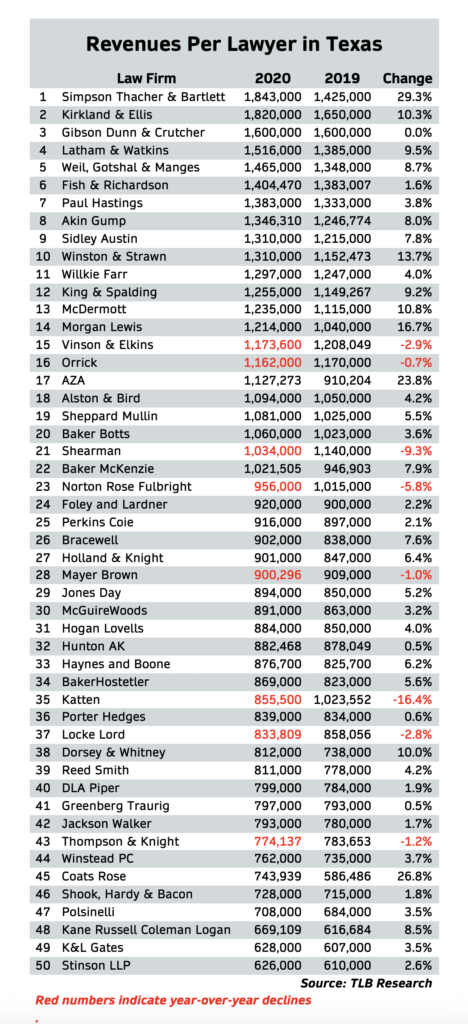

Something Simpson Thacher did in 2020 was absolutely jaw-dropping.

The firm grew its Texas revenues per lawyer by $418,000, outdoing its 2019 performance by nearly 30%. An RPL of $1,843,000 vaulted Simpson Thacher to the top of The Texas Lawbook 50 rankings of corporate law firms based on the number that most legal analysts consider the purest metric of financial health.

Already a Texas RPL superstar at No. 3 in 2019, Simpson Thacher pushed former No. 1 Kirkland & Ellis down to the second spot, with Gibson Dunn slipping down to third (chart 1). A week ago, The Lawbook revealed that Kirkland had risen to the top in total corporate-law revenues, the first firm headquartered outside Texas to do so.

The RPL data show a decided tilt toward out-of-state firms with offices in Texas. Twenty-two firms had RPLs above $1,000,000 in 2020; just four of them have Texas roots – Akin Gump at $1,346,310, Vinson & Elkins at $1,173,600 and Ahmad, Zavitsanos, Anaipakos, Alavi & Mensing (AZA) at $1,127,273 and Baker Botts at $1,064,000.

Related tidbits from the Lawbook 50 review of RPL include:

- The number of $1,000,000 RPL firms remained unchanged from 2019.

- Two firms entered the $1,000,000 club – Baker McKenzie and AZA, back after slipping out in 2019.

- Norton Rose Fulbright and Katten, both above $1,000,000 in 2019, slipped out of the club.

- Nine firms joined Simpson Thacher in boosting RPL by at least $100,000, and Akin Gump fell short of the benchmark by a mere $500.

- RPLs fell more than $168,000 at Katten and $106,000 at Shearman – the only two firms with declines exceeding $100,000.

- Adding $100,000 or less to RPL in 2021 could push seven firms above $1,000,000, including a return for Norton Rose Fulbright ($956,000).

Earlier Lawbook 50 installments reported that overall Texas revenues rose 4.3% from 2019 to 2020. At the same time, the state’s lawyer headcounts nudged upward by less than 1%. RPL divides the first of these into the second, so it’s not at all surprising that the Lawbook 50’s weighted average RPL rose 3.5%, going from $913,154 in 2019 to $944,758 in 2020.

Chart 1

Citi Private Bank Law Firm Group, an industry advisory group, calculated a 2020 RPL increase of 5.5% for national corporate law firms. The largest firms grew their RPLs two times faster than smaller ones, Managing Director Michael McKenney said.

