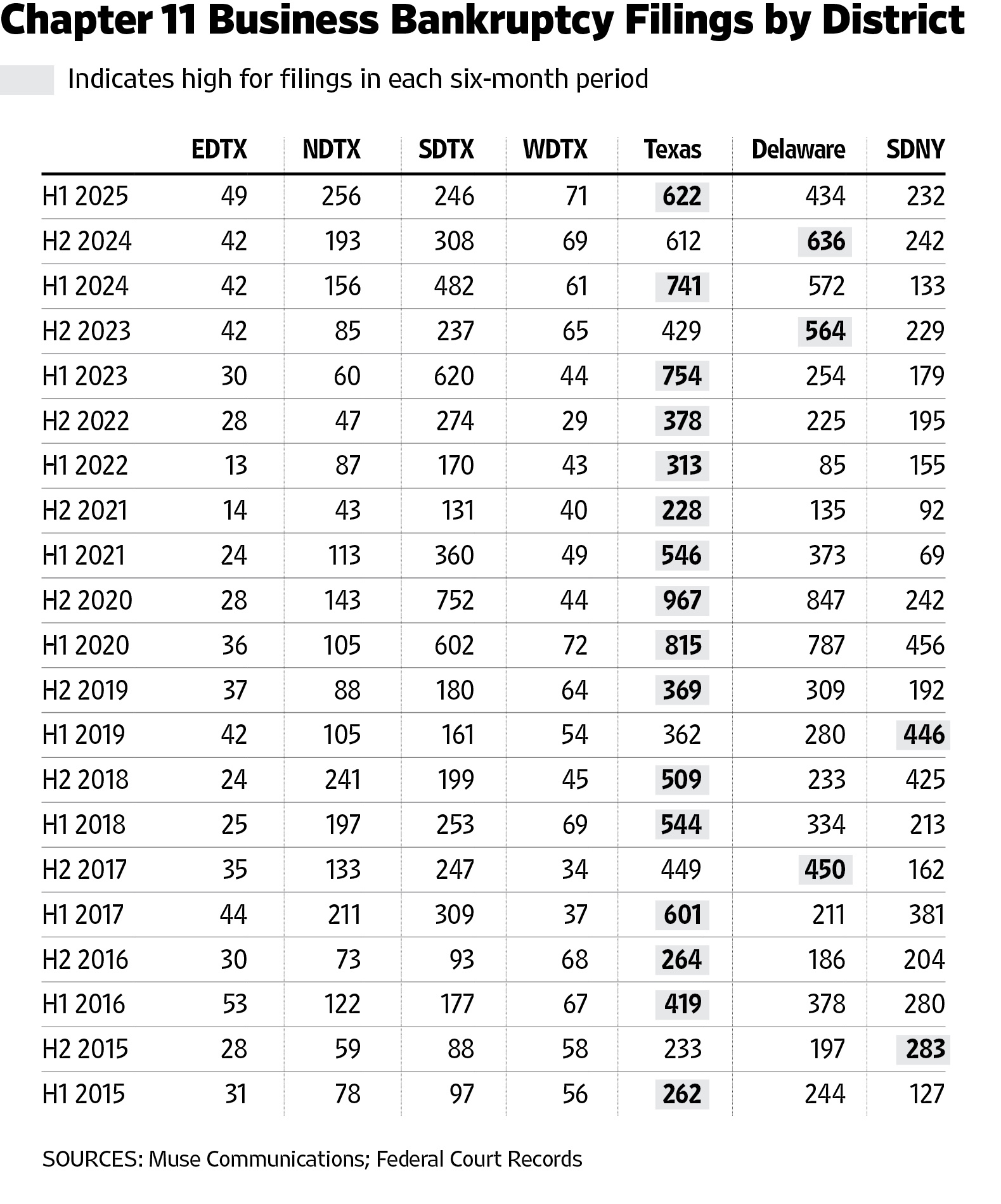

Fueled by financial distress in the healthcare and hospitality industries, a record number of businesses filed for bankruptcy in the Northern District of Texas federal courts during the first six months of 2025.

