Middle market M&A might be in for a rebound.

According to Boston-based Capstone Partners, which claims to be a leading middle market investment banking firm, these deals –– worth between $100 million and $500 million –– probably hit a trough in the second quarter.

Middle market deal volume in the second quarter declined 15.9 percent year-over-year, Capstone reports. Still, middle market dealmaking has continued to remain more resilient than broader M&A markets, as total transaction volume across all deal sizes sank by 24.8 percent over the same period.

What are the reasons for Capstone’s comeback predictions? Anecdotally, the bankers say dealmakers are noting a buildup in transaction inventory, with the expectation for a rebound toward the first quarter of next year. In addition, the market has entered a more normalized EBITDA environment for many private businesses following recent years of COVID “bumps” to revenue.

Strategics have continued to pursue quality companies, Capstone continued, and while sponsors have largely held off on exits, they have continued to actively evaluate investment opportunities.

After a historic 2021 for M&A, recessionary fears coupled with rising interest rates and challenging credit markets created a wait-and-see mentality for business owners regarding the M&A market for the past year, as per Peter Asiaf, Capstone’s head of business development.

“However, Q3 2023 has shown a steady increase in business owner response and owners’ willingness to transact in 2024,” he said. “From the conversations we have had in Q3 2023, there is an appearing latent interest in dealmaking and accessing capital and we anticipate those businesses that are best prepared will be in a prime position to capture opportunities as the fog lifts.”

Others think also that the middle market might be in comeback mode.

According to a recent report by PitchBook, dealmaking in middle markets is still down dramatically from its late-2021 peak, just less so than the overall decline in private equity buyout volumes. But short of a big move down in interest rates (the Federal Reserve is expected to keep the status quo when it meets this week), “Conditions favor the middle market for the foreseeable future,” the data firm said.

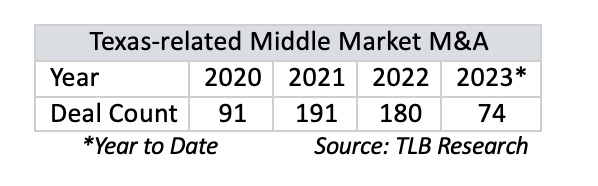

By our own CDT count, there have been 74 Texas-related middle market deals ($100 million to $499 million) so far this year versus 180 for the full year last year, 191 for all of 2021 and 91 in 2020. Certainly it’s a segment to watch.

The week closing on Sept. 16 ended with some eye-popping figures. Buoyed by 18 M&A/fundings transactions and nine CapM/credit deals, the week’s 27 reported transactions brought work for 353 mostly Texas lawyers. That’s more than double last week’s 12-deal count and nearly four times week’s $6.4 billion value. And more, even, than the 21-deal, $8.4 billion week this time last year.

For those who keep track of such things, the 353 mostly Texas lawyers from 23 different firms called out by name this week is the most since November of last year when we named 509 lawyers at 16 different firms.

Weekly Corporate Deal Tracker Roundup Stats

A compilation of weekly stats from The Lawbook's CDT Weekly Roundup

(Deal Values in Millions)

(Deal Values in Millions)

| Deal Count | Amount | Firms | Lawyers | M&A Count | M&A Value $M | CapM Count | ||