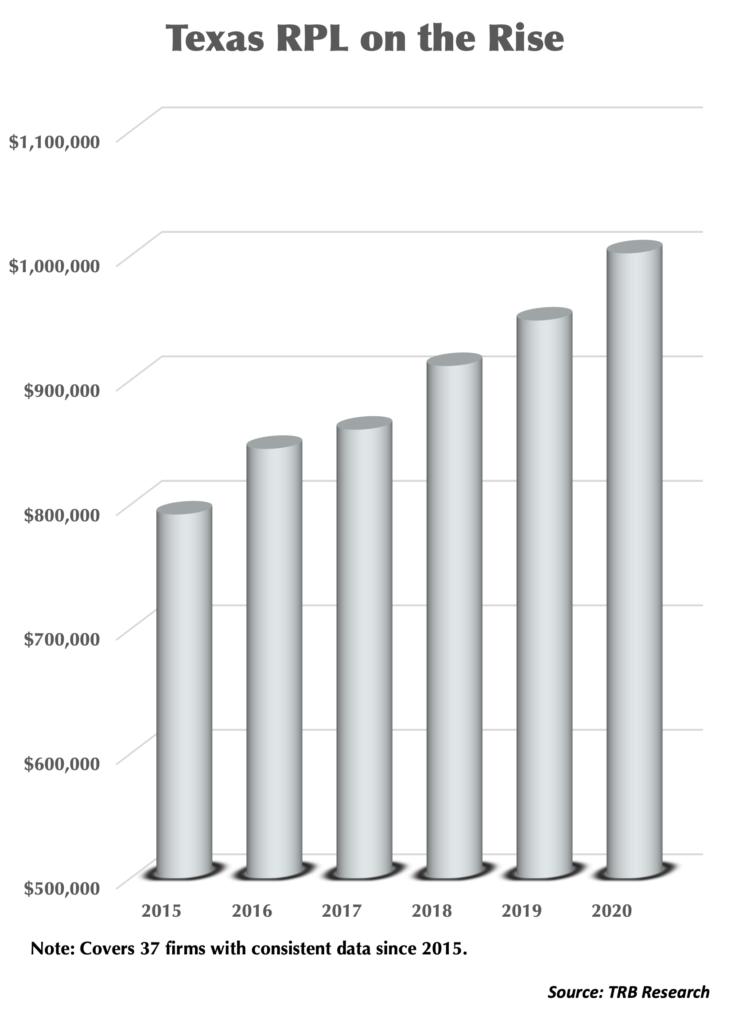

In Texas, last year built on a trend. RPL has risen steadily in recent years – up from $792,000 in 2015 to $1,001,974 in 2020 for a truncated sample of 37 firms with comparable data for the six-year period (chart 2). The 2020 gain of 5.7% was a full percentage point above the average since 2015.

Chart 2

RPL increased at 42 firms in 2020, matching the number in 2019.

