.5 billion of net sales and $800 million in operating earnings last year. For more on this deal, including in-house counsel at Celanese, click here.

Blackstone REIT acquires apartment communities for $5.8B

Deal Description: In an all-cash transaction valued at $5.8 billion, Blackstone Real Estate Income Trust announced Feb. 16 that it has reached an agreement to acquire all the outstanding shares of Atlanta-based Preferred Apartment Communities for $25 per share. The deal includes 44 multi-family communities concentrated primarily in Atlanta, Orlando, Jacksonville, Nashville, Charlotte and Tampa. The deal also includes 54 grocery-centered retail assets as well as properties under development.

BREIT Financial Advisors: Jones Lang LaSalle Limited, BofA Securities, Lazard Frères & Co.and Wells Fargo Securities

BREIT Outside Counsel: Simpson Thacher & Bartlett

PAC Financial Advisors: Goldman Sachs; KeyBank Capital Markets

PAC Outside Counsel: King & Spalding; Vinson & Elkins

The V& E team was led by partners Greg Cope and Steve Gill and senior associate Mariam Boxwala, with assistance from associates Elizabeth Shetty, Bekah Briggs, Ryan Polk and Terrence Ogren. Also advising were partner David D’Alessandro, counsel Regina Ibarra and associate Brian DeShannon (executive compensation/benefits); partner Wally Schwartz and senior associate Genta Stafaj (real estate); partners Christopher Mangin and Paige Anderson and associates Christina McLeod and Maddie Brown (tax); and partner Sean Becker and associate Peter Goetschel (labor/employment).

Madison Dearborn Agrees to Dole Out $1.8B in Cash for MoneyGram

Dallas-based MoneyGram International Inc. agreed Feb. 15 to be sold to Madison Dearborn Partners for $1.8 billion in cash, taking the company private. Vinson & Elkins advised the seller after its $1.2 billion sale to Hong Kong-based Ant Financial in 2018 was blocked by U.S. regulators (the firm counseled on that deal, too). For details about this deal, click here.

Water ventures combine to create Zurn Elkay Water Solutions in $1.56B deal

Deal Description: Milwaukee-based Zurn Water Solutions and faucet manufacturer Elkay Manufacturing announced Feb. 15 that they are combining to form Zurn Elkay Water Solutions Corporation. Zurn provides customized and sustainable water systems for non-residential buildings. Elkay is a manufacturer of water delivery products. Under the all-stock transaction, Zurn shareholders will own 71% of the newly created entity with Elkay shareholders holding 29%. Based on Zurn common stock pricing as of Feb. 11, the deal values Elkay at $1.56 billion, representing 14.2x the company’s forecasted 2022 EBITDA.

Zurn Financial Advisor: Evercore

Evercore Counsel: Baker Botts advised Evercore with a team led by partners Clint Rancher and Josh Davidson, both of Houston, along with Dallas partner Samantha Crispin and Houston senior associate Lakshmi Ramathan.

Zurn Outside Counsel: Morgan Lewis & Bockius advised Zurn with a team that included New York partners Alec Dawson, Allison Gargano, and Andrew Milano.

Elkay Financial Advisors: Citi; JP Morgan

Elkay Outside Legal Counsel: Mayer Brown

Akamai buys Linode for $900M

Deal Description: Cambridge, Mass.-based cybersecurity provider Akamai Technologies Inc. announced Feb. 15 that it agreed to pay $900 million for Linode, an infrastructure-as-a-service platform provider. As a result of structuring the transaction as an asset purchase, Akamai expects to achieve cash income tax savings over the next 15 years that have an estimated net present value of about $120 million. The deal is expected to close in the first quarter. The acquisition is anticipated to add around $100 million in revenue and be slightly accretive to non-GAAP earnings per share by about 5 to 6 cents in fiscal 2022. Akamai CEO and co-founder Tom Leighton said the opportunity to combine Linode’s developer-friendly cloud computing capabilities with Akamai’s market-leading edge platform and security services was “transformational.”

Akamai’s Financial Advisor: PJT Partners

Akamai’s Outside Counsel: WilmerHale

Linode’s Financial Advisor: DH Capital

Linode’s Outside Counsel: Latham & Watkins led by Century City/Los Angeles partner Jason Silvera as well as Houston partner James Garrett with Houston associates Jonathan Villa, Carlyle Reid and Zek Zhang. Advice was also provided on tax matters by Los Angeles partner Larry Stein but also Houston partner Jim Cole with Houston associate Christine Mainguy. Other offices pitched in with support.