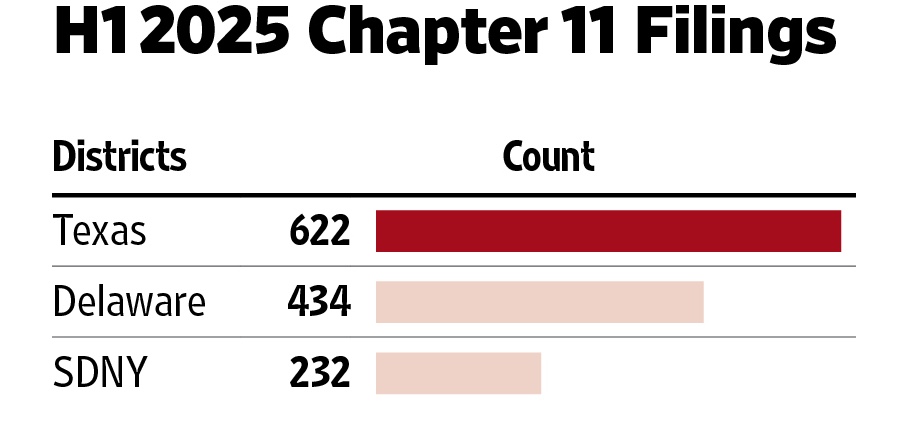

New Texas Lawbook data shows that 622 companies and their affiliated businesses sought protection to restructure under Chapter 11 in the Texas bankruptcy courts between Jan. 1 and June 30 — more than any other state by a large margin.

The Northern District of Texas, which includes Dallas and Fort Worth, recorded 256 new business bankruptcies during H1 — a 64 percent jump from the same period one year ago and more than any previous year on record.

Haynes Boone bankruptcy partner Charles Beckham said Chapter 11 cases, which allow companies to restructure their debt subject to court approval, are “up nationally, and we expect the trend to continue.”

“If a recession arrives in the fourth quarter of 2025, we expect all bankruptcy courts will see an increased number of cases,” Beckham said. “The end to the trillions in federal fiscal stimulus certainly impacted a cross section of industries, but consumer spending was the hardest hit.”

That being said, O’Melveny & Myers bankruptcy partner Lou Strubeck noted that DFW and Houston attract different types of bankruptcy cases.

“Dallas-Fort Worth, after decades of being viewed as a less favorable venue, is getting some traction, especially in the area of healthcare and middle-market companies such as those in the hospitality industry,” he said. “The volume of cases filed in Houston has dropped, but that seems to be stabilizing and moving up again. Houston still seems to be getting the larger complex cases.”

Healthcare, Hospitality Drive NDTX Docket

Strubeck said there is “lots of a ruin in the healthcare industry,” which will keep the Dallas and Fort Worth bankruptcy judges busy for the next year or more.

“Healthcare will continue to be a distressed area for the foreseeable future,” Beckham said. “If there are fewer federal dollars available to support healthcare services, there will be continued distress.”

“Healthcare companies made billion-dollar decisions years ago, based on what they perceived to be a reliable payment scenario. Those decisions have been thrown into chaos. Chaos causes business distress,” he said. “The volatile tariff situation is also causing distress for businesses that rely upon imported goods. Some companies will thrive, and some companies will suffer significant distress.”

Bradley Arant partner Jarrod Martin, who has been involved in the DFW bankruptcy cases involving Hooters of America and Genesis Healthcare, said the financial distress in the healthcare and hospitality business sectors is “the effects of labor shortages, rising interest rates and post-COVID normalization hit[ing] at the same time.”

“What will be interesting is to see whether there any losers from the Big Beautiful Bill in the near term,” Martin said.