|---|---|---|---|---|---|---|---|---|

| 28-Jun-2025 | 13 | $7,777 | 8 | 138 | 7 | $2,031 | 6 | $5,746 |

| 21-Jun-2025 | 16 | $5,984 | 10 | 113 | 11 | $3,087 | 5 | $2,897 |

| 14-Jun-2025 | 9 | $478 | 8 | 133 | 6 | 0 | 3 | $478 |

| 07-Jun-2025 | 16 | $26,210 | 11 | 196 | 11 | $24,744 | 5 | $1,466 |

| 31-May-2025 | 19 | $23,381 | 11 | 166 | 12 | $18,665 | 7 | $4,717 |

| 24-May-2025 | 15 | $24,033 | 11 | 121 | 13 | $23,624 | 2 | $409 |

| 17-May-2025 | 16 | $21,760 | 12 | 145 | 11 | $18,615 | 5 | $3,145 |

| 10-May-2025 | 24 | $33,175 | 16 | 206 | 19 | $30,765 | 5 | $2,410 |

| 03-May-2025 | 11 | $4,249 | 13 | 90 | 11 | $2,226.5 | 2 | $2,022.5 |

| 26-Apr-2025 | 12 | $8,787 | 9 | 168 | 9 | $6,011 | 3 | $2,776 |

| 19-Apr-2025 | 11 | $8,097 | 7 | 138 | 9 | $7,985 | 2 | $112 |

| 12-Apr-2025 | 13 | $2,392 | 8 | 152 | 10 | $2,065 | 3 | $327 |

| 05-Apr-2025 | 19 | $27,762 | 15 | 188 | 16 | $25,473 | 3 | $2,289 |

| 29-Mar-2025 | 21 | $8,188 | 10 | 258 | 16 | $4,125 | 5 | $4,064 |

| 22-Mar-2025 | 19 | $6,485 | 14 | 231 | 15 | $4,128 | 4 | $2,857 |

| 15-Mar-2025 | 13 | $13,737 | 13 | 151 | 10 | $9,932 | 4 | $3,805 |

| 8-Mar-2025 | 7 | $2,234 | 5 | 66 | 5 | $224 | 2 | $2,100 |

| 1-Mar-2025 | 11 | $3,050 | 8 | 75 | 10 | $2,550 | 1 | $500 |

| 24-Feb-25 | 12 | $16,397 | 7 | 149 | 6 | $6,635 | 6 | $9,862 |

| 17-Feb-25 | 17 | $12,136 | 13 | 134 | 10 | $9,411 | 2 | $2,725 |

| 10-Feb-25 | 14 | $7,154 | 9 | 179 | 9 | $4,950 | 5 | $2,204 |

| 3-Feb-25 | 16 | $10,068 | 7 | 200 | 11 | $7,553 | 5 | $2,515 |

| 25-Jan-25 | 14 | $10,261 | 10 | 125 | 9 | $2,207 | 5 | $8,054 |

| 18-Jan-25 | 19 | $7,382 | 15 | 316 | 12 | $2,300 | 7 | $5,082 |

| 11-Jan-25 | 21 | $33,560 | 16 | 187 | 16 | $32,521 | 5 | $1,039 |

| 4-Jan-25 | 9 | $6,827 | 9 | 80 | 9 | $6,827 | 0 | 0 |

| 21-Dec-24 | 11 | $2,798 | 11 | 92 | 8 | $2,229 | 3 | $570 |

| 14-Dec-24 | 15 | $5,323 | 12 | 186 | 12 | $3,812 | 3 | $1,511 |

| 07-Dec-24 | 16 | $4,766 | 10 | 231 | 11 | $2,321 | 5 | 2,445 |

| 30-Nov-24 | 10 | $10,291 | 9 | 103 | 4 | $8,290 | 6 | $2.001 |

| 23-Nov-24 | 15 | $4,553 | 15 | 153 | 11 | $3,379 | 4 | $1,174 |

| 16-Nov-24 | 17 | $11,488 | 11 | 245 | 13 | $10,186 | 4 | $1,303 |

| 09-Nov-24 | 14 | $2,110 | 12 | 139 | 12 | $1,410 | 2 | $700 |

| 02-Nov-24 | 12 | $52,788 | 11 | 107 | 11 | $52,738 | 1 | $50 |

| 26-Oct-24 | 8 | $3,160 | 8 | 65 | 7 | $3,065 | 1 | $75 |

| 19-Oct-24 | 12 | $5,304 | 11 | 136 | 11 | $4,554 | 1 | $750 |

| 12-Oct-24 | 17 | $8,438 | 12 | 150 | 15 | $8,116 | 2 | $322 |

| 05-Oct-24 | 22 | $23,181 | 12 | 189 | 15 | $19,980 | 7 | $3,201 |

| 28-Sep-24 | 11 | $2,356 | 7 | 144 | 7 | $53 | 4 | $2,303 |

| 21-Sep-24 | 12 | $9,568 | 10 | 169 | 5 | $4,101 | 7 | $5,467 |

| 14-Sep-24 | 24 | $10,988 | 12 | 235 | 16 | $7,175 | 8 | $3,813 |

| 7-Sep-24 | 12 | $20,420 | 16 | 168 | 11 | $20,307 | 1 | $112.9 |

| 31-Aug-24 | 13 | $20,631 | 9 | 134 | 12 | $14,775 | 1 | $5,856 |

| 24-Aug-24 | 19 | $8,452 | 21 | 325 | 16 | $7,102 | 3 | $1,350 |

| 17-Aug-24 | 25 | $49,196 | 16 | 304 | 11 | $39,386 | 14 | $9,810 |

| 10-Aug-24 | 20 | $12,264 | 15 | 312 | 16 | $9,794 | 4 | $2,470 |

| 03-Aug-24 | 26 | $16,498 | 16 | 334 | 18 | $8,137 | 8 | $8,361 |

| 27-Jul-24 | 19 | $16,442 | 21 | 271 | 15 | $13,838 | 4 | $2,604 |

| 20-Jul-24 | 15 | $16,016 | 14 | 184 | 10 | $14,232 | 5 | $1,784 |

| 13-Jul-24 | 20 | $17,220 | 14 | 265 | 18 | $7,146 | 2 | $10,074 |

| 6-Jul-24 | 11 | $3,941 | 11 | 95 | 8 | $2,650 | 3 | $1,291 |

| 29-Jun-24 | 14 | $6,296 | 15 | 224 | 8 | $6,296 | 6 | $1,927 |

| 22-Jun-24 | 12 | $5,679 | 8 | 137 | 5 | $210 | 7 | $5,469 |

| 15-Jun-24 | 13 | $9,895 | 16 | 214 | 10 | $5,280 | 3 | $4,615 |

| 8-Jun-24 | 19 | $23,859 | 13 | 239 | 12 | $19,436 | 7 | $4,423 |

| 1-Jun-24 | 12 | $34,510 | 11 | 147 | 9 | $26,110 | 3 | $8,400 |

| 25-May-24 | 13 | $9,684 | 15 | 171 | 10 | $4,434 | 3 | $5,250 |

| 18-May-24 | 11 | $5,490 | 11 | 173 | 8 | $3,129 | 3 | $2,361 |

| 11-May-24 | 22 | $14,855 | 14 | 227 | 16 | $11,105 | 6 | $3,750 |

| 4-May-24 | 13 | $3,139 | 9 | 87 | 10 | $1,297 | 3 | $1,842 |

| 27-Apr-24 | 10 | $6,684 | 6 | 28 | 10 | $6,684 | 0 | 0 |

| 20-Apr-24 | 19 | $15,989 | 11 | 147 | 9 | $5,208 | 10 | $10,781 |

| 13-Apr-24 | 13 | $8,952 | 9 | 76 | 10 | $1,652 | 3 | $7,300 |

| 6-Apr-24 | 23 | $26,616 | 14 | 222 | 14 | $13,501 | 8 | $13,116 |

| 30-Mar-24 | 12 | $9,286 | 8 | 136 | 8 | $4,299 | 4 | $4,987 |

| 23-Mar-24 | 18 | $5,451 | 17 | 266 | 16 | $4,759 | 2 | $692 |

| 16-Mar-24 | 21 | $11,437 | 13 | 186 | 14 | $9,316 | 6 | $2,070 |

| 9-Mar-24 | 23 | $4,695 | 21 | 218 | 19 | $2,723 | 4 | $1,972 |

| 2-Mar-24 | 20 | $9,108 | 19 | 372 | 14 | $4,558 | 6 | $4,550 |

| 24-Feb-24 | 19 | $16,382 | 12 | 248 | 15 | $9,507 | 4 | $6,875 |

| 17-Feb-24 | 16 | $29,932 | 15 | 157 | 12 | $29,216 | 4 | $716 |

| 10-Feb-24 | 25 | $10,750 | 17 | 196 | 19 | $5,372 | 6 | $5,379 |

| 3-Feb-24 | 12 | $8,416 | 18 | 125 | 9 | $3,416 | 3 | $5,000 |

| 27-Jan-24 | 9 | $8,165 | 9 | 87 | 8 | $7,815 | 1 | $800 |

| 20-Jan-24 | 14 | $4,084 | 12 | 109 | 12 | $3,219 | 2 | $865 |

| 13-Jan-24 | 17 | $33,588 | 12 | 256 | 12 | $26,765 | 5 | $6,823 |

| 6-Jan-24 | 8 | $7,915 | 8 | 84 | 6 | $7,265 | 2 | $650 |

| 30-Dec-23 | 17 | $14,599 | 12 | 99 | 15 | $2,714 | 2 | $11,885 |

| 23-Dec-23 | 23 | $4,182 | 13 | 219 | 16 | $1,813 | 7 | $2,370 |

| 16-Dec-23 | 13 | $16,436 | 13 | 280 | 7 | $15,150 | 5 | $1,286 |

| 9-Dec-23 | 26 | $14,633.90 | 17 | 244 | 16 | $8,095 | 10 | $6,538.90 |

| 2-Dec-23 | 13 | $6,720 | 9 | 57 | 12 | $6,630 | 1 | $90 |

| 25-Nov-23 | 9 | $4,835 | 9 | 131 | 6 | $1,785 | 3 | $3,050 |

| 18-Nov-23 | 22 | $6,568.70 | 17 | 184 | 14 | $4,709.20 | 8 | $1,859.50 |

| 11-Nov-23 | 15 | $9,825 | 13 | 179 | 12 | $6,581 | 3 | $3,244 |

| 4-Nov-23 | 15 | $20,582.50 | 14 | 193 | 12 | $19,417.50 | 3 | $1,165 |

| 28-Oct-23 | 18 | $68,419.10 | 18 | 152 | 15 | $66,646 | 3 | $1,773.10 |

| 21-Oct-23 | 16 | $6,755.90 | 16 | 165 | 15 | $6,755.90 | 1 | $3 |

| 14-Oct-23 | 14 | $67,851.20 | 13 | 125 | 9 | $61,998.50 | 5 | $5,852.70 |

| 7-Oct-23 | 17 | $6,595.50 | 13 | 228 | 16 | $5,995.50 | 1 | $600 |

| 30-Sep-23 | 17 | $1,896.45 | 13 | 189 | 14 | $806.45 | 3 | $1,090 |

| 23-Sep-23 | 23 | $6,432.70 | 17 | 230 | 16 | $1,402.80 | 7 | $5,029.90 |

| 16-Sep-23 | 25 | $23,226.70 | 23 | 353 | 16 | $17,239 | 9 | $5,987.70 |

| 9-Sep-23 | 12 | $6,369 | 8 | 102 | 7 | $4,311 | 5 | $2,058 |

| 2-Sep-23 | 14 | $2,522 | 6 | 92 | 13 | $1,322 | 1 | $1,200 |

| 26-Aug-23 | 17 | $12,160.25 | 13 | 202 | 15 | $6,573.25 | 2 | $5,587.00 |

| 19-Aug-23 | 19 | $11,505 | 13 | 213 | 15 | $11,255 | 4 | $250 |

| 12-Aug-23 | 19 | $9,698.80 | 13 | 184 | 7 | $3,270 | 12 | $6,428.80 |

| 5-Aug-23 | 13 | $5,201 | 12 | 118 | 12 | $5,051 | 1 | $150 |

| 29-Jul-23 | 15 | $21,031.60 | 13 | 196 | 11 | $18,292.00 | 4 | $2,739.60 |

| 22-Jul-23 | 18 | $3,992 | 12 | 130 | 13 | $2,808 | 5 | $1,184 |

| 15-Jul-23 | 13 | $8,254.95 | 13 | 81 | 13 | $8,254.95 | 0 | 0 |

| 8-Jul-23 | 16 | $5,441.45 | 12 | 172 | 11 | $2,443 | 5 | $2,998.45 |

| 1-Jul-23 | 16 | $6,872 | 10 | 105 | 12 | $5,474 | 4 | $1,398 |

| 24-Jun-23 | 13 | $10,914 | 16 | 201 | 10 | $7,874 | 3 | $3,040 |

| 17-Jun-23 | 17 | $5,880.70 | 15 | 151 | 15 | $4,705.70 | 2 | $1,175 |

