© 2017 The Texas Lawbook.

By Natalie Posgate

(April 12) – When it comes to the size of deals that most Texas M&A lawyers worked on last year, there’s no question that the sweet spot is in the middle-market space.

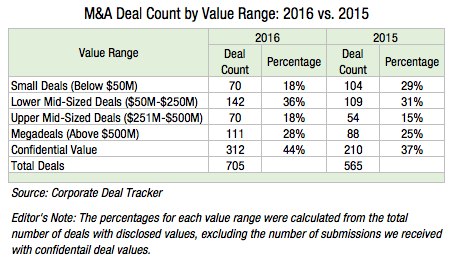

Deals valued between $50 million and $500 million accounted for 54 percent of the 393 deals reported to The Texas Lawbook’s Corporate Deal Tracker in 2016, an 8-percentage point jump from the previous year.

Moreover, there were far more deals in the lower half of that middle market than in the upper half. In 2016, there were 142 deals valued between $50 million and $250 million – more than double the number of deals (70) valued between $251 million and $500 million.

The number of transactions valued below $50 million dropped substantially in 2016. In 2015, the 104 deals valued below $50 million accounted for 29 percent of the 355 deals law firms reported with public values. In 2016, deals with a reported value of less than $50 million dropped to 70, a 33 percent decline – and only 18 percent of the 393 disclosed value deals.

The 111 deals valued above $500 million fell in the second most-represented value range in 2016, comprising 28 percent of the deals.

Dollar signs aside, the data indicates that the true winners are private companies. Last year there were 312 deals involving confidential values, which often involved a privately-held company or a private equity firm. These deals accounted for 44 percent of the 705 total transactions reported to the Corporate Deal Tracker last year. In 2015, 210 such deals made up 37 percent of all M&A deals reported.

All in all, confidentially-priced deals are much more prevalent in the M&A market than public ones. Companies generally do not disclose the price unless the deal must obtain public approval via shareholder votes, or if the value is material information.

The business sectors that made up more than two-thirds of the 312 confidentially-valued deals were energy (95), technology (37), manufacturing (35), financial services (23) and healthcare (22).

Who did what

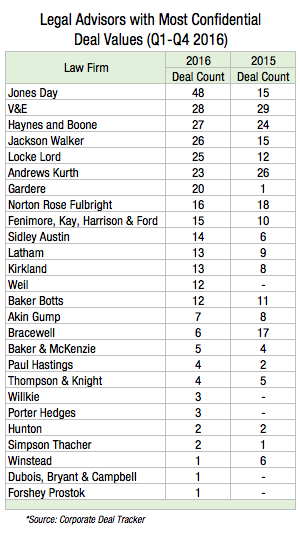

By far, Jones Day handled the most transactions with confidential deal values. Lawyers in the Cleveland-based firm’s Texas offices worked on 48 such deals, or two-thirds of the firm’s entire deal count for 2016; that’s more than triple the amount of confidentially-valued deals the firm handled in 2015. Of the transactions Jones Day handled that included public deal values, 16 were large deals, seven were small deals and only two were mid-sized.

Vinson & Elkins handled the second most deals in 2016 with confidential deal values. Haynes and Boone, Jackson Walker, Locke Lord and Andrews Kurth Kenyon followed.

Regardless of the value range, Vinson & Elkins always placed first for deal count, a testament to the firm’s domination not just in mega energy deals, but in M&A of all sizes (though energy still predominates).

“I think we really benefit from having strong M&A practices in Dallas, Houston and Austin,” said Keith Fullenweider, a partner in V&E’s Houston office and head of the firm’s corporate department. “We do a lot of work in the technology sector as well as energy, and we had some nice deals in the financial service space handled by the Dallas office. If energy slows down, our M&A lawyers still tend to be busy.”

V&E lawyers also have the tendency to get hired by the same clients regardless of the deal size, Fullenweider added.

“The client may hire us to do a $100 million acquisition and then a $1 billion acquisition,” he said. “It’s the same client, just with a different opportunity and a different situation.”

