As corporations did more and more mergers and acquisitions during the first six months of 2022, a record number of law firms participated in the Texas M&A boom.

Forty-four corporate law firms with offices in Texas reported that their lawyers in Texas played a substantive role in representing buyers, sellers, targets, conflicts committees, financial institutions and other third parties in various kinds of transactions in which assets were bought, sold or merged.

A handful of elite law firms – Sidley Austin, Kirkland & Ellis, Vinson & Elkins, Latham & Watkins, Gibson, Dunn & Crutcher, to name a few – topped The Texas Lawbook’sexclusive Corporate Deal Tracker law firm rankings for the first half of 2022.

Several Texas-headquartered corporate firms also experienced a strong six months, including Haynes and Boone, Baker Botts, Akin Gump and Locke Lord.

The Corporate Deal Tracker also documents securities offerings handled by Texas lawyers. The Lawbook will publish that data later this week.

Ten of the 44 top law firms are based in Texas. Four corporate law firms founded or headquartered in Chicago – Kirkland, Sidley, Winston and Katten – ranked in the top 20. Two firms birthed in Los Angeles – Latham and Gibson Dunn – both ranked in the top five in deal value.

Four law firms – Sidley, Kirkland, V&E, Latham – had Texas lawyers who worked on nearly three-quarters of all the transactions that had deal values of $500 million or more.

But before we unfold all the law firm details, here’s what you need to know about the data.

First, the Corporate Deal Tracker documents transactions handled by lawyers in Texas. The deals themselves may involve Texas-based businesses or private equity firms or they could be based in Dubai with no Texas connection. It does not matter.

The purpose of the CDT is to document the legal work of corporate transactional lawyers in Texas.

Second – and this is very important – the deals must have been announced after Jan. 1. If a deal was announced Dec. 31 or before, then the firm received the credit for it in the 2021 CDT law firm rankings.

The Texas Lawbook publishes the M&A and securities offerings master lists each month. If the deal is not on the master list, it does not get counted in the rankings. Be sure that your firm is submitting the transactions so that they can be published by Claire Poole in the Corporate Deal Tracker Weekly Roundup by sending the details of the deals to CDTRoundup@texaslawbook.net.

The Lawbook divides the CDT rankings in these six ways:

- Mergers, acquisitions and joint ventures;

- Securities offerings;

- Deal count;

- Deal value;

- General advisors who office in Texas for all parties involved in the transaction; and

- Lead advisors, which are the primary Texas-based lawyers for the buyers, sellers and targets.

Editor’s Note: To see the full list of M&A transactions so far in 2022, please visit the CDT/M&A section page here.