| 10-Jun-23 | 19 | $8,516.10 | 13 | 111 | 16 | $6,252.40 | 3 | $2,263.70 |

| June 3 2023 | 12 | $6,104.42 | 12 | 138 | 8 | $4,256.92 | 4 | $1,847.50 |

| 27-May-23 | 17 | $12,200 | 10 | 67 | 11 | $6,165 | 6 | $6,035 |

| 20-May-23 | 11 | $22,458.10 | 8 | 103 | 4 | $19,455 | 7 | $3,003 |

| 13-May-23 | 12 | $7,034 | 10 | 101 | 8 | $5,460 | 4 | $1,574 |

| 6-May-23 | 20 | $3,297.60 | 18 | 196 | 17 | $2,985.60 | 3 | $312 |

| 29-Apr-23 | 23 | $3,691.20 | 18 | 135 | 17 | $1,969.70 | 6 | $1,721.50 |

| 22-Apr-23 | 16 | $5,570 | 14 | 104 | 14 | $4,750 | 2 | $1,000 |

| 15-Apr-23 | 12 | $23,818.10 | 9 | 59 | 10 | $21,618.10 | 2 | $2,200 |

| 8-Apr-23 | 16 | $7,949 | 9 | 173 | 9 | $5,472 | 7 | $3,477 |

| 1-Apr-23 | 21 | $18,676.70 | 12 | 175 | 11 | $10,926.70 | 10 | $7,750 |

| 25-Mar-23 | 15 | $8,779.50 | 10 | 141 | 5 | $2,362 | 10 | $6,416.50 |

| 18-Mar-23 | 7 | $14,048.80 | 6 | 69 | 5 | $13,345 | 2 | $703.80 |

| 11-Mar-23 | 21 | $11,576 | 16 | 165 | 16 | $8,131 | 5 | $3,445 |

| 4-Mar-23 | 20 | $9,668 | 11 | 228 | 16 | $8,209 | 4 | $1,459 |

| 25-Feb-23 | 13 | $5,335 | 13 | 130 | 12 | $4,235 | 1 | $1,200 |

| 18-Feb-23 | 14 | $5,743.70 | 13 | 158 | 8 | $898.70 | 6 | $4,845 |

| 11-Feb-23 | 16 | $12,088 | 12 | 137 | 12 | $9,965 | 4 | $2,123 |

| 4-Feb-23 | 17 | $8,066 | 15 | 140 | 13 | $5,614 | 4 | $2,452 |

| 28-Jan-23 | 7 | $2,180 | 7 | 75 | 5 | $1,692.75 | 2 | $488 |

| 21-Jan-23 | 17 | $5,768 | 16 | 174 | 12 | $1,918 | 5 | $3,850 |

| 14-Jan-23 | 11 | $2, 800 | 10 | 102 | 8 | $421 | 3 | $2,400 |

| 7-Jan-23 | 18 | $8,296 | 11 | 167 | 14 | $6,461 | 3 | $1,835 |

| 31-Dec-22 | 14 | $2,732 | 11 | 99 | 12 | $2,092 | 2 | $640 |

| 17-Dec | 14 | $7,919 | 13 | 115 | 12 | $7,419 | 1 | $500 |

| 10-Dec-22 | 14 | $10,093 | 12 | 88 | 11 | $7,093 | 3 | $3,000 |

| 3-Dec-22 | 26 | $12,800.90 | 11 | 172 | 20 | $4,141 | 6 | $8,659.90 |

| 26-Nov-22 | 8 | $2,266.70 | 8 | 5 | 3 | $76 | 5 | $2,190.70 |

| 19-Nov-22 | 21 | $2,886 | 15 | 212 | 19 | $2,550 | 2 | $336 |

| 12-Nov-22 | 13 | $15,093.70 | 9 | 81 | 9 | $14,200 | 4 | $893.70 |

| 5-Nov-22 | 25 | 19,337.20 | 16 | 509 | 22 | $8,267.20 | 3 | $11,070 |

| 29-Oct-22 | 15 | $7,805.30 | 9 | 116 | 14 | $7,180.30 | 1 | $625 |

| 22-Oct-22 | 20 | $8,193.50 | 13 | 253 | 13 | $5,442 | 7 | $2,751.50 |

| 15-Oct-22 | 9 | $3,046.10 | 9 | 139 | 7 | $2,588.30 | 2 | $457.80 |

| 8-Oct-22 | 19 | $2,011.80 | 12 | 114 | 16 | $833.80 | 3 | $1,178 |

| 1-Oct-22 | 23 | $5,532.90 | 16 | 156 | 18 | $4,952.30 | 5 | $580.60 |

| 24-Sep-22 | 18 | $5,194 | 14 | 216 | 15 | $4,050 | 3 | $1,144 |

| 17-Sep-22 | 21 | $8,352.30 | 12 | 320 | 15 | $4,759.60 | 6 | $3,592.70 |

| 10-Sep-22 | 15 | $19,853.50 | 10 | 126 | 13 | $19,403.60 | 2 | $450 |

| 3-Sep-22 | 9 | $2,312 | 9 | 62 | 9 | $2,312 | 0 | 0 |

| 27-Aug-22 | 16 | $30,891.70 | 10 | 135 | 15 | $30,666.40 | 1 | 227.7 |

| 20-Aug-22 | 12 | $1,977 | 8 | 152 | 9 | 925 | 3 | $1,052 |

| 13-Aug-22 | 18 | $8,004.70 | 11 | 242 | 11 | $2,844.70 | 7 | $5,160 |

| 6-Aug-22 | 24 | $7,948.90 | 12 | 240 | 17 | $3,577 | 7 | $4,371.90 |

| 30-Jul-22 | 8 | $6,941 | 9 | 78 | 7 | $6,839 | 1 | $102 |

| 23-Jul-22 | 11 | $801 | 11 | 92 | 10 | $801 | 1 | 0 |

| 16-Jul-22 | 14 | $3,650 | 10 | 122 | 14 | $3,650 | 0 | 0 |

| 9-Jul-22 | 10 | $3,557.70 | 7 | 68 | 9 | $3,557.70 | 1 | 0 |

| 2-Jul-22 | 18 | $8,609.40 | 13 | 152 | 15 | $2,754.40 | 3 | $5,855 |

| 25-Jun-22 | 15 | $6,142 | 13 | 146 | 9 | $2,017 | 6 | $4,125 |

| 18-Jun-22 | 17 | $11,890.10 | 14 | 228 | 15 | $11,410 | 2 | 479.7 |

| 11-Jun-22 | 17 | $7,600 | 12 | 123 | 10 | $2,300 | 7 | $5,300 |

| 4-Jun-22 | 12 | $2,937 | 10 | 127 | 9 | $692 | 3 | $2,245 |

| 28-May-22 | 9 | $3,197.60 | 11 | 86 | 9 | $3,197.60 | 0 | 0 |

| 21-May-22 | 14 | $7,284.50 | 12 | 185 | 11 | $6,609 | 3 | $675.50 |

| 14-May-22 | 11 | $306.60 | 9 | 80 | 10 | $306.60 | 1 | $225 |

| 7-May-22 | 16 | $10,451.75 | 12 | 108 | 12 | $1,827 | 4 | $8,624.75 |

| 30-Apr-22 | 16 | $2,296.50 | 16 | 157 | 12 | $895.50 | 4 | $1,401 |

| 23-Apr-22 | 10 | $2,241 | 11 | 58 | 8 | $1,641 | 2 | $600 |

| 16-Apr-22 | 11 | $6,643 | 7 | 156 | 8 | $2,359 | 3 | $4,284 |

| 9-Apr-22 | 17 | $4,429 | 14 | 184 | 11 | $1,690 | 6 | $2,739 |

| 2-Apr-22 | 13 | $1,755 | 8 | 84 | 10 | $1,145 | 3 | $610 |

| 26-Mar-22 | 11 | $3,205 | 8 | 65 | 6 | $200 | 5 | $3,005 |

| 19-Mar-22 | 13 | $2,239.17 | 9 | 106 | 13 | $2,239.17 | 0 | 0 |

| 12-Mar-22 | 18 | $12,016 | 11 | 239 | 15 | $11,965 | 2 | $51.35 |

| 5-Mar-22 | 17 | $6,786 | 13 | 137 | 13 | $5,161 | 4 | $1,625 |

| 26-Feb-22 | 12 | $5,095 | 8 | 149 | 9 | $4,437.50 | 3 | $658 |

| 19-Feb-22 | 17 | $22,229 | 17 | 174 | 14 | $21,354 | 3 | $875 |

| 12-Feb-22 | 12 | $2,344.70 | 10 | 73 | 8 | $641.70 | 4 | $1,703 |

| 5-Feb-22 | 11 | $2,503 | 8 | 99 | 11 | $2,503 | 0 | 0 |

| 29-Jan-22 | 11 | $3,872 | 12 | 101 | 12 | $3,872 | 0 | 0 |

| 22-Jan-22 | 13 | $5,143.50 | 10 | 99 | 12 | $4,842.50 | 1 | $301 |

| 15-Jan-22 | 12 | $7,605 | 9 | 155 | 9 | $6,480 | 3 | $1,025 |

| 8-Jan-22 | 13 | $8,256.20 | 11 | 102 | 13 | $8,256.20 | 0 | 0 |

| 1-Jan-22 | 9 | $1,273.80 | 6 | 50 | 9 | $1,273.80 | 0 | 0 |

| 25-Dec-21 | 21 | $4,734.75 | 11 | 176 | 16 | $3,410 | 5 | $1,324.75 |

| 18-Dec-21 | 26 | $7,325.20 | 15 | 193 | 18 | $3,640.20 | 8 | $3,685.20 |

| 11-Dec-21 | 16 | $5,017 | 10 | 109 | 13 | $1,417 | 3 | $3,600 |

| 4-Dec-21 | 14 | $2,310 | 8 | 86 | 8 | $2,310 | 6 | $1,882.05 |

| 27-Nov-21 | 9 | $3.460.1 | 10 | 101 | 6 | $1,758 | 3 | $1,702.60 |

| 20-Nov-21 | 20 | $22,792 | 15 | 157 | 12 | $18,864.50 | 8 | $3,928 |

| 13-Nov-21 | 21 | $26,729 | 12 | 178 | 13 | $11,822 | 8 | $14,907 |

| 6-Nov-21 | 12 | $8,303 | 13 | 157 | 10 | $6,682 | 3 | $1,621 |

| 30-Oct-21 | 21 | $10,368 | 15 | 218 | 15 | $9,24.4 | 6 | $1,103.00 |

| 23-Oct-21 | 21 | $18.783.1 | 15 | 222 | 11 | $12,314 | 10 | $6,468.60 |

| 16-Oct-21 | 15 | $3,868 | 11 | 118 | 15 | $2,293 | 2 | $1,575 |

| 9-Oct-21 | 20 | $8,610 | 16 | 175 | 16 | $7,795 | 4 | $815 |

| 2-Oct-21 | 14 | $6,250 | 11 | 137 | 10 | $5,200 | 4 | $1,050 |

| 25-Sep-21 | 11 | $11,460 | 9 | 93 | 7 | $10,200 | 4 | $1,250 |

| 18-Sep-21 | 11 | $16,603 | 8 | 99 | 8 | $15,084 | 3 | $1,519 |

| 11-Sep-21 | 17 | $10,653 | 11 | 103 | 13 | $8,503 | 4 | $2,150 |

| 4-Sep-21 | 13 | $7,222 | 10 | 89 | 11 | $6,715 | 2 | $507 |

| 28-Aug-21 | 12 | $763 | 9 | 63 | 11 | $663 | 1 | $100 |

| 21-Aug-21 | 12 | $29,659 | 7 | 79 | 11 | $29,579 | 1 | $80 |

| 14-Aug-21 | 22 | $17,845 | 11 | 199 | 12 | $12,805 | 10 | $5,04 |

| 7-Aug-21 | 17 | $13,670 | 12 | 139 | 15 | $11,766 | 2 | $1,904 |

| 31-Jul-21 | 21 | $8,160 | 11 | 134 | 10 | $3,574 | 10 | $4,586 |

| July 24,2021 | 21 | $6,367 | 11 | 139 | 15 | $3,712 | 6 | $2,655 |

| 17-Jul-21 | 14 | $4,009 | 11 | 124 | 12 | $2,015 | 2 | $1,994 |

| 10-Jul-21 | 16 | $3,997 | 13 | 143 | 11 | $1,597 | 4 | $2,4 |

| 3-Jul-21 | 24 | $7,492 | 13 | 94 | 16 | $3,769 | 8 | $3,722 |

| 26-Jun-21 | 10 | $4,995 | 7 | 85 | 8 | $3,847 | 2 | $1,148 |

| 19-Jun-21 | 28 | $16,830 | 8 | 228 | 9 | $1,861 | 19 | $14,968 |

| 12-Jun-21 | 26 | $27,238 | 15 | 209 | 19 | $25,602 | 7 | $1,636 |

| 5-Jun-21 | 15 | $15,539 | 13 | 100 | 13 | $14,709 | 2 | $600 |

| 29-May-21 | 35 | $20,279 | 11 | 145 | 28 | $18,64 | 7 | $1,639 |

