© 2018 The Texas Lawbook.

By Mark Curriden

(March 14) – The bankruptcy case of Energy Future Holdings, once the largest power supplier in Texas, is essentially over and the Dallas company is nothing but a ghost of a business.

But hundreds of legal and financial advisors involved in the $42 billion corporate restructuring have been paid a gusher of cash, and more huge paydays may be in the works.

The law firms, banks and consultants working on the EFH case have received so far more than $600 million, making it one of the most complex and expensive corporate bankruptcies in U.S. history, according to new data research by The Texas Lawbook.

Federal court documents show that EFH and the other businesses involved in the bankruptcy have spent an average of $420,000 a day – including weekends and holidays – to the lawyers and other professionals who have worked on the matter since EFH filed for bankruptcy protection in April 2014.

The final price tag could approach 10-digits.

“It is an outrageous amount of money, but this has been an outrageously complicated case that took so many unexpected twists and turns,” Wright said. “Big corporate bankruptcies are expensive.”

Last Friday morning, EFH finalized the sale of its 80 percent ownership stake in Oncor Electric to Sempra Energy for $18.8 billion. This followed the $20 billion spin-off of TXU Energy and Luminant into a separate holding company now called Vistra Energy.

The moment that Sempra electronically wired the $9.5 billion Friday morning at 9:37 a.m., EFH, for all practical purposes, ceased to exist.

Within hours of the transaction, law firms and financial advisors started flooding the bankruptcy court with their fee applications – a process that Wright said will continue over the next month.

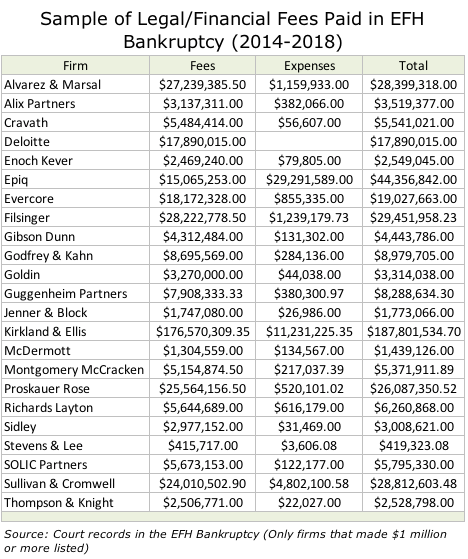

Several of the most elite and most expensive law firms in the U.S. have been involved in the EFH bankruptcy, including Cravath, Gibson Dunn, Kirkland & Ellis and Sullivan & Cromwell.

The biggest winner is Chicago-based Kirkland, which opened an office in Houston the month that EFH filed for Chapter 11. Bankruptcy records show that Kirkland, which has represented EFH in the bankruptcy, all M&A and restructuring activity and various bankruptcy-related litigation matters, has billed the one-time energy giant $187.8 million so far and that additional multimillion-dollar paydays are likely.

“We had Kirkland involved in every aspect of our business and Kirkland lawyers were involved in every big decision that we needed to make,” Wright said. “Kirkland lawyers are expensive, but they are also very good.”

Federal court records show that 384 lawyers whose specialties range from appellate and restructuring law to regulatory and M&A law have billed the bankrupt energy company. Ninety-one of those lawyers charged EFH at least $1,000 an hour or more. The most expensive lawyer was an appellate partner whose hourly rate is $1,700. Even first year associates working on the case are billing at $350 an hour.

In addition, EFH has paid more than 240 financial advisors, whose rates tend to be more modestly in the range of $300 to $800 an hour.

Here is a breakdown:

- To date, EFH has paid its legal and financial advisors $445 million in fees and expenses, according to court documents.

- Firms are likely to receive another $80 million, which represents 20 percent of previous billings that have been withheld back by the bankruptcy court until the case is officially concluded.

- EFH officials paid lawyers and financial experts an estimated $40 million in 2014 and 2015 to help the company prepare for Chapter 11 filing.

- Oncor, which was not technically part of the bankruptcy but was involved in four massive $18 billion M&A efforts, paid its legal and financial advisors about $50 million, according to Oncor officials.

- Four companies – Hunt Consolidated, NextEra, Berkshire Hathaway and Sempra Energy – paid its lawyers and financial advisors an estimated $40 million in their efforts to buy EFH’s stake in Oncor during the past three years.

- Finally, bankruptcy experts say that the lead legal and financial advisors are highly likely to ask the bankruptcy judge overseeing the EFH case to award them bonuses for their hard work and successes in the restructuring – bonuses that could reasonably hit $50 million.

“While Oncor was not part of the actual bankruptcy, we had lawyers at nearly every court hearing and significant event,” Oncor General Counsel Allen Nye said in an interview in January. “The fees are staggering, especially when we are talking about a company in distress and bankruptcy.

“But there have been so many constantly moving parts to this restructuring that required a lot of expertise,” Nye said. “It has been like playing four-dimensional chess.”

There is one remaining legal issue still alive and being litigated. Florida-based NextEra has sued EFH – or what is left of its remains – in federal court claiming that it is owed a $275 million break-up fee.

The federal court in Delaware has rejected NextEra’s argument and the case is now pending before the U.S. Court of Appeals for the Third Circuit.

Even if the EFH bankruptcy hits $1 billion in professional fees, it is half the price tag of the Lehman Brothers liquidation, which saw an estimated $2 billion in legal and financial advisory fees.

© 2018 The Texas Lawbook. Content of The Texas Lawbook is controlled and protected by specific licensing agreements with our subscribers and under federal copyright laws. Any distribution of this content without the consent of The Texas Lawbook is prohibited.

If you see any inaccuracy in any article in The Texas Lawbook, please contact us. Our goal is content that is 100% true and accurate. Thank you.