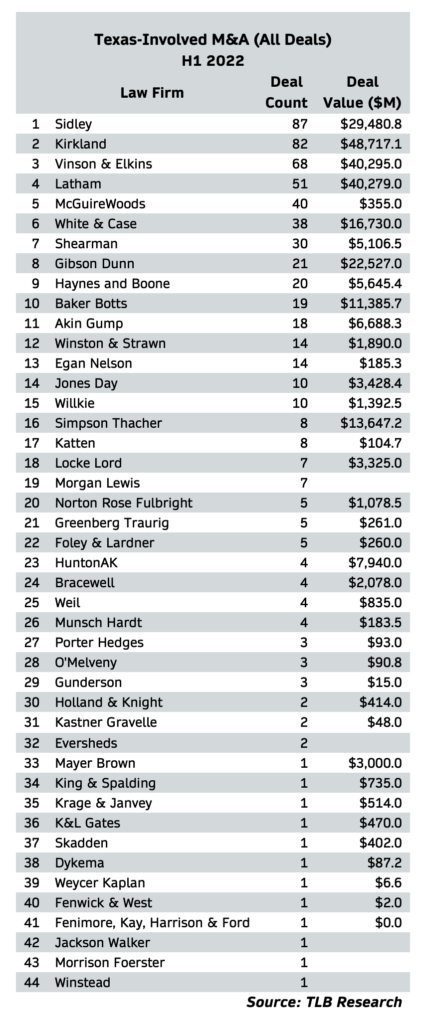

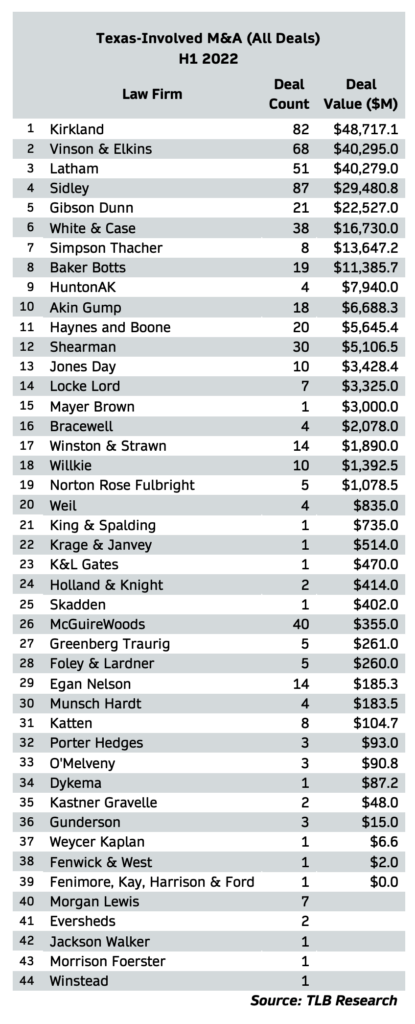

H1 2022 CDT Overall M&A Rankings by Deal Count and Deal Value

Four large corporate law firms had their Texas attorneys work on 50 or more transactions during the first six months of 2022. Two firms handled more than 80 deals.

With more than 200 lawyers in Dallas and Houston, Sidley attorneys in Texas worked on 87 different M&A transactions during H1 with a combined value of $29.5 billion. Houston partners Tim Chandler and Cliff Vrielink, for example, advised Stonepeak Infrastructure Partners on a $2.5 billion technology transaction, while Dallas partner Scott Parel was the lead counsel on three billion-dollar-plus transactions in the technology sector.

Sidley ranked No. 1 in deal count and No. 4 in deal value, according to CDT M&A data.

Ranking second in deal count but No. 1 in deal value is Kirkland, whose lawyers in Texas worked on 82 transactions during H1 2022 that had a combined price tag of $48.7 billion.

Kirkland lawyers represented Irving-based Celanese in its $11 billion purchase of assets from DuPont. Houston partners Sean Wheeler and Debbie Yee were lead advisors for Whiting Petroleum in its $6 billion merger of equals with Oasis Petroleum in March. Two months later, the duo were the lead lawyers for Centennial Resources in its $3.9 billion sale to Colgate Energy Partners in May.

Adam Larson and Jhett Nelson, both partners in Houston, represented Navitas Midstream in its $3.25 billion sale to Enterprise Products Partners.

V&E ranked third in the Corporate Deal Tracker’s deal count rankings and second in transactional value. The firm’s Texas lawyers worked on 68 deals during the first six months of 2022 with a combined value of $40.3 billion.

Houston partners Dave Oelman and Steve Gill were the lead advisors for Oasis in the $6 billion merger with Whiting. Oelman and V&E partner Mike Telle represented Oklahoma oilman Harold Hamm in his multibillion-dollar effort to take Continental Resources private.

The CDT rankings show Latham ranked fourth in deal count and third in deal value. Latham’s Texas lawyers worked on 51 transactions during H1 2022 that were valued at $40.3 billion total.

Latham partner David Miller in Austin and Kevin Richardson in Houston represented financial advisor Citigroup Global Markets in the Oasis and Whiting merger. John Greer and Ryan Maierson, Latham partners in Houston, were the lead advisors for Centennial Resources in its $3.9 billion purchase of Colgate Energy.