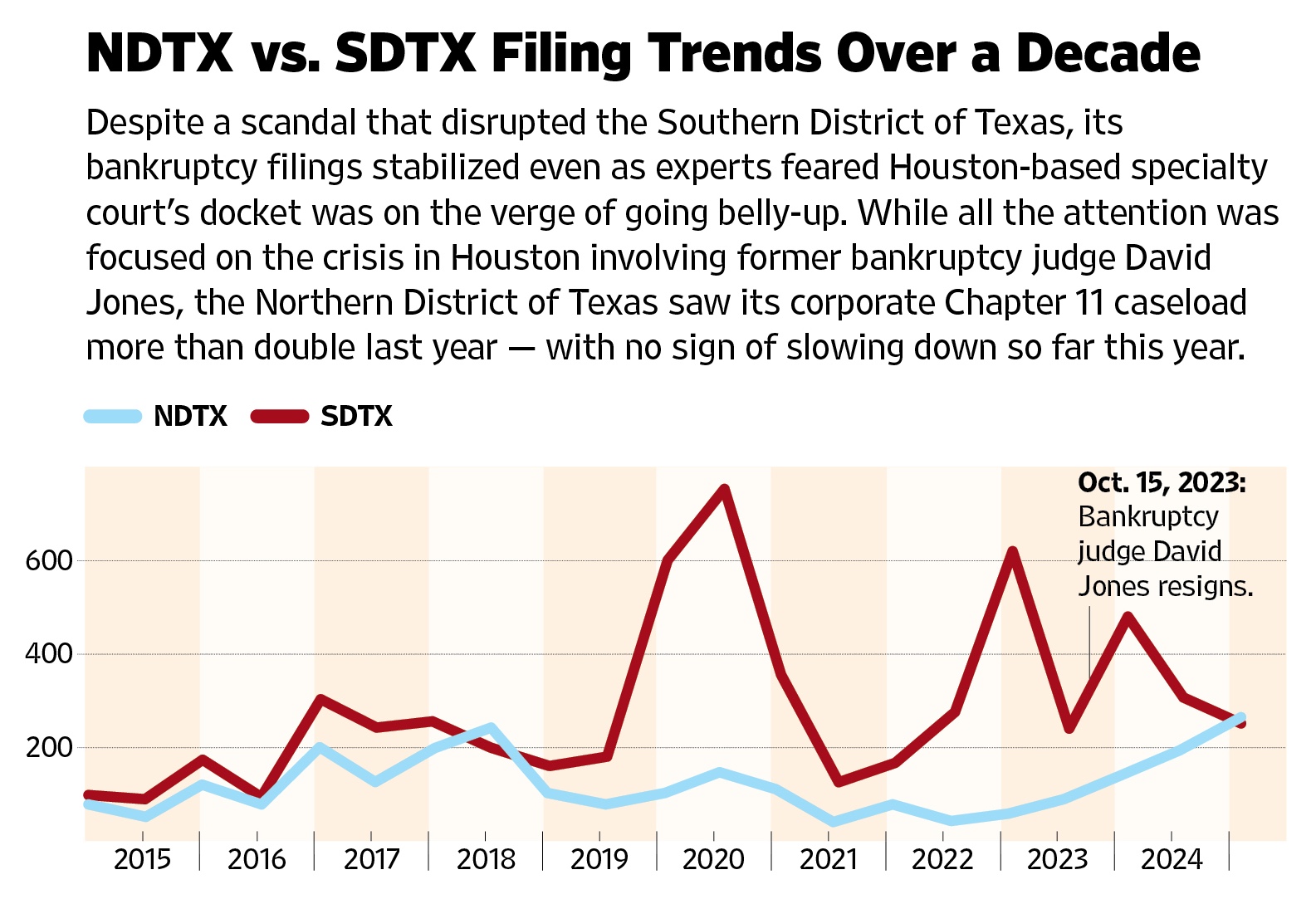

Nearly all legal experts agree that the Northern District of Texas bankruptcy courts have benefited from two nearly simultaneous events that occurred in 2023: the decision by the Dallas and Fort Worth judges to revise their local rules to make the jurisdiction more business-friendly and the secret romance scandal that rocked the Houston bankruptcy courts.