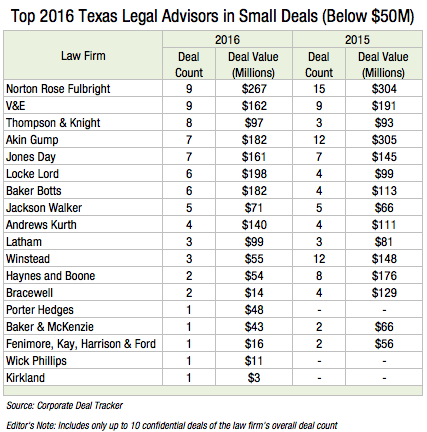

For smaller transactions in 2016, V&E tied for first with Norton Rose Fulbright. Both handled nine transactions valued below $50 million. Norton Rose Fulbright tied for first place despite handling 40 percent fewer deals in this value range than in 2015.

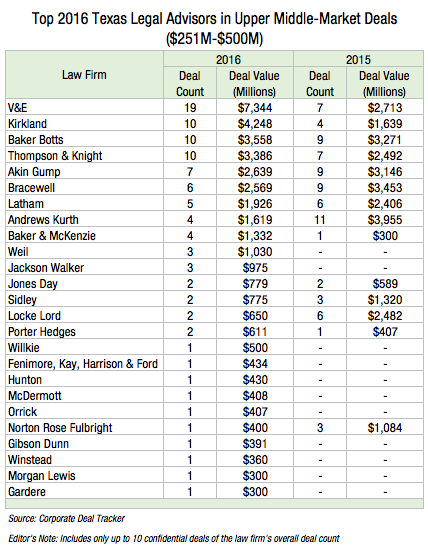

High deal count in the upper mid-market was dominated by firms heavily focused on oil & gas: Kirkland & Ellis, Baker Botts, Thompson & Knight and Akin Gump.

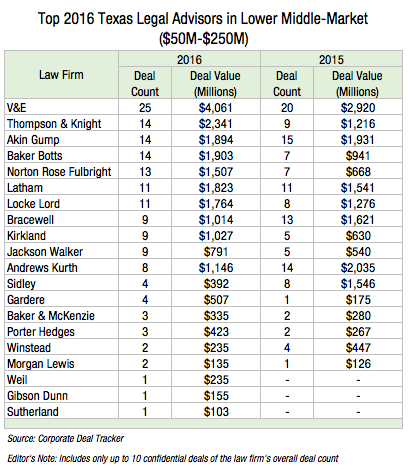

About the same occurred in the lower middle-market. After V&E, Thompson & Knight, Akin Gump and Baker Botts tied for second; Norton Rose Fulbright ranked fifth; and Latham & Watkins and Locke Lord tied for sixth in terms of handling the most deals between $50 million and $250 million.

Fullenweider said one reason for the influx in lower mid-market deals could be that “build up or add on transactions,” terms for an M&A deal that a company utilizes in order to grow its business, typically fall in the $50 million to $250 million range.

“You tend to do that when you’re optimistic and can raise financing… and prospects look better, capital is more available and banks are more interested in loaning,” he said.

Conversely, deals valued in the upper mid-market and above could indicate consolidation of entire companies, a deal trend that was very prevalent in 2015 and the beginning of 2016 when the commodity environment was much worse.

“We are in a better deal environment now than we were [the previous] year,” he said. “When things get really tough … people have to sell assets to survive or repay debt, or consolidate to cut costs. When you put entire companies together or have companies engaged in distressed M&A, they tend to be in the upper mid-market or above $500 million.”

Wes Williams, the corporate and securities practice leader at Thompson & Knight, said the bulk of his law firm’s M&A deals are related to private equity-backed energy companies – especially when these companies are just getting started.

“They start with a commitment from a private equity fund,” said Williams, a partner in the Dallas/Fort Worth area. “The initial acquisition will be a $40 million, $50 million, $100 million commitment.”

“With that geographic area being so hot, you have people putting out $60 million, $70 million, $150 million or $200 million to work. The big flashy deals that get headlines are fun to work on, but there is this constant activity in the lower mid-market range,” he said.

© 2017 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.