Crescent buys Uinta Basin assets once owned by EP Energy for $815M

Deal Description: Houston-based Crescent Energy Co. announced Feb. 16 that it agreed with EnCap Investments-backed Verdun Oil Co. II to acquire Uinta Basin assets formerly owned by EP Energy for $815 million. The all-cash transaction, expected to close in the first half of 2022, requires regulatory approval and will be funded through the company’s revolving credit facility and cash on hand. Crescent said the acquisition is consistent with its strategy to acquire high-value and accretive, cash flowing assets while maintaining financial strength. Crescent was created last year by merging Independence Energy, controlled by KKR, with Contango Oil & Gas Co. in a $5.7 billion deal.

Crescent’s Outside Counsel: Kirkland & Ellis led by corporate partners David Castro Jr., Chris Heasley and Kyle Watson and associates Jordan Silverman, Catharine Hansard, Skyler Sikes, Sam Roberts, Clayton Hart, Carl Stenberg and Robbie Dillard; antitrust & competition partners Chuck Boyars and Ian John; debt finance partners Lucas Spivey and Jordan Roberts and associates Michelle Williamson, Osaro Aifuwa and Keegan Bobholz; derivatives partner Jaime Madell; capital markets partners Matt Pacey and Anne Peetz and associate Sean Aguirre; tax partner David Wheat and associate Ryan Phelps; environmental transactions partner Jim Dolphin and associate Alex Noll; employee benefits partner Alexandra Mihalas and associate Chris Chase; and labor and employment partners R.D. Kohut and Madeline Klebanov and associate Charles Kassir.

MedProperties recapitalizes assets in $350M joint venture

Deal Description: Dallas-based MedProperties Realty Advisors announced Feb. 10 that it is entering a $350 million joint venture with Kayne Anderson and Remedy Medical Properties that will recapitalize 23 medical properties in 11 states owned by MedProp. The properties, 94% occupied and 71% leased are mostly medical office buildings but include an ambulatory surgery center in Texas and a rehabilitation hospital in Ohio. Tenants include such healthcare tenants as Baylor Scott & White, Children’s Hospital of Los Angeles and the U.S. Department of Veteran’s Affairs. Remedy is based in Chicago and Kayne Anderson in Boca Raton.

MedProperties Outside Counsel: Winston & Strawn advised MedProp with a team led from Dallas by shareholder Andy Dow along with Cole Gearhart, Justin Hoover, Jarrod Azopardi, Ginger Epstein, Nick Gerner, and Brad Kuntz .

Solek signs deal with BlackRock’s fund to build solar power plants

Deal Description: Prague-based solar power plant developer Solek Group, through its Chilean unit Solek Latam Holding, announced Feb. 14 it agreed to develop, build and sell solar projects in Chile to BlackRock’s Global Renewable Power Fund III. Terms weren’t disclosed. Solek will oversee the operation and maintenance services for the projects and Aediles Capital Inc. will oversee asset management on behalf of BlackRock Global Renewable Power Fund III. The deal enables Solek to develop up to 28 individual photovoltaic power plant projects with a capacity of up to 200 megawatts. Solar power plant projects with an installed capacity of 90.5 megawatts are under preparation phase of construction. The projects serve regions with high demand for electricity due to growing populations and a developed mining industry. Chile has a strategy to become carbon neutral by 2050.

Solek’s Outside Counsel: White & Case led by partners Thomas Pate in New York and Rodrigo Dominguez in Houston and associate Luisa Muskus in Houston.

Renovo Capital invests in Reynolds Lift

Deal Description: Renovo Capital announced Feb. 9 its recently closed growth equity investment in Reynolds Lift Technologies. Terms weren’t disclosed. Headquartered in Missouri City, Texas,Reynolds Lift is a technology company focused on engineering and manufacturing Permanent Magnet Motor solutions. Reynolds Lift’s products are sold primarily to oil and gas operators and oilfield service companies. Renovo is a Dallas-based lower middle market private equity firm makes control investments in technical businesses that have the potential to generate value through operational improvements and strategic initiatives. Since its founding in 2009, Renovo has completed more than 30 transactions and raised over $400 million of committed capital.

Renovo’s Outside Counsel: Baker Botts represented Renovo including, from corporate, partners Jon Platt and Grant Everett and associates Trevor Labarge and Derek Gabriel; on intellectual property senior associate Michael Silliman; on tax partners Jason Loden and Steve Marcus; and on labor and employment partner Jennifer Trulock.