| 22-May-21 | 24 | $53,208 | 14 | 174 | 17 | $51,047 | 7 | $2,161 |

| 15-May-21 | 18 | $10,620 | 13 | 220 | 11 | $5,870 | 7 | $4,809 |

| 8-May-21 | 17 | $10,400 | 11 | 156 | 15 | $8,386 | 2 | $2,500 |

| 1-May-21 | 21 | $7,200 | 16 | 115 | 12 | $3,808 | 9 | $3,392 |

| 24-Apr-21 | 8 | $20,200 | 9 | 31 | 8 | $20,200 | 0 | 0 |

| 17-Apr-21 | 14 | $6,270 | 8 | 102 | 11 | $40,180 | 3 | $2,260 |

| 10-Apr-21 | 15 | $8,940 | 13 | 129 | 14 | $7,990 | 1 | $950 |

| 3-Apr-21 | 18 | $19,513 | 10 | 151 | 12 | $16,923 | 6 | $2,590 |

| 27-Mar-21 | 27 | $13,942 | 15 | 244 | 14 | $4,300 | 13 | $9,633.50 |

| 20-Mar-21 | 11 | $2,046 | 4 | 102 | 3 | $270 | 8 | $1,776 |

| 13-Mar-21 | 15 | $3,270 | 9 | 109 | 6 | $538 | 9 | $2,732 |

| 6-Mar-21 | 24 | $13,617 | 10 | 196 | 13 | $10,395 | 11 | $3,222 |

| 27-Feb-21 | 19 | $8,105 | 12 | 139 | 15 | $4,970 | 4 | $3,135 |

| 20-Feb-21 | 9 | $8,820 | 9 | 153 | 8 | $8,520 | 1 | $300 |

| 13-Feb-21 | 12 | $4,852.60 | 7 | 81 | 7 | 2,766 | 5 | $2,086.60 |

| 6-Feb-21 | 18 | $9,752 | 13 | 153 | 14 | $5,222 | 4 | $4,530 |

| 30-Jan-21 | 18 | $9,449 | 9 | 182 | 15 | $8,753.80 | 3 | $695.30 |

| 23-Jan-21 | 14 | $8,150 | 8 | 118 | 6 | $4,000 | 8 | $4,150 |

| 16-Jan-21 | 17 | $6,783 | 13 | 138 | 11 | $2,400 | 6 | $4,382.90 |

| 9-Jan-21 | 22 | $6,829 | 14 | 135 | 18 | $3,139.30 | 4 | $3,690 |

| 2-Jan-21 | 7 | $1,466 | 7 | 60 | 7 | $1,466 | 0 | 0 |

| 26-Dec-20 | 18 | $15,900 | 12 | 163 | 16 | $5,300 | 1 | $600 |

| 19-Dec-20 | 18 | $9,769 | 14 | 110 | 14 | $8,426 | 4 | $1,343 |

| 12-Dec-20 | 10 | $7,200 | 9 | 100 | 9 | $3,325 | 1 | $3,830 |

| 5-Dec-20 | 15 | $4,261 | 9 | 122 | 9 | $2,780 | 6 | $1,481 |

| 28-Nov-20 | 19 | $7,758 | 10 | 110 | 13 | $4,003 | 6 | $3,755 |

| 14-Nov-20 | 14 | $864.10 | 14 | 157 | 12 | $289.10 | 2 | $575 |

| 7-Nov-20 | 13 | $6,332 | 9 | 129 | 9 | $2,483.50 | 4 | $3,849 |

| 31-Oct-20 | 10 | $3,995.80 | 8 | 103 | 6 | $3,231.10 | 4 | $754.70 |

| 24-Oct-20 | 6 | $18,100 | 6 | 58 | 5 | $17,709 | 1 | $350 |

| 17-Oct-20 | 8 | $351.90 | 5 | 55 | 8 | $351.90 | 0 | 0 |

| 10-Oct-20 | 7 | $5,229 | 3 | 50 | 4 | $735 | 3 | $4,494 |

| 3-Oct-20 | 14 | $21,428 | 9 | 173 | 9 | $17,535 | 5 | $3,893 |

| 26-Sep-20 | 10 | $12,770 | 8 | 93 | 5 | $10,300 | 5 | $2,470 |

| 19-Sep-20 | 14 | $8,365 | 9 | 101 | 6 | $1,020 | 8 | $7,345 |

| 12-Sep-20 | 6 | $4,406 | 8 | 59 | 3 | $1,270 | 3 | $3,136 |

| 5-Sep-20 | 11 | $5,191 | 8 | 117 | 9 | $4,061 | 2 | $1,130 |

| 29-Aug-20 | 11 | $2,531 | 9 | 94 | 5 | $1,130 | 6 | $1,401 |

| 22-Aug-20 | 18 | $6,574 | 12 | 140 | 7 | $1,930 | 11 | $4,644 |

| 15-Aug-20 | 13 | $4,991 | 10 | 97 | 7 | $1,216 | 6 | $3,775 |

| 8-Aug-20 | 12 | $32,092 | 11 | 112 | 9 | $30,457 | 3 | $1,635 |

| 1-Aug-20 | 7 | $5,287 | 8 | 76 | 5 | $3,687 | 2 | $1,600 |

| 25-Jul-20 | 9 | $18,751 | 6 | 67 | 7 | $18,403 | 2 | $348 |

| 18-Jul-20 | 6 | $1,982.50 | 5 | 50 | 4 | $1,407.50 | 2 | $575 |

| 11-Jul-20 | 11 | $565.10 | 12 | 75 | 10 | $65.10 | 1 | $500 |

| 4-Jul-20 | 10 | $8,889 | 8 | 98 | 9 | $8,788 | 1 | $100.30 |

| 27-Jun-20 | 8 | $6,874 | 10 | 50 | 5 | $4,972.50 | 3 | $2,081.50 |

| 20-Jun-20 | 12 | $4,444 | 9 | 115 | 7 | $2,829 | 5 | $1,615 |

| 13-Jun-20 | 6 | $3,582 | 4 | 37 | 2 | $350 | 4 | $3,232 |

| 6-Jun-20 | 11 | $3,213.70 | 8 | 65 | 7 | $470 | 4 | $2,743.70 |

| 30-May-20 | 8 | $7,335 | 7 | 48 | 6 | $4,639 | 2 | $2,697 |

| 23-May-20 | 4 | $432.40 | 4 | 34 | 3 | $432.40 | 1 | 0 |

| 16-May-20 | 6 | $310 | 6 | 34 | 5 | $310 | 1 | 0 |

| 9-May-20 | 18 | $5,630 | 16 | 124 | 14 | $3,180 | 4 | $2,450 |

| 2-May-20 | 15 | 10,400 | 10 | 90 | 8 | $1,900 | 7 | $,8,500 |

| 25-Apr-20 | 8 | $3,400 | 9 | 36 | 5 | $1,000 | 3 | $2,450 |

| 18-Apr-20 | 19 | $9,500 | 14 | 92 | 8 | $185.70 | 11 | $9,360 |

| 11-Apr-20 | 12 | $6,000 | 9 | 40 | 5 | $190 | 7 | $5,800 |

| 4-Apr-20 | 14 | $8,200 | 11 | 68 | 10 | $2,200 | 4 | $6,000 |

| 28-Mar-20 | 16 | $6,500 | 13 | 96 | 10 | $3,700 | 6 | $2,800 |

| 21-Mar-20 | 11 | $11,910 | 7 | 33 | 7 | $2,250 | 4 | $9,960 |

| 14-Mar-20 | 7 | 809.8 | 6 | 34 | 6 | 684.8 | 1 | 125 |

| 7-Mar-20 | 16 | $2,500 | 15 | 70 | 13 | $669 | 3 | $1,400 |

| 29-Feb-20 | 13 | $15,260 | 13 | 128 | 11 | $11,760 | 2 | $3,500 |

| 22-Feb-20 | 12 | $3,700 | 10 | 92 | 10 | $2,560 | 2 | $1,130 |

| 15-Feb-20 | 16 | $1,250 | 10 | 84 | 12 | $35 | 4 | $1,222 |

| 8-Feb-20 | 18 | $6,080 | 14 | 123 | 14 | $2,595 | 4 | $3,485 |

| 1-Feb-20 | 21 | $20,900 | 12 | 101 | 14 | $17,860 | 7 | $3,060 |

| 25-Jan-20 | 13 | $7,430 | 13 | 62 | 12 | $6,430 | 1 | $1,000 |

| 18-Jan-20 | 23 | $9,580 | 15 | 120 | 19 | $6,580 | 4 | $3,000 |

| 11-Jan-20 | 21 | $14,200 | 18 | 199 | 16 | $1,020 | 5 | $13,200 |

| 4-Jan-20 | 22 | $6,400 | 11 | 119 | 16 | $3,204 | 6 | $3,245 |

| 28-Dec-19 | 22 | $7,150 | 19 | 175 | 18 | $6,800 | 4 | $327.40 |

| 14-Dec-19 | 24 | $36,300 | 23 | 167 | 19 | $9,500 | 5 | $26,800 |

| 7-Dec-19 | 11 | $10,400 | 11 | 55 | 7 | $1,082 | 4 | $9,370 |

| November 30. 2019 | 14 | $2,450 | 12 | 126 | 12 | $1,760 | 2 | $692.50 |

| 23-Nov-19 | 16 | $1,995 | 10 | 41 | 11 | $615 | 5 | $1,380 |

| 16-Nov-19 | 15 | $3,820 | 13 | 135 | 11 | $2,500 | 4 | $1,271 |

| 9-Nov-19 | 25 | $12,900 | 17 | 182 | 23 | $12,200 | 2 | $575 |

| 2-Nov-19 | 10 | $2,470 | 12 | 61 | 9 | 2,450 | 3 | $22 |

| 26-Oct-19 | 12 | $5,560 | 14 | 70 | 11 | $3,860 | 1 | $1,700 |

| 19-Oct-19 | 8 | $6,600 | 8 | 138 | 8 | $6,600 | 0 | 0 |

| 12-Oct-19 | 19 | $4,300 | 14 | 55 | 16 | $3,800 | 3 | $500 |

| 5-Oct-19 | 18 | $14,500 | 19 | 166 | 15 | $11,100 | 3 | $3,400 |

| 28-Sep-19 | 19 | $8,100 | 18 | 132 | 18 | $7,560 | 1 | $550 |

| 21-Sep-19 | 14 | $6,300 | 16 | 66 | 11 | $2,160 | 3 | $4,170 |

| 14-Sep-19 | 15 | $23,800 | 12 | 56 | 11 | $21,250 | 4 | $2,570 |

| 7-Sep-19 | 17 | $3,500 | 15 | 98 | 14 | $1,900 | 3 | $1,600 |

| 31-Aug-19 | 5 | $8,700 | 6 | 50 | 5 | $8,700 | 0 | 0 |

| 24-Aug-19 | 16 | $10,000 | 14 | 82 | 15 | $4,250 | 1 | $5,750 |

| 16-Aug-19 | 10 | $1,680 | 5 | 52 | 7 | $650 | 3 | $950 |

| 9-Aug-19 | 17 | $17,700 | 15 | 68 | 14 | $3,900 | 3 | $13,800 |

| 2-Aug-19 | 13 | $5,760 | 12 | 108 | 13 | $5,760 | NA | NA |

| 27-Jul-19 | 11 | $7,300 | 13 | 76 | 8 | $6,570 | 3 | $730 |

| 20-Jul-19 | 13 | $11,800 | 13 | 125 | 11 | $5,300 | 2 | $6,500 |

| 13-Jul-19 | 10 | $775 | 7 | 46 | 8 | $542.50 | 2 | $233 |

| 6-Jul-19 | 7 | $2,500 | 9 | 85 | 7 | $2,500 | 0 | 0 |

| 29-Jun-19 | 23 | $8,290 | 15 | 154 | 17 | $2,300 | 6 | $5,970 |

| 22-Jun-19 | 17 | $10,700 | 10 | 139 | 14 | $7,700 | 3 | $3,000 |

| 15-Jun-19 | 11 | $13,500 | 14 | 160 | 11 | $13,500 | NA | NA |

| 8-Jun-19 | 13 | $2,870 | 17 | 55 | 11 | $1,570 | 2 | $1,300 |

| 1-Jun-19 | 10 | $4,460 | 11 | 60 | 8 | $4,140 | 2 | $315 |

| 25-May-19 | 17 | $4,360 | 14 | 79 | 14 | $3,700 | 3 | $612 |

| 18-May-19 | 22 | $9,000 | 17 | 150 | 16 | $3,400 | 6 | $5,600 |

| 11-May-19 | 18 | $19,800 | 17 | 177 | 15 | $18,300 | 3 | $1,500 |

| 4-May-19 | 10 | $7,075 | 6 | 32 | 8 | $6,900 | 2 | $175 |

| 27-Apr-19 | 15 | $3,200 | 14 | 117 | 14 | $3,160 | 1 | $40 |

| 20-Apr-19 | 13 | $13,500 | 10 | 90 | 9 | $12,200 | 4 | $1,300 |

| 13-Apr-19 | 16 | $38,900 | 14 | 91 | 14 | $37,800 | 2 | $1,100 |

| 6-Apr-19 | 12 | $6,870 | 11 | 94 | 10 | $6,730 | 2 | $50 |

| 30-Mar-19 | 15 | $6,470 | 12 | 84 | 10 | $7,91.5 | 5 | $5,677 |

