Business bankruptcy filings in Texas plummeted during the first six months of 2019 to levels prior to the oil price plunge in 2015 and 2016.

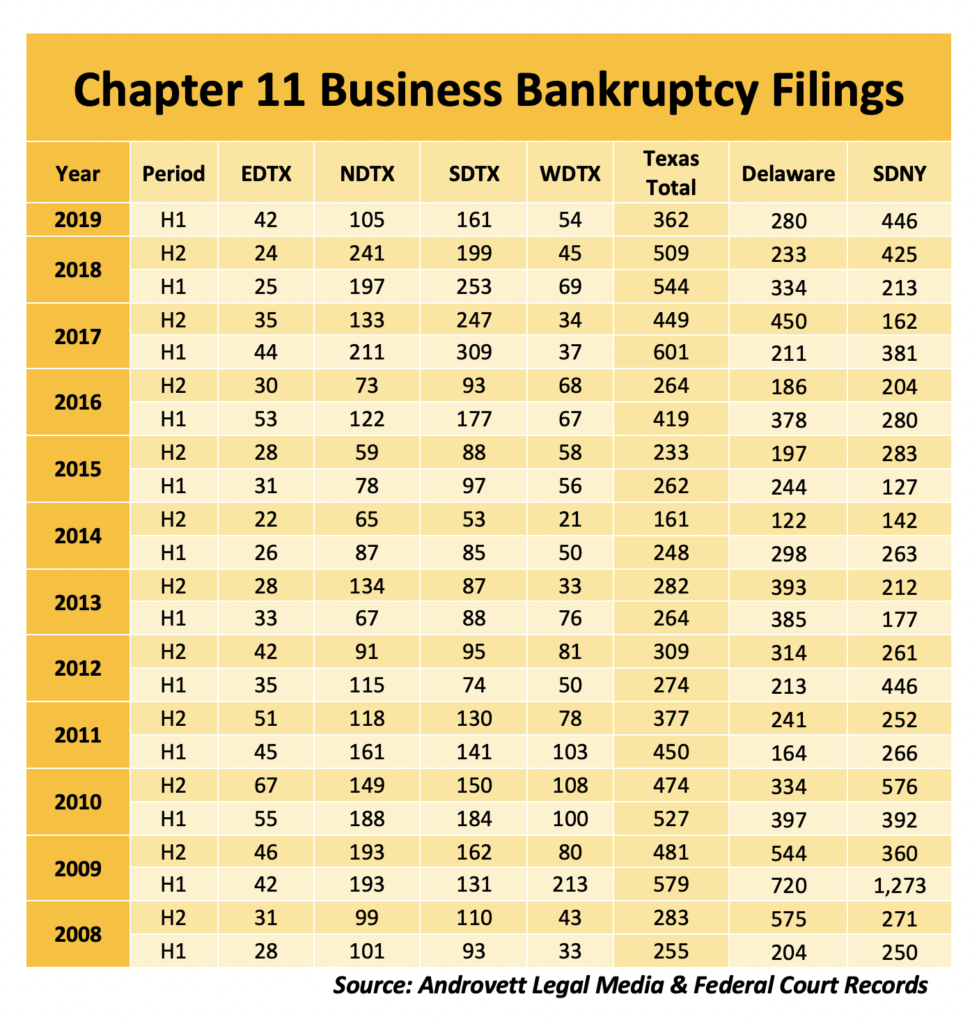

New data provided exclusively to The Texas Lawbook by Androvett Legal Media Research shows that the number of Chapter 11 restructuring petitions submitted during the first half of this year was down 55% in the DFW area and lower by 36% in the Houston region.

While legal and financial analysts credit the strong economy and low interest rates for the decline in new business bankruptcy, they also predict a severe financial storm is brewing that could force hundreds and hundreds of Texas businesses into insolvency.

“We are definitely in the calm before the storm,” says Norton Rose Fulbright bankruptcy partner Lou Strubeck. “We are on the cusp of something big happening.”

Corporate restructuring experts say they see specific signs – including record amounts of debt and leverage, lower oil prices, vacant commercial real estate space and increased pressures on healthcare companies and retailers – that a surge of business bankruptcies and reorganizations is heading toward Texas.

“Another wave of business bankruptcies is on the way,” says Elizabeth Freeman, a corporate restructuring law partner at Jackson Walker in Houston. “We were just recently retained in three new cases. There’s a lot of debt, a lot of notes signed in the early and mid-2000s that are coming due.”