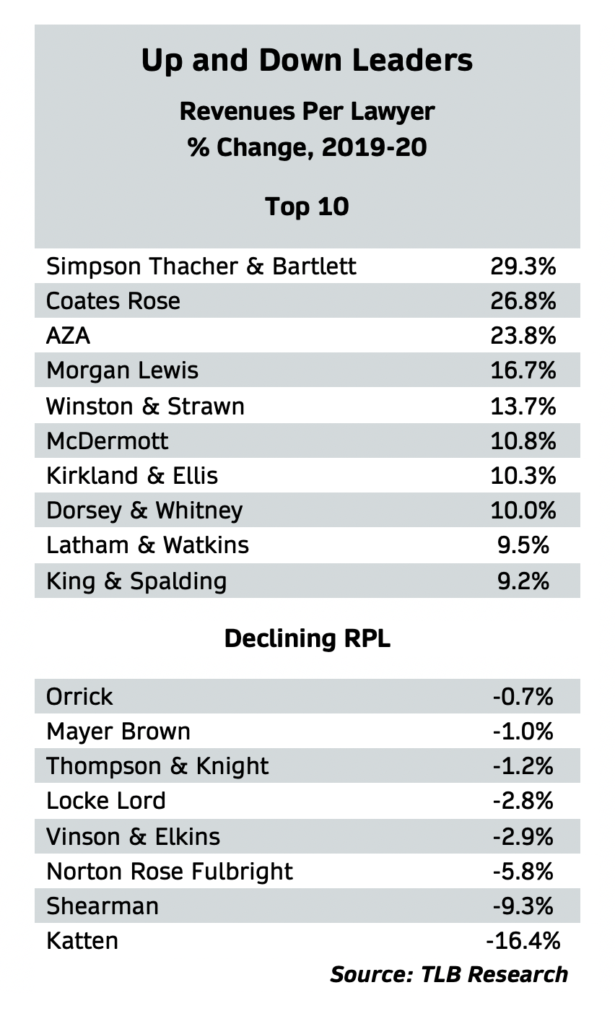

Simpson Thacher had the biggest percentage gain. Two smaller firms weren’t far behind – Coats Rose at 27% and AZA at 24% (chart 3). Five other firms increased RPL by 10% or more, with another 13 gaining between 5% and 10%.

Katten had the sharpest year-over-year decline at more than 16%. Shearman (-9%) and Norton Rose Fulbright (-6%) were the only other firms with RPL declines of more than 5%.

Mark Solomon, managing partner of Katten’s office in Dallas, said the firm’s revenue decline was attributed to a timing in collections rather than a decline in work. The firm received payment for a good bit of 2020 work in the first quarter of 2021.

“From the end of March until July [2020], it was very slow, but we have been buried in work ever since,” Solomon said. “M&A has been crazy busy across the board – technology, industrial, private equity, even real estate. 2021 is going to be a big year for us. Our biggest problem is getting enough talent to do the work that we have coming in.”

Real world results emerge from such idiosyncratic factors as client demand, billing rates, hiring decisions and departures. In a mathematical sense, though, the interplay of money and lawyers drives RPL changes from one year to the next.

The four relevant permutations:

Rising headcount, rising revenue: Simpson Thacher’s jaw-dropping year was manifest in a nearly 23% increase in lawyer staff and a 58% gain in revenue. The combination of rising headcount and rising revenue dominates the Lawbook 50 rankings, with 27 firms following the pattern. It usually leads to higher RPLs – but not always. At Shearman, a 48% rise in headcount swamped a 25% increase in revenues, leading to a 9.3% lower RPL. Two-thirds of the $1,000,000-plus firms had rising headcounts and rising revenues.

Falling headcount, rising revenue: At Coats Rose, 11% fewer lawyers produced 13% more revenue. Nine firms share this category with Coats Rose, and all saw higher RPLs in 2020. Most had only small changes in both headcounts and revenues, but Baker Botts managed to increase Texas revenues 4% with 13% fewer Texas lawyers. Winston & Strawn turned in a similar performance with revenues up 8%, lawyers down 5%.

Falling headcount, falling revenue: Among the big names in this category are Vinson & Elkins, Norton Rose Fulbright and Thompson & Knight. They had lower RPLs in 2020. Six firms with declining headcounts and revenues still managed to improve their RPLs, led by Baker McKenzie, the last entry into the $1,000,000 club.

Chart 3

Flat headcount, rising or falling revenue: Two firms with higher RPLs had no headcount growth and reported higher revenues – Akin Gump was up 8% and Shook, Hardy & Bacon just below 2%. Among firms with lower RPLs, Katten added less than one lawyer and saw revenues fall more than 17%.

American Lawyer first published PRL data four decades ago. Why do analysts like it? It’s a simple and transparent calculation: total revenues divided by the number of lawyers, based on full-time equivalency. Other data points, such as profits per partner, can be manipulated by reclassifying the partnerships in equity and non-equity members.