| 23-Mar-19 | 18 | $6,450 | 14 | 91 | 14 | $5,042 | 4 | $1,408 |

| 16-Mar-19 | 14 | $10,180 | 12 | 115 | 11 | $8,800 | 3 | $1,300 |

| 9-Mar-19 | 9 | $1,800 | 6 | 49 | 8 | $1,300 | 1 | $500 |

| 2-Mar-19 | 20 | $3,033 | 16 | 107 | 14 | $1,817 | 6 | $1,262 |

| 23-Feb-19 | 12 | $2,040 | 8 | 69 | 9 | $614.60 | 3 | $1,430 |

| 16-Feb-19 | 16 | $9,970 | 18 | 77 | 16 | $9,970 | 0 | 0 |

| 9-Feb-19 | 14 | $6,400 | 10 | 110 | 14 | $6,400 | 0 | 0 |

| 2-Feb-19 | 18 | $6,740 | 15 | 99 | 16 | $5,720 | 2 | $950 |

| 26-Jan-19 | 13 | $2,770 | 11 | 67 | 11 | $918.95 | 2 | $1,850 |

| 19-Jan-19 | 15 | $3,819 | 16 | 76 | 12 | $2,594 | 3 | $1,225 |

| 12-Jan-19 | 18 | $7,283 | 14 | 92 | 15 | $1,683 | 3 | $5,600 |

| 5-Jan-19 | 10 | $529 | 12 | 50 | 10 | $529 | 0 | 0 |

| 22-Dec-18 | 17 | $2,570 | 13 | 87 | 14 | $941 | 3 | $1,629 |

| 15-Dec-18 | 10 | $2,860 | 8 | 26 | 8 | $264 | 2 | $2,600 |

| 8-Dec-18 | 15 | $1,819 | 16 | 65 | 12 | $552 | 3 | $1,267 |

| 1-Dec-18 | 12 | $7,500 | 10 | 90 | 9 | $1,200 | 3 | $6,200 |

| 28-Nov-18 | 15 | $4,500 | 11 | 107 | 14 | $4,000 | 1 | $500 |

| 19-Nov-18 | 18 | $6,137 | 13 | 98 | 13 | $2,142 | 5 | $3,995 |

| 14-Nov-18 | 18 | $9,200 | 13 | 152 | 15 | $8,500 | 3 | $694 |

| 6-Nov-18 | 16 | $17,300 | 16 | 183 | 14 | $16,361 | 2 | $950 |

| 29-Oct-18 | 14 | $14,400 | 18 | 127 | 17 | $13,800 | 1 | $600 |

| 24-Oct-18 | 13 | $6,140 | 13 | 126 | 11 | $5,122 | 2 | $1,018 |

| 17-Oct-18 | 18 | $18,390 | 15 | 125 | 14 | $12,292 | 4 | $6,098 |

| 10-Oct-18 | 29 | $3,149 | 18 | 104 | 20 | $1,647 | 9 | $819 |

| 2-Oct-18 | 18 | $9,300 | 11 | 67 | 14 | $7,300 | 4 | $2,000 |

| 25-Sep-18 | 13 | $7,000 | 11 | 75 | 10 | $6,000 | 3 | $995 |

| 18-Sep-18 | 9 | $3,570 | 7 | 44 | 9 | $3,570 | 0 | 0 |

| 11-Sep-18 | 13 | $5,900 | 10 | 132 | 13 | $5,900 | 0 | 0 |

| 7-Sep-18 | 14 | $5,000 | 15 | 86 | 11 | $4,000 | 3 | $1,000 |

| 29-Aug-18 | 15 | $20,700 | 14 | 79 | 13 | $4,700 | 2 | $16,000 |

| 20-Aug-18 | 10 | $12,400 | 11 | 53 | 8 | $11,380 | 3 | $1,057 |

| 14-Aug-18 | 12 | $19,900 | 12 | 132 | 9 | $18,889 | 3 | $1,011 |

| 7-Aug-18 | 16 | $68,600 | 11 | 106 | 13 | $67,259 | 3 | $1,340 |

| 31-Jul-18 | 15 | $15,100 | 15 | 95 | 11 | $13,060 | 4 | $2,060 |

| 23-Jul-18 | 13 | $2,130 | 15 | 60 | 10 | $1,804 | 3 | $1,100 |

| 17-Jul-18 | 14 | $5,370 | 17 | 98 | 9 | $4,310 | 5 | $1,100 |

| 9-Jul-18 | 16 | $11,200 | 15 | 74 | 10 | $11,080 | 6 | $862 |

| 3-Jul-18 | 13 | $7,000 | 7 | 81 | 12 | $6,330 | 1 | $750 |

| 25-Jun-18 | 15 | $8,800 | 13 | 97 | 9 | $4,970 | 6 | $3,930 |

| 18-Jun-18 | 13 | $14,200 | 14 | 80 | 7 | $221 | 6 | $14,290 |

| 11-Jun-18 | 12 | $6,300 | 8 | 96 | 8 | $5,910 | 4 | $803 |

| 6-Jun-18 | 13 | $14,500 | 10 | 88 | 8 | $14,154 | 5 | $579 |

| 31-May-18 | 11 | $4,890 | 10 | 63 | 8 | $3,240 | 3 | $1,790 |

| 22-May-18 | 15 | $20,400 | 11 | 63 | 9 | $19,808 | 6 | $885 |

| 15-May-18 | 15 | $4,700 | 15 | 106 | 10 | $3,900 | 5 | $643 |

| 9-May-18 | 11 | $1,400 | 13 | 88 | 9 | $1,300 | 2 | $560 |

| 1-May-18 | 8 | $14,250 | 7 | 88 | 7 | $13,400 | 1 | $450 |

| 24-Apr-18 | 12 | $5,300 | 6 | 61 | 11 | $4,470 | 1 | $800 |

| 17-Apr-18 | 9 | $1,800 | 10 | 44 | 7 | $2,330 | 2 | $1,434 |

| 11-Apr-18 | 11 | $2,500 | 8 | 32 | 6 | $1,690 | 5 | $809 |

| 3-Apr-18 | 15 | $13,400 | 11 | 121 | 9 | $12,020 | 6 | $1,090 |

| 28-Mar-18 | 10 | $4,000 | 10 | 92 | 7 | $3,870 | 3 | $215 |

| 19-Mar-18 | 17 | $5,800 | 13 | 51 | 10 | $590 | 7 | $5,165 |

| 12-Mar-18 | 15 | $3,130 | 11 | 43 | 11 | $2,360 | 4 | $788 |

| 6-Mar-18 | 19 | $5,400 | 13 | 116 | 10 | $1,530 | 9 | $4,860 |

| 27-Feb-18 | 20 | $6,600 | 13 | 69 | 14 | $5,530 | 6 | $1,030 |

| 19-Feb-18 | 15 | $5,500 | 14 | 111 | 10 | $3,990 | 6 | $1,980 |

| 12-Feb-18 | 23 | $10,900 | 17 | 157 | 12 | $7,110 | 11 | $3,840 |

| 5-Feb-18 | 16 | $8,600 | 13 | 100 | 7 | $1,330 | 9 | $7,800 |

| 30-Jan-18 | 11 | $12,600 | 11 | 68 | 5 | $7,300 | 6 | $4,982 |

| 24-Jan-18 | 19 | $9,400 | 15 | 129 | 5 | $2,010 | 14 | $7,337 |

| 18-Jan-18 | 10 | $6,280 | 8 | 49 | 2 | $2,100 | 8 | $4,188 |

| 9-Jan-18 | 12 | $16,500 | 12 | 92 | 9 | $15,890 | 3 | $475 |

| 3-Jan-18 | 10 | $2,500 | 9 | 47 | 8 | $2,350 | 2 | $150 |

| 27-Dec-17 | 15 | $9,000 | 15 | 113 | 9 | $7,568 | 6 | $1,784 |

| 18-Dec-17 | 15 | $13,800 | 16 | 164 | 9 | $13,010 | 7 | $1,118 |

| 11-Dec-17 | 14 | $9,700 | 10 | 126 | 12 | $2,940 | 4 | $8,500 |

| 4-Dec-17 | 6 | $1,800 | 6 | 31 | 5 | $1,510 | 1 | $300 |

| 28-Nov-17 | 7 | $3,850 | 8 | 76 | 4 | $3,260 | 3 | $285 |

| 16-Nov-17 | 10 | $2,700 | 10 | 48 | 6 | $1,840 | 4 | $856 |

| 8-Nov-17 | 15 | $2,380 | 17 | 91 | 10 | $1,860 | 5 | $516 |

| 1-Nov-17 | 12 | $4,700 | 17 | 94 | 9 | $3,400 | 4 | $1,300 |

| 23-Oct-17 | 15 | $10,500 | 10 | 67 | 10 | $9,780 | 4 | $1,530 |

| 18-Oct-17 | 6 | $2,000 | 37 | 3 | $225 | 3 | $1,820 | |

| 10-Oct-17 | 12 | $6,570 | 100 | 9 | $3,880 | 3 | $3,360 | |

| 2-Oct-17 | 8 | $3,100 | 11 | 19 | 3 | $1,630 | 5 | $1,750 |

| 25-Sep-17 | 8 | $4,880 | 8 | 79 | 5 | $2,660 | 5 | $2,070 |

| 18-Sep-17 | 9 | $4,770 | 3 | $300 | 6 | $4,470 | ||

| 12-Sep-17 | 11 | $4,430 | 8 | $2,030 | 3 | $2,400 | ||

| 1-Sep-17 | 4 | $1,310 | 3 | $317 | 1 | $1,000 | ||

| 23-Aug-17 | 11 | $13,640 | 9 | 8 | $11,840 | 3 | $1,800 |

M&A/FUNDINGS

Smurfit Kappa, WestRock merge in $11B deal

Deal Description: In an $11 billion combination that will create the world’s largest packaging manufacturer, Atlanta-based WestRock Co. and Ireland-headquartered Smurfit Kappa announced Sept. 12 that they agreed to a merger of equals. The newly combined company, to be known as Smurfit WestRock, will be domiciled in Ireland with an enterprise value of $22 billion and be traded on the New York Stock Exchange. The company’s North and South American operations will be based in Atlanta. The new company will be headed by current Smurfit CEO Tony Smurfit. Under terms of the agreement, Smurfit and WestRock shareholders will receive a single share of the combined company for each share they hold. WestRock shareholders will also receive an additional $5 bonus for each share converted to a share in SmurfitWestRock, creating an effective per share price of $43.51 (or $11.15 billion) for WestRock. Once the transaction has closed, likely in Q2 of 2024, Smurfit shareholders will own about 50.4 percent of the new company, while current WestRock stockholders will control the remaining 49.6 percent.

Smurfit Kappa’s Financial Advisors: Citi and PJT Partners (UK) Ltd.

Smurfit Kappa’s Outside Counsel: Matheson, Wachtell, Lipton, Rosen & Katz and Freshfields Bruckhaus Deringer

WestRock’s Financial Advisors: Evercore Group to the board, Lazard Frères & Co. and Goldman, Sachs & Co. to the company

WestRock’s Outside Counsel: Paul, Weiss, Rifkind, Wharton & Garrison, Cravath, Swaine & Moore and Clifford Chance. The Clifford Chance team was co-led from Houston by partner Enoch Varner as well as partners David Brinton in New York and Stephen Fox in London. Other members of the CC team, all based in London, included partners Simon Thomas (capital markets), Greg Olsen (antitrust) and Nick Kinnersley along with associates Harriet Martin, Yuli Adagun and Greg Hayes and senior associate Katherine Sinclair.

