© 2016 The Texas Lawbook.

By Natalie Posgate

(Aug. 3) – Texas lawyers found that the capital markets remained tight-fisted during the first six months of this year, but new data indicates that the door to the vault might be cracking open ever so slightly for the rest of 2016.

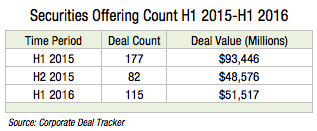

The Texas Lawbook’s Corporate Deal Tracker shows that Texas-based lawyers worked on 115 securities offerings valued at $51.5 billion in the first half of the year. That marks a significant decline from the deal flow witnessed in H1 2015 – down 35 percent on count and 45 percent on value – but it wasn’t nearly as bad as the market conditions during the second half of last year, the data shows.

At least from a deal count standpoint, that is.

The last six months of 2015 saw only 82 capital markets deals – which was less than three-fourths the number H1 2016 saw and less than half of H1 2015’s 177 offerings.

But the total value of the offerings occurring in the first half of this year was not too far off from the value of 2H 2015’s $48.58 billion. It increased by just 6 percent. However, it is down by 55 percent compared to H1 2015’s overall $93.45 deal value.

The data is heavily swayed by securities offerings involving energy companies, which comprised around 75 percent of all capital markets deals that Texas lawyers worked on in the first half of the year. When commodity prices first dropped, a flurry of energy companies turned to capital markets to raise money. But as conditions worsened throughout last year, the banks ceased being a steady a source for cash.

“Last year was very different,” said Mike O’Leary, a partner at Andrews Kurth. “In the first half of the year, there was an awful lot of capital markets transactions. Companies were trying to raise capital to address balance sheet issues, and the markets were open to do so. From July on, that window closed.

Experts say they’re still not sure how the finish line of this capital markets downturn will compare to previous ones.

“Usually downturns are V-shaped,” said Latham & Watkins partner J. Michael Chambers, alluding to the 2008 financial crisis. “The market crashed hard but rebounded hard. “2008 was more macro and not commodity-driven. There was a severe crash, but we were in and out of the whole thing in 18 months. The concern here is it’s not going to be V-shaped, but maybe U-shaped or L-shaped, where it would go down and stay down.”

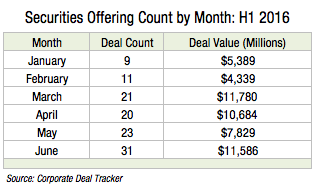

Still, the count and value for capital markets deals continue to increase each month, indicating that market conditions are consistently improving. June was the best month in the first half of this year, yielding 31 securities offerings valued at $11.6 billion, which is more than triple the amount of January’s nine deals. It more than doubled January’s $5.4 billion value.

Texas-based attorneys only worked on four IPOs during the first half of this year, whereas at least four – and likely more – occurred in the second quarter of 2015 alone. Of the four filed this year, one was in India, two were in the healthcare real estate and biotechnology industries and the fourth, Centennial Resource Development, got nixed, as company leaders opted instead to accept a major investment from a private equity firm. It would have been the first IPO in two years to involve a U.S. upstream oil company.

“The IPO market is pretty shut in energy, [at least] in the MLP space, where I spend a lot of time,” said capital markets partner Bill Cooper of Andrews Kurth. “Lots of MLPs have done preferred offerings, including several very large ones over $1 billion.”

“If you talk to the bankers, they’re just gloomy,” said A.J. Ericksen, a partner in Baker Botts’ Houston office.

Even so, some Texas lawyers active in the capital markets space say they are hopeful for the kind of deal flow anticipated for the second half of the year, which may even include an increase in IPOs.

Chris Schmitt, who worked on the premature Centennial IPO and the biotech IPO for Irving-based Reata Pharmaceuticals, which raised $70 million, said he thinks there will be a “renewed flurry of activity” in the fourth quarter.

Schmitt, who divides his time between M&A and securities offering work, said his focus this year has been much more on M&A, but has some indication that his workload may begin to resemble his days in 2014 and 2015, when the capital markets were more open.

“I sort of sense a trend right now based on what’s on my desk that we will see some robust activity that will hopefully be skewing toward offering work,” Schmitt said.

Chambers said he and his fellow Latham Houston office colleagues have been laying the groundwork for six or seven IPOs.

Josh Davidson, who heads Baker Botts’ capital markets and MLP/yieldco practices, said the same is happening at his firm.

“We have several IPOs we’re working on internally in terms of upstream and offshore and midstream that are not going out immediately, but we’re getting them ready to go for when the market opens,” Davidson said.

© 2016 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.