Jackson Walker partners Matthew Cavenaugh and Jennifer Wertz are representing Sanchez Energy, which filed for bankruptcy in Houston on Monday.

William Snyder, a partner at the national corporate turnaround firm CR3 Partners, says corporate debt as the result of M&A activity has soared well beyond any historical measurements.

“We’re talking $1.3 trillion and debt multiples of nine. Prices are astronomical. Leverage levels are astronomical,” says Snyder, who is based in Dallas. “Are you kidding me? It cannot be sustained.”

“Oil and gas companies are struggling. Healthcare companies are in distress. Recycling metals are in the ditch,” he says. “But if you look around, it’s like no one is paying attention. It’s like no one is noticing all this debt and the impact it could have.”

Until the inevitable wave hits, the bankruptcy courts have certainly seen less activity from businesses.

Between Jan. 1 and June 30 of this year, 105 companies sought Chapter 11 bankruptcy protection in the Northern District of Texas – that’s down from 241 during the final six months of 2018, according to the Androvett data. In fact, it is the lowest number of business bankruptcies filed in the district that includes Dallas and Fort Worth since the second half of 2016.

In the Southern District of Texas, there were 161 companies that filed for bankruptcy during the first half of 2019 – down 36 percent from the 253 Chapter 11’s during the same period a year earlier and also the fewest new business bankruptcies since 2016.

There were 54 corporate restructurings filed in the Western District of Texas, which includes San Antonio and Austin, during the first six months of this year, which is 21% less than H1 2018, Androvett research shows.

Bill Wallander, head of the bankruptcy and restructuring practice at Vinson & Elkins, says corporate bankruptcies are down because “U.S. business has been robust generally speaking and we have not had rising interest rates or recession.”

Credit availability, interest rates, capital raising, demand factors and recession risks are “factors that influence liquidity” and “lead to increased financial distress and restructuring,” Wallander says.

Corporate finance experts say that the low interest rates and the ability of private equity funds to plug holes in debt-laden companies – especially oil and gas operations – with much-needed cash has only delayed the inevitable if commodity prices continue to slide.

In the world of bankruptcy, lawyers and financial advisors call it “extend and pretend” – extend the debt and pretend (or pray) cash flow will improve.

“It’s hard to say for certain, but one view on why filings are down in Texas is a large number of distressed energy businesses went through restructuring since November 2014,” says Brian Schartz, a partner in the Houston office of Kirkland & Ellis, which has one of the elite bankruptcy practices in the U.S.

“The businesses restructuring today generally are energy companies doing so because they thought the downturn would not be as prolonged as it has been, energy service companies that were partially protected during the first part of most recent downturn because of contracts and a few companies that went through restructuring once already but didn’t do enough to succeed in the current environment,” Schartz says.

“It would seem we’re in another period of uncertainty in the energy space,” he says.

Experts say leaders at distressed companies will need to decide whether to go with a court-ordered restructuring or reorganize outside of the official Chapter 11 process with the help of creditors and financial institutions seeking to avoid the expenses associated with the bankruptcy court proceedings.

“I think we are beginning to see some bad signs,” says Duston McFaul, a bankruptcy partner in the Houston office of Sidley Austin. “I don’t think, however, that there will be a massive new wave of bankruptcies unless it’s associated with a broad-based recession.”

McFaul says upstream oil and gas companies can “expect to see more filings to be associated with any erosion in commodity pricing due to systemic long-term over-supply” or if “OPEC reverses its trend on curbing output.”

Porter Hedges partner John Higgins points out that some of the recent bankruptcy filings involve companies seeking to restructure for a second time in only a few years.

“Halcón Resources and Vanguard Natural Resources are back into bankruptcy again because they came out of bankruptcy last time with too much take-back debt,” Higgins says.

“We haven’t seen the end of stress in the healthcare industry either,” he says. “We know there are a couple healthcare companies teetering and may need to file soon.”

Strubeck points out that the economy and the bankruptcy/restructuring practice are cyclical and both are “overdue for a down cycle.”

“The market has been going crazy for so long and to a large extent it seems artificial,” Strubeck says. “(It) has the same feel to me as before the dot-com crash and 2007/2008 (recession).”

Editor’s Note: The Lawbook will publish Friday an in-depth article on the battle among law firms for restructuring talent to catch the next wave of bankruptcies.