Avantax signs $1.2B take-private deal with Cetera

Deal Description: Publicly traded Avantax Inc., a tax-focused financial planning and wealth management provider in Dallas, announced Sept. 11 that it agreed to be taken private by Aretec Group Inc., the holding company of Genstar Capital-backed Cetera Financial Group, in an all-cash transaction worth $1.2 billion, including net debt. Shareholders of Avantax common stock will receive $26 per share in cash, a 30 percent premium but lower than expectations. The transaction is expected to close by year-end if it’s approved by stockholders and regulators. Sidley Austin and Haynes Boone advised Avantax and Willkie Farr & Gallagher assisted Cetera. For more on the deal, click here.

Vital buys oil & gas assets for $1.16B

Deal Description: Tulsa-based Vital Energy Inc. announced Sept. 13 three acquisitions for $1.165 billion that promise to add scale in the Permian Basin, increase free cash flow, enhance capital efficiency and reduce leverage. The deals involved lawyers from the Texas offices of six different firms, including Akin, Baker Botts, Jackson Walker, Kirkland & Ellis, Latham & Watkins and Vinson & Elkins.. For more, click here.

Optimal Blue closes $700M purchase by Constellation Software’s Perseus

Deal Description: Black Knight Inc.’s Optimal Blue announced Sept. 15 the completion of its acquisition by the Perseus Operating Group, a unit of Constellation Software Inc. Constellation announced July 14 it agreed to acquire Plano-based Optimal Blue for $700 million in an all-cash deal, which was seen as a way to help win regulatory approval for Intercontinental Exchange’s previously announced acquisition of Black Knight. Optimal Blue offers software and services to market participants as they price, lock, hedge and trade mortgages. The company’s product, pricing and eligibility engine, the Optimal Blue PPE, is used by thousands of originators to lock roughly 40 percent of mortgages in the U.S.

Black Knight’s Outside Counsel: Wachtell, Lipton, Rosen & Katz led by Edward Herlihy and Jacob Kling and Shearman & Sterling led by Rory O’Halloran and Cody Wright

Constellation Software’s Outside Counsel: Womble Bond Dickinson (US) led by Shari Bacsardi and Laura Wiley

Trinity Gas Storage attracts $189M in funding

Deal Description: Dallas-based Trinity Gas Storage announced Sept. 8 it attracted equity funding from Chicago private equity firm Transition Equity Partners along with debt financing led by Investec, which acted as joint lead arranger and administrative agent. The equity consortium includes Pan Capital Management, Abrdn, SailingStone Capital Partners and Rice Investment Group. The funding marks a milestone in the development of Trinity’s natural gas storage facility, which is set to play a role in fortifying energy security across the region, the company said. The new natural gas storage facility in East Texas will offer 24 billion cubic feet of natural gas storage capacity in the initial phase of the project. Construction begins immediately and operations are slated to start in mid-2024. The Trinity storage facility will provide a buffer to balance supply and demand for natural gas, allowing continued service even during times of peak electricity demand.

Transition’s Outside Counsel: Kirkland & Ellis led by corporate partners Richard Campbell and Adam Garmezy and associates James Long, Thomas Matteson and Brandon King and debt finance partner Brian Greene and associates Rafael Breves de Toledo and Meng Ding

SailingStone’s Outside Counsel: Latham & Watkins led by Houston partner James Garrett with associates John Daywalt and Vera Bespalova. Advice was also provided on tax matters by Houston partner Jared Grimley.

Pan Capital’s Outside Counsel: Willkie Farr & Gallagher led by Kris Agarwal and assisted by Brad Honeycutt, Archie Fallon and Tan Lu

Trinity Gas Storage’s Outside Counsel: Locke Lord with a team led by Kevin Peter, Jennie Simmons, Eric Larson and Case Towslee (all of Houston), along with John Arnold, Ben Cowan, Sara Longtain, Buddy Sanders, Jeremy Petersen, Andrew Nelson, and Emily Howard (all also of Houston), as well as Jeffrey Escobar and Brennan Gumerove (both of New York).

Heliene raises $170M from Orion Infrastructure

Deal Description: Heliene Inc, a provider of North American-made solar PV modules, announced Sept. 12 it closed $170 million in funding led by a group of key partners and customers. The funding includes $20 million in equity and $150 million in debt to be used for Heliene’s expansion. The $150 million credit facility was provided by Orion Infrastructure Capital, a North American infrastructure investment firm. The $20 million equity round included participation from OIC and 2Shores Capital, an Ontario-based private investment company. Two existing Heliene customers – Valta Energy and Bullrock Renewables – also joined the round. The news follows an August announcement that Nexamp has executed a supply agreement for 1.5 gigawatts to be delivered by Heliene over five years, the largest community solar module order in U.S. history, Heliene said. It will support the development and construction of 400 new community solar projects. Heliene has production facilities in Minnesota and Ontario, Canada. OIC has $3.5 billion in assets under management.

OIC’s Outside Counsel: Kirkland & Ellis led by debt finance partners Kelann Stirling and Layton Bell and associate Sharaf Islam, corporate partner Shubi Arora and associates Emma Balls and Andrew Daniels and tax partners Mark Dundon and Mike Masri and associates Nicole Martin and Griffin Peeples.

Learfield attracts $150M in recap

Deal Description: Plano-based Learfield, a media and technology company powering college athletics, announced Sept. 13 that it closed on a comprehensive deleveraging transaction with its lenders and equity partners. Through this transaction, Learfield reduced its outstanding debt by more than $600 million and secured $150 million in new equity investment, strengthening its financial position and providing additional capital to fuel innovation and growth across its five operating divisions. The company’s majority ownership is now made up of its lead capital providers, including Clearlake Capital Group, Charlesbank Capital Partners and funds managed by affiliates of Fortress Investment Group. Learfield’s previous equity holders will keep an equity stake in the company.

Learfield’s Outside Counsel: Kirkland & Ellis and Simpson Thacher & Bartlett

Learfield’s Financial Advisors: Moelis & Co. and Alvarez & Marsal

Learfield Lenders’ Outside Counsel: Paul, Weiss, Rifkind, Wharton & Garrison

Learfield Lenders’ Financial Advisors: Centerview Partners

Clearlake’s Outside Counsel: Sidley Austin including partners Mehdi Khodadad and Stephen Hessler in New York and Mark Castiglia in Century City

Current Equity Holders’ Outside Counsel: Latham & Watkins and Davis Polk & Wardwell

Revolving Lenders’ Outside Counsel: White & Case

Revolving Lenders’ Financial Advisor: BRG

GCM Grosvenor to partner with Vesper committing $100M

Deal Description: Vesper Energy, a Dallas developer, owner and operator of utility-scale renewable energy assets, announced Sept. 13 that publicly traded GCM Grosvenor Inc. committed to invest up to $100 million in Vesper over the next 12 months and acquire a minority ownership stake in the company. GCM Grosvenor, a global alternative asset management solutions provider, joins the existing investor group for Vesper led by Magnetar Capital, another alternative asset manager. GCM Grosvenor’s investment is part of its “Infrastructure Advantage Strategy,” which focuses on unlocking value in infrastructure through close partnership between labor, government and private capital. The investment will advance Vesper Energy’s portfolio of utility-scale solar, solar and energy storage and standalone energy storage projects. Vesper has a 17 gigawatt pipeline of solar and energy storage projects in North America.

GCM Grosvenor’s Financial Advisor: Thorndike Landing

GCM Grosvenor’s Outside Counsel: Allen & Overy

Vesper/Magnetar’s Financial Advisors: BofA Securities and Marathon Capital

Vesper/Magnetar’s Outside Counsel: Eversheds Sutherland led by partners Thomas Warren and Michael Gurion and associate Katie Wymer Clarke in Atlanta assisted by partner Wes Sheumaker, counsel Frank Comparetto and associate Jeremy Andreades

CertifID secures $20M in series B funding

Deal Description: CertifID, an Austin-based wire fraud protection company, announced Sept. 12 $20 million in new funding. CertifID’s series B raise was led by Minneapolis-based Arthur Ventures, which also invested in CertifID’s $12.5 million series A in May 2022. CertifID’s funding comes on the heels of strong adoption of its wire fraud protection software, insurance and recovery services, the company said. In the past year, CertifID claims that it has launched its most successful new product yet, PayoffProtect, doubled its customer base and forged new enterprise partnerships such as with global fin-tech company Acrisure.

CertifID’s Outside Counsel: Honigman

Bradford Airport Logistics snares investment from Bregal Sagemount

Deal Description: Bradford Airport Logistics, a provider of logistics services to airports and other transportation hubs, announced Sept. 12 that it received a significant growth equity investment from Bregal Sagemount, a private equity platform with a focus on growth investments in the U.S. and Europe. Terms weren’t disclosed, although Bregal Sagemount typically invests $20 million to $400 million for equity transactions. The investment will help Bradford pursue domestic growth opportunities, deploy a new global-growth initiative and support capabilities in design-build-finance-operate-manage models for centralized receiving and distribution centers. The partnership with Sagemount will also allow for capital to be deployed as opportunities materialize. Bregal Sagemount, with offices in New York, Palo Alto and Dallas, has raised more than $6.8 billion of capital.

Financial Advisor to Bradford: Imperial Capital led by John E. Mack III

Bradford’s Outside Counsel: Sidley Austin led by Atman Shukla (energy and infrastructure), Zackary Pullin (tax), Chris Folmsbee (energy and infrastructure), and John Brannan III (energy and infrastructure). The team also included Walter Deere, Kevin Hess, Austin Jacobs (energy andiInfrastructure); Aaron Mitchell (tax); Valerie Truong (technology and life sciences transactions); Lauren Gallagher and Greg Matisoff (employee benefits and executive compensation); Heather Palmer (environmental); and Ash Nagdev (privacy and cybersecurity).

Bregal Sagemount’s Outside Counsel: Goodwin Proctor led by Jared Spitalnick, Gregory Cage, Victoria Woodward, Kirill Kovalenko and Dylan Roth in New York and Allen & Overy

Additional Financing Providers: MUFG, ING and Barings

CenterOak Partners buys Guardian Access Solutions

Deal Description: CenterOak Partners, a Dallas-based private equity firm, announced Sept. 12 that it completed a majority recapitalization of Guardian Access Solutions. Terms weren’t disclosed, but CenterOak typically invests $30 million to $150 million in equity. Based in Nashville, Guardian provides maintenance, repair and installation of exterior access control equipment in the southeast U.S., including automatic gates, parking equipment, closed-circuit television and door access control systems and overhead doors. The current management team will continue to lead Guardian following CenterOak’s investment. CenterOak and its partners have managed more than $2.4 billion of equity capital commitments and completed over 150 transactions representing over $8 billion in value.