Murata to buy Texas 5G developer for $300M

Deal Description: Murata Manufacturing, a Japanese electronics manufacturer and a major supplier to Apple, has agreed to purchase all the outstanding stock of Resonant, an Austin-based developer of advanced technology for mobile and wireless devices. Resonant has been instrumental in the development of bulk acoustic wave filters which are being refined and adapted to 5G to allow higher-grade filtering of higher-frequency signals. The technology — which Resonant has trademarked as XBAR — allows upgrades of existing 4G fabrication processes to accommodate faster production of 5G devices. Murata bought a 4% stake in Resonant in 2019 to help in the development of the proprietary technology. The acquisition by Murata includes the cash purchase of all Resonant stock it doesn’t already own at a price of $4.50 per share, or an estimated $300 million.

Resonant Financial Advisor: Centerview Partners and Stifel

Resonant Outside Counsel: Stubbs Alderton & Markiles; Proskauer Rose

Murata Financial Advisor: Mizuho Securities

Murata Outside Counsel: Gibson Dunn & Crutcher; Covington & Burling; Akin Gump Strauss Hauer & Feld

The Gibson Dunn team was led by Dallas partners Robert Little and Jonathan Whalen, who were assisted by associates Steve Wright, Susie Choi and Tukeni Obasi, also in Dallas, along with Sarah Ediger in Denver and Andrew Hartman, in New York. Tax advice was provided from Dallas by partner Michael Cannon and associate Josiah Bethards. Dallas partner Krista Hanvey advised on benefits. Partner Adam Di Vincenzo and counsel Andrew Cline are advising on antitrust matters from Washington, D.C. Partner Carrie LeRoy in Palo Alto and associate Elizabeth Pica in New York are advising on IP issues.

Nogin goes public with de-SPAC merger

Deal Description: Ecommerce provider Nogin announced Feb. 14 its agreement to merge with Software Acquisition Group III, a blank check company. Nogin will receive $211 million from SWAG II’s trust account, funds generated by the SPAC’s IPO in July. Based in Tustin, California, Nogin provides scalable sales and analytics services for internet sales, primarily in the fashion, beauty, wellness and consumer packaged goods spaces.

Nogin Outside Counsel: Latham & Watkins advised Nogin in the merger with a team led by Houston partners Ryan Maierson and John Greer. The corporate team also included partner Ryan Lynch with Houston associates Clayton Heery, Jessica Sherman, Austin Sheehy and Ziyad Barghouthy. Advising on tax issues were Houston partners Tim Fenn and Bryant Lee, along with associate Emily Fawcett. Advice on environmental issues was provided by partner Joel Mack in Houston and counsel Josh Marnitz in Los Angeles. The team was rounded out with lawyers from the firm’s offices in the Bay Area, Los Angeles, Frankfurt and Washington DC.

Notes: This is the third de-SPAC merger for SWAG which is headed from Las Vegas by former Bass organization executive Jonathan Huberman, a Princeton/Wharton grad.

Payroll platform Payrix sold to FIS

Deal Description: FIS, a Florida-based Fortune 500 Fintech provider, announced Feb. 14 that it is acquiring Payrix, the Atlanta-headquartered SaaS payroll platform. Formed in 2015, Payrix is a portfolio company of growth equity firm Providence Strategic Growth (PSG) and Blue Star Innovation Partners, the growth equity family office of Rob Wechsler and Jerry Jones, owner of the Dallas Cowboys. Terms of the deal were undisclosed.

Payrix Outside Counsel: Payrix was advised by Weil Gotshal with a team led from Boston by Kevin Sullivan and from Dallas by partner David Gail. Assisting were associates Benjamin Rowe and Luke Harley in Dallas and Jeff Lord in New York. The team also included tax partner Hillel Jacobson and benefits partner Jennifer Britz, also in New York.

Notes: Gail and Sullivan have represented PSG in a variety of deals over the past few years. Last year the two helped PSG recapitalize Lumaverse, a SaaS platform for education and nonprofit operations, as well as a $425 million growth investment in Formstack, yet another business software provider, led by Silversmith Capital Partners. PSG was an existing investor in Formstack.