McGuireWoods is fifth in the CDT’s deal count rankings. The firm advised clients on 40 transactions. All but two of the firm’s transactions have confidential deal values. Dallas partner Kevin Boardman represented Compass Group Equity Partners in a $255 million transaction with investors.

The CDT ranks White & Case sixth in M&A deal count and deal value. The firm’s attorneys in Texas handled 38 transactions during H1 2022 with a combined value of $16.7 billion.

White & Case partner Morgan Hollins in Houston advised Toronto-based Brookfield Infrastructure in a $5 billion consumer services acquisition. Fellow Houston partners Bill Parish and Rodrigo Dominguez Sotomayor represented EIG Global in its $1.165 billion purchase of Chile-based Enagas Chile SpA.

Shearman & Sterling’s Texas operations rank seventh in the CDT’s deal count list with 30 transactions valued at $5.1 billion. Shearman partners Jeremy Kennedy and Todd Lowther, both in Houston, advised Chesapeake Energy in its $2.65 billion acquisition of Chief E&D Holdings.

The CDT ranks Gibson Dunn eighth on the M&A deal count list and fifth in the deal value rankings. The firm’s Texas lawyers worked on 21 M&A transactions announced during the first six months of 2022 that had a combined price tag of $22.5 billion.

Doug Rayburn, a partner in Gibson Dunn’s Dallas office, advised BoA Securities in its $11 billion Celanese transaction. Gibson Dunn partner Jeff Chapman represented Lone Star North America in its $3.8 billion acquisition of SPX Flow Inc. Chapman and Houston partner Mike Darden advised Chief E&D in the Chesapeake deal.

Haynes and Boone ranks ninth in the CDT law firm M&A rankings for H1 2022. The firm’s lawyers in Texas worked on 20 deals during the period with values totaling $5.6 billion.

Houston partner Brent Shultz advised financial advisor Mizuho Bank in the $3.55 billion transaction between Targa Resources and Lucid Energy. Haynes and Boone Houston partner Austin Elam represented Earthstone Energy in its $860 million purchase of Bighorn Permian Resources.

Rounding out the top 10 is Baker Botts. The firm’s Texas lawyers worked on 19 M&A transactions announced during H1 2022 that had a combined deal value of $11.4 billion.

Baker Botts partner Clint Rancher of Houston advised Tudor Pickering Holt in the Oasis and Whiting merger. Joshua Davidson advised Shell USA in a $1.96 billion transaction.