CenterOak’s Outside Counsel: Gibson, Dunn & Crutcher led by partner Robert Little and including partner Joe Orien and associates Kiel Sauerman, Cody Wilson and Hayden McGovern. Partner Cromwell Montgomery and associates Matt Flores and Abby Joens-Witherow advised on financing, partner Michael Cannon and associate Blake Hoerster on tax and partner Krista Hanvey and associate Lucy Hong on benefits. Partner Michael Murphy and associate Taylor Cathleen Amato advised on environmental aspects, partner Daniel Angel and associate Jacqueline Malzone on intellectual property and associate Zane Clark on investment funds.

Chevron acquires Haddington-backed Magnum Development

Deal Description: Chevron U.S.A. Inc., through its Chevron New Energies division, announced Sept. 12 it closed a transaction with Haddington Ventures to acquire Magnum Development and thus a majority interest in ACES Delta, a joint venture between Mitsubishi Power Americas Inc. and Magnum Development. Terms weren’t disclosed. ACES Delta is developing the Advanced Clean Energy Storage project in Delta, Utah. The project plans to use electrolysis to convert renewable energy into hydrogen and will utilize solution-mined salt caverns for seasonal, dispatchable storage of the energy. The first project, designed to convert and store up to 100 metric tons per day of hydrogen, is under construction and expected to enter commercial-scale operations in mid-2025.

Chevron’s Financial Advisor: Citigroup Global Markets Inc.

Chevron’s Outside Counsel: Inosi Nyatta at Sullivan & Cromwell in New York

Chevron’s In-House Counsel: Brian Martin

Haddington’s Financial Advisor: Jefferies

Haddington’s Outside Counsel: Willkie Farr & Gallagher led by partner Archie Fallon. The team also included partner Robert Jacobson, counsel Jonathan Konoff and associates Joe Laurel, Sidney Nunez, Hayden Kursh and Tyler Kuhn.

Notes: In 2022, Haddington formed Haddington ESP I to provide construction equity for projects developed by ACES Delta, attracting a $650 million equity commitment from Alberta Investment Management Corp., GIC, Manulife Financial Corp. and Ontario Teachers’ Pension Plan Board with rights to increase the investment to $1.5 billion. Willkie’s Fallon advised Haddington and Sidley Austin partner Tim Chandler the investor group.

Lime Rock New Energy buys Power TakeOff

Deal Description: Power TakeOff, a software-enabled energy efficiency services company, announced Sept. 5 that funds managed by Lime Rock New Energy acquired a controlling interest in Power TakeOff from the company’s founding shareholder group. Terms weren’t disclosed. The Power TakeOff and Lime Rock New Energy teams will work closely to accelerate Power TakeOff’s growth and service offerings for utilities nationwide. Kevin Martin and Peter Widmer, co-CEOs of Power TakeOff, have also invested alongside Lime Rock New Energy and will to continue to lead the company.

Lime Rock’s Outside Counsel: Locke Lord led by DeLaina Mulcahy and Bill Swanstrom in Houston and David Ruediger in Boston. Additional assistance was provided by Chris Schrauff (Dallas) and Andrew Truong (Boston).

Versatile Credit attracts investment from PSG

Deal Description: Versatile Credit, a provider of software connecting merchants, lenders and consumers to facilitate loans at points-of-sale, announced Sept. 13 an investment from PSG, a growth equity firm partnering with software and technology-enabled services companies. PSG’s Marco Ferrari and Chris Nesbitt will join Versatile’s board. Financial terms were not disclosed.

Versatile’s Financial Advisor: Vista Point Advisors

PSG’s Outside Counsel: Weil, Gotshal & Manges including partner David Gail and associates Niko Lane and Carson Parks

Bernhard-backed Allied Power acquires Dominion Engineering

Deal Description: Allied Group Holdings, a purveyor of power plant services backed by Bernhard Capital Partners, announced Sept. 14 that it acquired Dominion Engineering Inc., which provides field service equipment, technology and engineering services to the nuclear power industry. Financial terms were not disclosed. Baton Rouge- and Brentwood, Tenn.-based Bernhard is a services and infrastructure-focused private equity management firm established in 2013. It has deployed capital in four funds across several strategies with $3.4 billion of gross assets under management.

Allied’s Outside Counsel: Kirkland & Ellis led by corporate partner Bill Benitez and associates Michael Bassi and Brennon Nelson; and tax partners Mark Dundon and Ryan Phelps and associate Matthew Wahlquist.

DEI’s Financial Advisor: Baird

DEI’s Outside Counsel: Greenberg Traurig

Diamondback, Five Point Energy form Deep Blue Midland Basin

Deal Description: Diamondback Energy Inc. and Five Point Energy announced Sept. 11 the formation of a new joint venture entity Deep Blue Midland Basin. Terms weren’t disclosed. The joint venture claims to create the largest independent water infrastructure platform in the Midland Basin with substantial excess capacity in place to pursue third-party growth.

Deep Blue’s Outside Counsel: Skadden, Arps, Slate, Meagher & Flom and Winston & Strawn. From Skadden: The team includes M&A partner Eric Otness and associates Brittney Brescia and Libby Rudolf (Houston); tax partner Paul Schockett (Washington, D.C.) and associates Jeff Romero (Houston) and Caitlin Hird (Washington, D.C.); labor and employment partner David Schwartz and associate Emily Safko (New York); and executive compensation and benefits partner Erica Schohn and associate Loren Koles (New York).

Diamondback’s Financial Advisor: Piper Sandler

Diamondback’s Outside Counsel: Akin Gump Strauss Hauer & Feld led by corporate partner John Goodgame with support from U.S. oil & gas practice leader Stephen Boone. The team also included tax partner Alison Chen; labor and employment partner Desiree Busching; antitrust/competition partner Corey Roush; corporate counsel Leana Garipova and associates Courtney Beloin, Mary Day Royston and Madeline Sullivan; tax counsel Aaron Farovitch and Aaron Vera; antitrust/competition counsel Brian Rafkin; and environment & natural resources practice head David Quigley and senior counsel Andrew Oelz.

Sumitomo’s Perennial Power JV’s with Advantage to start Perennial Renewables

Deal Description: Perennial Power Holdings Inc., a wholly owned unit of Sumitomo Corp. of Americas, inked a joint venture transaction with Advantage Capital to establish Perennial Renewables, a new limited liability company that develops renewable energy projects with a focus on solar power generation. Terms weren’t disclosed on the JV, which was announced Sept. 11. PR will focus on completing the development of AC’s portfolio, consisting of 2-plus gigawatts of solar generation across six states, and later will add new renewable energy projects. Located mainly in the Midwest and northeastern U.S., the projects are expected to be operational by the second half of 2024. Founded in 2002, Perennial Power maintains five renewable energy projects in the U.S. mostly made up of onshore wind power generation.

Perennial Power Holdings’ Outside Counsel: Norton Rose Fulbright led by Becky Diffen (Austin) and Erin Mitchell (Houston) and also included Shaileen Berlas (New York), Justin Lee (Los Angeles) and Lauryn Robinson (Austin). Additional support was provided by Julie Searle (Austin), Christine Fernandez Owen, Emily Beckman and Kayce Borders (Chicago), Bob Greenslade (Denver), Jamila Mensah and Kevin Gieseke (Houston), Marjorie Glover and Gabrielle Jacques (New York) and Hilary Lefko and Stefan Reisinger (Washington, D.C.).

Crowley, Seacor to create JV

Deal Description: Global maritime and logistics providers Crowley and Seacor Holdings, through its subsidiary Seabulk Tankers Inc., announced Sept. 13 an agreement to form a joint venture that will integrate their liquid energy and chemical transportation vessels, operations and related services into a new, independent U.S. Jones Act service provider, Fairwater Holdings. Terms weren’t disclosed. Fairwater will leverage and scale both entities’ operational and safety-focused capabilities to serve the U.S. domestic market with vessels and marine transportation solutions across the petroleum and chemical trades and related third-party ship management services. It will include 20 ocean-going, articulated tug-barges and 11 tankers, many under long-term charter. The JV will provide crewing and technical management for an additional 21 third-party owned vessels.

Expected Closing: Q1 2024 if it clears regulators

Crowley’s Outside Counsel: Vinson & Elkins led by partners Creighton Smith, Nettie Downs and John Michael and senior associate Jordan Fossee, with assistance from associates Tushar Parashar and Patrick Reintjes. Also advising were partner Todd Way and associate Dan Henderson (tax); partner Becky Baker and associate Peter Goetschel (employment/labor); partners Patricia Adams and David D’Alessandro, senior associate Brian DeShannon and associate Cassandra Zarate (executive compensation/benefits); partners Darren Tucker and Kara Kuritz, counsel David Smith and associate Adam Thomas (HSR); associates Ryan Bullard and Hunter Michielson (energy transactions/projects); partner Brett Santoli and senior associates Maya Bobbitt and Jen Bassett (finance); counsel Rajesh Patel and associate Haley Titcomb (technology transactions/IP); partner Matt Dobbins and associate Kelly Rondinelli (environmental); counsels Brian Howard and Elizabeth McIntyre and associates Pete Thomas and Connor Wilson (litigation); and associate David Smith (corporate).

Seacor’s Outside Counsel: Milbank and Watson Farley & Williams

CAPITAL MARKETS/FINANCINGS

Enbridge closes $3.4B share offering

Deal Description: Calgary-based Enbridge Inc. announced Sept. 8 that it closed its public offering of common shares by a syndicate of underwriters led by RBC Capital Markets and Morgan Stanley, together with BMO Capital Markets, CIBC Capital Markets, National Bank Financial Markets, Scotiabank and TD Securities as joint bookrunners. Enbridge issued 102.9 million common shares, including 13.4 million common shares issued to the full exercise of the underwriters’ over-allotment option. Gross proceeds from the offering are C$4.6 billion ($3.4 billion). Enbridge intends to use the net proceeds to finance a portion of the cash consideration payable for the purchase of local distribution company gas utilities in the U.S. from Dominion Energy Inc. announced Sept. 5.

Underwriters’ U.S. Outside Counsel: Baker Botts including corporate partners Joshua Davidson and Natasha Khan with help from senior associate Garrett Hughey and associates Marshall B. Heins II and Chelsea Johnson.

Ovintiv prices $684.8M offering of shares by selling stockholder

Deal Description: Ovintiv Inc. announced Sept. 11 the pricing of an underwritten public offering of 15 million shares of its common stock by NMB Stock Trust for gross proceeds of $684.8 million. The company won’t sell any shares in the offering and won’t receive any proceeds. The offering was expected to close on Sept. 13. J.P. Morgan is acting as underwriter. The company agreed to purchase from the underwriter 1 million out of the 15 million shares in the offering at a price per share equal to the price at which the underwriter will purchase the shares from the selling stockholder.