Infrastructure contractor acquires Idaho fiber firm

Deal Description: Atlanta-based Revive Infrastructure Group announced Feb. 1 that it has purchased the Elite Utilities and Trenching an Idaho fiber optics-to-home installation contractor. Terms of the deal were not disclosed. The add-on deal was done in partnership with Sileo Capital and Brightwood Capital and is the fourth acquisition since Sileo formed Revive as part of its July 2021 acquisition of Excel Utility Contractors last year.

Revive Outside Counsel: McGuireWoods advised Revive with a team led from Dallas by partner Jeffrey Brooker, along with associates William Matthews and Leslie DeGonia, also in Dallas.

Elite Outside Counsel: Todd Rossman Law

Iowa fiber provider imOn acquired by Goldman Sachs

Deal Description: In another infrastructure acquisition, Goldman Sachs Asset Management announced Feb. 17 the acquisition of an Iowa fiber-to-the-residence provider. ImOn Communications is hoping to expand its high-speed fiber network beyond its regional operations in the Cedar Rapids area. The company currently owns and operates more than 2,000 miles of fiber optic networking routed to homes and businesses for video, voice and data.

Goldman Sachs Outside Counsel: Simpson Thacher & Bartlett advised Goldman Sachs with a team led by partners Katherine Krause from New York and Breen Haire from Houston. Other Texas lawyers included associates Tyler Cox, Zain Rifat and Austin Hubbert, also of Houston.

Note: Last year, Haire led a Simpson team advising KKR in its major investment with Indiana-based ISP MetroNet.

CAPITAL MARKETS/FINANCINGS

Valero prices $650M public offering of senior notes

Deal Description: Valero Energy Corp. announced Feb. 2 the pricing of its public offering of $650 million of 4% senior notes due 2052. The offering closed Feb. 7. Valero used all of the net proceeds and cash on hand to finance its cash tender offers to repurchase its outstanding 3.650% senior notes due 2025, 2.850% senior notes due 2025, 3.400% senior notes due 2026, 2.150% senior notes due 2027 and 4.350% senior notes due 2028 and the 4.375% senior notes due 2026 and 4.500% senior notes due 2028 issued by Valero Energy Partners and guaranteed by Valero. The early settlement date with respect to the tender offers was Feb, 17.

Banks Involved: J.P. Morgan Securities, BofA Securities Inc., Scotia Capital (USA) Inc. and Wells Fargo Securities were joint book-running managers and SMBC Nikko Securities America Inc., J.P. Morgan Securities, Mizuho Securities USA, Citigroup Global Markets Inc. and MUFG Securities Americas Inc. were dealer managers in the tender offers.

Valero’s Outside Counsel: Baker Botts including, from corporate, Ted Paris (senior counsel), Jamie Yarbrough (senior associate), Parker Hinman (associate) and Rob Cowan (associate) and from tax Derek Green (partner), Jon Lobb (partner) and Phillip Clifton (associate), all from Houston.

HighPeak prices $225M private placement of senior unsecured notes

Deal Description: HighPeak Energy, Inc. announced Feb. 9 the pricing of a private placement of $225 million principal amount of 10.0% senior unsecured notes due 2024. The offering was expected to close on Feb. 16. HighPeak intends to use the proceeds to fund its 2022 development drilling program, pay off the outstanding debt under its revolving credit agreement and pay related fees and expenses. HighPeak is a publicly traded independent oil and natural gas company, headquartered in Fort Worth, focused on the acquisition, development, exploration and exploitation of unconventional oil and natural gas reserves in the Midland Basin in West Texas.

HighPeak’s Outside Counsel: Vinson & Elkins led by partners Sarah Morgan and David Wicklund, senior associates Caitlin Snelson and Jackson O’Maley and associate Ximena Kuri.

Venterra counts First Reserve as investor in third funding round

Deal Description: Venterra Group, an offshore wind energy services business, announced Feb. 18 that First Reserve participated as a strategic investor in its third funding round since its formation in early 2021. Terms were not disclosed. Venterra was created to support the offshore wind industry’s expansion as part of the energy transition. It is building a service offering across the wind-farm lifecycle through acquisition and investment to generate accelerated growth. First Reserve CEO Alex Krueger was appointed to Venterra’s board as a non-executive director. First Reserve is a global private equity investment firm focused on industrial, infrastructure and energy businesses.

Venterra’s Outside Counsel: Vinson & Elkins advised in its private placement of ordinary shares with corporate team was led by partners David Oelman and Michael Gibson with assistance from associate Christina Wu. Also advising was partner Palmina Fava (litigation).