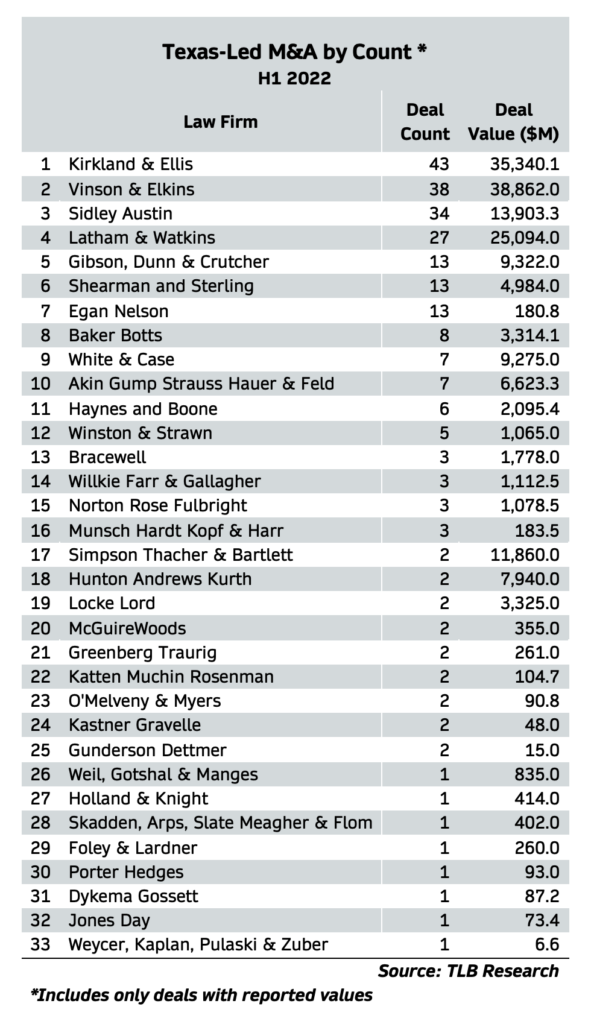

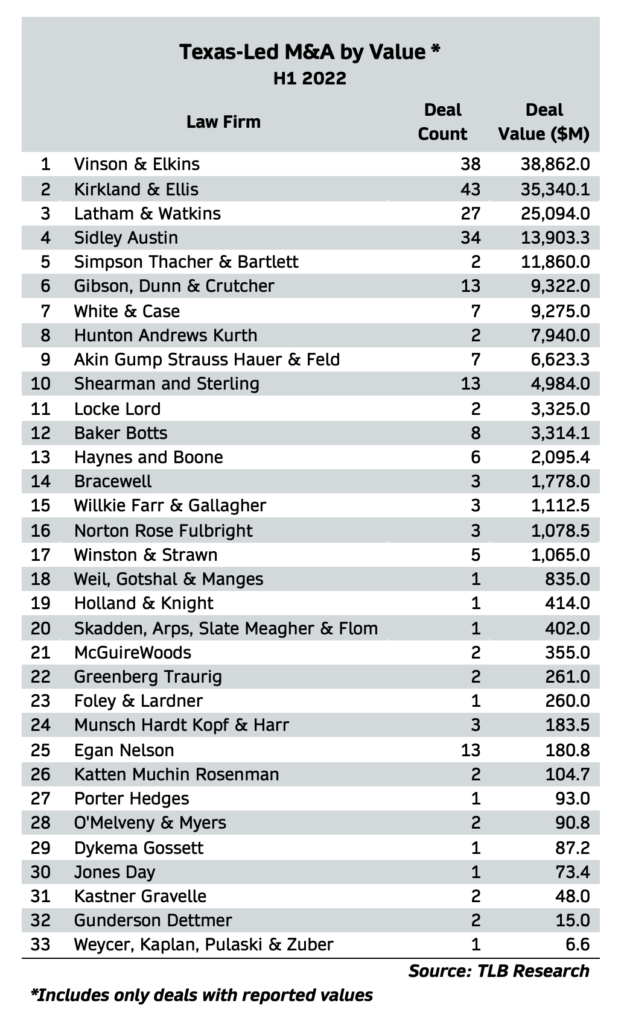

H1 2022 M&A Lead Advisors Law Firms

The Corporate Deal Tracker ranking of law firms who were the lead advisors for the buyers, sellers and targets of M&A transactions announced during H1 2022 shows that V&E and Kirkland battled it out for the top spot.

Kirkland lawyers in Texas led the most deals with 43.

V&E was second with 38.

In deal value, the two firms flipped positions. V&E was No. 1 with $38.9 billion. Kirkland was second with $35.3 billion.

Similarly, the Texas attorneys for Latham and Sidley vied for the next two spots. During H1 2022 Sidley led Latham in deal count, 34 to 27, while Latham’s deal value of $25 billion led Sidley’s $13.9 billion.

Simpson Thacher jumped up to the No. 4 ranking in deal value. Houston partners David Lieberman and Christopher May were the lead legal advisors for New York-based DigitalBridge in its $11 billion acquisition of Las Vegas-based Switch.

Texas lawyers at Gibson Dunn, Shearman and Egan Nelson each led 13 M&A transactions for the principals.

Editor’s Note: Later this week, The Texas Lawbook will publish the CDT rankings for securities offerings.