Ovintiv’s Outside Counsel: Gibson, Dunn & Crutcher with a corporate team that included partners Cynthia Mabry and Hillary Holmes and associates Justine Robinson, William Bald and Matthew Goldstein. Partner Pamela Lawrence Endreny and of counsel Jennifer Sabin advised on tax.

Diamond Offshore Drilling units launch upsized $550M private placement of notes

Deal Description: Diamond Foreign Asset Co. and Diamond Finance, wholly owned subsidiaries of Diamond Offshore Drilling Inc., announced Sept. 12 they priced their upsized offering of $550 million in 8.5 percent senior secured second lien notes due 2030. The offering was expected to close on Sept. 21. The company intends to use the net proceeds to fully repay and terminate its term loan credit facility, redeem in full its senior secured first lien PIK toggle notes due 2027 and repay all of the borrowings outstanding under its senior secured revolving credit agreement. The company intends to use any remaining net proceeds for general corporate purposes.

Initial Purchasers’ Outside Counsel: Latham & Watkins with a corporate deal team led by Houston partner Ryan Maierson and Austin partner David Miller with associates Om Pandya, Zainab Hashmi, Wole Oluborode, Natasha Kalaouze and Dalyn Dessaure. Advice was provided on finance matters by Houston partner Pamela Kellet with associate Kirby Swartz; on tax by Houston partner Jim Cole with associate Dylan White; on executive compensation, employment and benefits by Houston counsel Krisa Benskin; on environmental by Houston/Los Angeles partner Joshua Marnitz; and on sanctions by Washington, D.C. partner Eric Volkman, with associate Julie Shin.

Diamond’s Outside Counsel: Vinson & Elkins with a corporate team led by partners Mark Kelly, David Stone and Mike Telle with assistance from senior associate Alex Lewis and associates Cole Leveque, Alex Riddle and Hope Kaady. The finance team was led by partner Brett Santoli with assistance from counsel Noelle Alix, senior associates Jen Bassett and Maya Bobbitt and associates Hayley Johnson and Lary Yau. Other key team members included partner Wendy Salinas and associate Tyler Underwood (tax); counsel Corinne Snow and associate Alyssa Sieja (environmental); counsels Elizabeth McIntyre and Brian Howard and associate Pete Thomas (sanctions); partner John Michael and associates Ryan Bullard and Hunter Michielson (energy transactions/projects).

Sunoco prices $500M private offering of senior notes

Deal Description: Sunoco announced Sept. 13 that it priced a $500 million private offering of 7 percent in senior notes due 2028. Sunoco Finance Corp., a wholly owned direct subsidiary of Sunoco, will serve as co-issuer of the notes. The sale is expected to settle on Sept. 20. Sunoco intends to use the net proceeds to repay a portion of the outstanding borrowings under its existing $1.5 billion revolving credit facility.

Initial Purchasers’ Outside Counsel: Sidley Austin including partners Jon Daly and Johnny Skumpija assisted by Tanner Groce and Alan Williams

Issuer’s Outside Counsel: Vinson & Elkins with a team led by partners Jackson O’Maley and David Stone with assistance from associates Markeya Brown, Nate Richards, Ryan Polk, Jacqueline Cummings and Patience Li. Also advising were partner Lande Spottswood (corporate); partners Wendy Salinas, Ryan Carney, Jim Meyer and associate Tyler Underwood (tax); partner James Longhofer and associate Joe Kmak (finance); counsel Rajesh Patel and associate Warner Scott (technology/IP); partner Damien Lyster and associate Ryan Hoeffner (energy regulatory); partner Matt Dobbins and associate Simon Willis (environmental); and counsel Missy Spohn (executive compensation/benefits).

Patterson-UTI Energy launches $400M offering of senior notes

Deal Description: Patterson-UTI Energy Inc. priced Sept. 11 a registered underwritten public offering of $400 million in 7.15 percent senior notes due 2033. The company intends to use the net proceeds to repay outstanding borrowings under its revolving credit facility and for general corporate purposes. Goldman Sachs Group, U.S. Bank and Wells Fargo Securities are the underwriters.

Patterson-UTI Energy’s Outside Counsel: Gibson, Dunn & Crutcher led by partner Tull Florey and included associates Justine Robinson and Caitlyn Fiebrich. Partner Michael Cannon and associate Blake Hoerster advised on tax.

Underwriters’ Outside Counsel: Latham & Watkins with a corporate deal team led by Houston partners Ryan Lynch and Ryan Maierson with associates Clayton Heery, Sydney Verner and Molly Elkins. Advice was also provided on tax matters by Houston partner Jim Cole with associate Christine Mainguy and on environmental matters by Houston/Los Angeles partner Josh Marnitz, with associate Cody Kermanian.

Crescent Energy prices upsized $154.9M public offering of Class A common stock

Deal Description: Houston-based Crescent Energy Co. announced Sept. 6 the pricing of an underwritten, upsized public offering of 11 million shares of its Class A common stock at a price to the public of $12.25 per share, or $154.9 million. The offering represents a 1 million share upsize to the originally proposed 10 million share offering. The company intends to use the net proceeds to fund a portion of the purchase price for the recently announced acquisition of interests in oil and gas properties, rights and related assets primarily in Dimmit and Webb Counties, Texas, a deal that is expected to close this month. If the acquisition is not completed, proceeds of the offering will be used for general corporate purposes. The company granted the underwriters a 30-day option to purchase up to an additional 1.65 million shares of Class A common stock at the public offering price, less the underwriting discounts and commissions. The offering was expected to close on Sept. 11.

Managers: Wells Fargo Securities, KKR Capital Markets, Evercore Group, Raymond James & Associates Inc., Mizuho Securities USA and Truist Securities Inc. as book-running managers; Stephens Inc. and TPH&Co., the energy business of Perella Weinberg Partners, are co-managers.

Underwriters’ Counsel: Simpson Thacher including David Azarkh, Brian Rosenzweig, Richie Ragusa, Maggie Selbe and Luke Riel (capital markets); Michael Mann and Scott Grundei (tax); Mark Natividad (IP); Pasco Struhs (compensation/benefits); Michael Isby and Deepa Sarkar (environmental); Abram Ellis and Christine Tillema (regulatory); and Jennie Getsin (Blue Sky).

Crescent’s Outside Counsel: Vinson & Elkins with a corporate team led by partners Doug McWilliams and Jackson O’Maley with assistance from senior associate Alex Lewis and associates Nate Richards, Chase Browndorf, Autumn Simpson and Kylie Paradowski. Also advising were partner Lina Dimachkieh and associate Jeff Slusher (tax); and partners David D’Alessandro and Dario Mendoza and associates Maddison Riddick and Cassandra Zarate (executive compensation/benefits).

Crescent Energy prices upsized $150M private placement of more senior notes

Deal Description: Crescent Energy Co. announced Sept. 7 that its indirect subsidiary Crescent Energy Finance priced its previously announced private placement pursuant of $150 million in 9.25 percent senior notes due 2028. The size of the offering was increased from the previously announced $125 million to $150 million. The notes mature on Feb. 15, 2028. The issuer intends to use the net proceeds to fund a portion of the purchase price for the recently announced acquisition of interests in oil and gas properties, rights and related assets primarily in Dimmit and Webb Counties, Texas, a deal expected to close this month, and the remaining net proceeds will be used to repay a portion of the amounts outstanding under its revolving credit facility. The offering is expected to close on Sept. 12.

Crescent’s Outside Counsel: Vinson & Elkins with a corporate team led by partners Doug McWilliams, Jackson O’Maley and David Wicklund with assistance from senior associate Alex Lewis and associates Nate Richards, Chase Browndorf, Autumn Simpson and Kylie Paradowski. Also advising were partner Wendy Salinas and associate Jeff Slusher (tax) and partners David D’Alessandro and Dario Mendoza and associates Maddison Riddick and Cassandra Zarate (executive compensation/benefits).

Initial Purchasers’ Counsel: Simpson Thacher including David Azarkh, Brian Rosenzweig, Richie Ragusa, Maggie Selbe and Luke Riel (capital markets); Michael Mann and Scott Grundei (tax); Mark Natividad (IP); Pasco Struhs (compensation/benefits); Michael Isby and Deepa Sarkar (environmental); Abram Ellis and Christine Tillema (regulatory); and Jennie Getsin (Blue Sky).

SilverBow Resources launches $148M secondary

Deal Description: SilverBow Resources Inc. announced Sept. 13 the upsize and pricing of its previously announced underwritten public offering of its common stock. The size of the offering increased from the previously announced 3 million shares to 4 million shares, which includes 2.8 million shares offered by the company and 1.189 million shares offered by an affiliate of Strategic Value Partners at a price to the public of $37 per share. The company and the selling stockholder granted the underwriters a 30-day option to purchase up to an additional 600,000 shares, upsized from the previously announced 450,000 shares. The offering is expected to close on or about Sept. 18. The company intends to use the net proceeds to repay a portion of the amounts outstanding under its senior secured revolving credit facility and for general corporate purposes. It will subsequently use borrowings under its credit facility and proceeds from its amended second lien notes to fund the purchase price for the company’s pending acquisition of Chesapeake Energy Corp.’s oil and gas assets in South Texas.

Managers: Citigroup, Mizuho and Johnson Rice & Co.; Truist Securities, BofA Securities, KeyBanc Capital Markets, Capital One Securities and Barclays; PNC Capital Markets and CIBC Capital Markets; and Fifth Third Securities, Northland Capital Markets, Tuohy Brothers and Regions Securities

SilverBow’s Outside Counsel: Gibson, Dunn & Crutcher led by partners Hillary Holmes and Cynthia Mabry and including associates Justine Robinson, Malakeh Hijazi, and Mason Gauch

Underwriters’ Outside Counsel: Shearman & Sterling including Texas attorneys Bill Nelson and Emily Leitch

Recoil Resources attracts financing from Valor Upstream Credit Partners

Deal Description: Recoil Resources, a privately held oil and gas company focused in the oil window of the Eagle Ford shale, announced Sept. 14 that it closed a senior secured term loan with Valor Upstream Credit Partners. Terms weren’t disclosed. VCP is a dedicated upstream credit fund formed by Riverstone Credit Partners and energy trader Vitol. Charles Cusack, CEO of Recoil, said in a release that the company chose VCP due to its long-term view and alignment with its objective of continuing to develop its position in the Eagle Ford oil window and generate high returns for its equity owners. Daniel Flannery, managing director at Riverstone Credit, said Recoil is VCP’s first transaction, having formed in June. Recoil was founded in 2018 with an initial acquisition in Wilson County and since then has drilled and completed 44 Eagle Ford wells.

Valor’s Outside Counsel: Kirkland & Ellis led by debt finance partners Lucas Spivey and James Bedotto and associates Purun Cheong and Brock Baker with support from corporate partner Shubi Arora and tax partner David Wheat.