Frances Smith, managing shareholder at Dallas bankruptcy law firm Ross & Smith, said the North Texas bankruptcy bar has witnessed an increase in expertise during the past few years.

“Several international and national firms with robust bankruptcy practices have increased their Texas — and specifically DFW — presence and have taken on attorneys familiar with our NDTX judges,” she said.

Smith said the DFW bankruptcy judges have an “understanding of the need for parties to seek practical business solutions while still operating within the parameters of the Bankruptcy Code. And she said the new procedures for complex cases implemented in 2023 “have been very helpful to coordinate first-day and second-day hearings and set expectations for entry of interim and final orders.”

“The judges’ staffs and the clerk’s office are easy to deal with, polite and professional,” she said. “The NDTX has been very good generous in use of virtual hearings for all cases, not just the mega cases, which saves time and money for all parties in the small cases.”

North Texas bankruptcy judges have made their courts more attractive to smaller businesses seeking to restructure.

“The use of virtual hearings in those cases is especially appealing as many of those cases involve entrepreneurs and smaller family businesses in which it is very difficult for the business owner to take a day away for court,” Smith said.

Other lawyers agree.

“There’s been a deliberate, thoughtful effort to position NDTX as a sophisticated forum for complex business cases,” Martin said. “What jumps out [from the Texas Lawbook data] is how quickly the Northern District of Texas has emerged as a go-to venue for large and complex business restructurings. The shift has been rapid and pronounced.”

“The continued filings speak for themselves,” he said. “Coming off the turbulence in SDTX since 2023, it’s no surprise that more debtors are looking north.”

SDTX Seeks Stability After Scandal

For decades prior to 2017, most Texas companies — American Airlines, Energy Future Holdings and Enron, for example — filed their bankruptcies in Delaware and the Southern District of New York, where the judges were viewed as more experienced and sophisticated. That dynamic changed when then-Houston Bankruptcy Judge David Jones and his colleague Judge Marvin Isgur rewrote the local rules, making the venue more attractive to large companies seeking to restructure.

Between 2019 and 2023, scores of financially distressed corporations from across the U.S. filed their complex, billion-dollar bankruptcies in the Southern District of Texas, which is anchored in Houston.

Then, scandal hit the Southern District in 2023, when it was revealed that Judge Jones had been having a decade-long secret relationship with a corporate bankruptcy lawyer who had been involved in dozens of cases involving the judge, including the bankruptcies of Neiman Marcus, J.C. Penney and Brazos Electric Coop.

The result: The Houston court saw its new business bankruptcy docket plummet from 482 business filings during the first six months of 2024 to 246 this year — a 48 percent decline.

Even so, the bankruptcy judges in DFW and Houston remain among the busiest in the U.S.

“I’m seeing most of the activity in renewables right now, as well as consumer facing businesses, particularly now with those impacted by tariffs,” said Sidley Austin bankruptcy partner Duston McFaul, who has filed new cases in both jurisdictions during the past year. “Projects that have been started may never be completed, and we are already working on a number of projects facing problems with the withdrawal of support for energy renewal projects.”

Bracewell partner Trey Wood said tariffs, the passage of the One Big Beautiful Bill Act and private credit are factors to consider for future bankruptcies.

“Any company or industry effected by tariffs or cuts under the OBBBA are having to face some form of restructuring,” Wood said. “We see this trend continuing, with private credit stepping in to provide liquidating solutions where traditional banks cannot or chose not to.”

Sidley Austin’s McFaul said the Northern District was never “an unattractive venue.”

“The NDTX’s complex local rules were modeled very closely with those of the SDTX, and as practitioners, we’re lucky to have incredibly dedicated, smart judges in both the venues and an ability to schedule hearings quickly in emergencies,” he said.

McFaul said his decision on which jurisdiction to file each business bankruptcy is “usually driven more by the nerve center of the particular debtors.”